After Leaping 27% Dollar General Corporation (NYSE:DG) Shares Are Not Flying Under The Radar

Dollar General Corporation (NYSE:DG) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 82%.

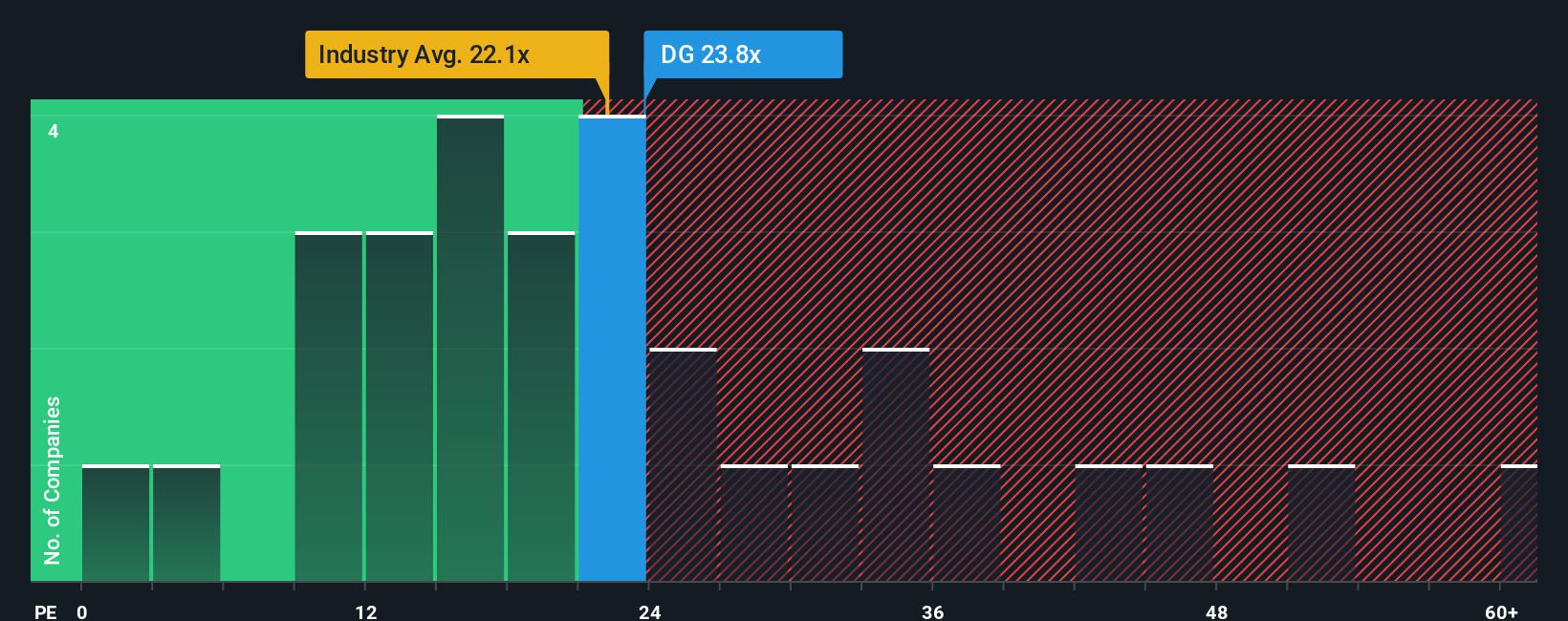

Following the firm bounce in price, Dollar General may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 23.8x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Dollar General could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Dollar General

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Dollar General would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 4.6% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 44% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the analysts watching the company. With the market only predicted to deliver 12% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Dollar General's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Dollar General's P/E

Dollar General's P/E is getting right up there since its shares have risen strongly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Dollar General's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Dollar General that you should be aware of.

If you're unsure about the strength of Dollar General's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.