Revenues Working Against Oxford Biomedica plc's (LON:OXB) Share Price

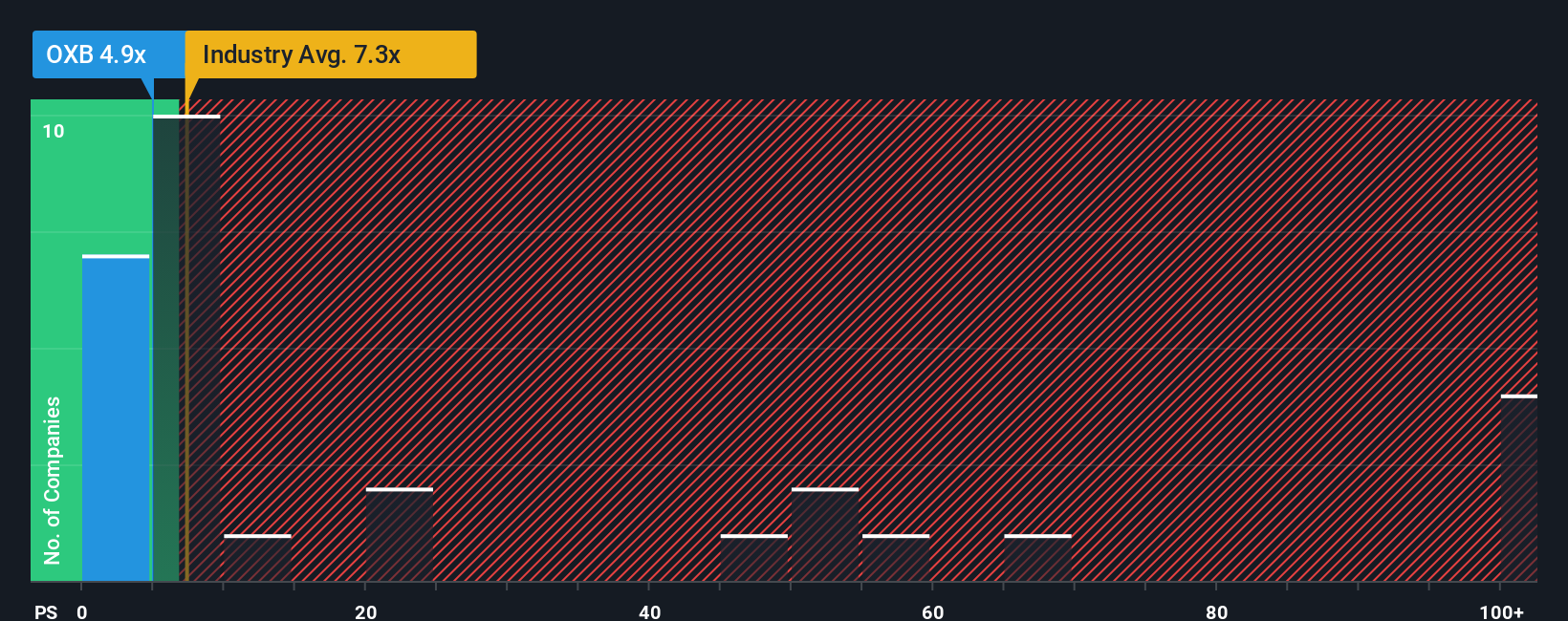

With a price-to-sales (or "P/S") ratio of 4.9x Oxford Biomedica plc (LON:OXB) may be sending bullish signals at the moment, given that almost half of all the Biotechs companies in the United Kingdom have P/S ratios greater than 7.2x and even P/S higher than 50x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Oxford Biomedica

What Does Oxford Biomedica's Recent Performance Look Like?

Oxford Biomedica could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oxford Biomedica.How Is Oxford Biomedica's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Oxford Biomedica's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 55%. Revenue has also lifted 20% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 28% per annum during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 110% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Oxford Biomedica's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Oxford Biomedica's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Oxford Biomedica maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Oxford Biomedica with six simple checks.

If you're unsure about the strength of Oxford Biomedica's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.