Why Investors Shouldn't Be Surprised By Geospace Technologies Corporation's (NASDAQ:GEOS) 55% Share Price Surge

Geospace Technologies Corporation (NASDAQ:GEOS) shareholders are no doubt pleased to see that the share price has bounced 55% in the last month, although it is still struggling to make up recently lost ground. The last 30 days bring the annual gain to a very sharp 71%.

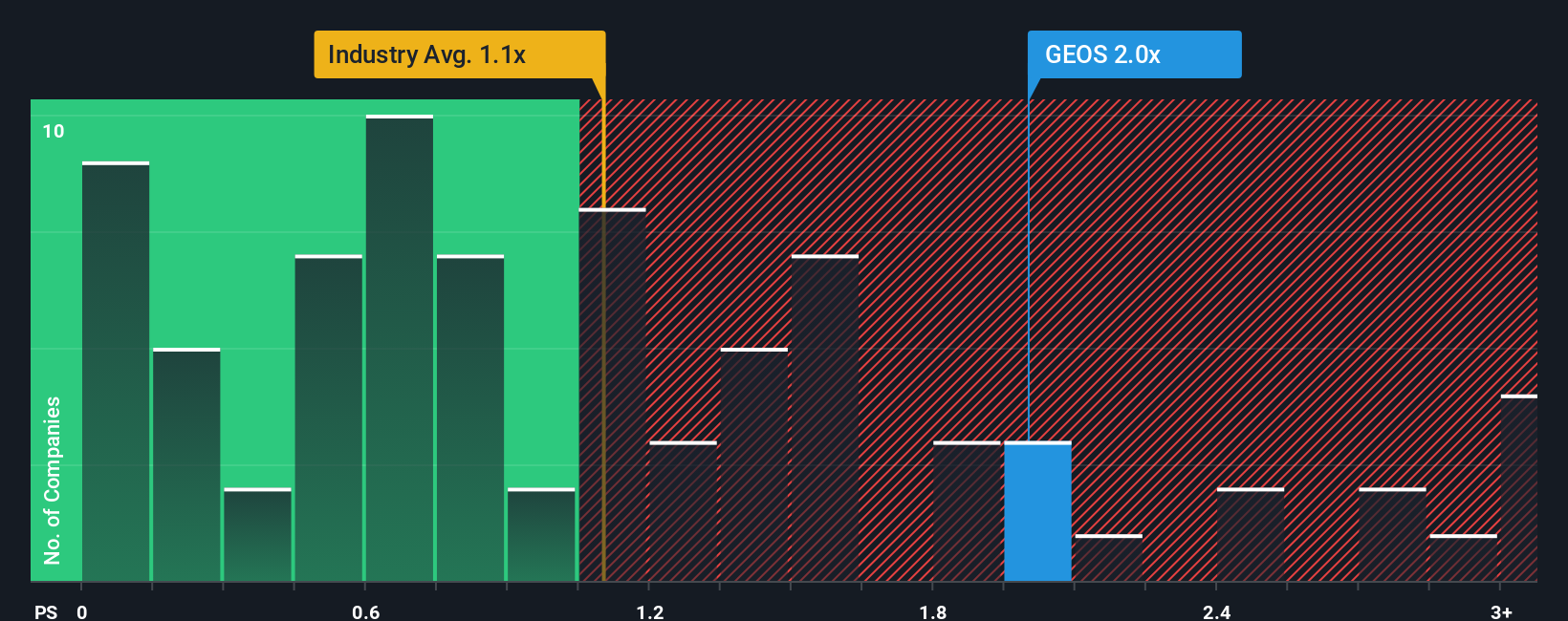

Since its price has surged higher, when almost half of the companies in the United States' Energy Services industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Geospace Technologies as a stock probably not worth researching with its 2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Geospace Technologies

How Geospace Technologies Has Been Performing

As an illustration, revenue has deteriorated at Geospace Technologies over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Geospace Technologies' earnings, revenue and cash flow.How Is Geospace Technologies' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Geospace Technologies' is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 2.6% shows it's noticeably more attractive.

In light of this, it's understandable that Geospace Technologies' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Geospace Technologies' P/S?

Geospace Technologies shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Geospace Technologies revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Geospace Technologies (1 is concerning!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.