Discover 3 Undiscovered Gems in the US Market

As the major U.S. stock indexes experience mixed performance following consecutive sessions of losses, investors are keenly observing market movements and economic indicators that could impact small-cap stocks. In this fluctuating environment, identifying promising opportunities requires a focus on companies with strong fundamentals and growth potential that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Senstar Technologies | NA | -15.82% | 43.55% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| NameSilo Technologies | 12.63% | 14.48% | 3.12% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Parke Bancorp (PKBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Parke Bancorp, Inc. is the bank holding company for Parke Bank, offering personal and business financial services to individuals and small to mid-sized businesses, with a market capitalization of approximately $289.89 million.

Operations: Parke Bancorp generates revenue primarily from its community banking segment, amounting to $71.77 million.

Parke Bancorp, with assets totaling US$2.2 billion and equity of US$314.8 million, showcases its robust footing in the financial sector. The company has a net interest margin of 3% and holds total deposits of US$1.8 billion against loans worth US$1.9 billion, indicating a healthy balance sheet structure. Its high-quality earnings have seen a substantial growth rate of 20.5% over the past year, outpacing the industry average by 2%. With an allowance for bad loans at 272%, Parke Bancorp seems well-prepared to handle potential loan defaults while trading significantly below its estimated fair value by nearly half.

- Dive into the specifics of Parke Bancorp here with our thorough health report.

Review our historical performance report to gain insights into Parke Bancorp's's past performance.

Karat Packaging (KRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Karat Packaging Inc. specializes in manufacturing and distributing single-use disposable products for restaurant and foodservice settings, with a market cap of approximately $459.07 million.

Operations: Karat Packaging generates revenue primarily from the manufacturing and supply of a diverse range of single-use products, totaling approximately $453.78 million. The company's financial performance is highlighted by its gross profit margin, which provides insight into its cost management and pricing strategies.

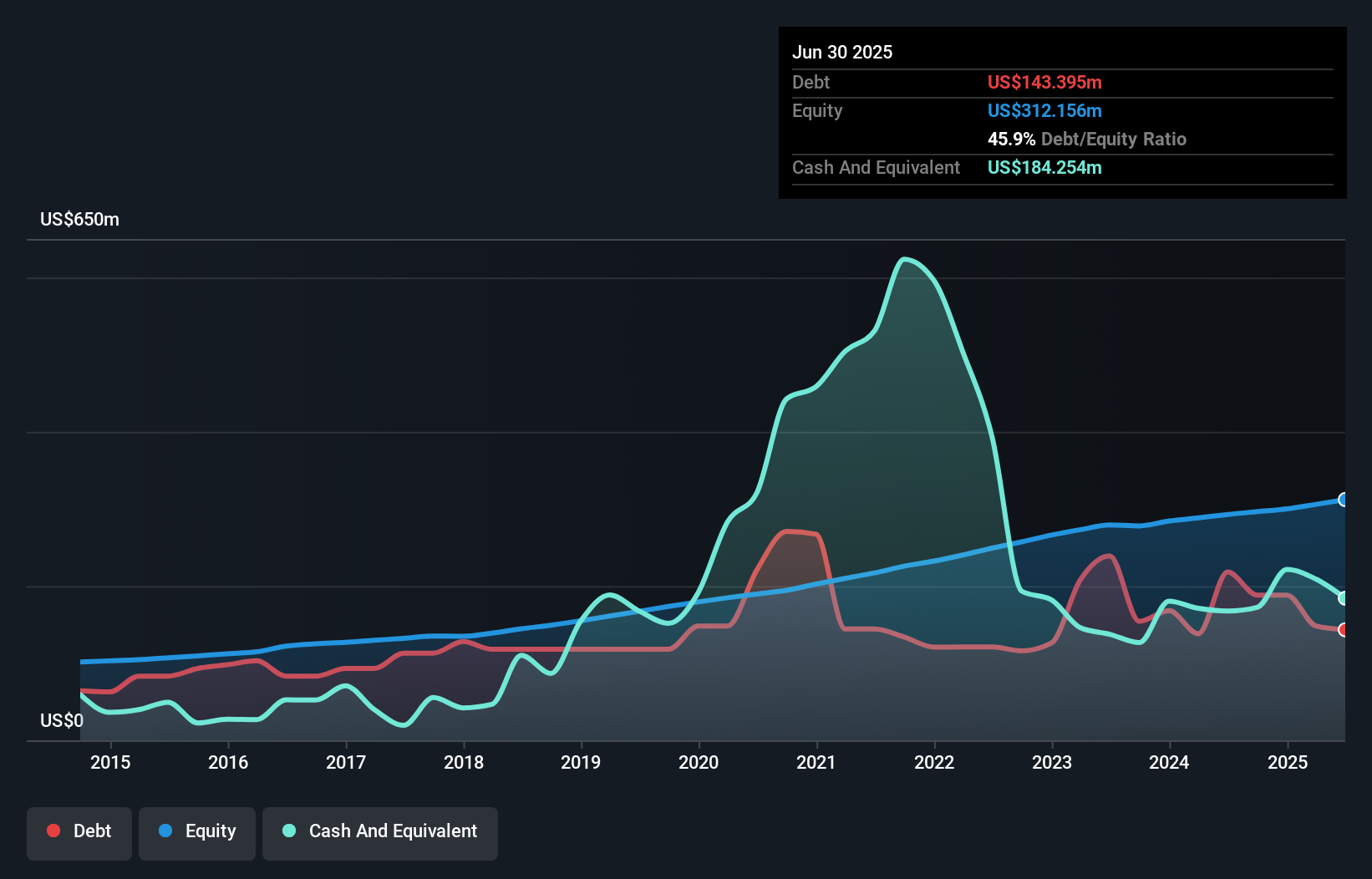

Karat Packaging appears to be navigating the packaging industry with a focus on sustainable solutions, catering to eco-conscious consumers and the booming takeout market. The company has seen its debt-to-equity ratio improve from 266% to 27.9% over five years, indicating better financial management. Despite net income for Q3 2025 dropping to US$7.33 million from US$9.09 million in the previous year, sales increased by nearly US$11 million over the same period, reaching US$124.52 million. With a price-to-earnings ratio of 15x below market average and high-quality earnings, Karat seems poised for steady growth amidst evolving industry dynamics and competition pressures.

Waterstone Financial (WSBF)

Simply Wall St Value Rating: ★★★★★★

Overview: Waterstone Financial, Inc. is a bank holding company for WaterStone Bank SSB, offering a range of financial services in southeastern Wisconsin, with a market cap of $309.39 million.

Operations: The company generates revenue primarily through its Mortgage Banking ($77.02 million) and Community Banking ($60.02 million) segments.

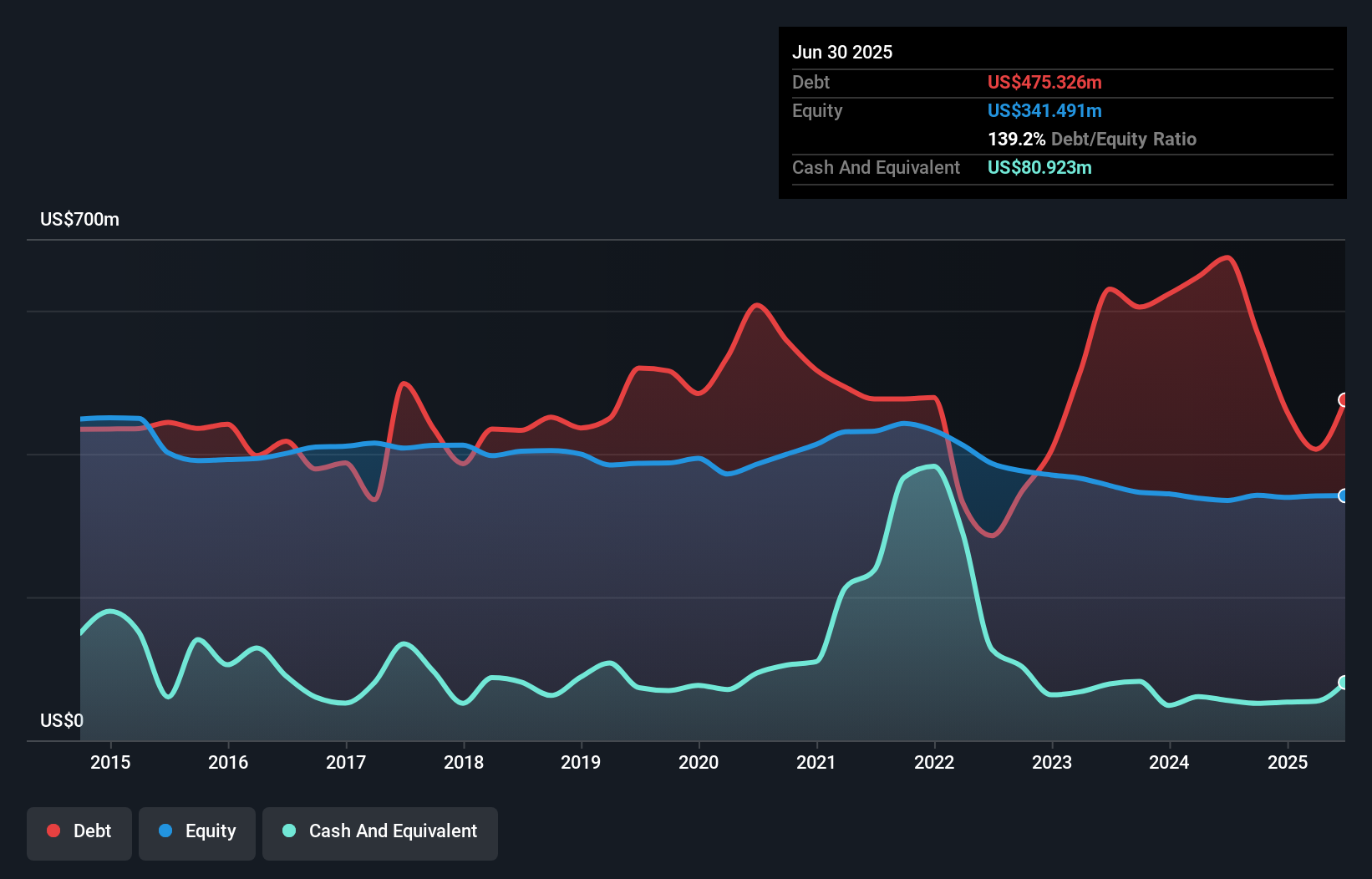

Waterstone Financial, with assets totaling US$2.3 billion and equity of US$345.5 million, stands out for its robust financial footing. The company boasts a sufficient allowance for bad loans at 295% and maintains an appropriate level of non-performing loans at 0.3%. Its earnings surged by 77.8% over the past year, surpassing industry growth rates significantly, while its price-to-earnings ratio of 12.9x suggests good value compared to the broader market's 19.2x. Waterstone has also actively repurchased shares recently, completing a significant buyback tranche that underscores confidence in its market position and future prospects.

- Take a closer look at Waterstone Financial's potential here in our health report.

Assess Waterstone Financial's past performance with our detailed historical performance reports.

Summing It All Up

- Access the full spectrum of 297 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com