How to Find Dividend Stocks

What are Dividend Stocks?

Dividend stocks distribute a part of a company’s earnings to their investors on a regular basis.

Companies that pay high dividends tend to be well-established. They usually show a stable earnings ability, thus adding some stability to your portfolio.

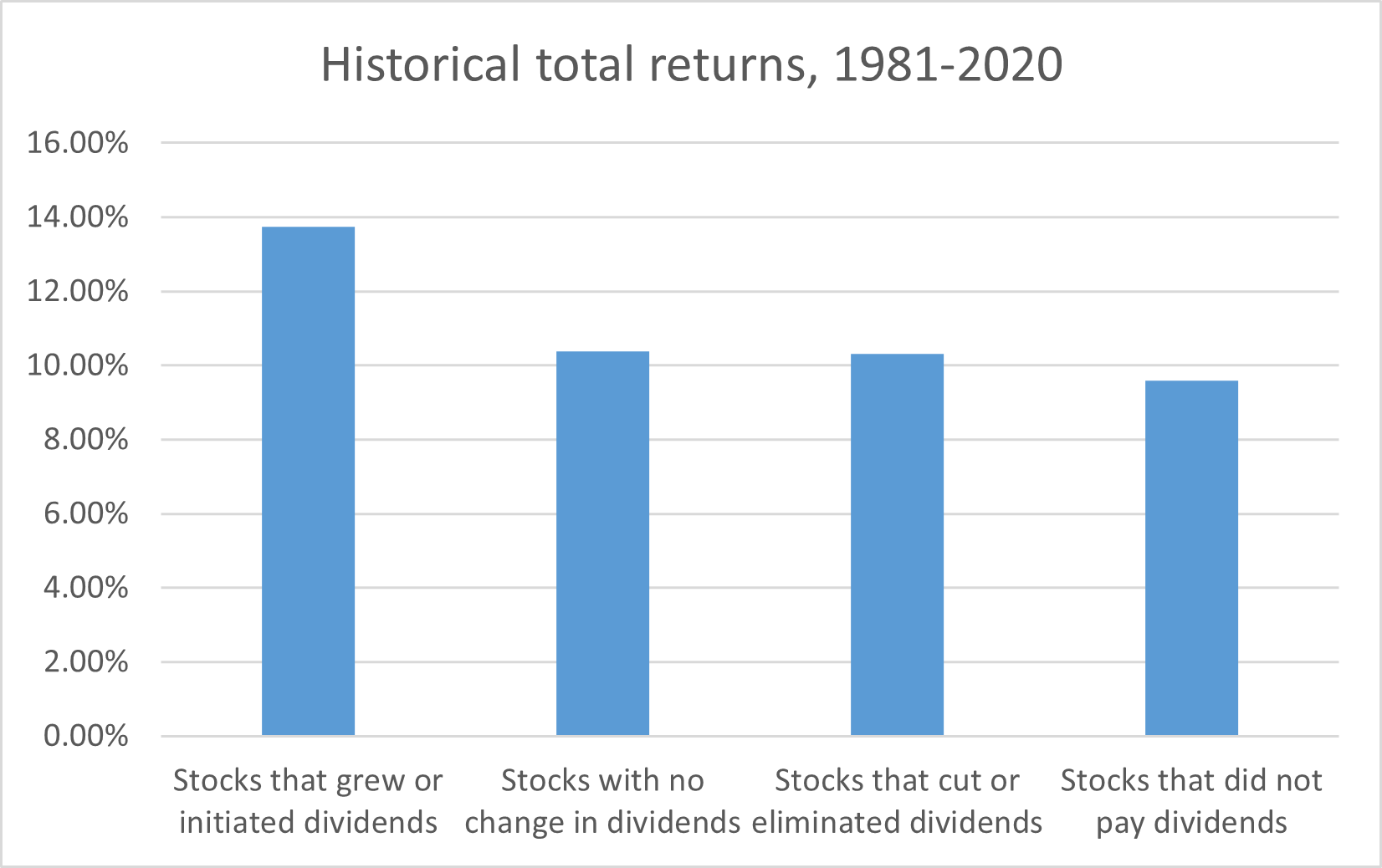

Research finds that stocks with increasing dividends tend to have higher earnings than those that keep the same dividend over time, cut dividends, or do not pay dividends at all.

Source: Compustat, Ned Davis Research, S&P Capital IQ, and S&P Dow Jones Indices.

How Do you Find Dividend Stocks on Webull?

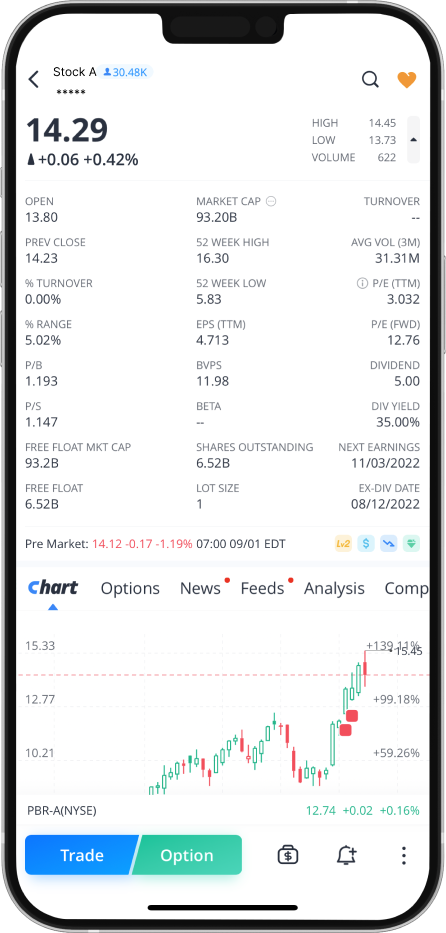

Go to Market>Explore. Scroll down to see the ‘Dividend Stock List’. Here you can see all the dividend-paying stocks tradable on Webull. Rank them by dividend yield, P/E, or one of the other options available.

What are some Standards to Evaluate Dividend Stocks?

There are thousands of dividend-paying stocks in the market. Are stocks with higher dividend yield always the better? Not necessarily.

1. Dividend yield is important, but it’s not everything.

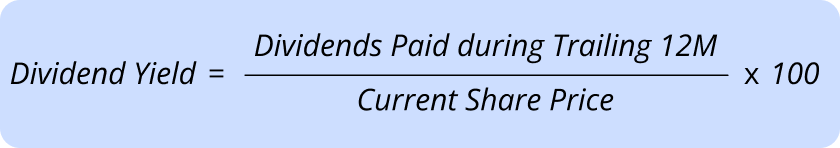

A Dividend yield is how much income a share generates in a year relative to its stock price. It could be considered when picking dividend stocks, but it’s not everything.

Let’s look at the calculation first.

A high yield can mean two things: either the dividends increased, or the current share price dropped.

For your reference, the S&P 500 dividend yield was only 1.69% in June 2022. If you see a dividend yield way above 10%, find out if there is a good reason for that.

2. The fundamentals—steadily growing earnings are essential.

It’s also important to consider financial performance when choosing a stock.Choose a symbol and go to the details page. Click Company>Financials to see the fundamentals.Take a look at two things: the total revenue and earnings per share (EPS).

- Total revenue shows the total income the company generated in the last quarter.

- EPS, on the other hand, shows how much the company has earned for each share of the stock.

Steadily growing revenue and EPS are evidence of sustainable growth.

Tip: How can you check the historical financial performance of a stock on Webull? Choose a symbol and go to the details page. Click Company>Financials to see the fundamentals.

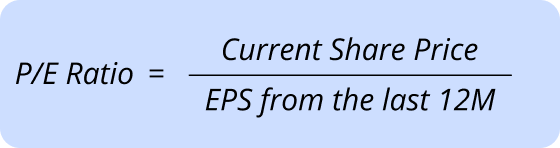

3. Moderate P/E ratio—is the stock fairly valued?

The price-to-earnings (P/E) ratio often refers to the 12-M trailing (TTM) P/E.

P/E ratio reflects how much an investor will pay for one dollar of a company’s earnings over a year. Stocks with high P/E can be considered overvalued, while stocks with low P/E can be considered undervalued. Compare a stock with other companies in the same sector to determine an average P/E of its peers.

However, there is no standard for determining what is high and low. For your reference, the long-term average P/E for the S&P 500 is around 16x, which means investors are paying an average of $16 for a share in the S&P 500.

On Webull, investors can check the rank of a company in ‘Peer Comparison’ (as shown below). Look at the rank to see if it’s fairly priced.

Starting Small? It can add up.

Many people dream about investing in a stock and getting rich overnight. Unfortunately, this is not usually a reality. To create a long-term portfolio, it’s important to add stability and sustainability. Dividend stocks can help.

Once you have chosen a suitable stock to trade, you can set a recurring investment to invest a small amount regularly. Small amounts can add up. Before you know it, you have made a big investment.

Check below to see how to make a recurring investment on Webull.