Innoviz Technologies (INVZ) Q3 Results: Revenue Beats Estimates, Loss Narrows

Innoviz Technologies Ltd (NASDAQ:INVZ) shares are in the spotlight Wednesday morning after the company delivered third-quarter financial results that topped analyst expectations on both the top and bottom lines. Here’s what investors need to know.

- INVZ is rising today. Stay ahead of the curve here.

What To Know: The developer of high-performance LiDAR sensors reported a quarterly loss of 8 cents per share, beating the consensus estimate of 9 cents and marking a nearly 47% improvement over the 15-cent loss reported in the same period last year.

Revenue for the quarter surged 238% year-over-year to $15.28 million, surpassing analysts’ projections of $14.67 million. The company noted that year-to-date revenues of $42.4 million are approximately 2.3 times higher than 2024 levels, driven by a significant increase in LiDAR unit shipments.

On the operational front, Innoviz announced a strategic milestone: selection by a major commercial vehicle OEM for the series production of Level 4 autonomous trucks. The company also highlighted the unveiling of the InnovizThree, which features a 60% size reduction and improved power efficiency.

Looking ahead, Innoviz affirmed its fiscal year 2025 revenue guidance of $50 million to $60 million. While the guidance range remains steady, it sits below the prevailing analyst consensus of $60.25 million.

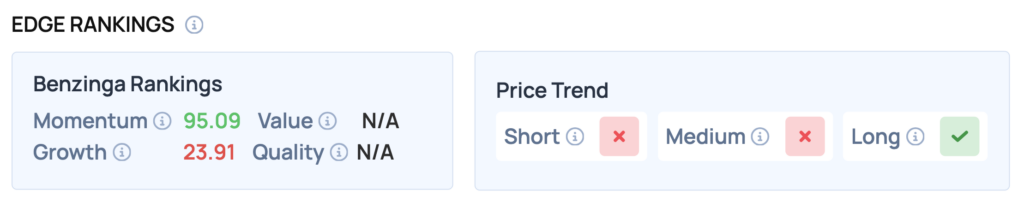

Benzinga Edge Rankings: Benzinga Edge rankings highlight a strong Momentum score of 95.09 for Innoviz Technologies, significantly outpacing its Growth score of 23.91.

INVZ Price Action: Innoviz Technologies shares were up 4.35% at $1.54 at the time of publication on Wednesday, according to Benzinga Pro data.

Read Also: AMD Stock Surges On Explosive AI Growth Targets, Analysts See Further Upside

How To Buy INVZ Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Innoviz Technologies’ case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock