Exploring Three Undiscovered European Gems For Your Portfolio

As the pan-European STOXX Europe 600 Index edges closer to record highs, buoyed by positive sentiment about future earnings and economic prospects, investors are increasingly looking toward small-cap stocks for potential opportunities. In this dynamic environment, identifying promising companies with strong fundamentals and growth potential can be a strategic move for diversifying portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★★

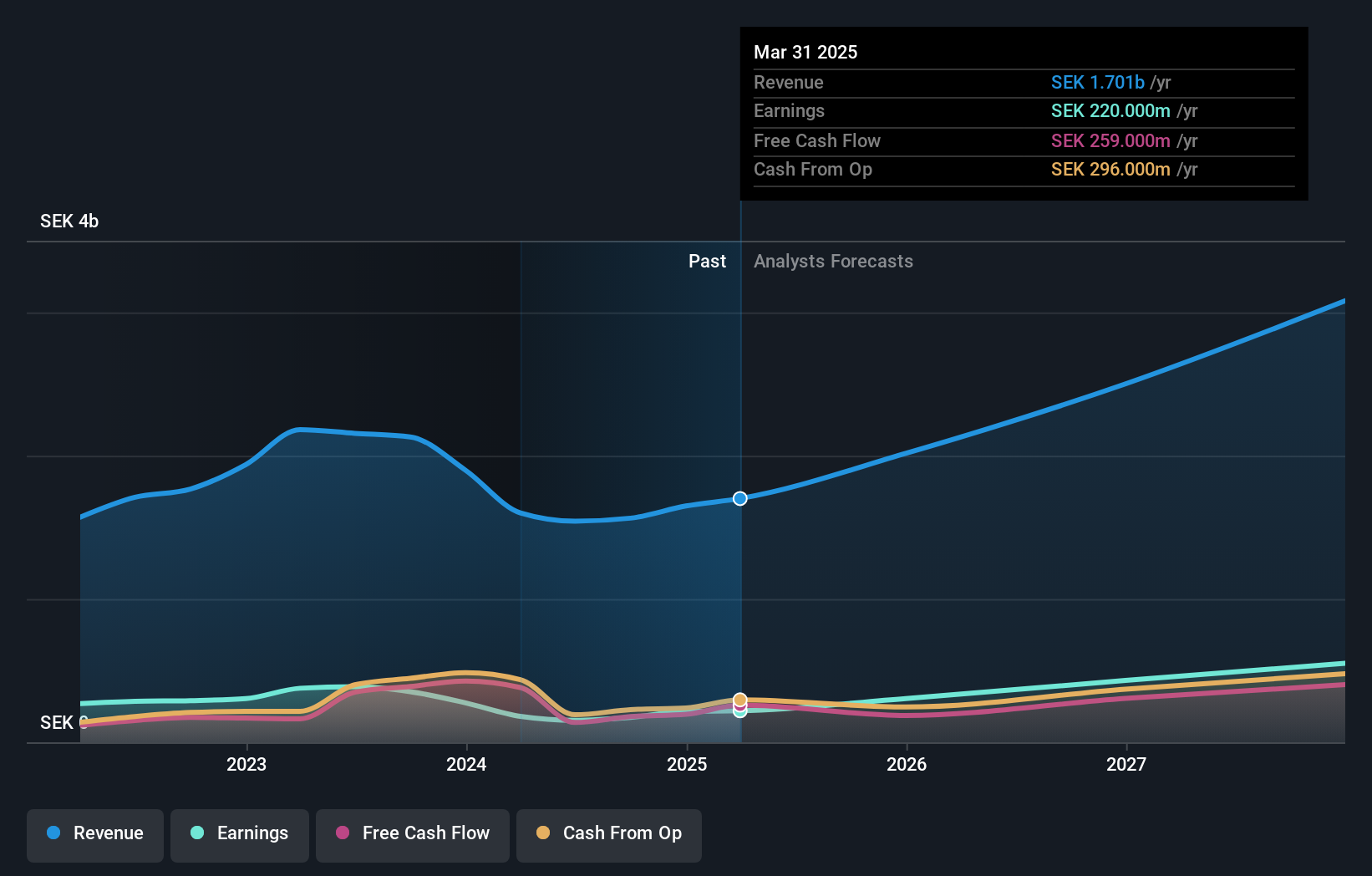

Overview: engcon AB (publ) specializes in designing, producing, and selling excavator tools across various international markets, with a market cap of SEK12.69 billion.

Operations: The company generates revenue primarily from its Construction Machinery & Equipment segment, amounting to SEK1.78 billion.

Engcon, a dynamic player in the machinery sector, has been making waves with its strategic moves and solid financial footing. The company recently reported a net income of SEK 170 million for the first nine months of 2025, compared to SEK 162 million last year. Its debt to equity ratio has improved from 16.9% to 14.6% over five years, showcasing prudent financial management. Engcon's earnings growth of 29.5% outpaced the industry average significantly and its interest payments are well covered by EBIT at a robust 15.8x coverage ratio. Recent partnerships in France and Italy aim to bolster market presence, tapping into key rental markets and expanding product reach through local expertise, which seems likely to enhance future growth prospects further.

- Unlock comprehensive insights into our analysis of engcon stock in this health report.

Review our historical performance report to gain insights into engcon's's past performance.

Zinzino (OM:ZZ B)

Simply Wall St Value Rating: ★★★★★★

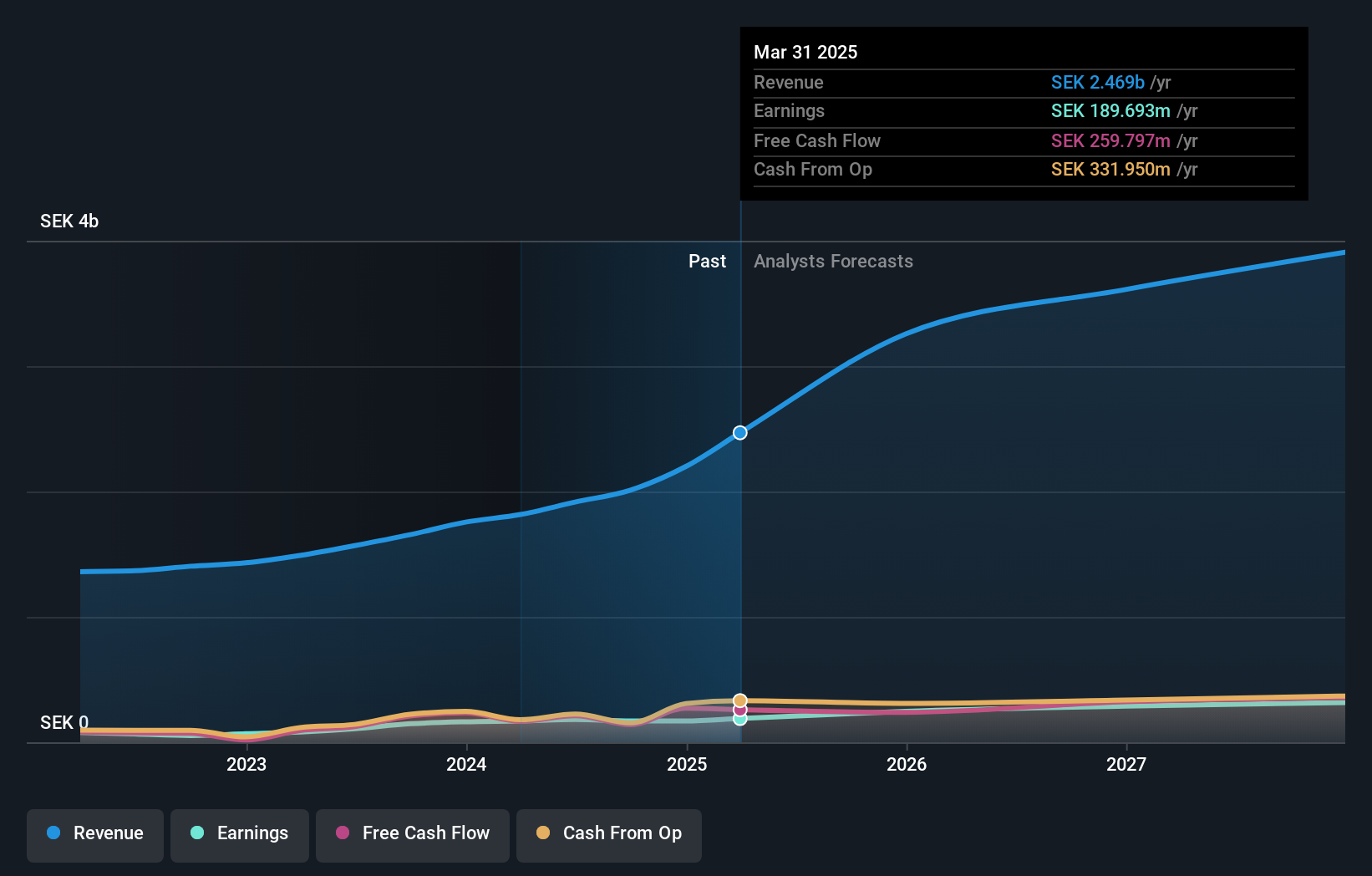

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products in Sweden and internationally, with a market cap of SEK5.77 billion.

Operations: The primary revenue stream for Zinzino comes from its dietary supplements and skincare products, generating SEK2.95 billion. The company's financial data indicates a focus on direct sales in Sweden and international markets.

Zinzino, a small player in the health and wellness sector, has shown impressive growth with recent earnings rising by 43.3%, outpacing the industry average of 8.9%. The company is debt-free, which provides financial flexibility and eliminates concerns about interest coverage. Its innovative gut Health Test is gaining traction, potentially boosting future sales. Despite high volatility in its share price over the last three months, Zinzino's stock trades at a significant discount of 61% below estimated fair value. Recent revenue reports highlight a robust increase of 45% year-to-date to SEK 379 million compared to last year’s figures.

- Click to explore a detailed breakdown of our findings in Zinzino's health report.

Gain insights into Zinzino's historical performance by reviewing our past performance report.

APG|SGA (SWX:APGN)

Simply Wall St Value Rating: ★★★★★☆

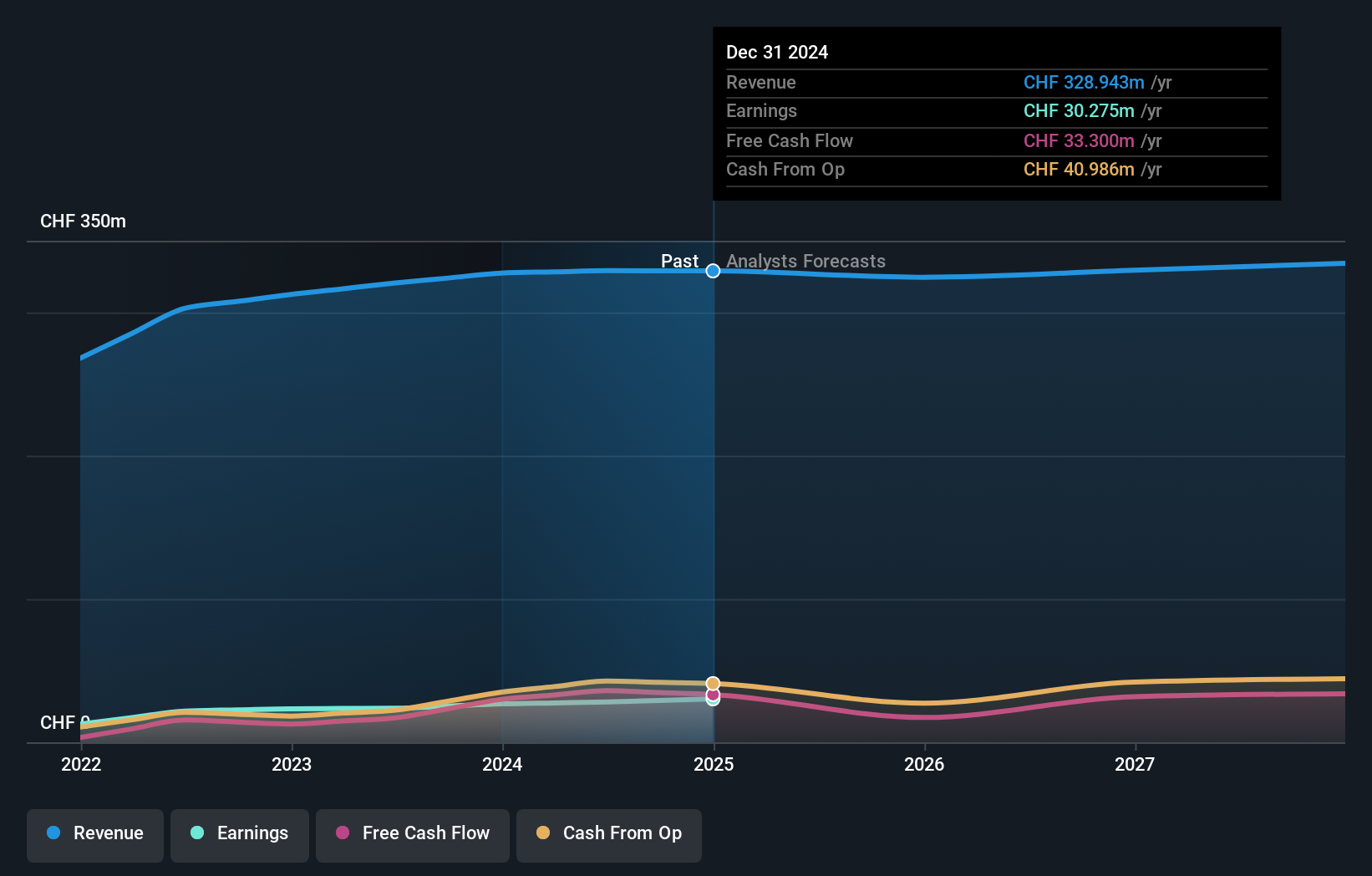

Overview: APG|SGA SA operates in the advertising sector, focusing on providing advertising services mainly in Switzerland and Serbia, with a market capitalization of CHF623.38 million.

Operations: APG|SGA's primary revenue stream is from the acquisition, sale, and management of advertising spaces, generating CHF326.69 million. The company has a market capitalization of CHF623.38 million.

APG|SGA exhibits a robust financial profile, with earnings growth of 8.6% over the past year, surpassing the Media industry's -7.6%. This Swiss advertising company is debt-free for five years, ensuring no concerns about interest payments. Trading at 43.8% below its estimated fair value suggests potential undervaluation in the market. Recent developments include Neue Zürcher Zeitung AG's purchase agreement to acquire a 10.86% stake from JCDecaux SE for CHF 71.6 million, priced at CHF 220 per share, signaling strategic interest and confidence in APG|SGA's prospects despite industry challenges.

Seize The Opportunity

- Click this link to deep-dive into the 304 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com