3 Promising Penny Stocks With A Market Cap Below $400M

As the holiday-shortened week begins, major U.S. stock indexes have dipped, with technology shares leading the decline and precious metals retreating from recent highs. In such a fluctuating market landscape, identifying stocks with potential for growth can be challenging but rewarding. Penny stocks, often associated with smaller or emerging companies, continue to offer intriguing opportunities for investors willing to explore beyond traditional blue-chip options. These stocks can provide significant growth potential when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.68 | $617.2M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.88 | $679.93M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8371 | $145.28M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.30 | $555.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.14 | $1.29B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.29 | $563.4M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Nephros (NEPH) | $4.87 | $51.75M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $1.00 | $7.26M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.08 | $92.44M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 339 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Vuzix (VUZI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vuzix Corporation designs, manufactures, and markets AI-powered smart glasses, waveguides, and augmented reality technologies globally with a market cap of $269.22 million.

Operations: The company generates its revenue primarily from its Video Eyewear Products segment, which accounted for $5.31 million.

Market Cap: $269.22M

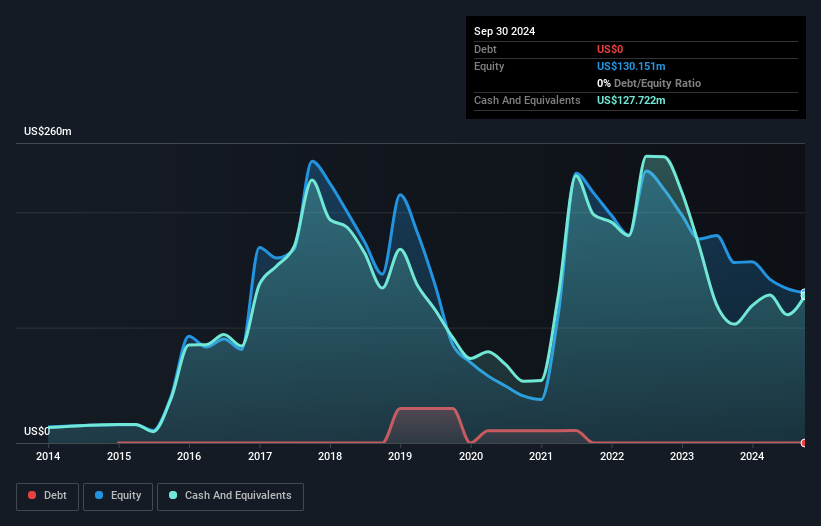

Vuzix Corporation, with a market cap of US$269.22 million, has been actively pursuing strategic alliances and expanding its client base to bolster its position in the augmented reality sector. Recent collaborations with Collins Aerospace for defense applications and partnerships like BUNDLAR highlight potential growth avenues. Despite generating US$5.31 million from Video Eyewear Products, Vuzix remains unprofitable with increasing losses over five years but maintains a strong cash position relative to liabilities. The company's management is experienced, and it has no debt, though high share price volatility persists alongside significant revenue growth forecasts of 75.45% annually.

- Get an in-depth perspective on Vuzix's performance by reading our balance sheet health report here.

- Understand Vuzix's earnings outlook by examining our growth report.

Aclaris Therapeutics (ACRS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aclaris Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing novel drug candidates for immune-inflammatory diseases in the United States, with a market cap of $326.12 million.

Operations: The company's revenue is primarily derived from its Therapeutics segment, generating $13.76 million, and Contract Research services, contributing $16.37 million.

Market Cap: $326.12M

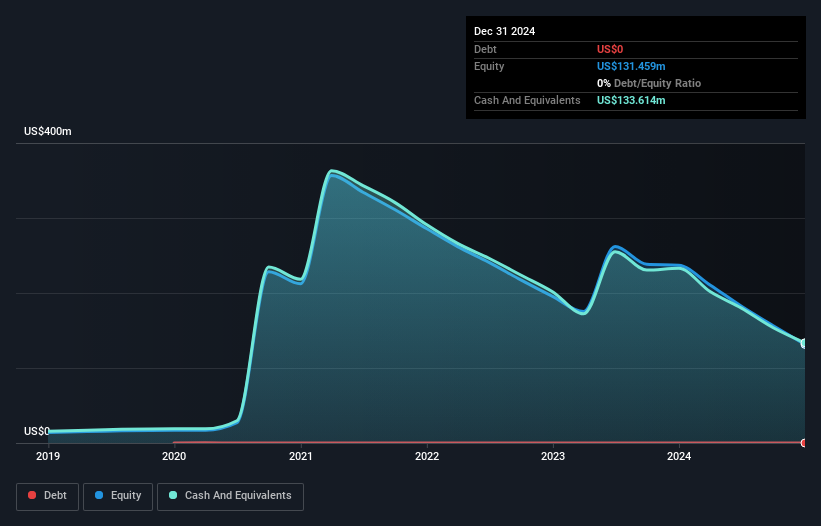

Aclaris Therapeutics, with a market cap of US$326.12 million, is navigating the volatile penny stock landscape while focusing on immune-inflammatory treatments. Despite being unprofitable and facing increasing losses, the company remains debt-free and maintains a strong cash position with short-term assets of US$100.6 million exceeding liabilities. Recent inclusion in the NASDAQ Biotechnology Index may enhance visibility among investors. Revenue has declined to US$3.3 million for Q3 2025 from US$4.35 million a year ago, but revenue growth is projected at 22.29% annually, providing potential upside amidst high share price volatility and an inexperienced management team.

- Click to explore a detailed breakdown of our findings in Aclaris Therapeutics' financial health report.

- Gain insights into Aclaris Therapeutics' future direction by reviewing our growth report.

Prelude Therapeutics (PRLD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prelude Therapeutics Incorporated is a clinical-stage precision oncology company dedicated to discovering and developing novel cancer medicines for underserved patients, with a market cap of $242.25 million.

Operations: Prelude Therapeutics generates revenue from its Biotechnology (Startups) segment, totaling $10.5 million.

Market Cap: $242.25M

Prelude Therapeutics, with a market cap of US$242.25 million, is navigating the penny stock arena by focusing on precision oncology. Despite being unprofitable and having a negative return on equity, it has no debt and maintains sufficient short-term assets to cover liabilities. The company recently raised US$25 million through private placement and filed a shelf registration for US$9.125 million, indicating efforts to bolster its cash runway beyond the current 7 months. Recent preclinical data presentations at major conferences highlight promising developments in their JAK2V617F inhibitors and mCALR-targeted therapies, potentially enhancing investor interest despite high share price volatility.

- Navigate through the intricacies of Prelude Therapeutics with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Prelude Therapeutics' future.

Turning Ideas Into Actions

- Take a closer look at our US Penny Stocks list of 339 companies by clicking here.

- Contemplating Other Strategies? The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com