TSX Penny Stocks Under CA$300M Market Cap To Watch

The Canadian market has seen significant shifts, with diversification emerging as a key strategy for investors, particularly in the energy, industrials, and materials sectors. Penny stocks may be an old term, but they continue to offer intriguing opportunities for growth at lower price points. By focusing on companies with strong balance sheets and solid fundamentals, investors can uncover potential gems among these smaller or newer entities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.97M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.35 | CA$255.45M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.25 | CA$125.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.41 | CA$3.43M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.31 | CA$871.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.24 | CA$24.58M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.29 | CA$166.88M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$184.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 387 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

D-BOX Technologies (TSX:DBO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: D-BOX Technologies Inc. designs, manufactures, and commercializes haptic motion systems for theatrical entertainment, sim racing, and simulation training across multiple continents with a market cap of CA$209.34 million.

Operations: The company's revenue is primarily derived from its theatrical segment at CA$27.36 million, followed by sim racing at CA$10.22 million and simulation and training at CA$8.33 million.

Market Cap: CA$209.34M

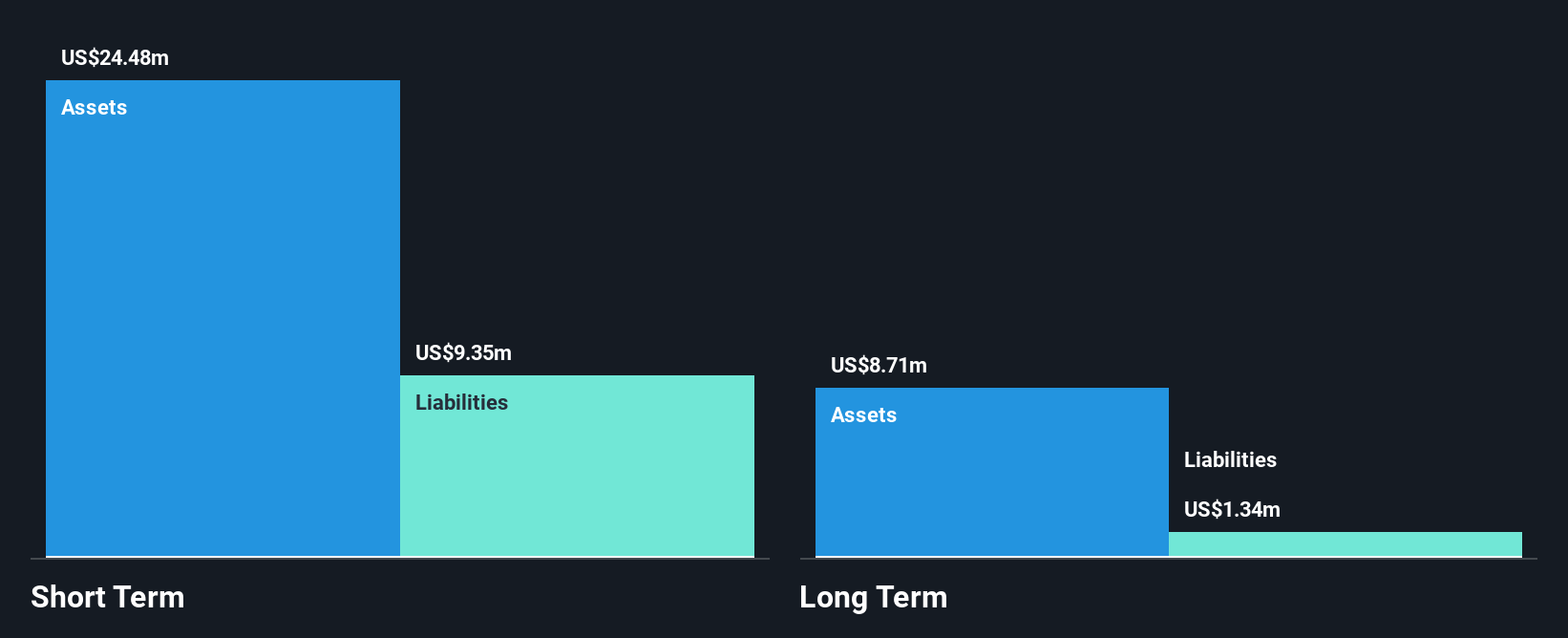

D-BOX Technologies has shown significant financial improvement, with earnings growing 394% over the past year and a net profit margin increase from 4.5% to 17.1%. The company has reduced its debt-to-equity ratio significantly over five years and maintains strong interest coverage, with EBIT covering interest payments by a large margin. D-BOX's short-term assets comfortably exceed both short-term and long-term liabilities, indicating solid financial health. Recent executive changes include appointing Scott Sherr as Chief Commercial Officer, bringing extensive industry experience to enhance global business activities across sales and partnerships amid stable weekly volatility of 12%.

- Unlock comprehensive insights into our analysis of D-BOX Technologies stock in this financial health report.

- Understand D-BOX Technologies' track record by examining our performance history report.

Puma Exploration (TSXV:PUMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Puma Exploration Inc. is a junior mining exploration company focused on acquiring, prospecting, and developing mining properties in Canada, with a market cap of CA$32.54 million.

Operations: Puma Exploration Inc. currently does not report any revenue segments.

Market Cap: CA$32.54M

Puma Exploration Inc. is a pre-revenue junior mining company with a market cap of CA$32.54 million, actively engaged in exploration activities at its McKenzie Gold Project in Northern New Brunswick. Recent private placements have strengthened its financial position, with Kinross Gold Corp increasing its stake to 14.8% undiluted and potentially up to 19.9%. The company has no debt and maintains short-term assets of CA$1.1 million, though these do not fully cover short-term liabilities of CA$1.2 million. Puma's ongoing drilling programs aim to further delineate high-grade gold zones, supported by promising sampling results indicating substantial mineralization potential.

- Get an in-depth perspective on Puma Exploration's performance by reading our balance sheet health report here.

- Learn about Puma Exploration's historical performance here.

Zoomd Technologies (TSXV:ZOMD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zoomd Technologies Ltd. operates as a marketing technology user-acquisition and engagement platform worldwide, with a market cap of CA$125.99 million.

Operations: The company generates revenue from its Internet Software & Services segment, totaling $68.93 million.

Market Cap: CA$125.99M

Zoomd Technologies Ltd., with a market cap of CA$125.99 million, is showing robust financial health and strategic growth initiatives. The company reported third-quarter revenues of US$16.13 million, slightly down from the previous year, but net income increased to US$3.8 million. Zoomd's earnings have grown significantly over the past year by 203.8%, surpassing industry averages and reflecting high-quality past earnings without debt concerns. Recent partnerships, such as with E2-Quadrat communications GMBH, align with its focus on expanding in high-growth verticals while actively exploring M&A opportunities to enhance technological capabilities and customer base expansion globally.

- Take a closer look at Zoomd Technologies' potential here in our financial health report.

- Gain insights into Zoomd Technologies' future direction by reviewing our growth report.

Make It Happen

- Investigate our full lineup of 387 TSX Penny Stocks right here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com