Discover 3 Asian Dividend Stocks Yielding Up To 8.8%

As Asian markets continue to navigate a complex economic landscape, characterized by cautious optimism and varied growth indicators, investors are increasingly seeking stable returns amidst the volatility. In this context, dividend stocks stand out as an attractive option for those looking to capitalize on consistent income streams while benefiting from potential capital appreciation.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.71% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.77% | ★★★★★★ |

| NCD (TSE:4783) | 4.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.79% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.75% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.26% | ★★★★★★ |

Click here to see the full list of 1026 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

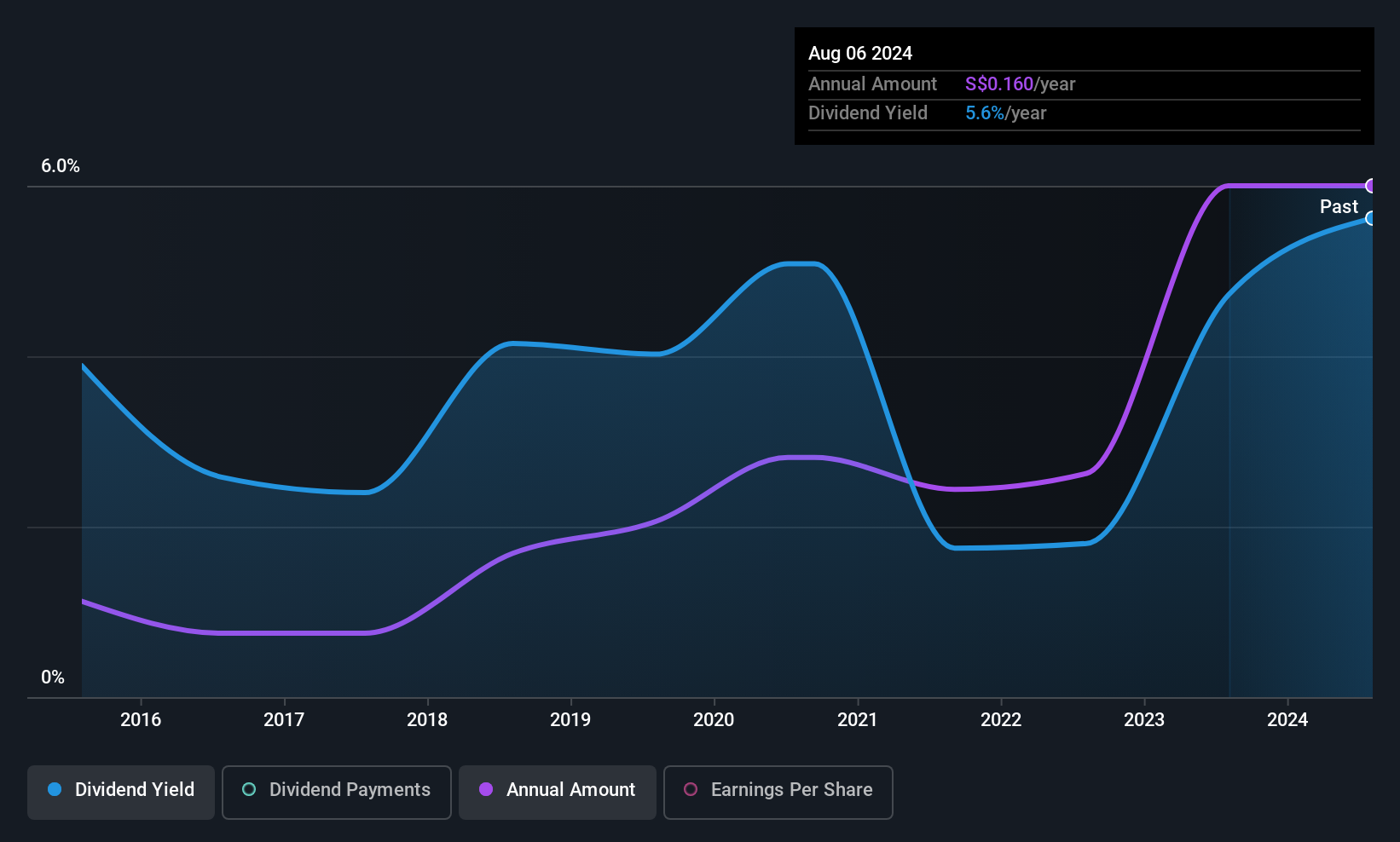

Cortina Holdings (SGX:C41)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cortina Holdings Limited is an investment holding company involved in the distribution and retailing of timepieces and accessories across Singapore, Malaysia, Thailand, Indonesia, Hong Kong, Taiwan, and internationally with a market cap of SGD619.26 million.

Operations: Cortina Holdings Limited generates its revenue primarily from two segments: Retail, which accounts for SGD858.54 million, and Wholesale, contributing SGD117.06 million.

Dividend Yield: 4.3%

Cortina Holdings' dividend payments have been unreliable and volatile over the past decade, despite being well-covered by earnings (payout ratio: 5%) and cash flows (cash payout ratio: 32.9%). The dividend yield of 4.28% is below the top quartile in Singapore's market. Recent business expansion into Australia, with a S$21 million acquisition funded through internal resources and bank borrowings, could influence future earnings stability but does not require shareholder approval due to its size.

- Delve into the full analysis dividend report here for a deeper understanding of Cortina Holdings.

- Our valuation report here indicates Cortina Holdings may be undervalued.

Mitachi (TSE:3321)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitachi Co., Ltd. operates in the semiconductor and electronic components industry, offering electronics manufacturing services both in Japan and internationally, with a market cap of ¥16.31 billion.

Operations: Mitachi Co., Ltd. generates its revenue through the sale of semiconductors, electronic components, and provision of electronics manufacturing services across domestic and international markets.

Dividend Yield: 3.9%

Mitachi's dividends are well-covered by earnings (payout ratio: 12.6%) and cash flows (cash payout ratio: 24.2%), with a dividend yield of 3.91%, placing it in Japan's top quartile for dividend payers. Despite past volatility in dividend payments, recent earnings growth of 78.5% suggests potential stability improvements. The company projects net sales of ¥105 billion and profit attributable to owners at ¥1.75 billion for the fiscal year ending May 31, 2026, which may impact future payouts positively.

- Navigate through the intricacies of Mitachi with our comprehensive dividend report here.

- Our valuation report unveils the possibility Mitachi's shares may be trading at a discount.

ISE Chemicals (TSE:4107)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ISE Chemicals Corporation operates in Japan's iodine, natural gas, and metallic compound sectors with a market cap of ¥219.38 billion.

Operations: ISE Chemicals Corporation generates revenue from its operations in the iodine and natural gas, as well as metallic compound sectors.

Dividend Yield: 8.8%

ISE Chemicals offers a high dividend yield of 8.83%, ranking it in the top 25% of dividend payers in Japan. However, its dividends have been unreliable and volatile over the past decade, with a cash payout ratio of 666.6%, indicating poor coverage by free cash flows. Despite earnings growth of 30.9% last year and a low payout ratio of 43.6%, sustainability concerns remain due to insufficient coverage by earnings or cash flows amidst recent share price volatility.

- Take a closer look at ISE Chemicals' potential here in our dividend report.

- According our valuation report, there's an indication that ISE Chemicals' share price might be on the expensive side.

Seize The Opportunity

- Click through to start exploring the rest of the 1023 Top Asian Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com