Insiders Favor American Resources And Two Other Leading Growth Stocks

As the U.S. stock market closes a holiday-shortened week on a high note, with the S&P 500 hitting fresh all-time highs and major indexes poised for weekly gains, investors are increasingly turning their attention to growth companies with substantial insider ownership. In such an environment, stocks favored by insiders can offer insights into potential opportunities as these individuals often have unique perspectives on their company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

| AppLovin (APP) | 27.3% | 27.1% |

Underneath we present a selection of stocks filtered out by our screen.

American Resources (AREC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: American Resources Corporation focuses on producing rare earth and critical mineral concentrates for the infrastructure and electrification markets, with a market cap of $275.79 million.

Operations: The company's revenue segments include Re Elements (RLMT) with a revenue of -$0.01 million, adjusted by $0.10 million.

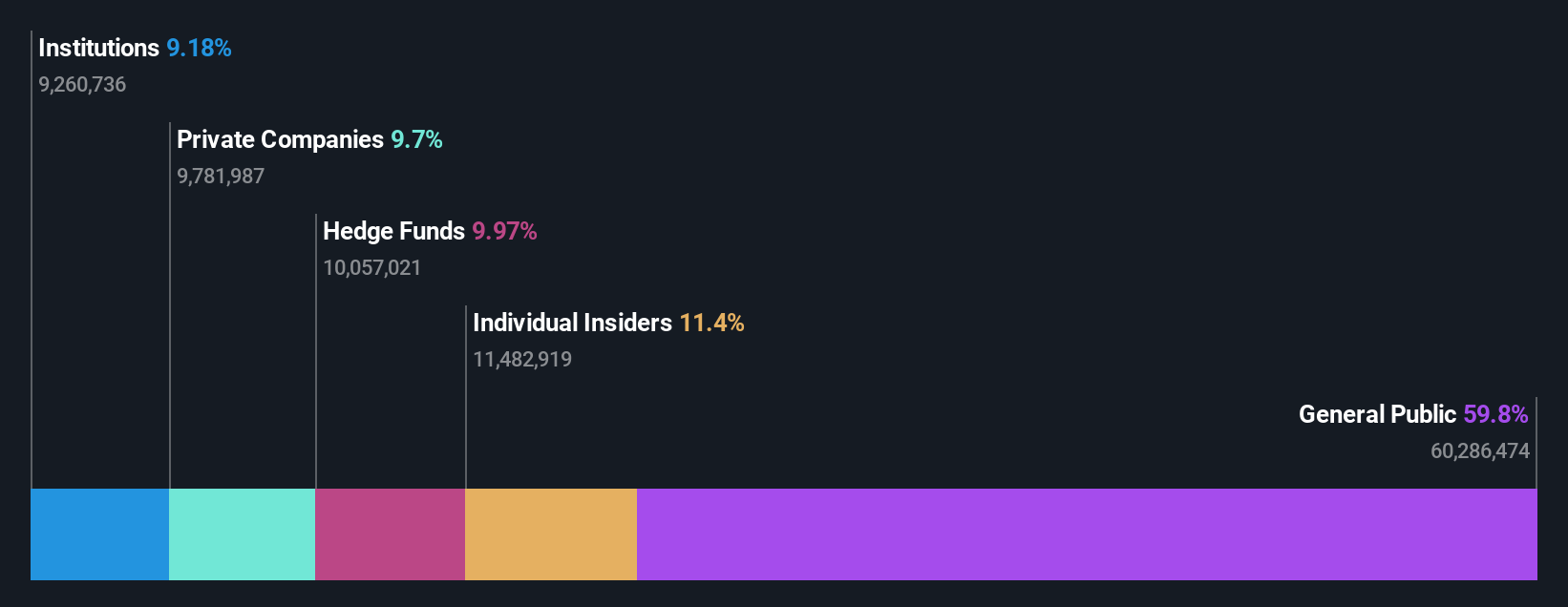

Insider Ownership: 11.3%

Revenue Growth Forecast: 72% p.a.

American Resources Corporation has experienced significant shareholder dilution recently, yet it remains a compelling growth prospect with insider ownership. The company forecasts revenue growth of 72% annually, outpacing the broader U.S. market's expected rate. Despite its current low revenue base under US$1 million, American Resources aims for profitability within three years. Recent financial activities include private placements and a US$67 million shelf registration closure, indicating active capital management amid volatile share prices.

- Unlock comprehensive insights into our analysis of American Resources stock in this growth report.

- Our expertly prepared valuation report American Resources implies its share price may be too high.

SKYX Platforms (SKYX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SKYX Platforms Corp. operates in the United States, offering a range of safe-smart platform technologies, with a market capitalization of approximately $267.31 million.

Operations: The company's revenue primarily comes from its Electric Equipment segment, which generated $90.75 million.

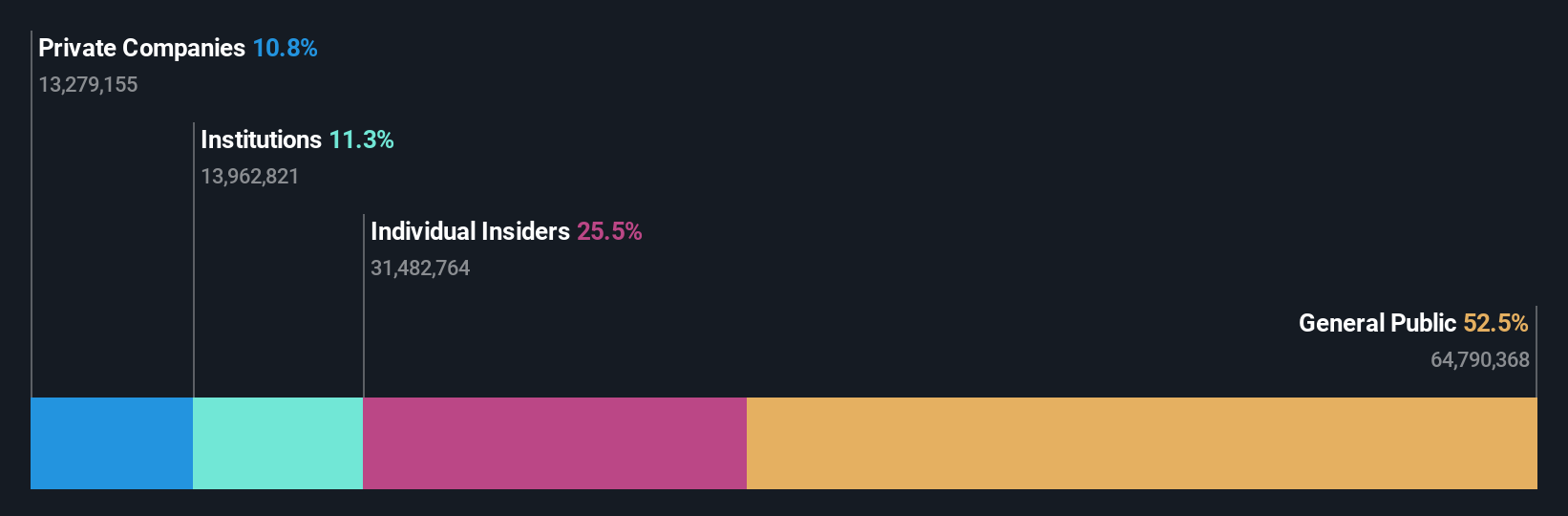

Insider Ownership: 27.3%

Revenue Growth Forecast: 22.1% p.a.

SKYX Platforms is poised for significant growth with its innovative product launches, such as the SKYFAN & TURBO HEATER, set to debut at Target in 2026. The company forecasts revenue growth of 22.1% annually, surpassing the U.S. market average. Despite recent losses, SKYX aims for profitability within three years and actively manages capital through private placements and a US$17 million shelf registration closure amid high share price volatility.

- Click here and access our complete growth analysis report to understand the dynamics of SKYX Platforms.

- Our comprehensive valuation report raises the possibility that SKYX Platforms is priced higher than what may be justified by its financials.

PDF Solutions (PDFS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDF Solutions, Inc. offers proprietary software, intellectual property for integrated circuit designs, measurement hardware tools, methodologies, and professional services globally with a market cap of approximately $1.14 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $206.71 million.

Insider Ownership: 17.1%

Revenue Growth Forecast: 17.5% p.a.

PDF Solutions is advancing in semiconductor manufacturing analytics, with recent collaborations like Lavorro enhancing operational efficiency. Despite reporting a net loss for the first nine months of 2025, revenue increased to US$156.62 million from US$129.38 million year-over-year. The company forecasts annual revenue growth between 21-23%, surpassing the U.S. market average, and anticipates profitability within three years, driven by innovations such as Exensio Studio AI and strategic partnerships leveraging AI technologies.

- Take a closer look at PDF Solutions' potential here in our earnings growth report.

- Our valuation report here indicates PDF Solutions may be overvalued.

Turning Ideas Into Actions

- Dive into all 208 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com