3 ASX Dividend Stocks Yielding Up To 6.2%

As the Australian market winds down for the holiday season, it is experiencing a slight dip, possibly due to profit-taking ahead of the break, while major indices like those on Wall Street approach record highs. In this environment, dividend stocks can offer a stable income stream and potential resilience against market fluctuations; here we explore three ASX-listed companies yielding up to 6.2%.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 7.42% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.02% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.94% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.72% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.42% | ★★★★☆☆ |

| MFF Capital Investments (ASX:MFF) | 3.59% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.46% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.29% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.73% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.33% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cash Converters International (ASX:CCV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cash Converters International Limited operates in the unsecured lending and second-hand retail sectors across Australia, New Zealand, the United Kingdom, and other international markets, with a market capitalization of A$224.88 million.

Operations: Cash Converters International Limited generates revenue through various segments, including A$22.19 million from New Zealand operations, A$12.02 million from Vehicle Finance, A$78.53 million from Personal Finance, A$157.12 million from Store Operations, and A$83.49 million from its United Kingdom activities.

Dividend Yield: 6.2%

Cash Converters International offers a dividend yield of 6.25%, placing it among the top 25% of Australian dividend payers. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 51% and 18.5%, respectively, suggesting sustainability despite a history of volatility over the past decade. Recent follow-on equity offerings totaling A$50 million may impact future payouts, but current valuations appear favorable with a price-to-earnings ratio of 9.2x against the market's 21.7x.

- Click here to discover the nuances of Cash Converters International with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Cash Converters International's current price could be quite moderate.

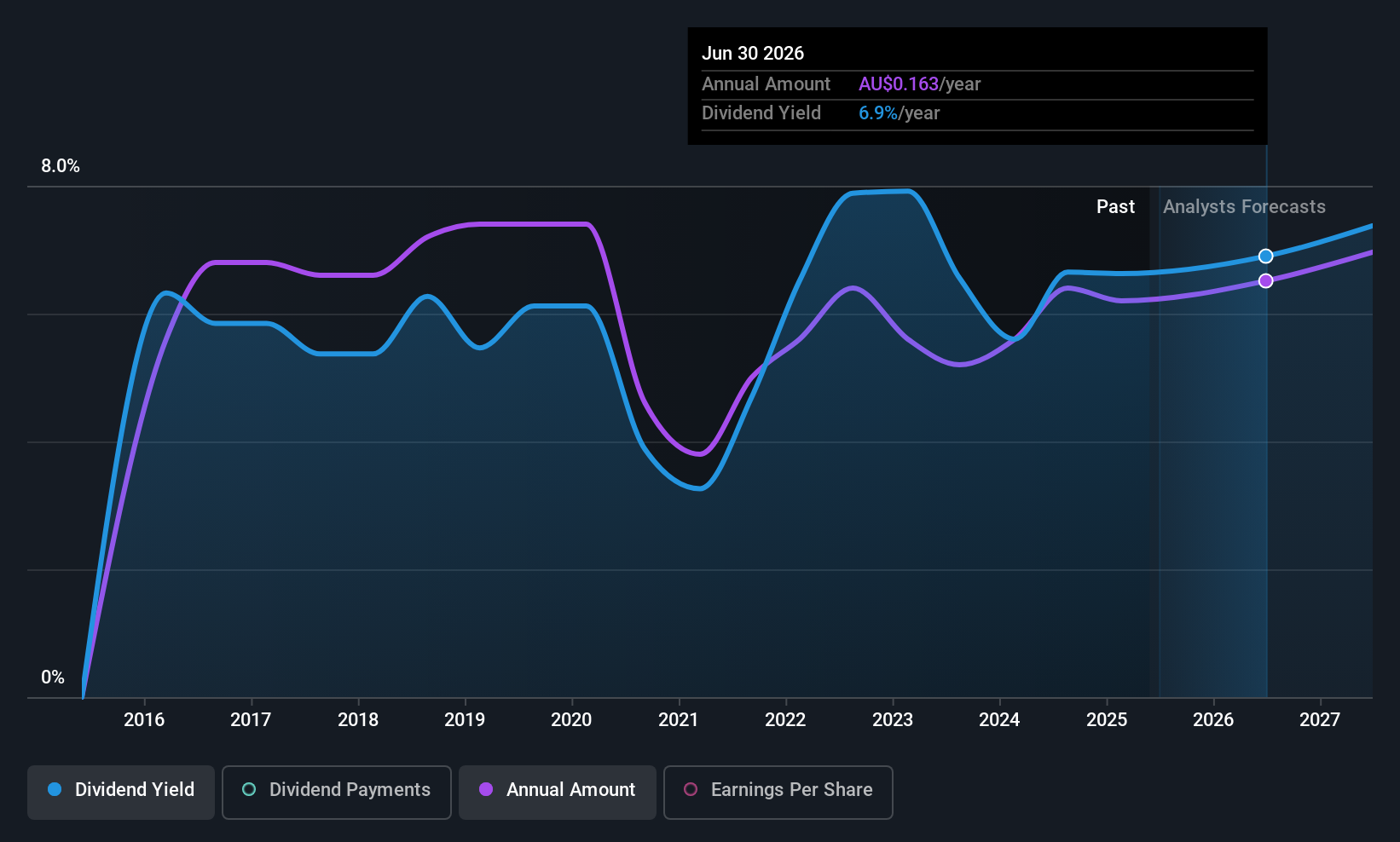

GWA Group (ASX:GWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GWA Group Limited researches, designs, manufactures, imports, and markets building fixtures and fittings for residential and commercial premises in Australia, New Zealand, the United Kingdom, and internationally with a market cap of A$655.69 million.

Operations: GWA Group Limited generates its revenue primarily from the Water Solutions segment, which accounts for A$418.48 million.

Dividend Yield: 6.2%

GWA Group's dividend yield of 6.2% ranks it in the top 25% among Australian dividend payers, yet its high payout ratio of 94.8% indicates dividends are not well covered by earnings. Although cash flows cover the dividends with a cash payout ratio of 61.3%, historical volatility raises concerns about reliability. Recent board changes, including Nicola Page's appointment as an Independent non-Executive Director, may influence strategic direction and governance in future periods.

- Unlock comprehensive insights into our analysis of GWA Group stock in this dividend report.

- Our valuation report here indicates GWA Group may be undervalued.

Joyce (ASX:JYC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Joyce Corporation Ltd (ASX:JYC) is an Australian company that specializes in retailing kitchen and wardrobe products, with a market capitalization of A$156.72 million.

Operations: Joyce Corporation Ltd generates revenue from its Retail Bedding - Franchise Operations (A$6.10 million), Retail Bedding Stores - Company-owned (A$21.11 million), and Retail Kitchen and Wardrobe Showrooms (A$120.39 million) in Australia.

Dividend Yield: 5.2%

Joyce Corporation's dividend yield of 5.19% falls short of the top quartile in Australia, and its payout ratio of 88.5% suggests dividends are covered by earnings but may be pressured. Cash flow coverage is robust with a low cash payout ratio of 33.4%. However, an unstable dividend history raises concerns about reliability despite recent increases over a decade. The stock trades significantly below estimated fair value, potentially offering value to investors seeking capital appreciation alongside dividends.

- Dive into the specifics of Joyce here with our thorough dividend report.

- Upon reviewing our latest valuation report, Joyce's share price might be too pessimistic.

Where To Now?

- Access the full spectrum of 29 Top ASX Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com