VM Inc.'s (KOSDAQ:089970) 25% Share Price Surge Not Quite Adding Up

VM Inc. (KOSDAQ:089970) shares have continued their recent momentum with a 25% gain in the last month alone. This latest share price bounce rounds out a remarkable 327% gain over the last twelve months.

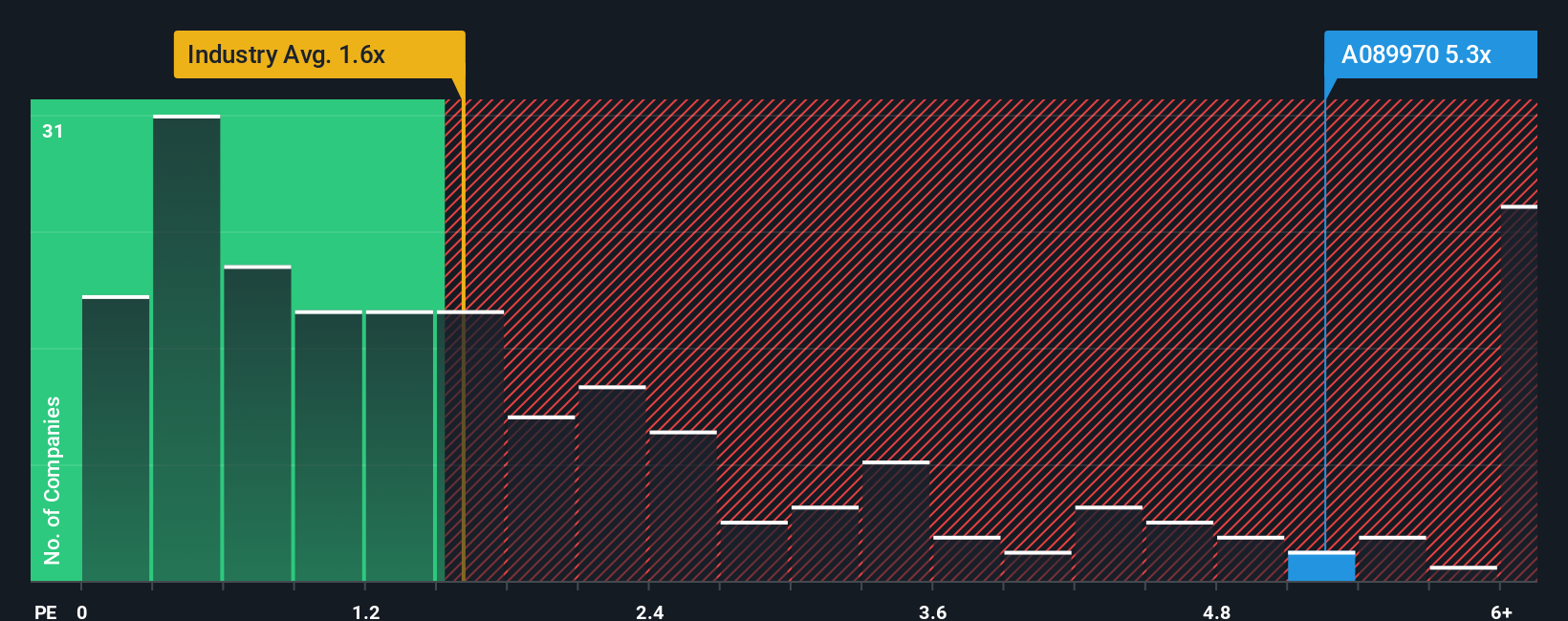

Following the firm bounce in price, you could be forgiven for thinking VM is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.3x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 1.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for VM

What Does VM's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, VM has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on VM will help you uncover what's on the horizon.How Is VM's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like VM's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 209%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 19% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 46% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 49%, which is not materially different.

With this information, we find it interesting that VM is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

The strong share price surge has lead to VM's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting VM's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for VM you should be aware of, and 1 of them is potentially serious.

If you're unsure about the strength of VM's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.