3 Growth Companies With Insider Ownership Up To 18%

As the major U.S. stock indexes log weekly gains amid a holiday-shortened trading week, investors are increasingly focusing on growth companies that demonstrate strong insider ownership. In the current market environment, where stability and confidence are key, companies with significant insider stakes can signal alignment between management and shareholders' interests, potentially making them attractive options for those seeking long-term growth opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.7% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

| AppLovin (APP) | 27.3% | 27.1% |

Underneath we present a selection of stocks filtered out by our screen.

Celsius Holdings (CELH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celsius Holdings, Inc. is engaged in the development, manufacturing, marketing, and distribution of functional energy drinks across various regions including the United States, North America, Europe, and the Asia Pacific with a market cap of approximately $11.75 billion.

Operations: The company's revenue primarily comes from its non-alcoholic beverages segment, generating approximately $2.13 billion.

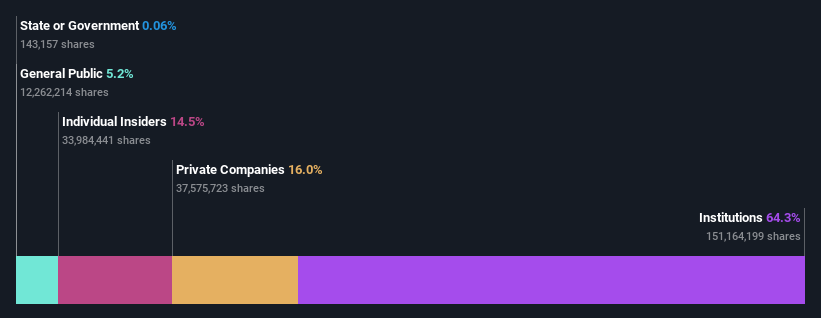

Insider Ownership: 13%

Celsius Holdings demonstrates potential as a growth company with high insider ownership, despite recent financial challenges. Forecasted earnings growth of 48% annually outpaces the US market, and revenue is expected to grow at 16.8% per year. However, profit margins have decreased from last year. The company announced a $300 million share repurchase program and recently refinanced debt to lower interest rates following its acquisition of Alani Nutrition, LLC.

- Click to explore a detailed breakdown of our findings in Celsius Holdings' earnings growth report.

- According our valuation report, there's an indication that Celsius Holdings' share price might be on the expensive side.

Amer Sports (AS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amer Sports, Inc. is a global company involved in designing, manufacturing, marketing, distributing, and selling sports equipment, apparel, footwear, and accessories across various regions including Europe and Asia Pacific with a market cap of $21.28 billion.

Operations: The company's revenue segments include Technical Apparel at $2.60 billion, Outdoor Performance at $2.23 billion, and Ball & Racquet Sports at $1.27 billion.

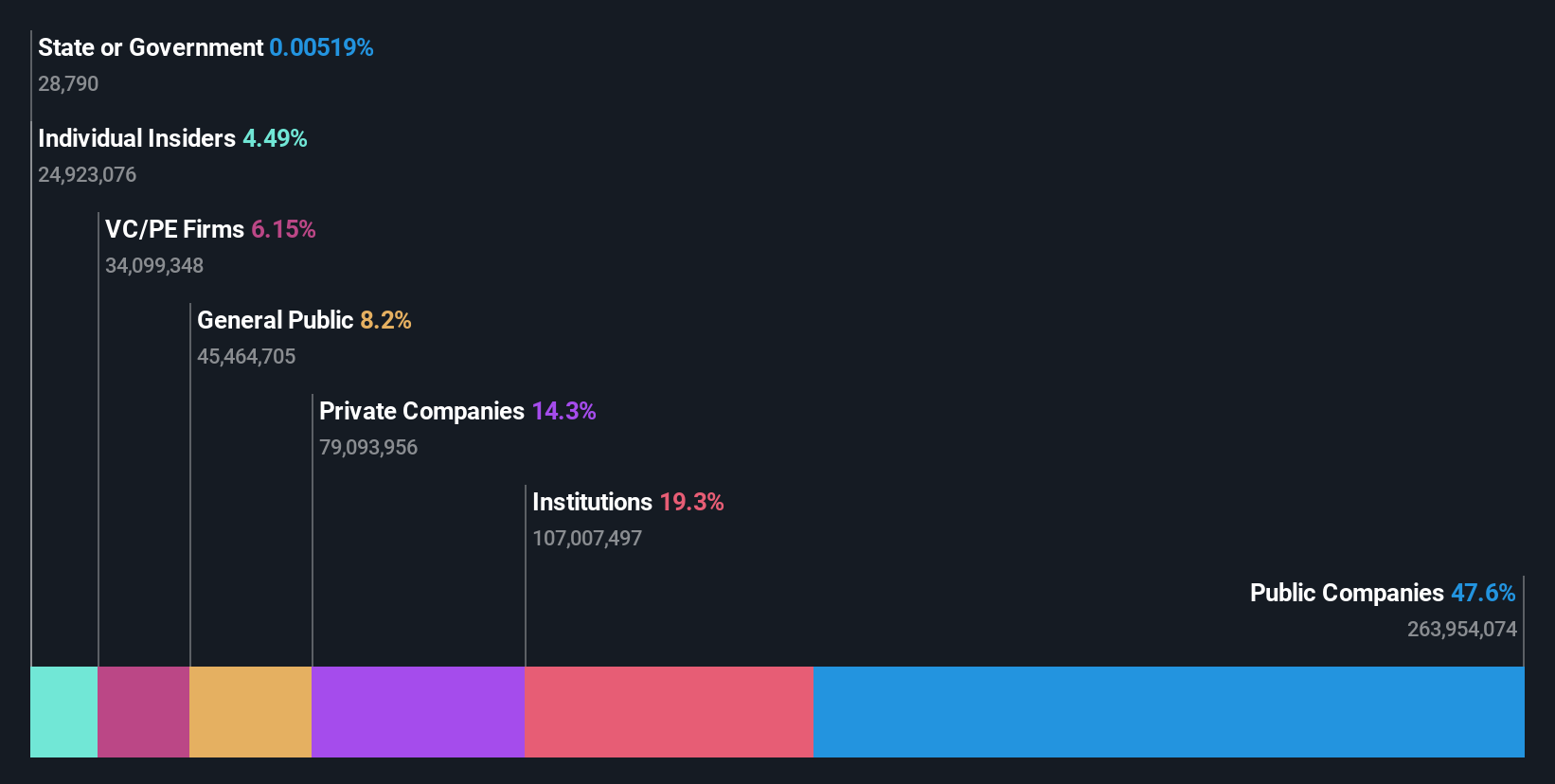

Insider Ownership: 18%

Amer Sports shows promise with insider ownership and is projected to achieve significant annual earnings growth of 28.1%, surpassing the US market's average. The company recently reported strong Q3 results, with sales reaching US$1.76 billion and net income at US$143.1 million, despite a goodwill impairment of US$6.7 million. Revenue growth is expected at 13.9% annually, outpacing the broader market but not reaching high-growth thresholds, while return on equity remains modestly forecasted at 13.6%.

- Navigate through the intricacies of Amer Sports with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Amer Sports implies its share price may be too high.

Roblox (RBLX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Roblox Corporation operates an immersive platform for connection and communication both in the United States and internationally, with a market cap of $57.71 billion.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, which amounts to $4.46 billion.

Insider Ownership: 10.7%

Roblox Corporation, an immersive gaming platform, is experiencing robust growth with revenue forecasted to expand at 22% annually, outpacing the US market. Despite recent financial losses, it is projected to become profitable within three years. The company has formed strategic alliances with Universal Music Group and Mattel to enhance user engagement and drive revenue through innovative collaborations. Insider activity shows more buying than selling over the past three months, indicating confidence in future prospects.

- Click here to discover the nuances of Roblox with our detailed analytical future growth report.

- The analysis detailed in our Roblox valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Delve into our full catalog of 208 Fast Growing US Companies With High Insider Ownership here.

- Ready For A Different Approach? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com