December 2025's Asian Stocks That May Be Trading Below Estimated Value

As we approach the end of 2025, Asian markets have shown resilience with notable gains in key indices, despite global economic challenges and mixed signals from major economies. In this context, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | CN¥16.40 | CN¥32.50 | 49.5% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥82.98 | CN¥162.17 | 48.8% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.42 | HK$16.37 | 48.6% |

| PharmaEssentia (TWSE:6446) | NT$484.50 | NT$946.92 | 48.8% |

| Kuraray (TSE:3405) | ¥1594.50 | ¥3161.62 | 49.6% |

| JINS HOLDINGS (TSE:3046) | ¥5620.00 | ¥11007.05 | 48.9% |

| Forth Corporation (SET:FORTH) | THB5.75 | THB11.20 | 48.7% |

| CURVES HOLDINGS (TSE:7085) | ¥809.00 | ¥1581.32 | 48.8% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥259.79 | CN¥516.30 | 49.7% |

| Aidma Holdings (TSE:7373) | ¥3165.00 | ¥6305.80 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Foxconn Industrial Internet (SHSE:601138)

Overview: Foxconn Industrial Internet Co., Ltd. operates in smart manufacturing and industrial internet services across Mexico, Vietnam, Singapore, Mainland China, and internationally, with a market cap of approximately CN¥1.30 trillion.

Operations: Foxconn Industrial Internet generates revenue through its smart manufacturing and industrial internet services across various regions including Mexico, Vietnam, Singapore, and Mainland China.

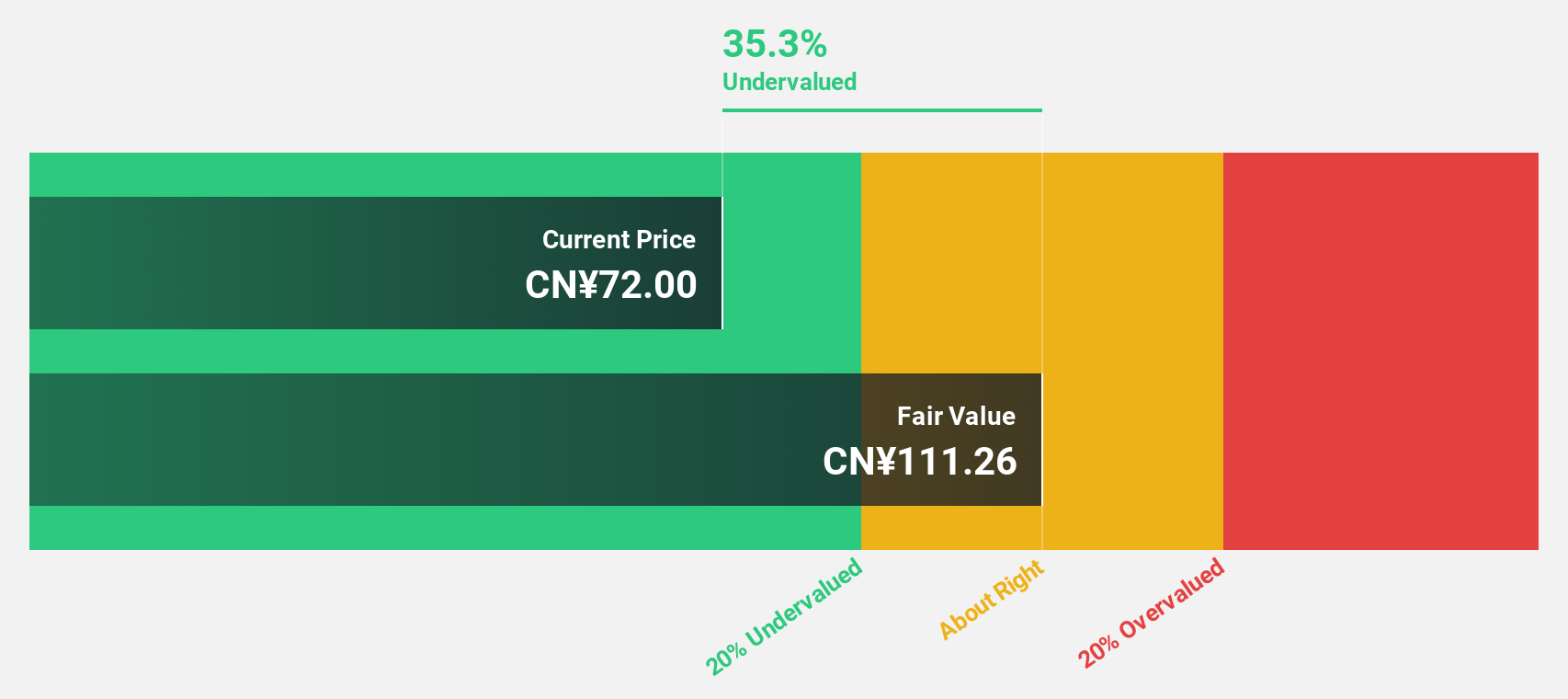

Estimated Discount To Fair Value: 41.4%

Foxconn Industrial Internet is trading significantly below its estimated fair value, with a share price of CN¥65.24 compared to the fair value estimate of CN¥111.4. Despite a volatile share price, the company has demonstrated robust earnings growth, reporting net income of CN¥22.49 billion for the first nine months of 2025, up from last year’s CN¥15.14 billion. Revenue and earnings forecasts suggest continued strong growth above market averages in China, enhancing its attractiveness based on cash flow analysis.

- Insights from our recent growth report point to a promising forecast for Foxconn Industrial Internet's business outlook.

- Unlock comprehensive insights into our analysis of Foxconn Industrial Internet stock in this financial health report.

Zhejiang Tenchen Controls (SHSE:603085)

Overview: Zhejiang Tenchen Controls Co., Ltd. is involved in the research, development, production, sale, and service of automobile seats across China, the United Kingdom, and internationally with a market capitalization of CN¥4.49 billion.

Operations: Zhejiang Tenchen Controls Co., Ltd. generates revenue through its operations in the research, development, production, sale, and service of automobile seats across various markets including China and the United Kingdom.

Estimated Discount To Fair Value: 40.2%

Zhejiang Tenchen Controls is trading at a considerable discount, with its current share price of CN¥11.4 well below the estimated fair value of CN¥19.07. The company reported substantial revenue growth for the first nine months of 2025, reaching CNY 1.85 billion from CNY 1.46 billion the previous year, and net income increased to CNY 50.33 million from CNY 26.25 million, despite profit margins declining to 0.3%. Earnings are projected to grow significantly above market averages in China, although high debt levels present a financial risk factor.

- The growth report we've compiled suggests that Zhejiang Tenchen Controls' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang Tenchen Controls.

Sega Sammy Holdings (TSE:6460)

Overview: Sega Sammy Holdings Inc., with a market cap of ¥517.02 billion, operates through its subsidiaries in the entertainment contents business.

Operations: The company's revenue segments include the development and sale of digital games, amusement machines, and pachislot and pachinko machines.

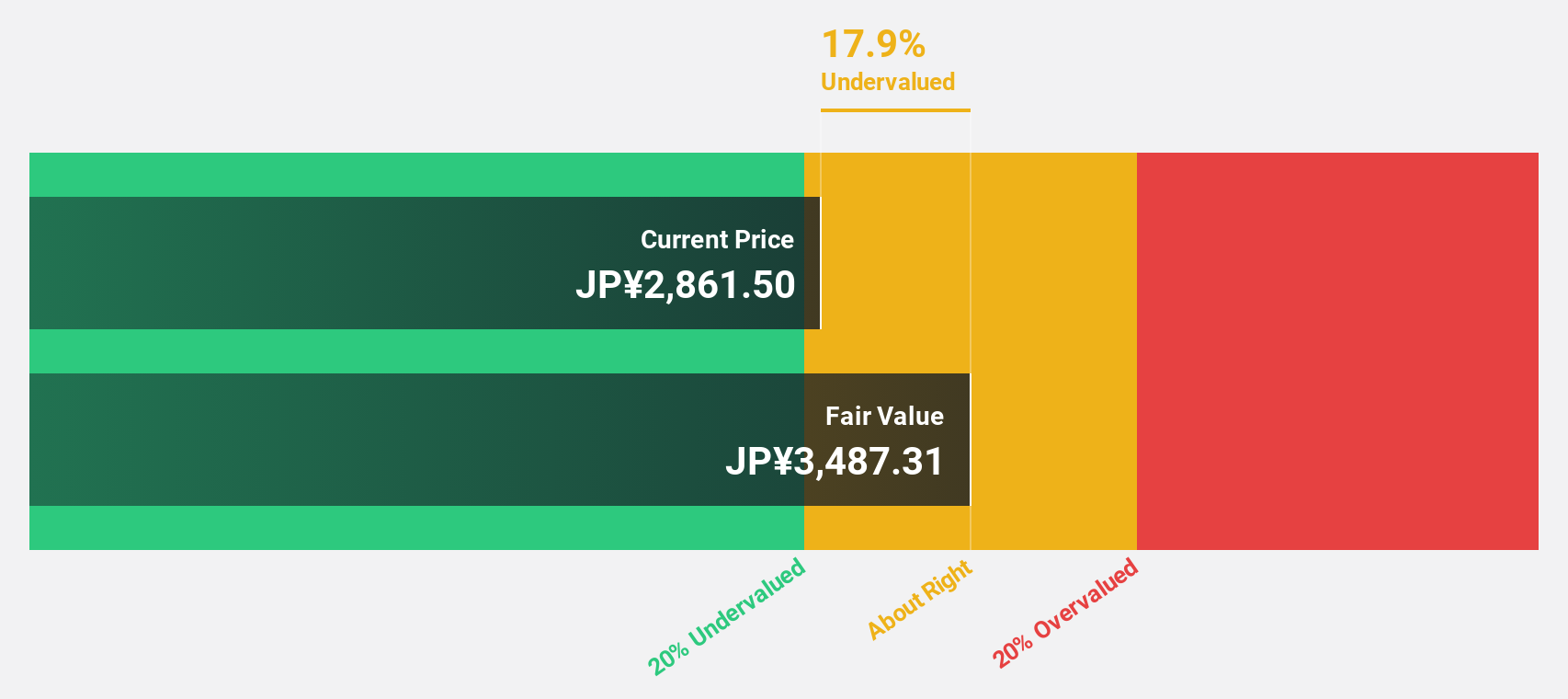

Estimated Discount To Fair Value: 33.7%

Sega Sammy Holdings is trading at a significant discount, with its share price of ¥2,459 below the fair value estimate of ¥3,711.11. Despite lower profit margins compared to last year, earnings are forecast to grow significantly above Japan's market average at 23.7% annually over the next three years. However, its dividend yield of 2.28% is not well covered by free cash flows and return on equity remains modestly low at a forecasted 11.5%.

- Our expertly prepared growth report on Sega Sammy Holdings implies its future financial outlook may be stronger than recent results.

- Take a closer look at Sega Sammy Holdings' balance sheet health here in our report.

Summing It All Up

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 267 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com