European Growth Companies With Up To 22% Insider Ownership

As the pan-European STOXX Europe 600 Index inches closer to record highs, positive sentiment about future earnings and economic conditions is fostering optimism across the continent. Amidst this backdrop, growth companies with high insider ownership often attract attention for their potential alignment of management interests with those of shareholders, making them an intriguing focus in today's market environment.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Ercros (BME:ECR)

Simply Wall St Growth Rating: ★★★★☆☆

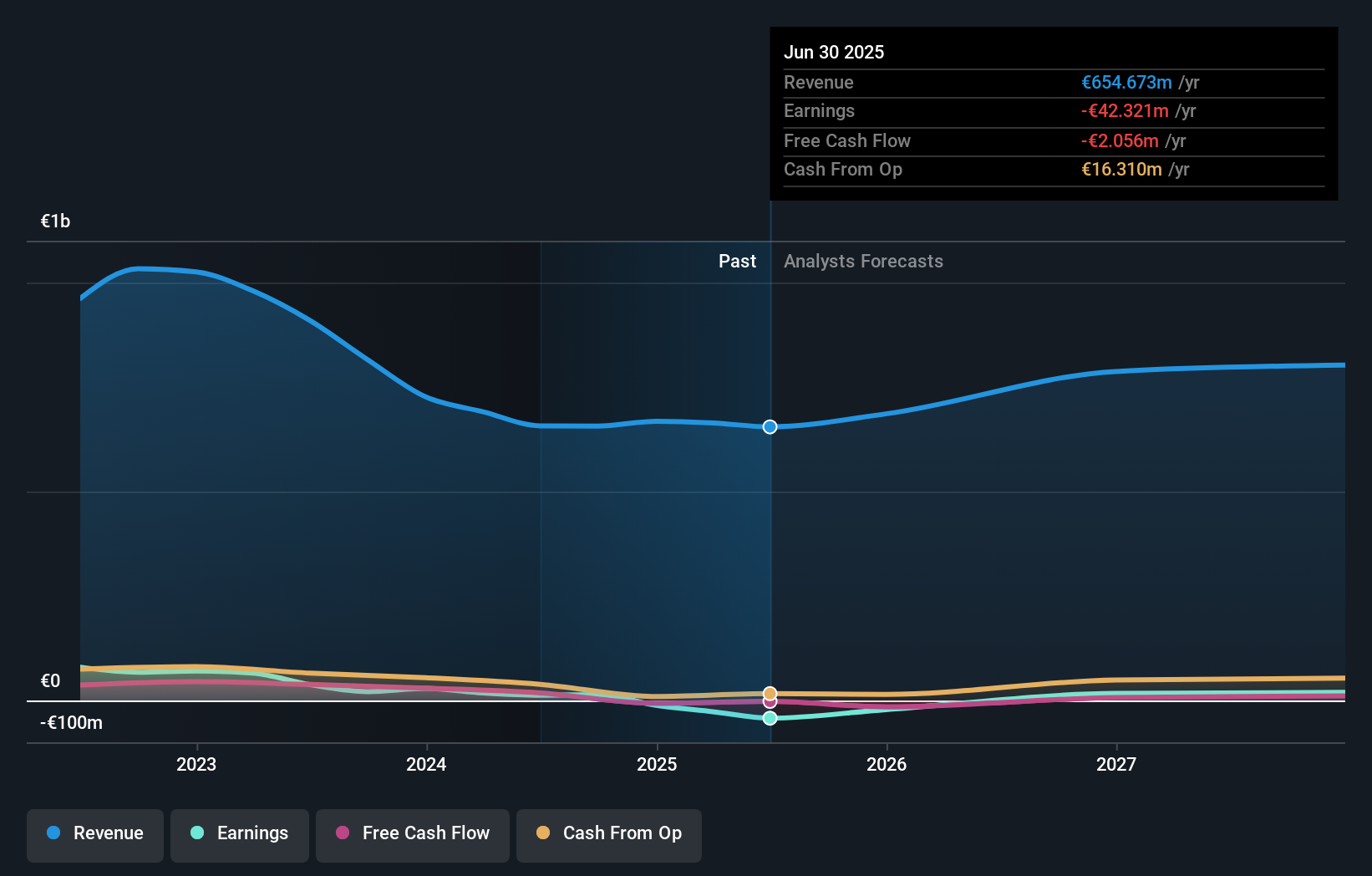

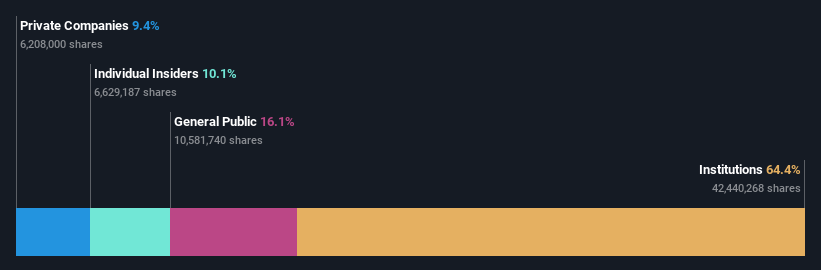

Overview: Ercros, S.A. is a Spanish company that manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals with a market cap of €314.08 million.

Operations: The company's revenue is primarily derived from chlorine derivatives (€376.44 million), intermediate chemicals (€182.19 million), and pharmaceuticals (€62.24 million).

Insider Ownership: 15.9%

Ercros is experiencing mixed financial performance, with a net loss of €41.22 million for the first nine months of 2025, yet it shows potential for growth as earnings are forecast to grow significantly at 107.59% annually. Revenue growth is projected at 9.6% per year, outpacing the Spanish market average. Despite high share price volatility and low return on equity forecasts, Ercros trades at good value compared to peers and industry standards.

- Get an in-depth perspective on Ercros' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Ercros is priced lower than what may be justified by its financials.

Bonesupport Holding (OM:BONEX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bonesupport Holding AB is an orthobiologics company that develops and sells injectable bio-ceramic bone graft substitutes globally, with a market cap of SEK11.94 billion.

Operations: The company's revenue segment is primarily derived from Pharmaceuticals, amounting to SEK1.12 billion.

Insider Ownership: 10.4%

Bonesupport Holding is positioned for robust growth, with revenue expected to rise 27.8% annually, surpassing the Swedish market average. Its earnings are forecasted to grow significantly at 49.6% per year. The company recently shifted its CERAMENT V regulatory process to De Novo with the FDA, potentially establishing a new product category. Despite trading below fair value estimates and analyst price targets suggesting a significant upside, no recent insider trading activity has been reported.

- Click here and access our complete growth analysis report to understand the dynamics of Bonesupport Holding.

- According our valuation report, there's an indication that Bonesupport Holding's share price might be on the cheaper side.

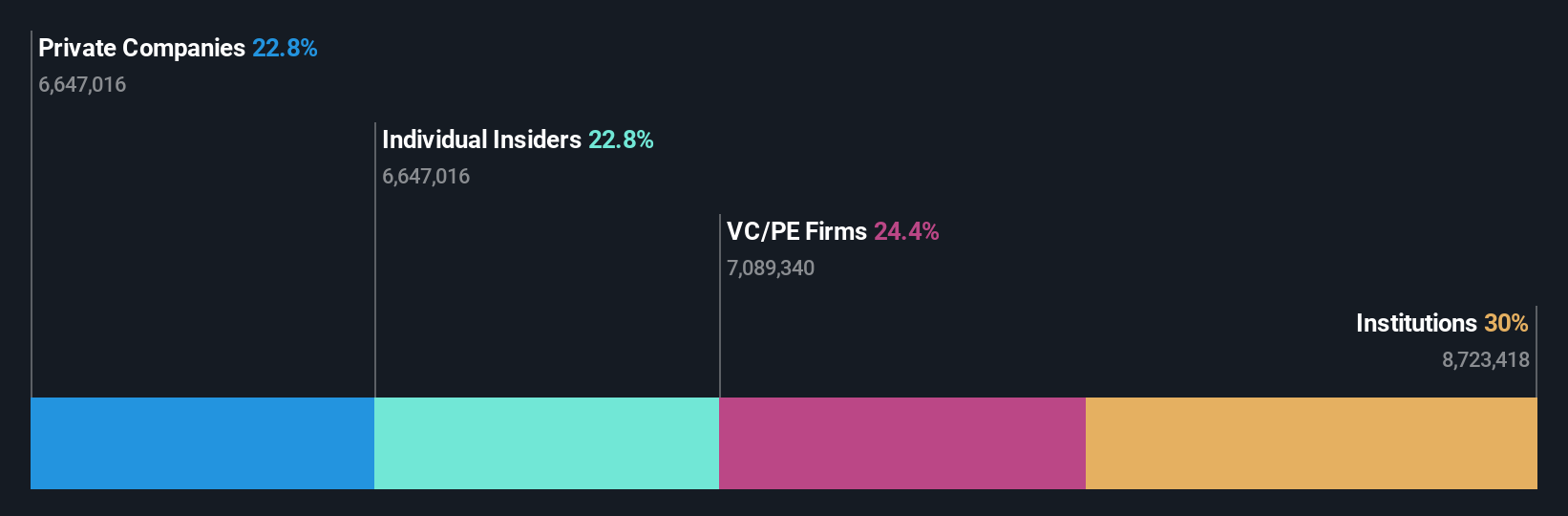

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shoper S.A. offers software as a service solutions for e-commerce in Poland and has a market capitalization of PLN1.47 billion.

Operations: Shoper S.A. generates revenue from its software as a service offerings through two main segments: Solutions, which accounts for PLN168.70 million, and Subscriptions, contributing PLN44.74 million.

Insider Ownership: 22.5%

Shoper's earnings are projected to grow significantly at 22.2% annually, outpacing the Polish market, while revenue growth is forecasted at 15.2%, also above market average. Recent results show an increase in net income to PLN 29.52 million for the nine months ending September 2025, with basic EPS rising from PLN 0.84 to PLN 1.05 year-over-year. Trading below fair value estimates suggests potential upside despite no recent insider trading activity reported.

- Unlock comprehensive insights into our analysis of Shoper stock in this growth report.

- Our comprehensive valuation report raises the possibility that Shoper is priced higher than what may be justified by its financials.

Where To Now?

- Click through to start exploring the rest of the 206 Fast Growing European Companies With High Insider Ownership now.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com