Undiscovered Gems in the US Market to Explore This December 2025

As the U.S. stock market continues to reach new heights, with the S&P 500 setting all-time records and major indices logging consecutive gains, investors are keenly observing the dynamics that drive these trends. In this buoyant environment, identifying promising small-cap stocks can be particularly rewarding, as these "undiscovered gems" often offer unique growth opportunities amidst broader market optimism.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Senstar Technologies | NA | -15.82% | 43.55% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Gyre Therapeutics (GYRE)

Simply Wall St Value Rating: ★★★★★★

Overview: Gyre Therapeutics, Inc. is a pharmaceutical company focused on developing and commercializing small-molecule drugs for treating organ fibrosis, with a market cap of $653.50 million.

Operations: Gyre Therapeutics generates revenue primarily from its Gyre Pharmaceuticals segment, totaling $107.27 million. The company's financial model is centered around the development and commercialization of specialized drugs targeting organ fibrosis.

Gyre Therapeutics, a nimble player in the biotech space, has shown resilience with its recent profitability and high-quality earnings. The company is debt-free, which simplifies its financial landscape and reduces risk. In the third quarter of 2025, Gyre reported sales of US$30.56 million, up from US$25.49 million the previous year, while net income increased to US$3.61 million from US$1.12 million last year. Despite revising its revenue guidance downward due to supply chain issues and market uncertainty in China, Gyre's ongoing clinical trials for Pirfenidone show promise in addressing pneumoconiosis and liver fibrosis challenges.

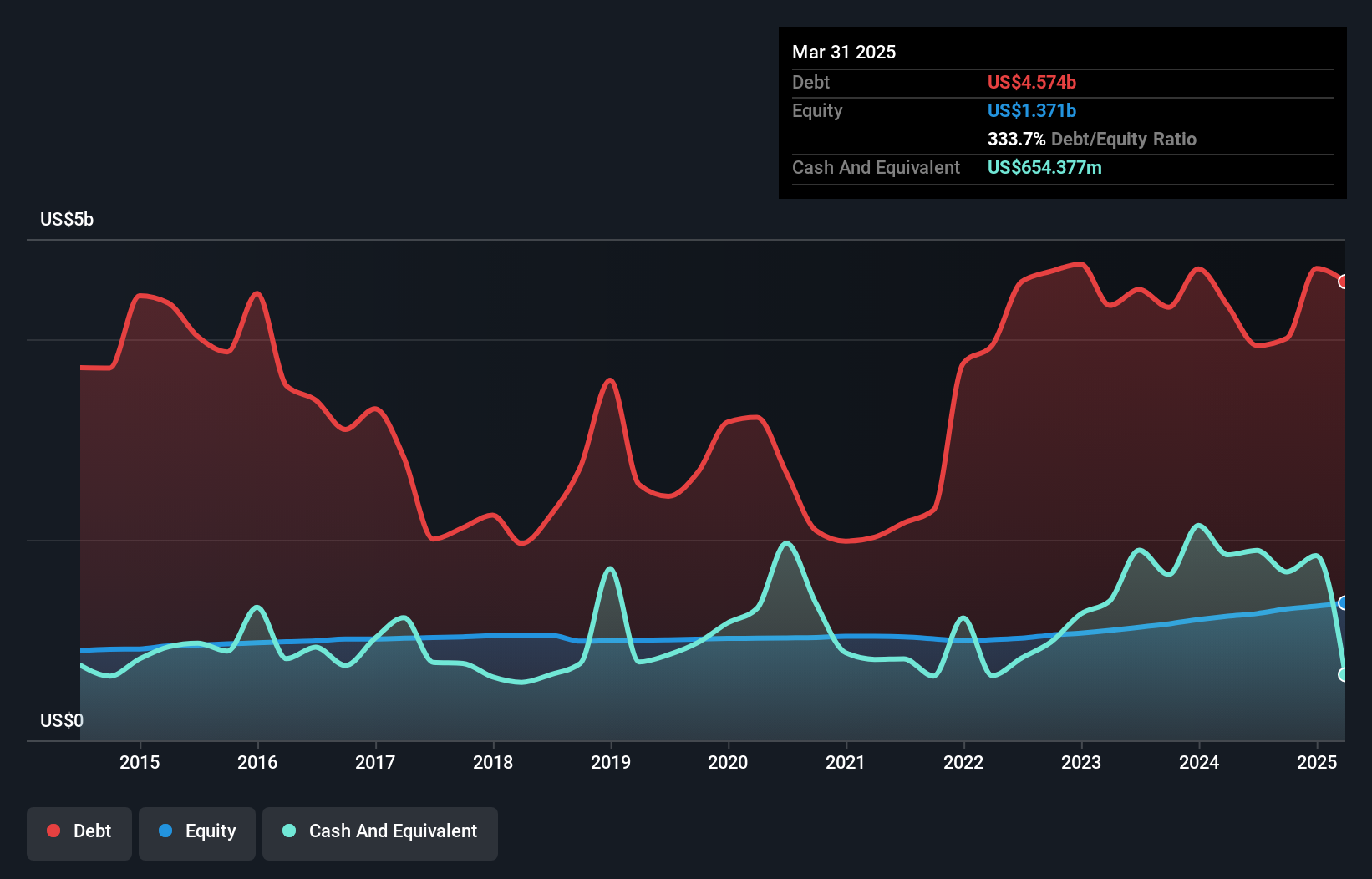

Banco Latinoamericano de Comercio Exterior S. A (BLX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Banco Latinoamericano de Comercio Exterior S.A. (BLX) is a financial institution that focuses on providing trade financing solutions primarily in Latin America and the Caribbean, with a market cap of $1.63 billion.

Operations: BLX generates revenue primarily from its Commercial segment, contributing $276.93 million, while the Treasury segment adds $31.51 million. The company's net profit margin shows a notable trend at 30%.

Bladex, with total assets of US$12.5 billion and equity of US$1.6 billion, showcases robust financial health. Its allowance for bad loans stands at a solid 463%, covering non-performing loans which are just 0.2% of the total. The bank's earnings grew by 10.8% last year, surpassing the industry average of 8.5%. Trading at 37.5% below its estimated fair value, Bladex is considered a good buy relative to peers and the industry standard, despite challenges like economic volatility in Latin America that could affect revenue growth and profit margins over time.

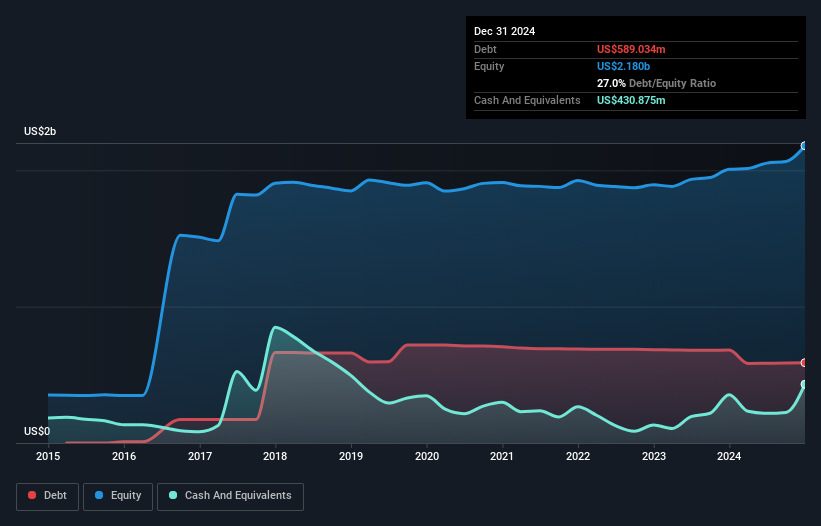

Five Point Holdings (FPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Five Point Holdings, LLC designs, owns, and develops mixed-use planned communities in Orange County, Los Angeles County, and San Francisco County with a market capitalization of approximately $822.24 million.

Operations: Five Point Holdings generates revenue primarily from its Valencia and Great Park segments, with $139.51 million and $1 billion respectively. The company's net profit margin is impacted by segment adjustments and the removal of Great Park Venture, which accounts for -$949.93 million in their financials.

Five Point Holdings, a small cap player in the real estate sector, has shown impressive financial resilience. Over the past five years, its debt to equity ratio improved from 37.4% to 21.6%, indicating prudent financial management. The company boasts high-quality earnings with an 83.1% increase over the past year, outpacing industry growth of 15.5%. Despite recent revenue shrinkage to US$13.49 million in Q3 compared to US$17.01 million previously, net income surged from US$4.76 million to US$21.07 million this quarter—highlighting operational efficiency and strategic cost control efforts amidst challenging market conditions.

- Navigate through the intricacies of Five Point Holdings with our comprehensive health report here.

Explore historical data to track Five Point Holdings' performance over time in our Past section.

Where To Now?

- Delve into our full catalog of 299 US Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com