Celsius Holdings Among 3 Value Stocks Trading Below Estimated Worth

As the United States market kicks off a holiday-shortened week with major stock indexes closing lower, investors are closely watching sectors like technology and precious metals, which have recently experienced notable declines. In this fluctuating environment, identifying stocks that are trading below their estimated worth can offer potential opportunities for value-seeking investors.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.74 | $52.61 | 49.2% |

| UMB Financial (UMBF) | $117.16 | $233.30 | 49.8% |

| Sportradar Group (SRAD) | $23.41 | $45.62 | 48.7% |

| SmartStop Self Storage REIT (SMA) | $31.25 | $61.30 | 49% |

| Schrödinger (SDGR) | $17.84 | $35.41 | 49.6% |

| Prelude Therapeutics (PRLD) | $2.94 | $5.72 | 48.6% |

| Nicolet Bankshares (NIC) | $123.67 | $242.21 | 48.9% |

| Community West Bancshares (CWBC) | $22.63 | $44.11 | 48.7% |

| Clearfield (CLFD) | $29.94 | $58.39 | 48.7% |

| BioLife Solutions (BLFS) | $25.12 | $49.94 | 49.7% |

We'll examine a selection from our screener results.

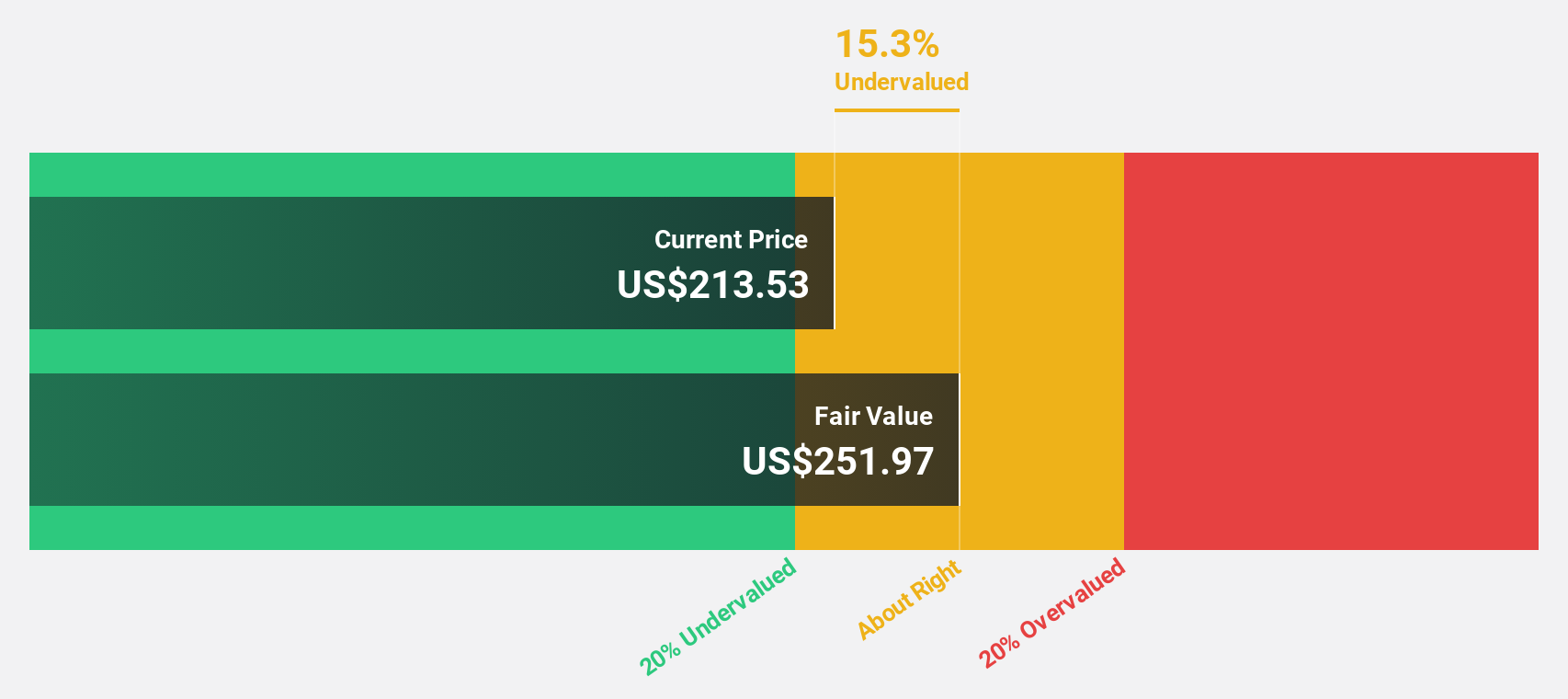

Celsius Holdings (CELH)

Overview: Celsius Holdings, Inc. is a company that develops, manufactures, and distributes functional energy drinks globally, with a market cap of approximately $11.97 billion.

Operations: The company's revenue is primarily derived from its non-alcoholic beverages segment, totaling $2.13 billion.

Estimated Discount To Fair Value: 32.6%

Celsius Holdings is trading at US$46.44, significantly below its estimated fair value of US$68.86, highlighting potential undervaluation based on discounted cash flow analysis. Despite a recent decline in profit margins and net income, earnings are forecast to grow substantially by 48% annually over the next three years. The company has initiated a US$300 million share repurchase program and refinanced debt to reduce interest costs, which may enhance future cash flows.

- In light of our recent growth report, it seems possible that Celsius Holdings' financial performance will exceed current levels.

- Click here to discover the nuances of Celsius Holdings with our detailed financial health report.

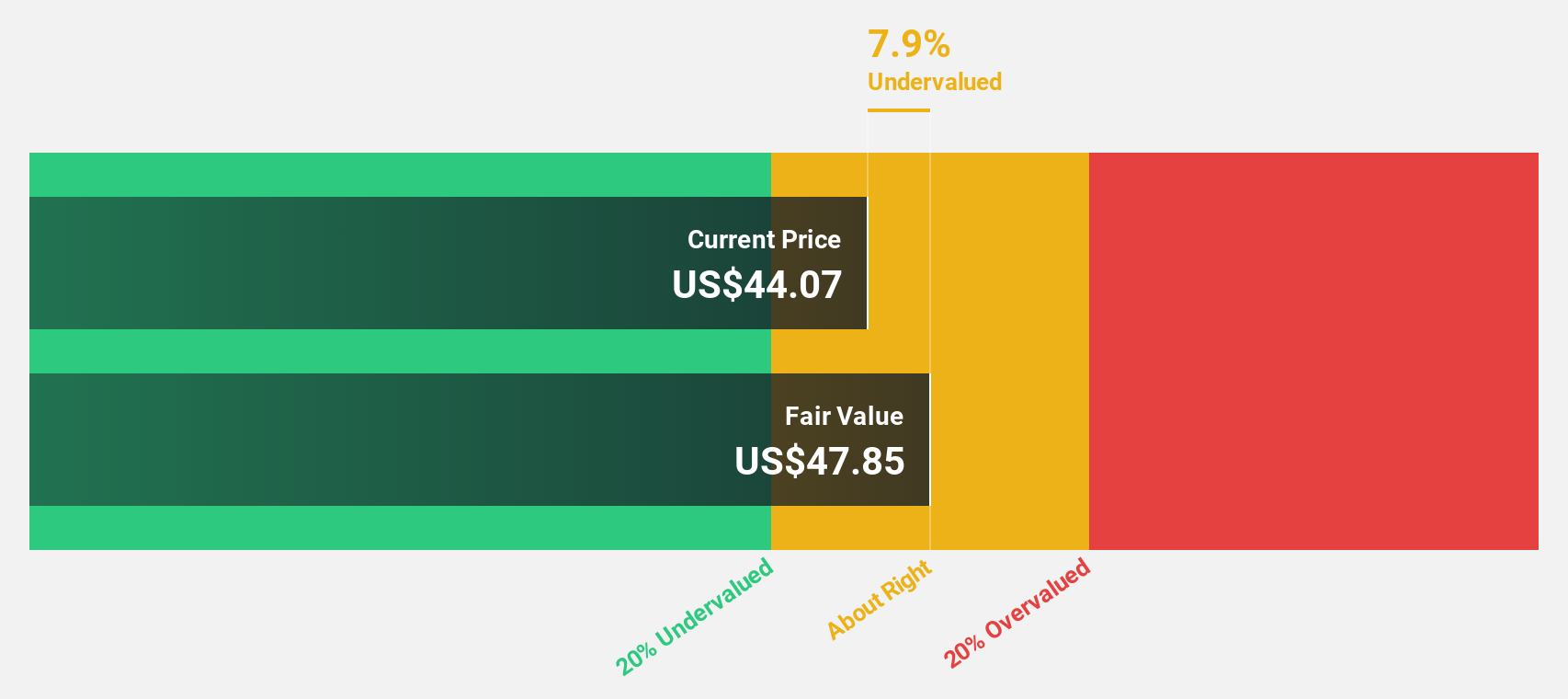

Vertex (VERX)

Overview: Vertex, Inc. offers enterprise tax technology solutions for the retail trade, wholesale trade, and manufacturing industries both in the United States and internationally, with a market cap of approximately $3.24 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $732.19 million.

Estimated Discount To Fair Value: 38.7%

Vertex Inc. is trading at US$20.28, notably below its estimated fair value of US$33.06, suggesting potential undervaluation based on cash flow analysis. Despite a drop in net income to US$4.05 million for Q3 2025, revenue increased to US$192.11 million from the previous year. The company has expanded its strategic alliances and authorized a share repurchase program worth up to US$150 million, which could positively impact future cash flows and shareholder value.

- Upon reviewing our latest growth report, Vertex's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Vertex.

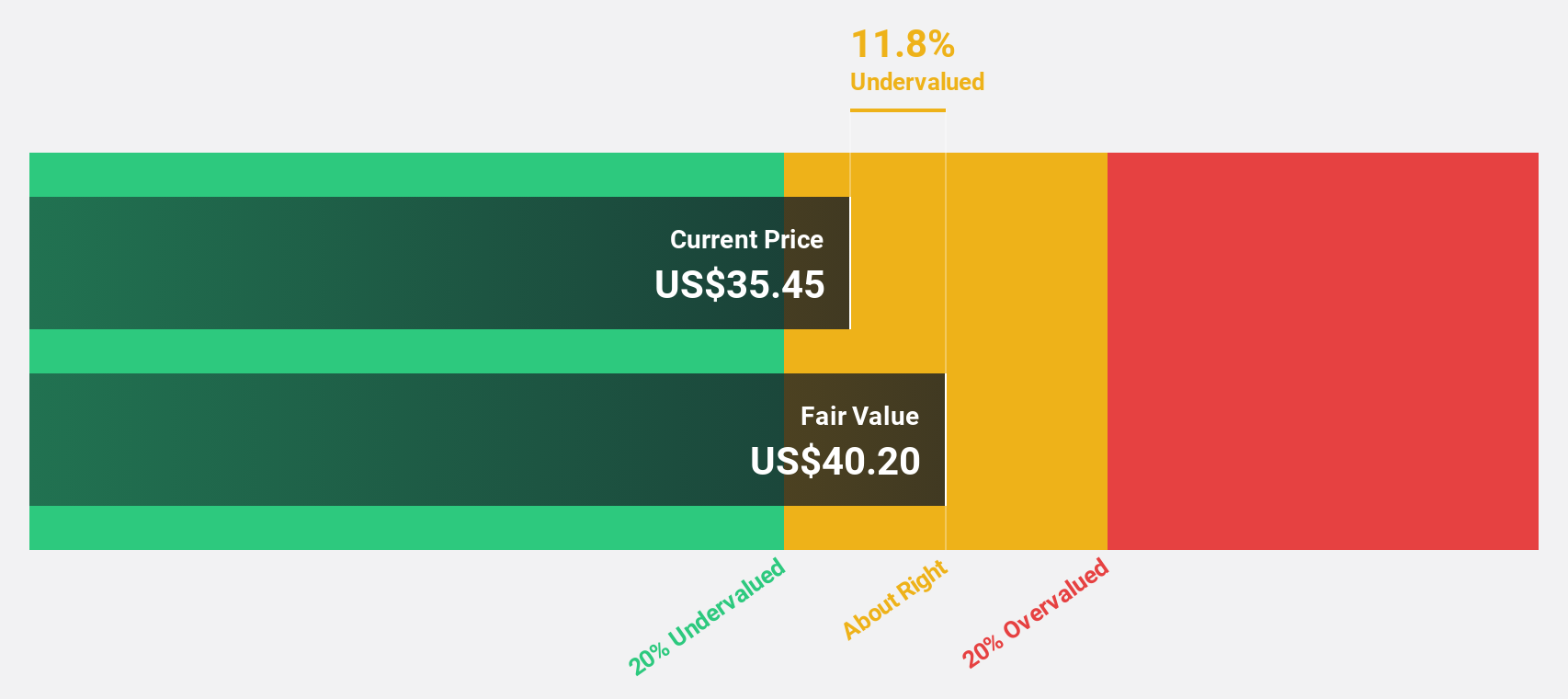

Atlassian (TEAM)

Overview: Atlassian Corporation offers collaboration software designed to enhance productivity across organizations globally, with a market cap of approximately $43.15 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating approximately $5.46 billion.

Estimated Discount To Fair Value: 33.8%

Atlassian is trading at US$163.99, significantly below its estimated fair value of US$247.72, highlighting potential undervaluation based on cash flow analysis. Recent partnerships with AWS could enhance long-term revenue streams and operational efficiency. Despite a net loss of US$51.87 million for Q1 2026, revenue rose to US$1.43 billion from the previous year, and the company has initiated a substantial share buyback program worth up to US$2.5 billion, potentially enhancing shareholder value.

- The growth report we've compiled suggests that Atlassian's future prospects could be on the up.

- Navigate through the intricacies of Atlassian with our comprehensive financial health report here.

Summing It All Up

- Unlock our comprehensive list of 207 Undervalued US Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com