Foreign investment returns to Southeast Asia! Asian investment “bastards” surfaced in 2026

The Zhitong Finance App learned that global capital is returning to the Southeast Asian stock market this month, making the region a key sector that cannot be ignored in the 2026 global financial landscape.

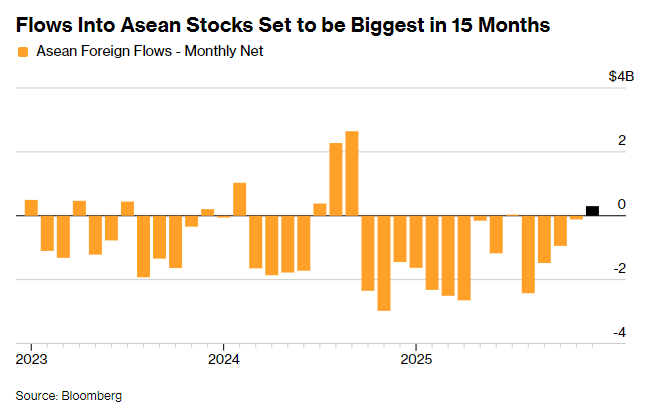

Driven by undervaluation advantages and demand for diversified investment portfolios, the Southeast Asian emerging market attracted net foreign capital inflows of US$337 million in December. This scale is expected to hit a new high since September 2024. In the previous 11 months, foreign investors were selling stocks in Southeast Asia for 10 months, and currently the Indonesian and Thai markets are leading a wave of capital return. However, looking at the full year, the net outflow of foreign capital from the Southeast Asian stock market in 2025 will still be as high as 15 billion US dollars.

In 2025, the MSCI ASEAN Index outperformed the broader Asia Pacific Index by about 13 percentage points, creating the biggest gap in five years. One of the core reasons is that the region lacks underlying assets related to the booming artificial intelligence (AI) industry. In addition to the appeal of valuation depressions, in the context of market concerns about the expansion of the AI bubble, many fund managers are rushing to find alternative allocations for high-position technology stocks, and the ASEAN market has become the preferred target.

Christopher Wong, portfolio strategist at Fidelity International, said, “Investors generally have a demand for decentralized allocation. They hope to reduce their dependence on the US market and crowded racetracks such as AI. The ASEAN market will directly benefit from this.” He also pointed out that ASEAN markets “have vastly different growth drivers behind them.”

ASEAN markets such as Vietnam are also thought to benefit from the shift in global supply chains and the expected interest rate cuts from the Federal Reserve. Furthermore, FTSE Russell announced in October that it would upgrade the Vietnamese stock market to a secondary emerging market status, which will also benefit its stock market.

Stock market profit prospects in countries such as Indonesia, Vietnam, and the Philippines are gradually improving. Positive factors include governments launching large-scale fiscal expenditure plans to focus on strengthening infrastructure construction and boosting consumer demand. At the same time, some countries also have a supportive environment for loose monetary policies.

Judging from the valuation level, the current dynamic price-earnings ratio of the benchmark stock indexes of Indonesia, Thailand, Malaysia and Vietnam is in the range of 12 to 15 times, and the price-earnings ratio of the Philippine benchmark stock index is even less than 10 times. By contrast, the price-earnings ratio of the S&P 500 index has exceeded 22 times.

However, the regional market still faces multiple risks. As the two largest economies in Southeast Asia, both Thailand and Indonesia are under pressure due to domestic political turmoil. Thai Prime Minister Anutin Sanwela's army announced the dissolution of the National Assembly at the beginning of this month, and a general election is scheduled to be held on February 8 next year; on the Indonesian side, investors are wary of the populist policies carried out by President Prabowo Subianto.

At the same time, if the AI investment boom continues to be sought after by the market, it may be difficult for the ASEAN market to reverse its current failure situation.

Analysts at J.P. Morgan Chase pointed out last month that “moderate valuation levels are gradually making the ASEAN market more attractive to value investors, especially when profit growth rebounds.” Judging from the December capital flow data, this judgment has been verified.

J.P. Morgan analyst Khoi Vu and others predicted in a research report released on November 28 that if the foreign holding ratio returns to the median level of the past three years, the Southeast Asian market as a whole is expected to usher in a net potential inflow of up to 20 billion US dollars.