Exploring YAPP Automotive Systems And 2 Other Promising Small Caps

As global markets continue to navigate a landscape marked by record highs in major indices like the S&P 500 and Dow Jones Industrial Average, small-cap stocks have shown more modest gains, with the Russell 2000 Index edging up just 0.19% over a recent week. In this environment of mixed economic signals—such as robust U.S. GDP growth contrasted with weakening consumer confidence—investors might find opportunities in lesser-known small-cap companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Fortune Gas Cryogenic Group | NA | 17.03% | 23.40% | ★★★★★★ |

| Shandong Link Science and TechnologyLtd | 7.07% | 15.69% | 19.39% | ★★★★★★ |

| Xiamen Jihong | 17.57% | 6.86% | -18.83% | ★★★★★★ |

| Shandong Sinoglory Health Food | NA | 4.47% | 5.27% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| Lee's Pharmaceutical Holdings | 12.63% | 1.31% | -43.22% | ★★★★★☆ |

| Zhongyeda Electric | 0.41% | -0.88% | -14.90% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

YAPP Automotive Systems (SHSE:603013)

Simply Wall St Value Rating: ★★★★★★

Overview: YAPP Automotive Systems Co., Ltd. specializes in the research, development, manufacturing, sale, and service of energy storage and thermal management system products with a market cap of CN¥12.58 billion.

Operations: YAPP Automotive Systems generates revenue primarily from auto parts manufacturing, amounting to CN¥9.02 billion.

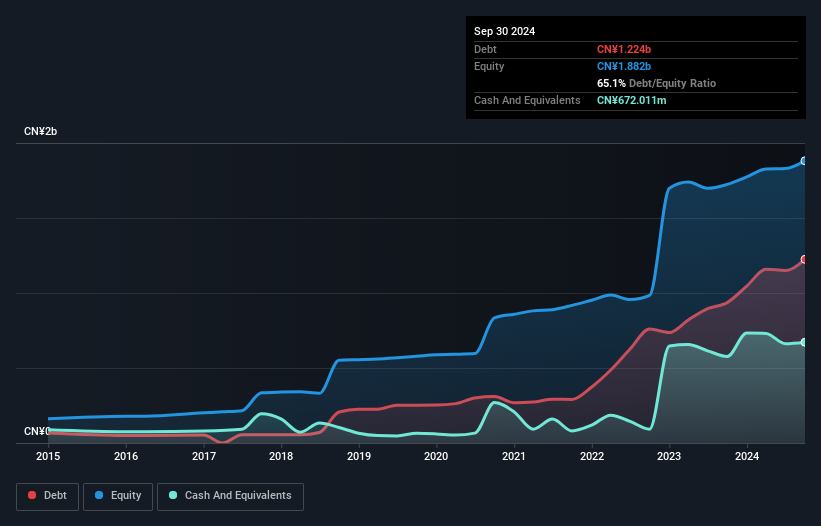

YAPP Automotive Systems, a notable player in the automotive sector, has demonstrated robust growth with earnings rising 25.8% over the past year, outpacing the industry average of 8%. The company holds a favorable debt position, with more cash than its total debt and a significantly reduced debt-to-equity ratio from 17.7% to 0.5% over five years. Trading at a price-to-earnings ratio of 23.2x below the CN market's 45x suggests good value relative to peers. Recent financials show sales climbing to CNY 6.62 billion from CNY 5.67 billion last year, alongside net income increasing to CNY 417 million from CNY 374 million previously reported for nine months ending September.

- Take a closer look at YAPP Automotive Systems' potential here in our health report.

Understand YAPP Automotive Systems' track record by examining our Past report.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi Longsheng Technology Co., Ltd is involved in the research, development, production, sales, and service of automotive parts both in China and internationally, with a market cap of CN¥12.13 billion.

Operations: Wuxi Longsheng Technology Co., Ltd generates revenue primarily from the sale of automotive parts. The company's financial performance includes a notable net profit margin trend, reflecting its ability to manage costs effectively.

Wuxi Longsheng Technology, a nimble player in the Auto Components sector, has shown robust earnings growth of 38.2% over the past year, outpacing the industry average of 8%. Its net income for the nine months ended September 30, 2025, reached CN¥210.27 million from CN¥153.6 million a year earlier. The company's net debt to equity ratio stands at a satisfactory 24%, indicating prudent financial management. Despite recent volatility in its share price and large one-off gains totaling CN¥134.7 million affecting its results, Wuxi trades at an attractive discount of 16.8% below estimated fair value and remains free cash flow positive.

- Delve into the full analysis health report here for a deeper understanding of Wuxi Longsheng TechnologyLtd.

Gain insights into Wuxi Longsheng TechnologyLtd's past trends and performance with our Past report.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Value Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan, with a market capitalization of approximately ¥162.02 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its diverse portfolio of financial products and services in Japan. The company has a market capitalization of approximately ¥162.02 billion, reflecting its scale in the financial sector.

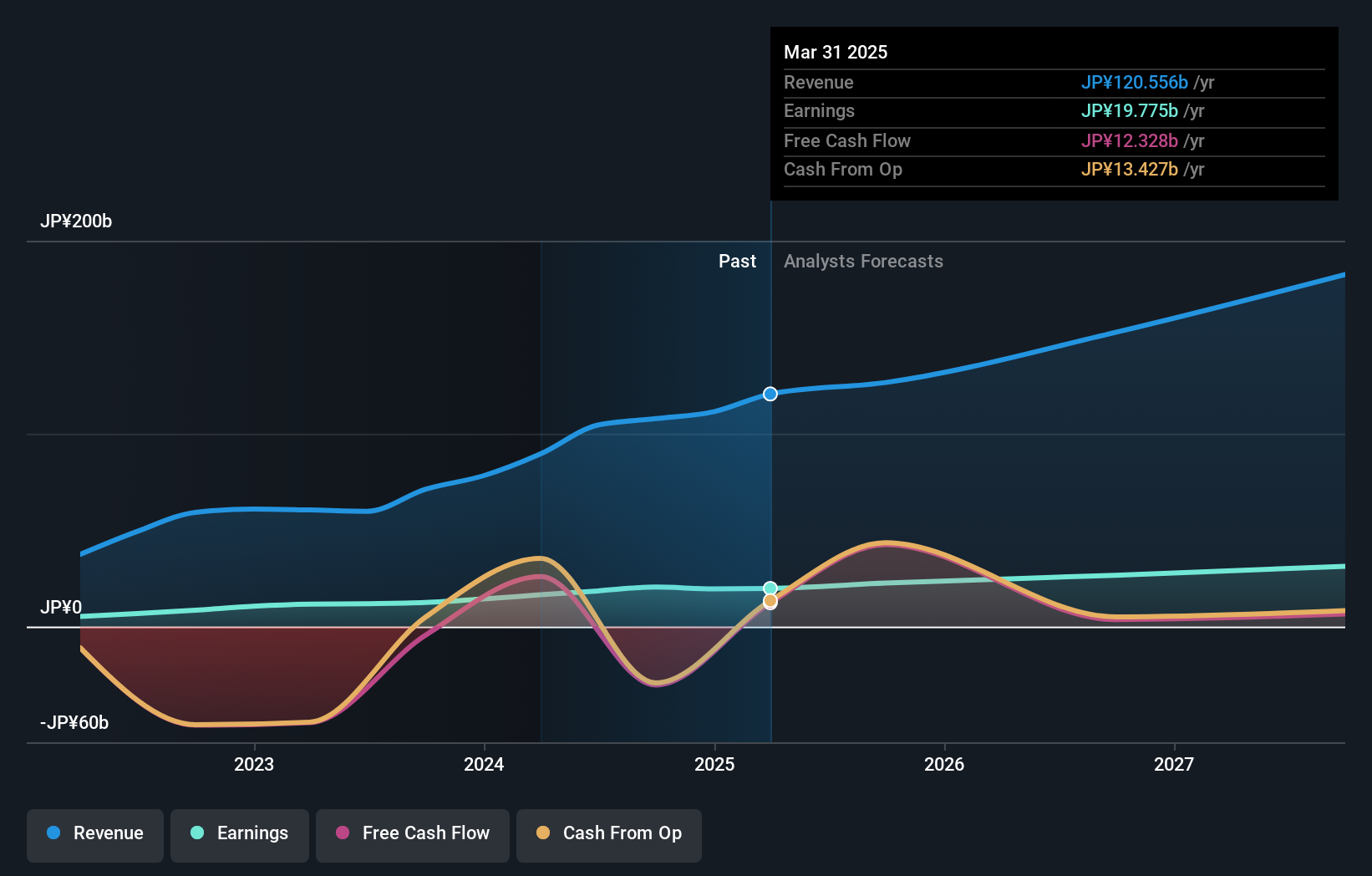

Financial Partners Group Ltd. offers an intriguing opportunity, trading at 50.3% below its estimated fair value, suggesting potential undervaluation. Despite a high net debt to equity ratio of 68.8%, the company has significantly reduced this from 349.4% over five years, showing improved financial management. Earnings are projected to grow by 10.71% annually, although last year's earnings saw an -11.2% change compared to the industry average of 10.3%. The company's interest payments are well covered by EBIT with a coverage of over 1155 times, indicating strong operational efficiency amidst high-quality past earnings and positive free cash flow status.

Seize The Opportunity

- Delve into our full catalog of 2992 Global Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com