High Growth Tech Stocks in Asia for December 2025

As global markets close out the year with mixed performances, Asian tech stocks have garnered attention amid rising optimism around artificial intelligence and technology-driven growth. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and innovation in adapting to evolving market demands and technological advancements.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 36.73% | 37.89% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Shenzhen Kinwong Electronic (SHSE:603228)

Simply Wall St Growth Rating: ★★★★★☆

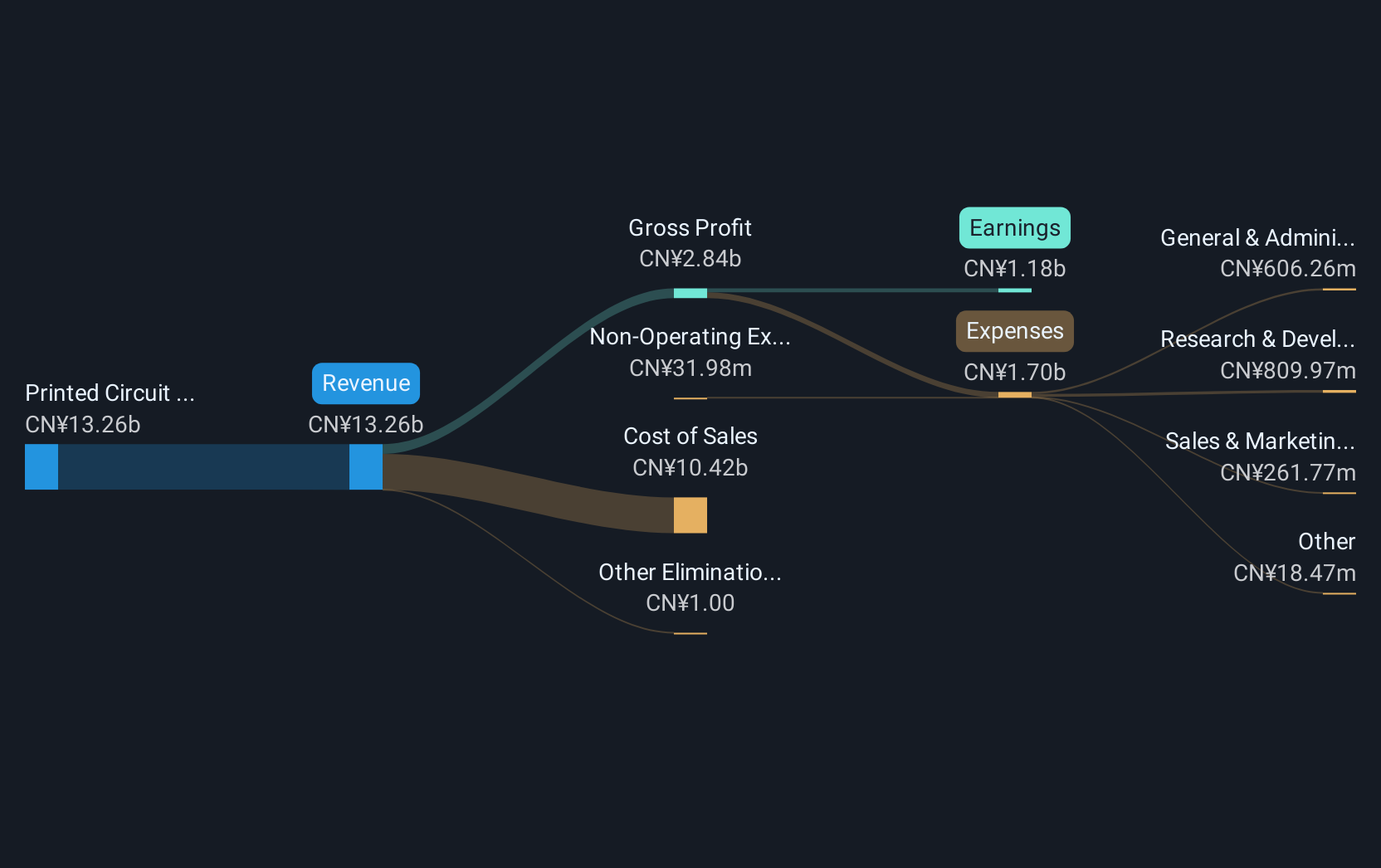

Overview: Shenzhen Kinwong Electronic Co., Ltd. focuses on the research, development, production, and sale of printed circuit boards and electronic materials both in China and globally, with a market cap of CN¥75.66 billion.

Operations: Kinwong generates revenue primarily from its printed circuit board segment, which accounts for CN¥14.66 billion. The company operates both domestically and internationally in the electronic materials sector.

Shenzhen Kinwong Electronic has demonstrated a robust financial performance, with revenues soaring to CNY 11.08 billion, up from CNY 9.08 billion year-over-year, and net income increasing slightly to CNY 948.12 million. This growth is underscored by an annualized revenue increase of 20.4%, significantly outpacing the broader Chinese market's growth rate of 14.6%. Despite a more volatile share price recently, the company's earnings are projected to grow by an impressive 35.7% annually, highlighting its potential in a competitive electronics sector where innovation and rapid adaptation are critical. The recent shareholders' meeting could indicate strategic shifts that further enhance this trajectory.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

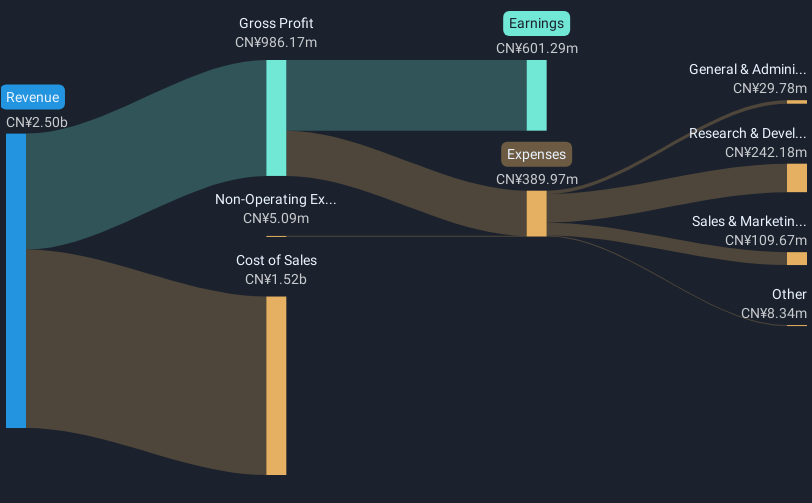

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and globally, with a market cap of CN¥18.96 billion.

Operations: Willfar Information Technology Co., Ltd. specializes in smart utility services and IoT solutions, generating revenue primarily from these segments. The company operates both domestically in China and on an international scale.

Willfar Information Technology, amid a competitive tech landscape in Asia, has shown notable financial resilience and growth potential. In the recent fiscal period, the company's revenue surged to CNY 2.11 billion from CNY 1.94 billion year-over-year, marking an impressive annualized increase of 24.2%. This growth is complemented by a robust net income rise to CNY 474.19 million, up from CNY 422.47 million, reflecting an earnings growth of about 13.5% over the past year which surpasses its industry's average of 9.4%. The firm's strategic focus on innovation is evident as it channels significant resources into R&D, ensuring it stays ahead in technological advancements and market competitiveness.

- Click here and access our complete health analysis report to understand the dynamics of Willfar Information Technology.

Understand Willfar Information Technology's track record by examining our Past report.

Chengdu Spaceon Electronics (SZSE:002935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Spaceon Electronics Co., Ltd. is involved in the R&D, design, production, and sale of time-frequency and satellite application products globally, with a market cap of CN¥9.36 billion.

Operations: The company generates revenue primarily from the Computer, Communications, and Other Electronic Equipment Manufacturing segment, amounting to CN¥923.28 million.

Chengdu Spaceon Electronics, navigating through a challenging tech environment in Asia, has demonstrated resilience with its recent financial performance. Despite a slight decrease in revenue to CNY 535.81 million from CNY 576.91 million year-over-year as of September 2025, the company maintains steady net income at CNY 15.22 million. With an impressive forecasted annual earnings growth of 39.6% and revenue growth rate of 28.8%, it outpaces the broader Chinese market projections of 27.6% and 14.6%, respectively, highlighting its potential amidst industry volatility. The firm's commitment to innovation is underscored by substantial R&D investments, positioning it well for future technological advancements and market competitiveness.

Summing It All Up

- Embark on your investment journey to our 185 Asian High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com