European Market's Prominent Stocks Priced Below Estimated Value In December 2025

As the European market shows signs of steady economic growth and benefits from looser monetary policy, major stock indexes have risen, with the pan-European STOXX Europe 600 Index climbing 1.60%. In this environment, identifying undervalued stocks becomes crucial for investors seeking to capitalize on potential opportunities, particularly those that may be priced below their estimated value amidst favorable economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Streamwide (ENXTPA:ALSTW) | €72.60 | €142.21 | 49% |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.38 | 49.9% |

| Redelfi (BIT:RDF) | €11.70 | €23.31 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.278 | €8.48 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK32.95 | NOK65.81 | 49.9% |

| Hemnet Group (OM:HEM) | SEK170.90 | SEK337.18 | 49.3% |

| cyan (XTRA:CYR) | €2.26 | €4.50 | 49.8% |

| Artifex Mundi (WSE:ART) | PLN12.20 | PLN24.34 | 49.9% |

| Allegro.eu (WSE:ALE) | PLN30.625 | PLN60.10 | 49% |

| Allcore (BIT:CORE) | €1.345 | €2.66 | 49.4% |

Let's review some notable picks from our screened stocks.

Metsä Board Oyj (HLSE:METSB)

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp sectors both in Finland and internationally, with a market cap of €1.09 billion.

Operations: The company's revenue from its folding boxboard, fresh fibre linerboard, and market pulp operations amounts to €1.83 billion.

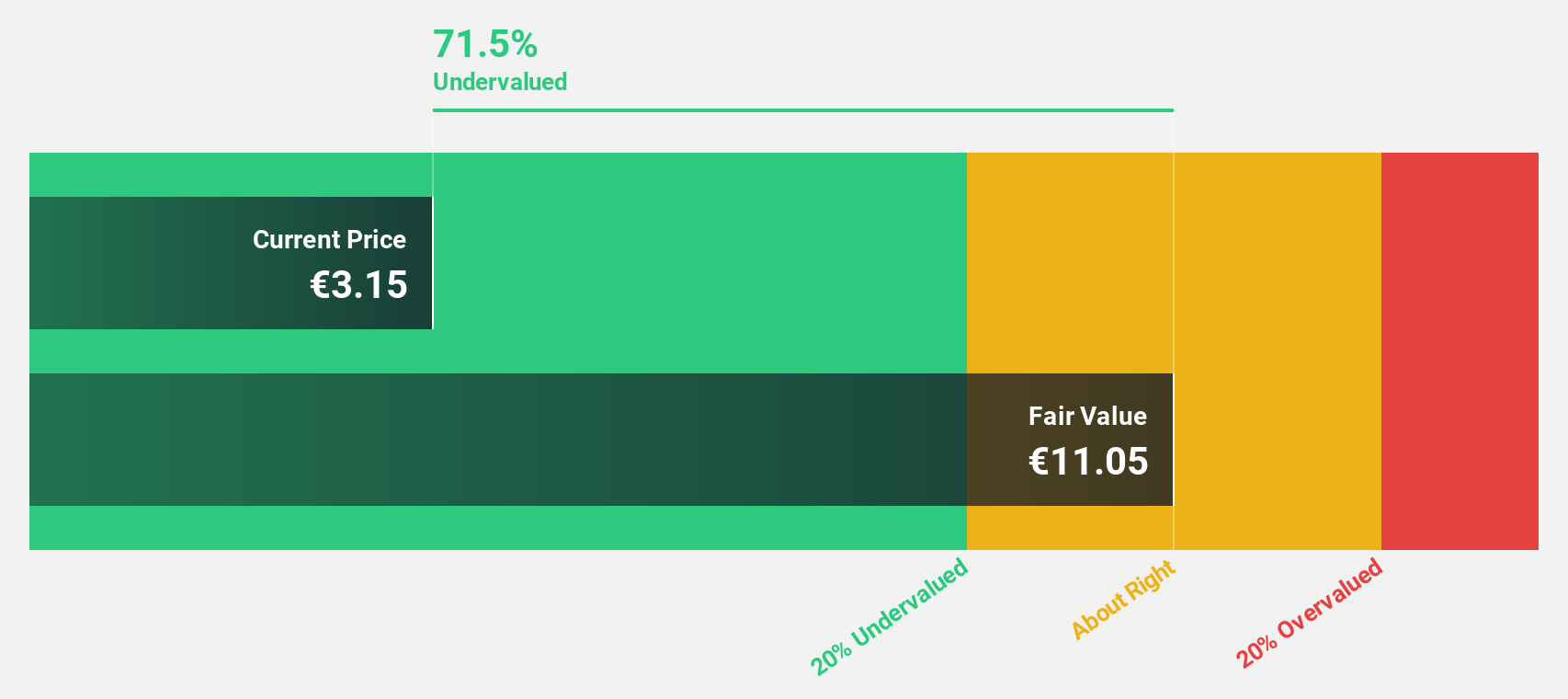

Estimated Discount To Fair Value: 42.3%

Metsä Board Oyj is trading at a significant discount, approximately 42.3% below its estimated fair value of €5.13 per share, supported by strong cash flow analysis. Despite recent financial challenges, including a net loss for the third quarter of 2025 and ongoing cost-saving measures worth €200 million, the company is positioned for future profitability with expected earnings growth of over 116% annually. Recent strategic initiatives include modernizing production facilities and enhancing sustainability efforts through a new €250 million credit facility linked to climate targets.

- Upon reviewing our latest growth report, Metsä Board Oyj's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Metsä Board Oyj with our comprehensive financial health report here.

Pexip Holding (OB:PEXIP)

Overview: Pexip Holding ASA is a video technology company offering an end-to-end video conferencing platform and digital infrastructure across the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of NOK7.71 billion.

Operations: The company's revenue primarily comes from the sale of collaboration services, amounting to NOK1.23 billion.

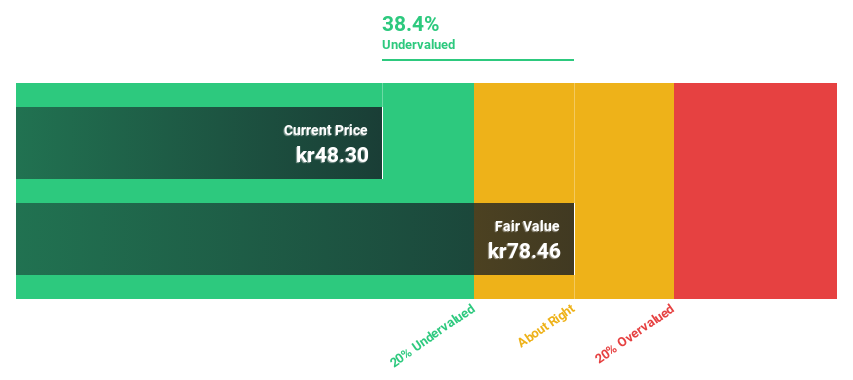

Estimated Discount To Fair Value: 13.7%

Pexip Holding is trading at NOK 75.2, slightly below its fair value estimate of NOK 87.16, reflecting potential undervaluation based on cash flows. The company recently became profitable, with third-quarter net income rising to NOK 25.64 million from NOK 5.8 million a year prior. Although revenue growth is modest at 11.2% annually, earnings are projected to increase significantly by over 26% per year, outpacing the broader Norwegian market's growth rate of 15.9%.

- According our earnings growth report, there's an indication that Pexip Holding might be ready to expand.

- Dive into the specifics of Pexip Holding here with our thorough financial health report.

NCAB Group (OM:NCAB)

Overview: NCAB Group AB (publ) specializes in the manufacture and sale of printed circuit boards (PCBs) across Sweden, the Nordic region, Europe, North America, and Asia, with a market cap of SEK8.91 billion.

Operations: The company's revenue segments are distributed as follows: East SEK226 million, Europe SEK1.77 billion, Nordic SEK839 million, and North America SEK842 million.

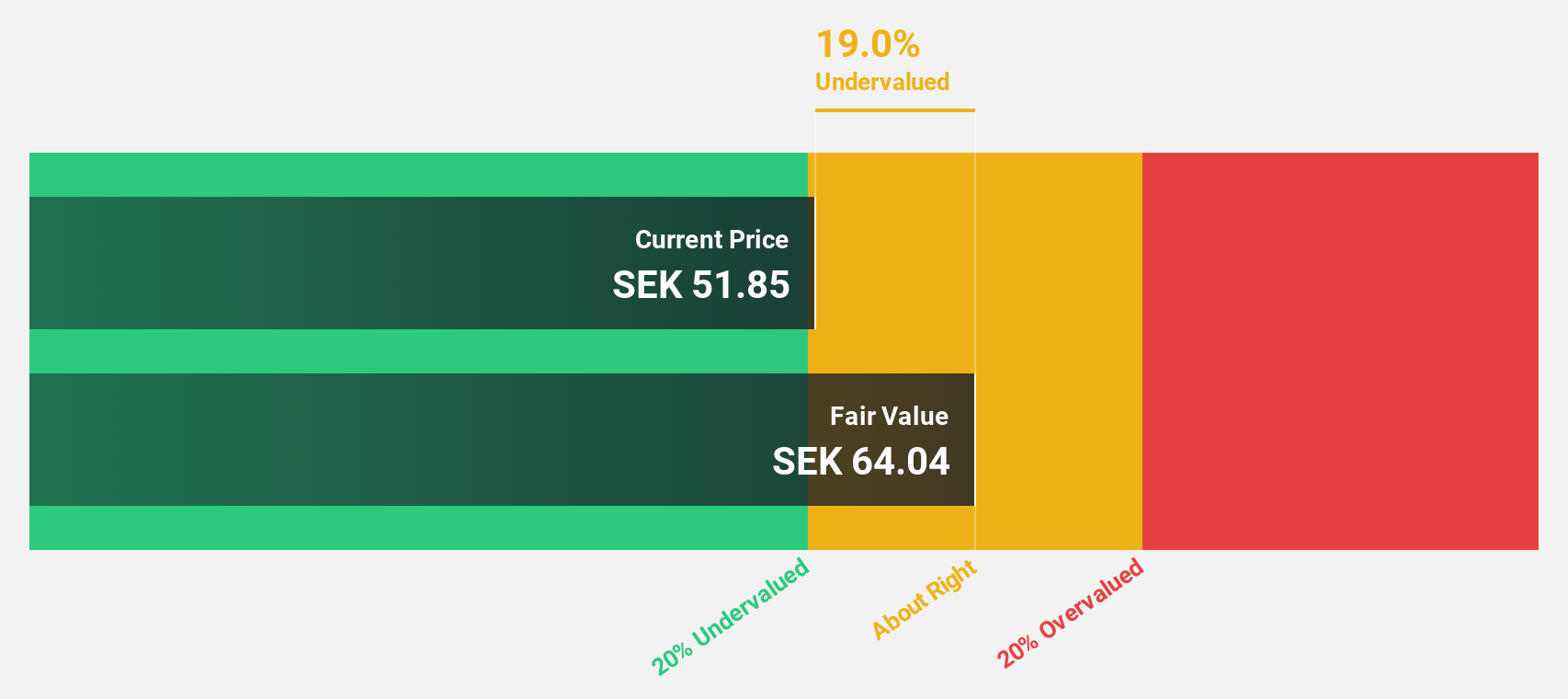

Estimated Discount To Fair Value: 17.5%

NCAB Group's current trading price of SEK 47.64 is approximately 17.5% below its estimated fair value of SEK 57.73, suggesting potential undervaluation based on cash flows. Despite a high debt level, earnings are expected to grow significantly at 31.6% annually, surpassing the Swedish market's growth rate of 13.7%. Recent third-quarter results show increased net income to SEK 60.9 million from SEK 50.2 million the previous year, although profit margins have declined from last year’s figures.

- The analysis detailed in our NCAB Group growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of NCAB Group stock in this financial health report.

Seize The Opportunity

- Dive into all 191 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com