Porch Group And 2 Other Growth Stocks Insiders Are Confident In

In the current U.S. market landscape, major stock indexes are experiencing mixed performance following two consecutive sessions of losses, with investors keeping a close eye on technology giants and precious metals making notable rebounds. In such an environment, stocks with high insider ownership can be appealing as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.7% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

| AppLovin (APP) | 27.3% | 27.1% |

Let's review some notable picks from our screened stocks.

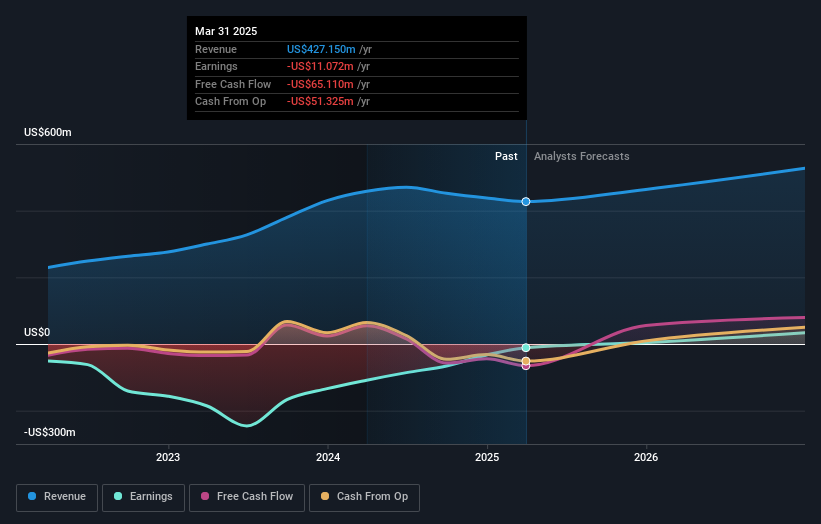

Porch Group (PRCH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Porch Group, Inc. operates a vertical software and insurance platform in the United States with a market cap of approximately $960.99 million.

Operations: Porch Group's revenue segments include a vertical software and insurance platform operating in the United States.

Insider Ownership: 19.4%

Earnings Growth Forecast: 29.0% p.a.

Porch Group shows strong growth potential with earnings forecasted to grow at 29% annually, surpassing the US market average. Despite trading at a significant discount to its estimated fair value, recent financials reveal a net loss of US$10.86 million for Q3 2025, contrasting with last year's profit. Insider activity indicates substantial selling over the past three months without notable buying. The company is enhancing its Home Factors platform, aiming for improved risk assessment in property underwriting.

- Click here and access our complete growth analysis report to understand the dynamics of Porch Group.

- The valuation report we've compiled suggests that Porch Group's current price could be quite moderate.

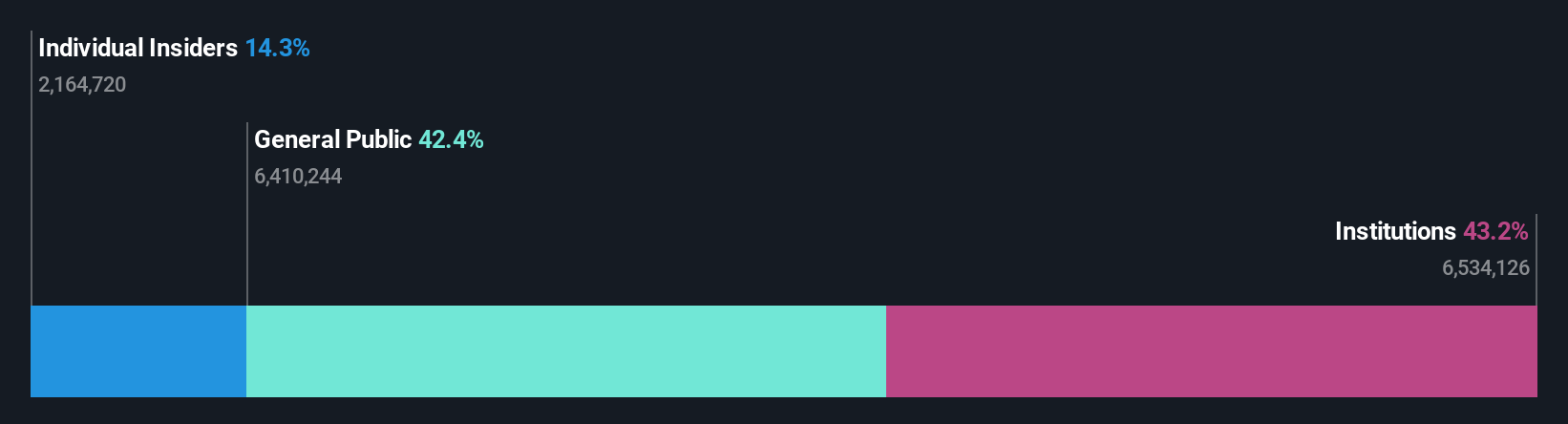

Coastal Financial (CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation is the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington, with a market cap of $1.77 billion.

Operations: Coastal Financial's revenue segments include CCBX generating $241.19 million, Community Bank contributing $85.52 million, and Treasury & Administration adding $16.96 million.

Insider Ownership: 13.9%

Earnings Growth Forecast: 45.4% p.a.

Coastal Financial's earnings are projected to grow substantially at 45.4% annually, outpacing the US market, with revenue growth expected to exceed 31.4% per year. Despite trading below its estimated fair value, recent financials show a slight increase in net income for Q3 2025 compared to last year. Insider activity reveals more shares sold than bought recently, and a shelf registration filing of US$62.46 million was announced for an ESOP-related offering.

- Click to explore a detailed breakdown of our findings in Coastal Financial's earnings growth report.

- Upon reviewing our latest valuation report, Coastal Financial's share price might be too optimistic.

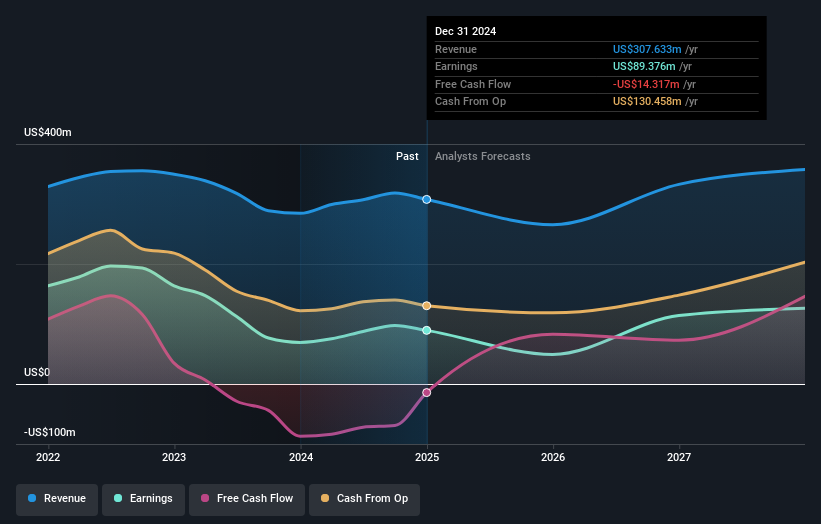

Safe Bulkers (SB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Safe Bulkers, Inc. and its subsidiaries offer international marine drybulk transportation services, with a market cap of $495.23 million.

Operations: The company's revenue is primarily derived from its transportation and shipping segment, which generated $274.66 million.

Insider Ownership: 31.4%

Earnings Growth Forecast: 50.9% p.a.

Safe Bulkers is positioned for significant earnings growth of 50.9% annually, surpassing the US market. Despite a recent decline in profit margins and revenue, it trades at a substantial discount to its estimated fair value. The company announced a share buyback program representing 9.8% of outstanding stock, funded by existing cash resources, reflecting confidence in its valuation. However, interest payments remain inadequately covered by earnings and the dividend is not well-supported by free cash flow.

- Get an in-depth perspective on Safe Bulkers' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Safe Bulkers shares in the market.

Next Steps

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 208 companies by clicking here.

- Ready For A Different Approach? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com