European Dividend Stocks To Watch In December 2025

As the pan-European STOXX Europe 600 Index edges closer to record highs amid positive economic sentiment, investors are keenly observing dividend stocks that could offer stable returns in a fluctuating market environment. In such conditions, stocks with a strong track record of consistent dividend payouts and robust financial health become particularly attractive for those seeking income stability.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.09% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.78% | ★★★★★★ |

| Evolution (OM:EVO) | 4.83% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.10% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.31% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.17% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.40% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 4.89% | ★★★★★☆ |

Click here to see the full list of 195 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Huhtamäki Oyj (HLSE:HUH1V)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huhtamäki Oyj is a global provider of packaging solutions operating in various countries including the United States, Germany, and India, with a market cap of €3.10 billion.

Operations: Huhtamäki Oyj's revenue is primarily derived from its North America segment (€1.43 billion), Flexible Packaging (€1.28 billion), Foodservice Packaging (€962.50 million), and Fiber Packaging (€381 million).

Dividend Yield: 3.7%

Huhtamäki Oyj offers a reliable dividend yield of 3.72%, supported by a reasonable payout ratio of 57.7% and cash flow coverage at 61.9%. While its dividend yield is below the Finnish market's top tier, the company's dividends have been stable and growing over the past decade. Despite high debt levels, Huhtamäki trades significantly below estimated fair value and analysts project price growth. Recent earnings show slight declines in sales and net income compared to last year but maintain steady profitability with basic EPS at €0.56 for Q3 2025.

- Dive into the specifics of Huhtamäki Oyj here with our thorough dividend report.

- The valuation report we've compiled suggests that Huhtamäki Oyj's current price could be quite moderate.

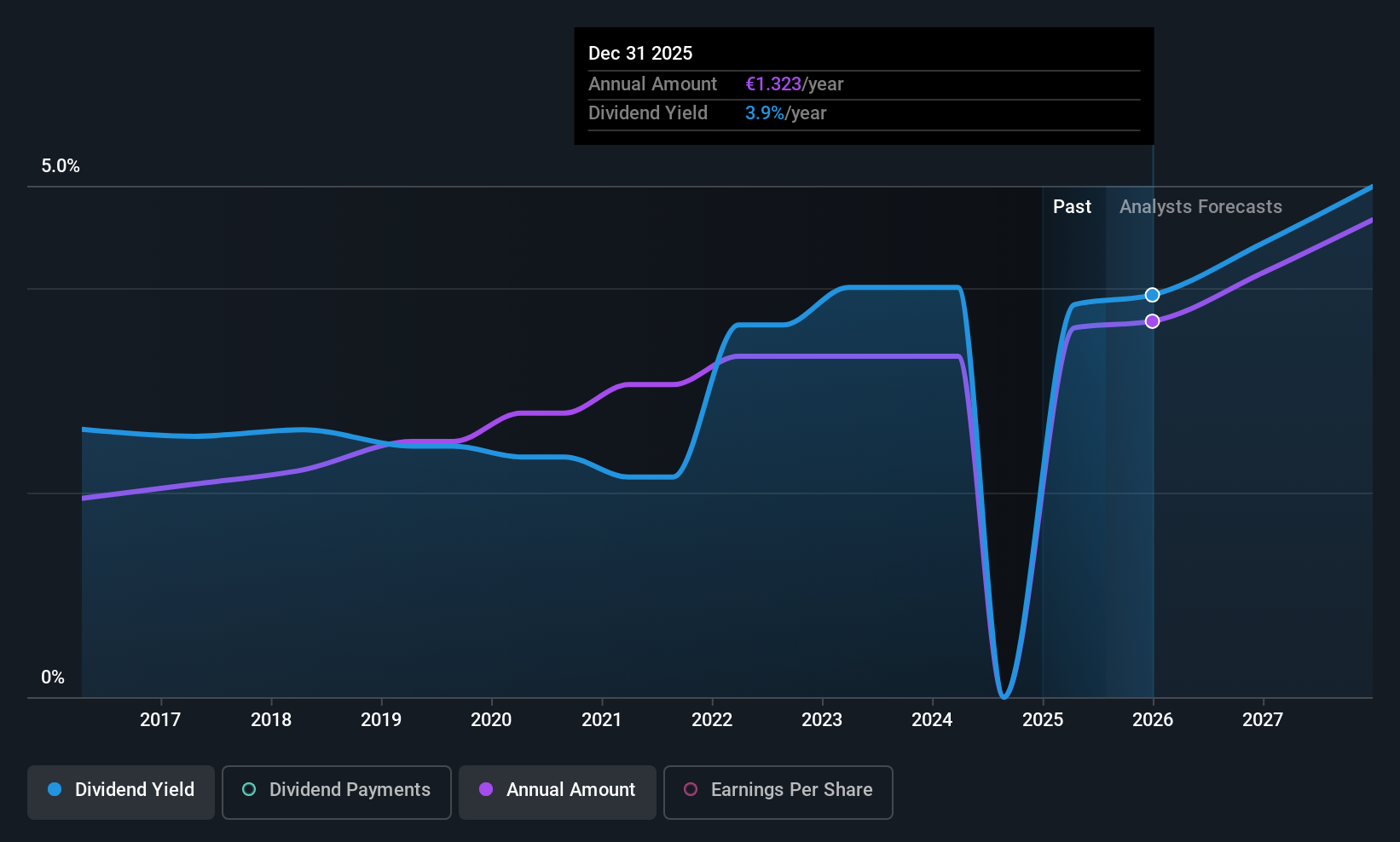

Olvi Oyj (HLSE:OLVAS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Olvi Oyj is a beverage company that manufactures and sells alcoholic and non-alcoholic beverages across Finland, Estonia, Latvia, Lithuania, Denmark, and Belarus with a market cap of €651.18 million.

Operations: Olvi Oyj generates revenue of €661.03 million from its alcoholic beverages segment.

Dividend Yield: 4.1%

Olvi Oyj's dividend yield of 4.13% is lower than the Finnish market's top tier, with a payout ratio of 49.5% indicating earnings coverage, though cash flow coverage is weaker at 90.3%. Dividends have been stable and growing over the past decade, but recent earnings show a slight decline in net income and EPS compared to last year. Despite trading well below estimated fair value, Olvi revised its annual earnings guidance downward due to consumer demand uncertainties and seasonal impacts.

- Click here to discover the nuances of Olvi Oyj with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Olvi Oyj is priced lower than what may be justified by its financials.

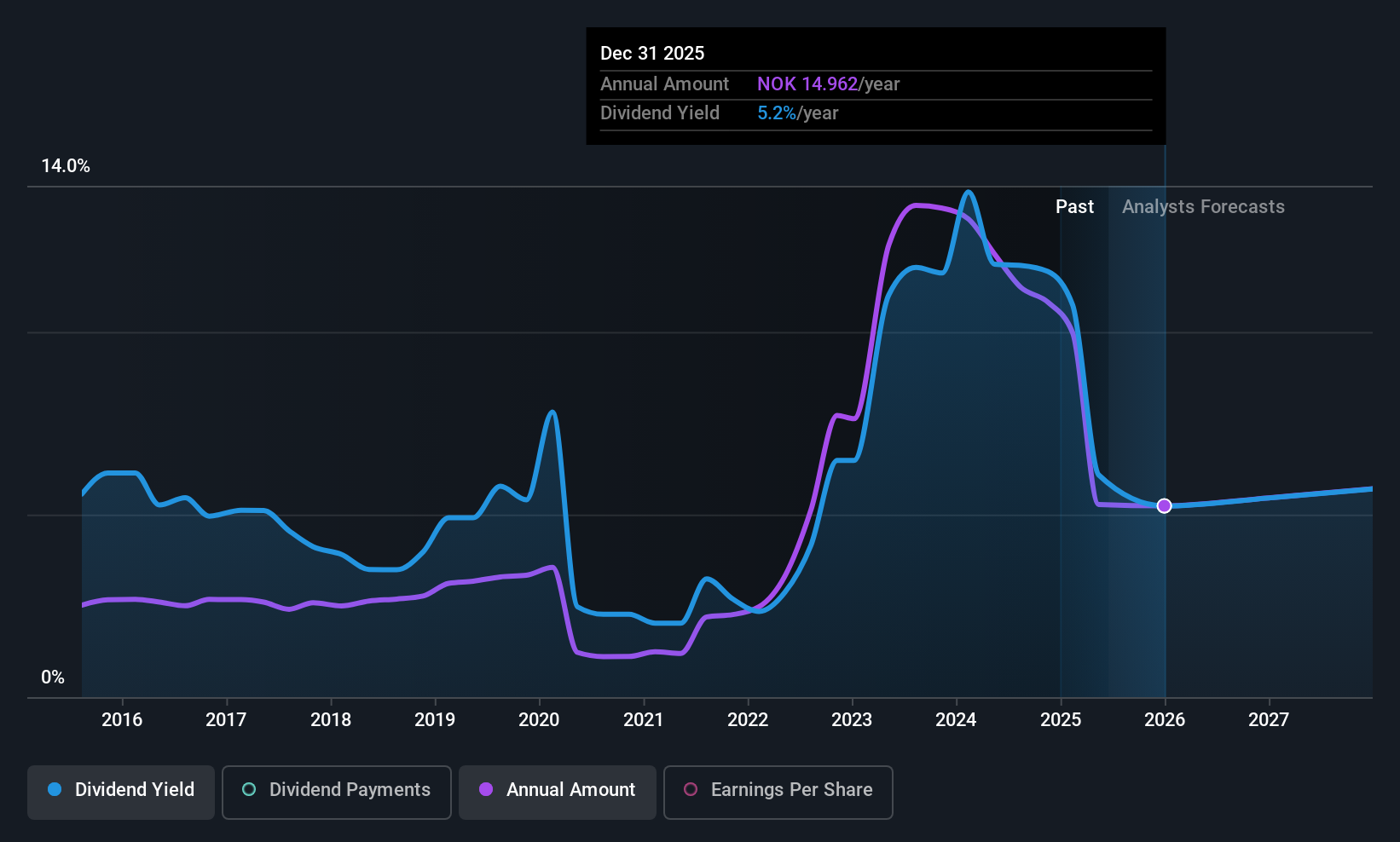

Equinor (OB:EQNR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Equinor ASA is an energy company involved in the exploration, production, transportation, refining, and marketing of petroleum and other energy forms both in Norway and internationally, with a market cap of NOK588.11 billion.

Operations: Equinor's revenue segments include Exploration & Production Norway at $35.29 billion, Marketing, Midstream & Processing at $106.10 billion, Exploration & Production USA at $4.21 billion, Exploration & Production International (excluding E&P USA) at $5.53 billion, and Renewables at $102 million.

Dividend Yield: 6.2%

Equinor's dividend payments have been volatile over the past decade, yet they are covered by earnings and cash flows with payout ratios of 68.5% and 51.8%, respectively. The stock trades at a significant discount to its estimated fair value, offering good relative value compared to peers. Despite a lower dividend yield of 6.23% compared to top Norwegian payers, recent significant gas discoveries in the North Sea could enhance future cash flows and support dividends.

- Take a closer look at Equinor's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Equinor is trading behind its estimated value.

Make It Happen

- Click through to start exploring the rest of the 192 Top European Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com