3 Undiscovered Australian Gems with Promising Potential

As the Australian market approaches the holiday season, it is witnessing a slight downturn, with the ASX experiencing a 0.2% drop amidst profit-taking activities and early closures for Christmas. Despite this lull, small-cap stocks continue to capture interest due to their potential for growth in sectors like precious metals and defense technologies. In this context, identifying undervalued companies with strong fundamentals and innovative strategies can offer promising opportunities for investors seeking to uncover hidden gems in Australia's vibrant market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Argosy Minerals | NA | -12.81% | -19.89% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

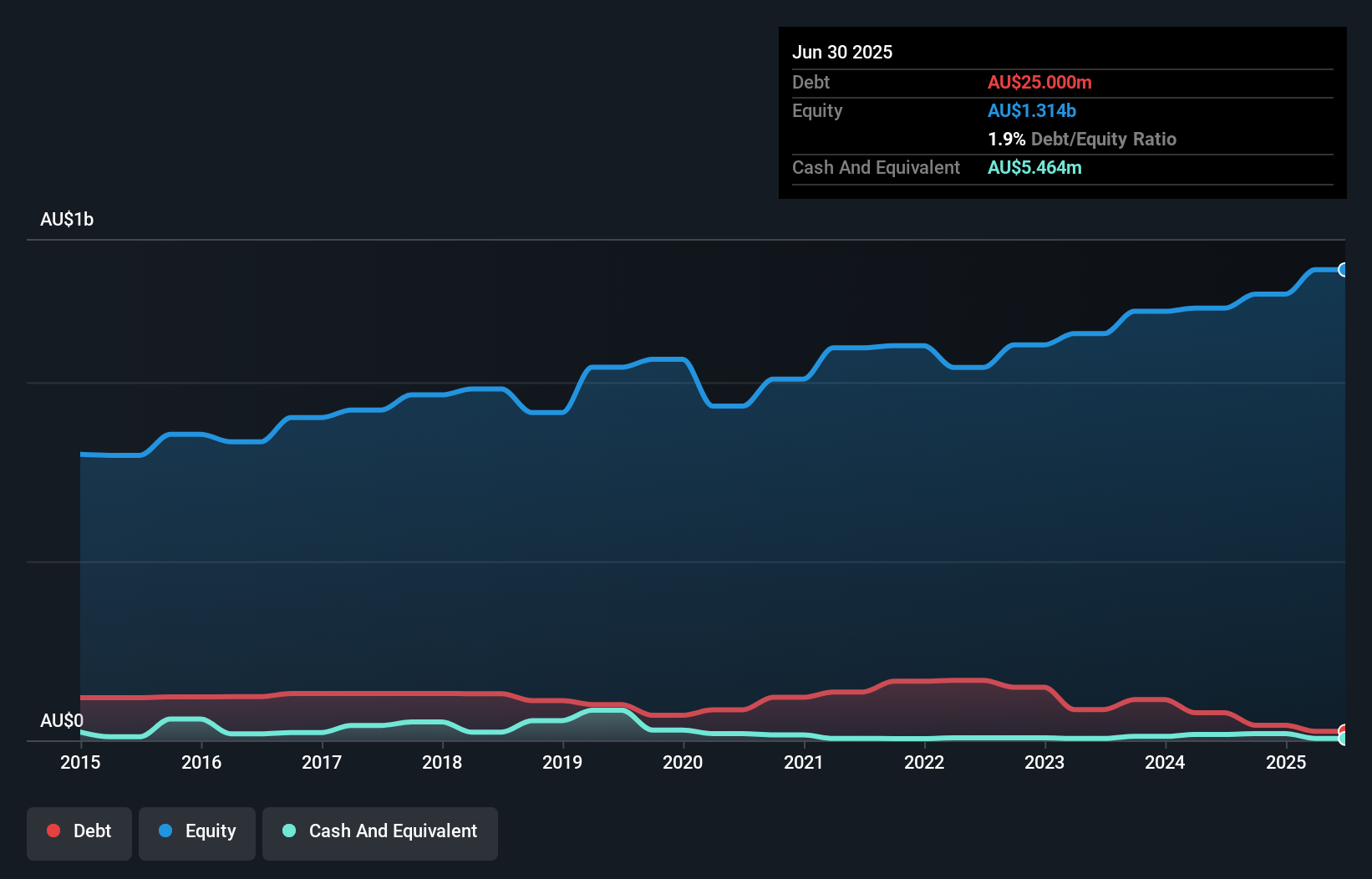

Australian United Investment (ASX:AUI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited is a publicly owned investment manager with a market cap of A$1.41 billion.

Operations: The company generates revenue primarily from investments, amounting to A$57 million. It has a market cap of approximately A$1.41 billion.

Australian United Investment (AUI) showcases a strong financial foundation with its net debt to equity ratio at a satisfactory 1.5%, reflecting prudent financial management. Over the past five years, AUI has reduced its debt to equity from 9.1% to 1.9%, indicating effective debt reduction strategies. The company's high-quality earnings are complemented by robust interest coverage, with EBIT covering interest payments 22.8 times over, ensuring financial stability and resilience in challenging market conditions. Despite a modest annual earnings growth of 4.6% over the last five years, AUI remains profitable with positive free cash flow and no immediate cash runway concerns.

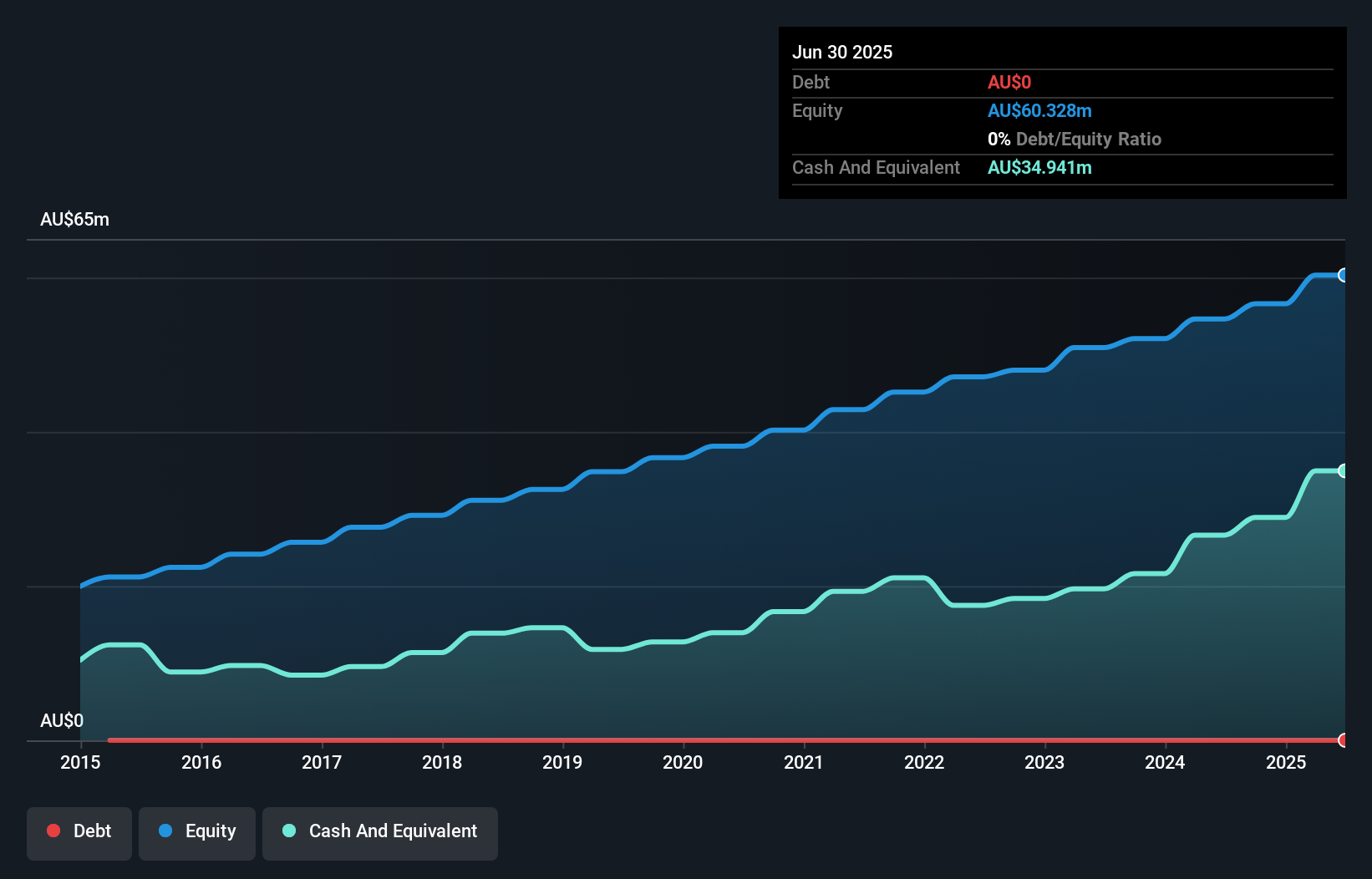

Fiducian Group (ASX:FID)

Simply Wall St Value Rating: ★★★★★★

Overview: Fiducian Group Ltd operates in Australia offering a range of financial services through its subsidiaries and has a market cap of approximately A$378.81 million.

Operations: The company's primary revenue streams include financial planning (A$29.66 million), funds management (A$25.59 million), corporate services (A$17.67 million), and platform administration (A$16.45 million).

Fiducian Group, a nimble player in the financial landscape, stands out with its debt-free status over the past five years. This lack of debt removes any concerns about interest coverage and highlights its robust financial health. The company has demonstrated impressive earnings growth of 23.5% over the last year, significantly outpacing the broader Capital Markets industry growth of 6%. With high-quality earnings and a favorable price-to-earnings ratio of 20.4x compared to the Australian market's 21.7x, Fiducian seems well-positioned for continued success in its sector.

- Unlock comprehensive insights into our analysis of Fiducian Group stock in this health report.

Gain insights into Fiducian Group's historical performance by reviewing our past performance report.

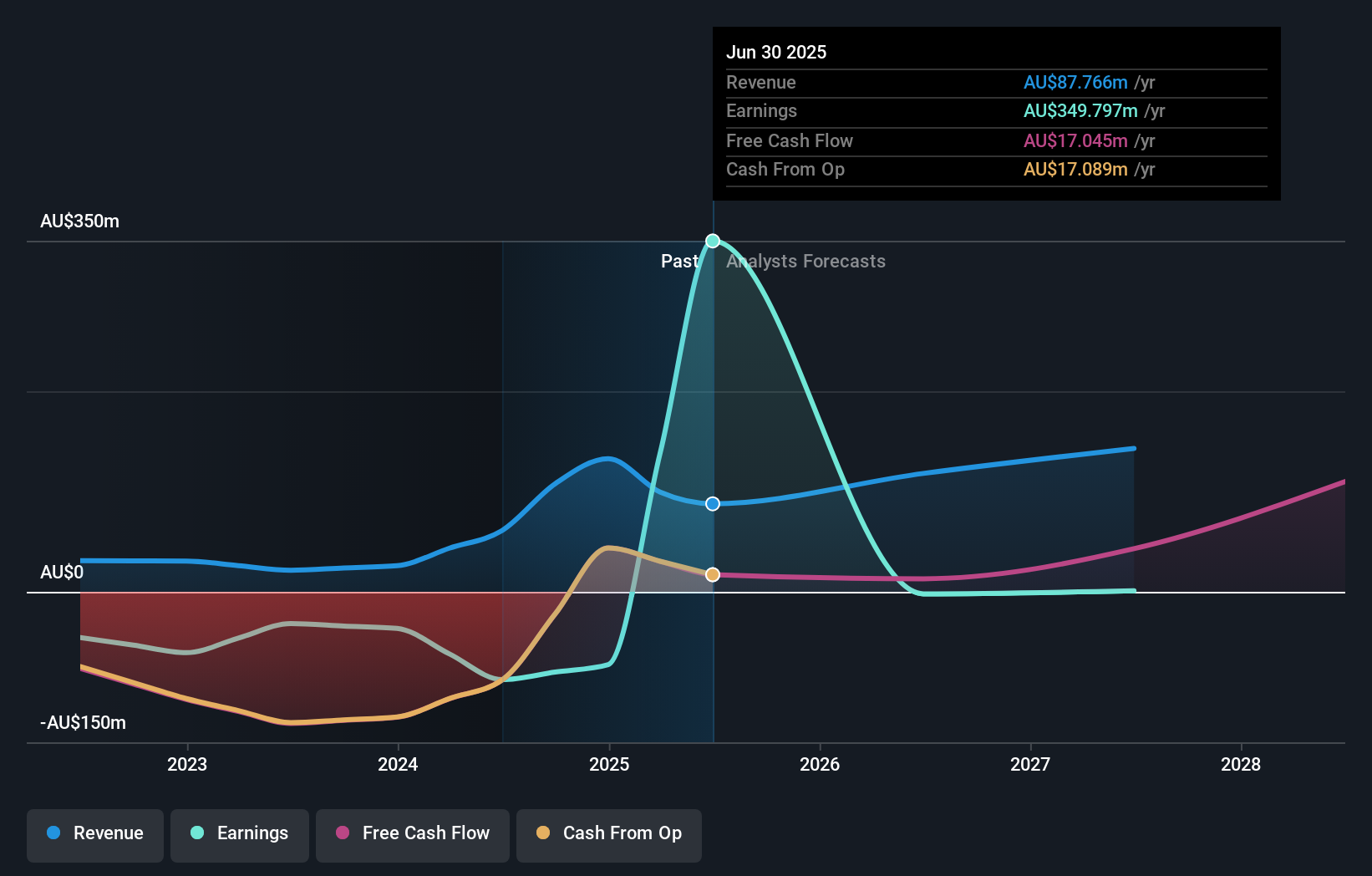

Omni Bridgeway (ASX:OBL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Omni Bridgeway Limited operates as a global provider of dispute and litigation finance services across multiple regions including Australia, the United States, and Europe, with a market capitalization of A$432.40 million.

Operations: Omni Bridgeway generates revenue primarily from funding and providing services related to legal dispute resolution, amounting to A$87.77 million.

Omni Bridgeway, a promising player in the Australian market, recently turned profitable, making it stand out in the financial sector. The company's price-to-earnings ratio of 1.2x positions it attractively against the broader Australian market at 21.7x. Despite a forecasted earnings decline averaging 148% annually over three years, revenue is expected to grow by nearly 24% per year. Omni Bridgeway's debt management shines with a reduction in its debt-to-equity ratio from 18.7% to just 2.3% over five years and having more cash than total debt ensures financial stability moving forward into potential growth opportunities.

Seize The Opportunity

- Reveal the 59 hidden gems among our ASX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com