Carvana Stock Was a Top Performer in 2025. Is There Gas Left in the Tank for 2026?

After a remarkable rally in 2025, Carvana Co. (CVNA) stock emerged as one of the standout performers in the market, rewarding investors with strong appreciation and renewed confidence in the company’s business model. Once teetering on the brink of collapse, the online used-car retailer reported record-breaking quarterly results across revenue, unit sales, and profitability, leading to inclusion in the S&P 500 Index ($SPX) a milestone that underscored its dramatic turnaround and validated its strategic execution.

Bolstered by industry-leading growth rates, multiple analyst upgrades, and sustained demand for its direct-to-consumer used vehicle platform, Carvana has defied skeptics and delivered outsized returns for shareholders in 2025.

But as we look ahead to 2026, accompanied by broader market headwinds and competitive pressures in play, is the stock worth buying?

About Carvana Stock

Carvana is a leading e‑commerce platform specializing in the buying, selling, financing, and delivery of used vehicles. Headquartered in Tempe, Arizona, the company operates one of the most ambitious vertically integrated automotive businesses in the country.

Since its IPO in 2017, Carvana has undergone a dramatic turnaround, surviving near-bankruptcy to emerge in 2025 with strong profitability margins, streamlined operations, and rapid sales growth. Currently, Carvana’s market cap is around $96.1 billion, placing it firmly within the large‑cap category.

After nearly collapsing to single-digit levels in late 2022, CVNA has staged a remarkable rebound, with its shares climbing thousands of percent over the multi-year turnaround and significantly outpacing peers and the broader S&P 500.

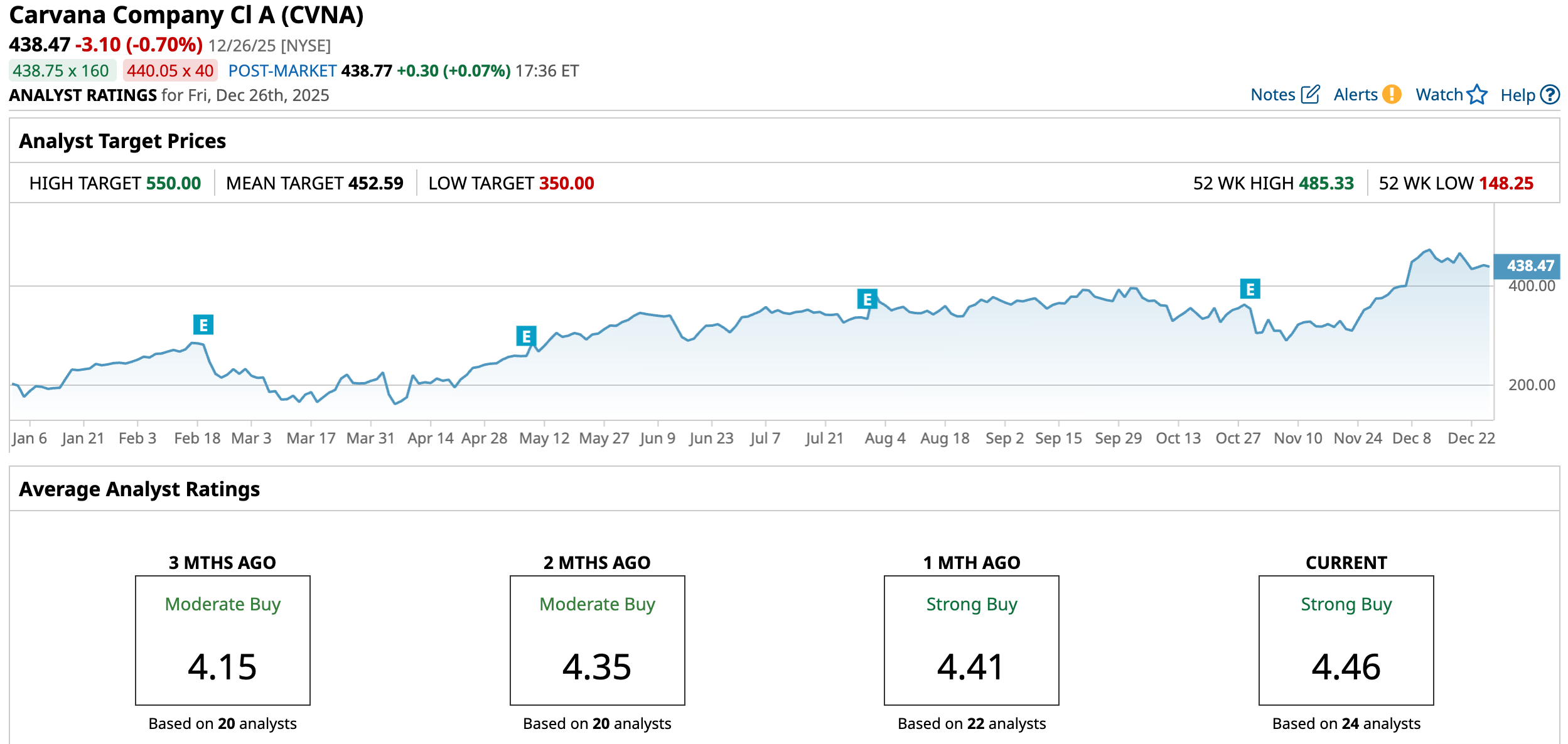

Over the past year, Carvana’s shares have rallied roughly 95.7%, with year-to-date (YTD) gains of 115.6%, closing the last session at $438.47. This remarkable run has been fueled by improving fundamentals, record vehicle sales, expanding profitability, and renewed investor confidence as the company moved back into growth mode after years of volatility.

Also, the stock experienced heightened momentum this month, following the news on Dec. 5, that Carvana would be added to the S&P 500 Index, with the change becoming effective before trading on Dec. 22. The excitement caused an intraday surge of 12.1% on the next trading day (Dec. 8) and recorded a 52-week high of $485.33 on Dec. 12.

Despite a pullback of 9.7% from its peak, Carvana continues to outperform the broader market with its return well ahead of the broader S&P 500 Index’s 17.8% gains YTD.

The stock is trading at 81.14 times forward earnings, well above the sector average.

Blockbuster Q3 Results

Carvana released its third-quarter 2025 earnings report on Oct. 29, providing one of the most compelling updates in the company’s turnaround story. In that quarter, the online used-car retailer reported record retail units sold of 155,941, representing a 44% increase compared with Q3 2024, while total revenue surged 55% year-over-year (YOY) to $5.65 billion, marking the highest quarterly sales figure in the company’s history.

In addition, profitability strengthened meaningfully in the quarter. Net income rose to $263 million, up 78% YOY, with net income margin expanding to 4.7%, and operating income climbed 64%. Adjusted EBITDA reached $637 million, a company record and a 48% YOY increase. Its EPS came in at $1.03, a significant increase from $0.64 in Q3 2024.

Carvana further expects retail units sold in Q4 2025 to exceed 150,000, and it reiterated that full-year adjusted EBITDA should reach or exceed the high end of its previously communicated range of $2.0 billion to $2.2 billion.

Analysts tracking Carvana project the company’s EPS to climb 428.4% YOY to $5.39 in fiscal 2025 and grow another 37.1% to $7.39 in fiscal 2026.

What Do Analysts Expect for Carvana Stock?

This month, Argus initiated coverage on Carvana with a “Buy” rating and a $500 price target, citing competitive advantages over traditional dealerships. The firm highlighted Carvana’s robust revenue growth and recent profitability, noting positive trends toward achievable sales and earnings goals.

Also, UBS initiated coverage on Carvana with a “Buy” rating and a $450 price target. The firm views Carvana’s best-in-class online platform and customer experience as key drivers of market-share gains in the fragmented used-car market. UBS sees significant long-term growth potential, supported by rising adoption of online car buying, strong revenue growth, and continued focus on customer experience and fast delivery.

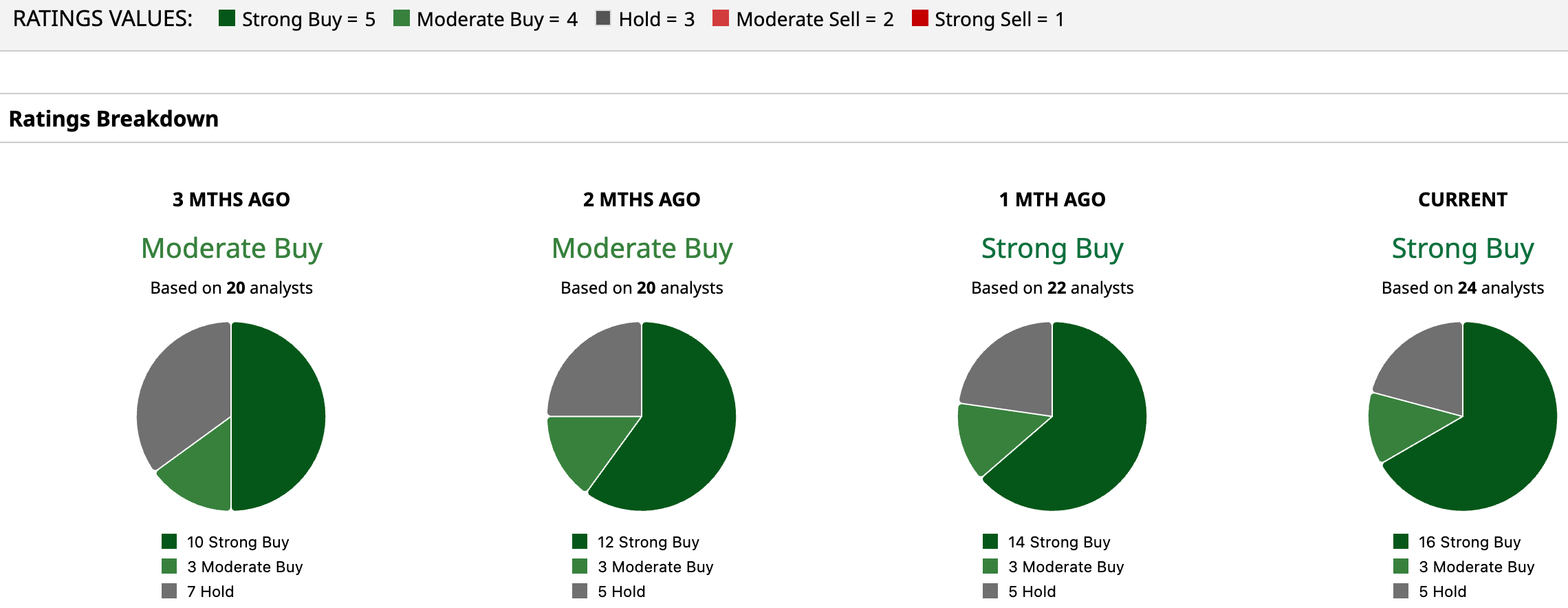

CVNA has a consensus rating of a “Strong Buy” overall. Of the 24 analysts covering the stock, 16 advise a “Strong Buy,” three suggest a “Moderate Buy,” and five analysts give it a “Hold” rating.

While CVNA’s average price target of $452.59 suggests an upside of 3.2%, the Street-high target of $550 signals that the stock could rise as much as 25.44% from current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.