Gränges AB (publ)'s (STO:GRNG) Shares Not Telling The Full Story

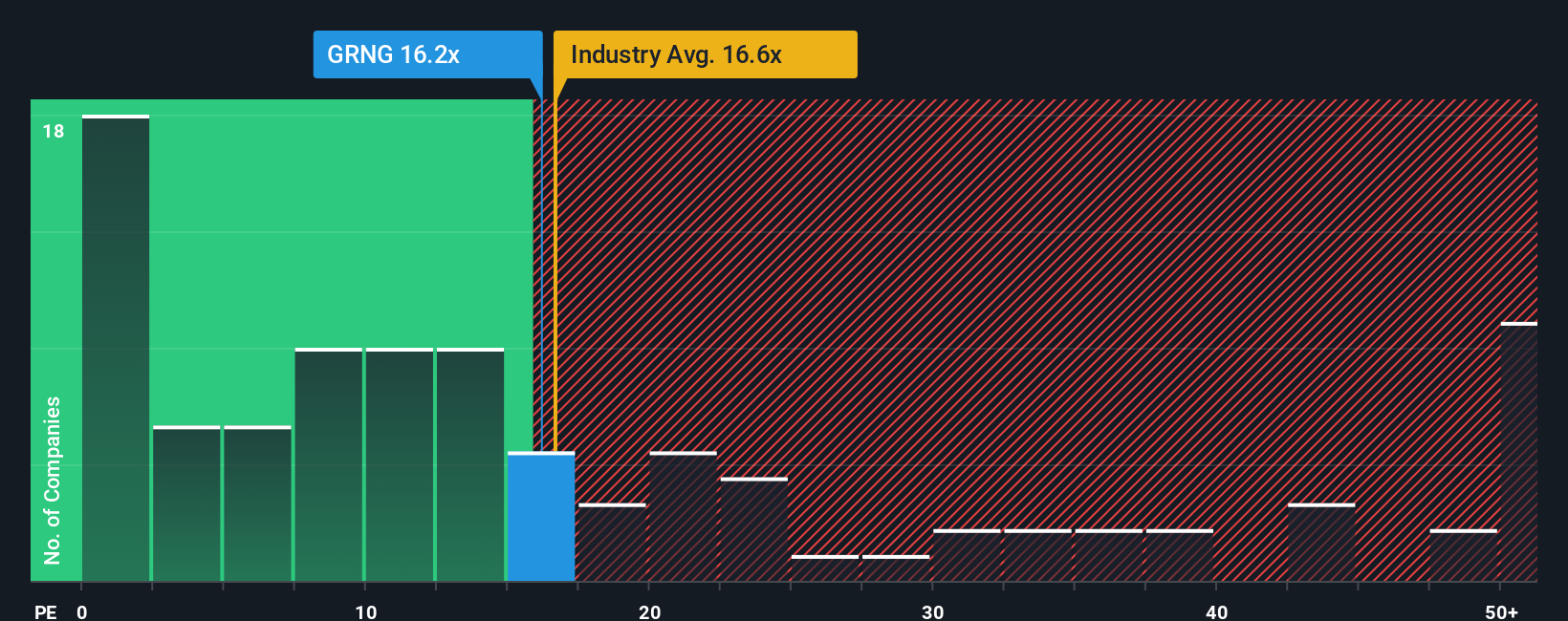

With a price-to-earnings (or "P/E") ratio of 16.2x Gränges AB (publ) (STO:GRNG) may be sending bullish signals at the moment, given that almost half of all companies in Sweden have P/E ratios greater than 22x and even P/E's higher than 35x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's inferior to most other companies of late, Gränges has been relatively sluggish. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

See our latest analysis for Gränges

Is There Any Growth For Gränges?

In order to justify its P/E ratio, Gränges would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow EPS by an impressive 51% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 29% over the next year. With the market predicted to deliver 29% growth , the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Gränges' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Gränges' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Gränges' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Gränges that we have uncovered.

If you're unsure about the strength of Gränges' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.