Exploring High Growth Tech Stocks in December 2025

As the global markets wrap up a holiday-shortened week, U.S. stocks have surged to record highs, buoyed by robust economic growth and optimism surrounding artificial intelligence, despite mixed signals from consumer confidence and durable goods orders. In this environment of fluctuating indices and economic indicators, identifying high-growth tech stocks requires a focus on companies with strong innovation potential and resilience in adapting to evolving market dynamics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Presight AI Holding (ADX:PRESIGHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Presight AI Holding PLC is a big data analytics company utilizing generative artificial intelligence to serve markets in the United Arab Emirates and internationally, with a market cap of AED18.85 billion.

Operations: Presight AI Holding PLC generates revenue primarily from its artificial intelligence, machine learning, data analytics, and hosting services, amounting to AED2.78 billion. The company leverages generative AI to provide advanced data solutions across various markets.

Presight AI Holding has demonstrated robust financial performance with a 22.3% annual revenue growth and a notable 16.6% increase in earnings per year, outpacing the AE market average significantly. The company's strategic alliances, such as the recent MoU with HSBC UAE during Abu Dhabi Finance Week, underscore its commitment to integrating AI into financial services to boost risk intelligence and operational efficiency. This focus on enhancing core business areas through advanced AI solutions not only aligns with industry trends towards digital transformation but also positions Presight to capitalize on new growth opportunities within the tech-driven financial ecosystem.

- Click here and access our complete health analysis report to understand the dynamics of Presight AI Holding.

Assess Presight AI Holding's past performance with our detailed historical performance reports.

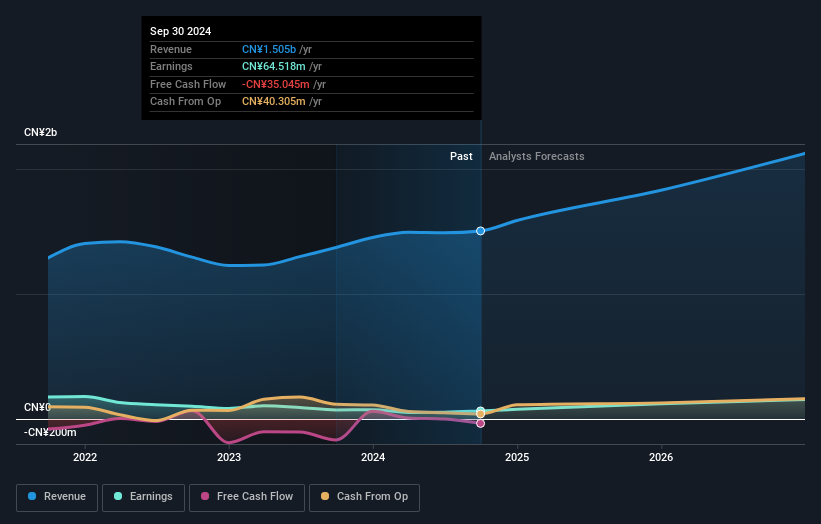

Beijing Zhidemai Technology (SZSE:300785)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Zhidemai Technology Co., Ltd. operates in the Internet marketing and data service sectors both within China and internationally, with a market capitalization of CN¥7.84 billion.

Operations: Zhidemai Technology focuses on Internet marketing and data services across domestic and international markets. The company leverages its expertise in these areas to generate revenue, contributing to its market capitalization of CN¥7.84 billion.

Beijing Zhidemai Technology has shown a remarkable ability to outpace its sector, with earnings growth of 31.6% over the past year, significantly higher than the Interactive Media and Services industry's 6.7%. This performance is underscored by an aggressive R&D strategy, evidenced by their recent earnings report showing substantial investment in innovation. The company's focus on refining its governance structures through upcoming shareholder meetings suggests a strategic pivot aimed at sustaining this growth trajectory and enhancing operational efficiency. With revenue also expected to surge by 24.3% annually, Beijing Zhidemai is positioning itself as a formidable contender in China’s tech landscape, navigating through market volatilities with robust financial health and strategic foresight.

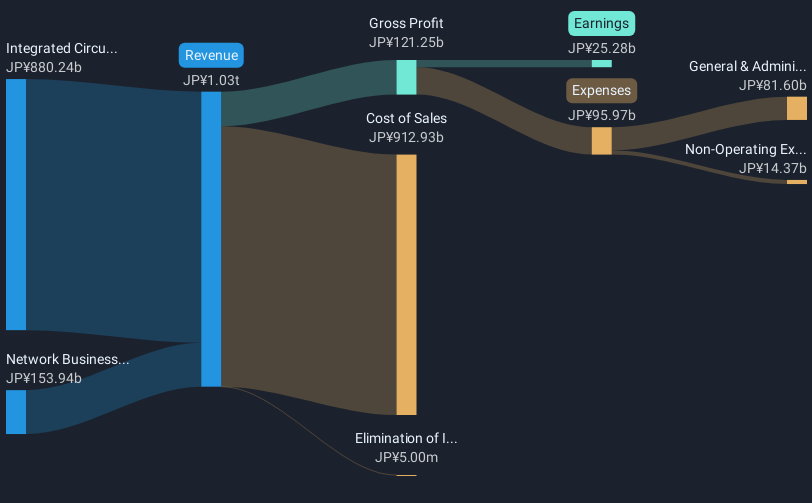

Macnica Holdings (TSE:3132)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Macnica Holdings, Inc. is engaged in the import, sale, and export of electronic components in Japan with a market capitalization of ¥431.23 billion.

Operations: Macnica Holdings focuses on importing, selling, and exporting electronic components within Japan.

Despite a challenging year with earnings contraction by 43.8%, Macnica Holdings demonstrates resilience with projected earnings growth at an impressive 28.9% annually, outpacing the broader Japanese market's 8.6%. This rebound is supported by a robust R&D commitment, integral to its strategic emphasis on innovation and market adaptation. The company also maintains a positive free cash flow and anticipates revenue growth of 7.7% per year, which exceeds the national average of 4.6%, signaling potential for sustained improvement in its financial health and competitive positioning in the electronics sector.

- Take a closer look at Macnica Holdings' potential here in our health report.

Gain insights into Macnica Holdings' past trends and performance with our Past report.

Summing It All Up

- Access the full spectrum of 241 Global High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com