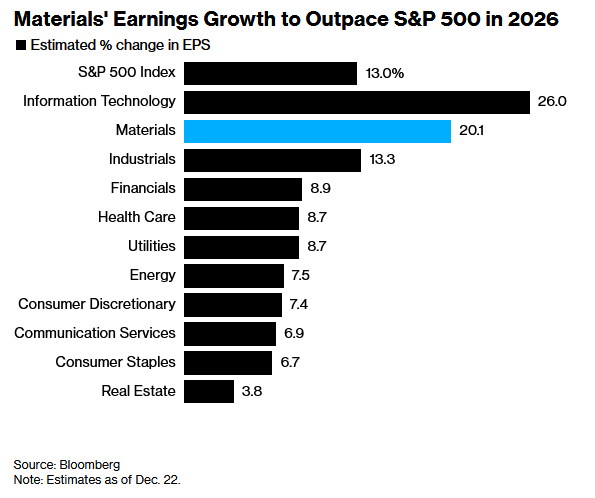

The US stock materials sector has become the “invisible winner” of Trump's tariff policy! Profit growth is expected to hit a five-year high in 2026

The Zhitong Finance App learned that although the Trump administration's tariff policy and fluctuating consumer confidence continue to bring resistance to US companies, the profit growth rate of US materials stocks in 2026 is expected to rise to the highest level in five years. According to industry research data, profits in the materials sector are expected to increase by 20% in 2026 — the sector covers a range of companies including steelmaker NUE.US (NUE.US) and paint manufacturer Sherwin (SHW.US) to packaging manufacturers Smurfit WestRock (SW.US) and BALL.US (BALL.US). The profit growth rate of this sector is expected to be second only to the technology sector.

The profit growth rate of the materials sector will exceed the S&P 500 index in 2026

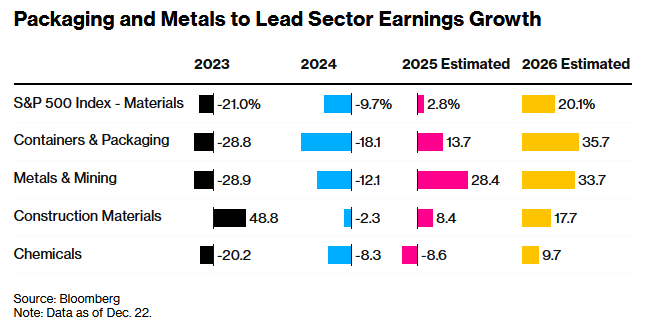

Profits of companies active in the metals and packaging industry are expected to be boosted the most, as the Trump administration's trade protection measures strengthen steel prices, while consumer goods makers' strategies to drive sales also drive demand for all types of packaging, from cereal boxes to soda cans. The profits of these two sub-sectors are expected to increase by more than 30% next year.

Packaging and metal segments will lead profitable growth in the materials sector

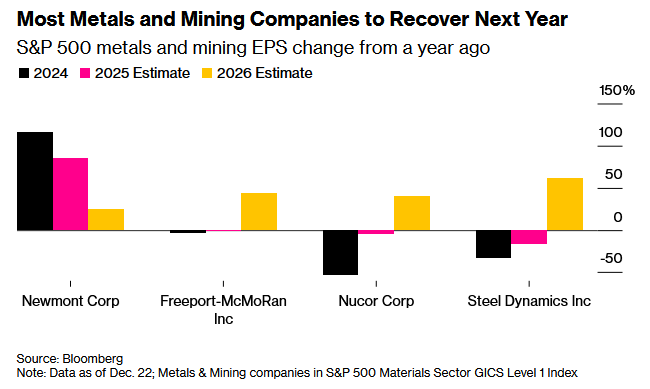

Industry research analyst Richard Burke pointed out in a November report that tariffs imposed by the US on steel imports give domestic steel producers the right to set prices. “As long as the 50% tariff based on section 232 remains unchanged, US steel producers should continue to replace imports,” he said. He was referring to the trade bill Trump used to levy tariffs.

Burke added that Nucor Steel has the broadest product line and idle production capacity in the US. The company said in a statement in December that its backlog of orders is growing as it enters 2026, driven by energy, infrastructure, data centers and manufacturing. The company said that the current trade policy should “drive continuous and gradual improvement in business conditions.” Nucor Steel's counterpart, Steel Dynamics (STLD.US), expressed similar views on its backlog of orders, and expects lower interest rates to increase infrastructure spending and manufacturing backflow, thereby boosting sales in 2026. Burke said, “A lot of contracts are overdue, so they'll basically show up next year.”

Most metal companies will see a recovery next year

Truist analyst Michael Roxland said that although tariffs are more of a drag on packaging and container manufacturers, food manufacturers have begun to increase sales through promotions — a trend reflected in companies such as General Mills (GIS.US) and Pepsi (PEP.US), which supports demand for consumer packaging suppliers such as Amcor (AMCR.US). Jefferies analysts also believe that the easier comparison base compared to the same period last year and the restoration of consumer confidence may boost sales in the second half of next year.

Royal Bank of Canada analyst Matthew McKellar said in a report that the supply of boxboard paper in North America should be in a “healthy state of tension” in 2026, and the factory operating rate is close to full capacity, which will support price increases and promote ongoing cost and efficiency optimization efforts by International Paper (IP.US) and Smurfit WestRock.

Similar concerns about the company's internal operating leverage are unfolding across the packaging sector. Amcor CEO Peter Konecny said in a conference call that the company expects to achieve its 2026 outlook through synergy without depending on macroeconomic improvements or a rebound in customer and consumer demand. In a report released in November, the company predicted that adjusted profit would grow 12% to 17% at a fixed exchange rate, the highest growth rate in five years.

However, the increase in sales brought about by packaged food manufacturers has not been reflected in other customer groups in the packaging sector, and overall packaging demand remains mixed. This has prompted companies in the packaging industry to rely on cost cuts and operational adjustments (such as closing factories) to offset the effects of weak economic conditions and weak demand for boxes.

International Paper's management warned at an industry conference in early December that demand remains sluggish as consumers and customers deal with inflation, tariffs, and a weak real estate market. Despite this, the company's earnings are expected to resume growth after four consecutive years of decline. International Paper Chief Financial Officer Lance Loeffler said, “In North America, we are still very nervous from a supply and demand perspective. We just need a little spark on the demand side, which I think will be very good for the business.”

Furthermore, the prospects for the Federal Reserve to cut interest rates are expected to benefit two other major industries in the materials sector — the chemical industry, which is expected to resume growth after three consecutive years of contraction, while the construction materials industry will reverse last year's contraction.

Citigroup analyst Patrick Cunningham believes Sherman will start the new year in a favorable interest rate environment, and the paint maker will benefit from a recovery in existing home sales. Cunningham also pointed out that America's Alb.US (ALB.US) is another winner in the coming year because lithium prices are improving as demand grows (especially from energy storage systems).

In the construction materials sector, companies such as CRH Cement (CRH.US) should see increased demand as lower interest rates lower borrowing costs. Industry research analyst Sonia Baldera said in a report that this “may inspire confidence in residential and non-residential construction deals.”