Exploring High Growth Tech Stocks in Australia Featuring Three Prominent Companies

As the Australian market edges towards the holiday season, it is experiencing a slight dip, largely attributed to profit-taking as major global indices approach record highs. In this context, high growth tech stocks in Australia can offer intriguing opportunities for investors seeking innovation and potential expansion, particularly when these companies demonstrate resilience and adaptability amidst fluctuating economic conditions.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 10.51% | 37.56% | ★★★★★☆ |

| Pro Medicus | 19.70% | 21.17% | ★★★★★☆ |

| Kinatico | 13.27% | 42.29% | ★★★★☆☆ |

| Clinuvel Pharmaceuticals | 22.02% | 23.88% | ★★★★★☆ |

| BlinkLab | 104.90% | 101.40% | ★★★★★★ |

| Xero | 18.02% | 24.83% | ★★★★☆☆ |

| Wrkr | 35.94% | 53.22% | ★★★★★★ |

| Artrya | 50.54% | 61.25% | ★★★★★☆ |

| Ai-Media Technologies | 16.83% | 94.47% | ★★★★☆☆ |

| FINEOS Corporation Holdings | 9.22% | 57.85% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

FINEOS Corporation Holdings (ASX:FCL)

Simply Wall St Growth Rating: ★★★★☆☆

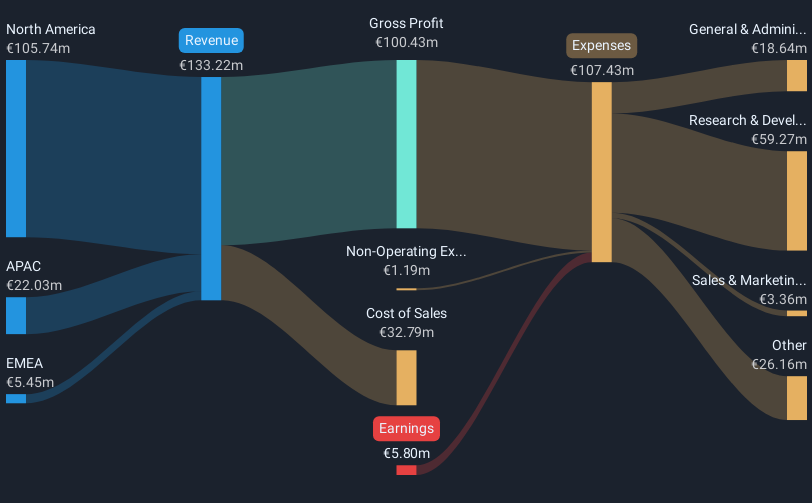

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa; it has a market capitalization of approximately A$1.03 billion.

Operations: FINEOS generates revenue primarily from its software and programming segment, amounting to €135.90 million. The company focuses on providing specialized software solutions for insurers and benefits providers across various regions.

FINEOS Corporation Holdings has positioned itself distinctively in the high-growth tech sector of Australia, with a notable annual revenue growth rate of 9.2%. Despite its current unprofitability, the company's strategic focus on software solutions for the insurance industry is underscored by robust plans for profitability within three years, reflecting an impressive expected earnings growth of 57.85% annually. Recent executive changes aim to further enhance governance and market strategy, as evidenced by Michael Kelly transitioning to Executive Chairman and the introduction of seasoned industry professionals like Stephen Devine to its Board. This leadership refresh promises to invigorate FINEOS’s trajectory amidst competitive pressures, potentially accelerating its journey towards positive cash flows and above-market performance.

- Click here and access our complete health analysis report to understand the dynamics of FINEOS Corporation Holdings.

Learn about FINEOS Corporation Holdings' historical performance.

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★☆☆

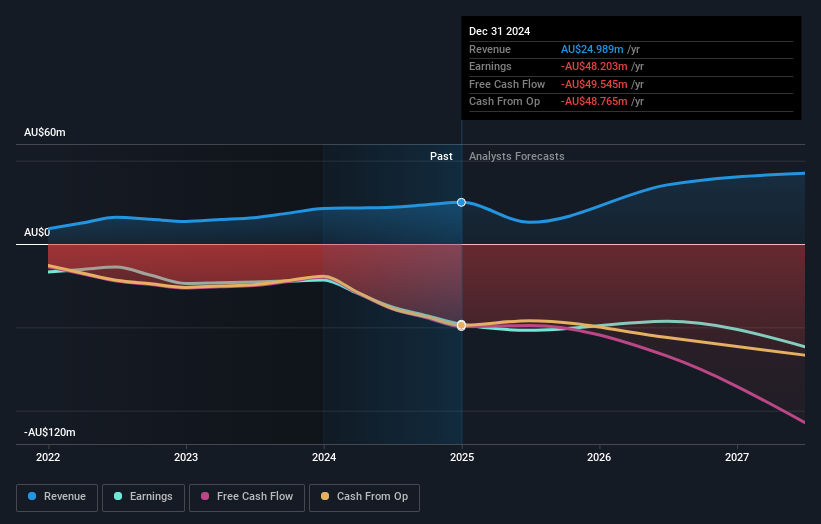

Overview: PYC Therapeutics Limited is a drug-development company focused on creating RNA-based treatments for genetic diseases in Australia, with a market cap of A$956.55 million.

Operations: The company generates revenue through its focus on the discovery and development of novel RNA therapeutics, with reported revenue of A$23.49 million.

PYC Therapeutics, navigating through a challenging phase with expected revenue contraction of 5.8% annually over the next three years, remains optimistic about its future profitability, projecting an earnings growth of 27.6% per annum. This contrasts starkly with its current unprofitability and shareholder dilution experienced last year. Recent strategic board changes, including the appointment of Peter Coleman as Independent Non-Executive Chair, underscore a commitment to leveraging his M&A expertise to steer PYC towards anticipated robust returns on equity of 22.8%. These moves are pivotal as PYC aims to reverse negative trends and capitalize on growth opportunities in the biotech sector.

- Unlock comprehensive insights into our analysis of PYC Therapeutics stock in this health report.

Gain insights into PYC Therapeutics' past trends and performance with our Past report.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

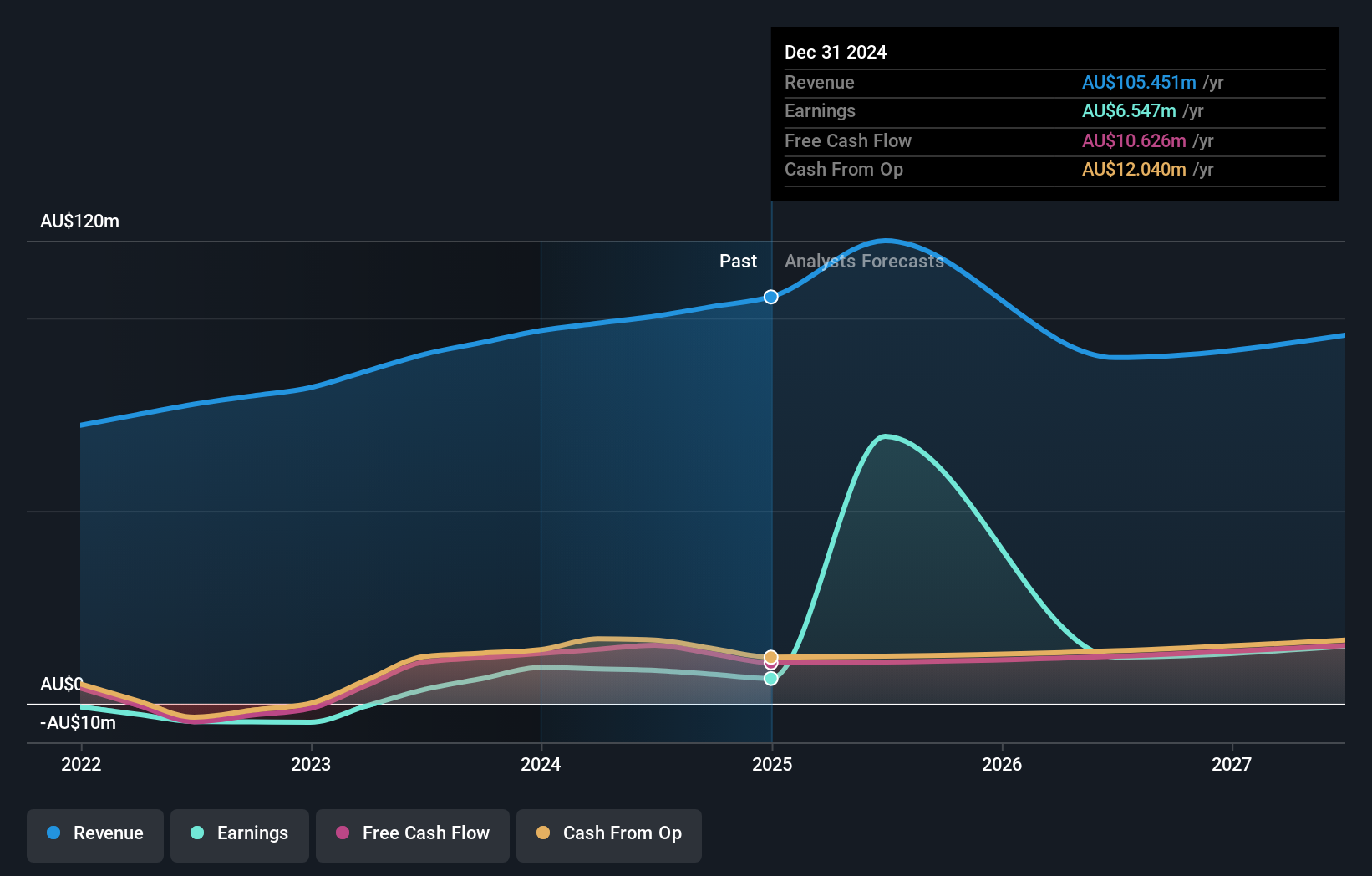

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across various regions including Australia, Asia, the Americas, Africa, and Europe with a market capitalization of approximately A$1.10 billion.

Operations: RPMGlobal Holdings generates revenue primarily through its Software segment, accounting for A$73.96 million, while the Advisory segment contributes A$24.77 million.

RPMGlobal Holdings, with a projected annual revenue growth of 15% and earnings surge of 55%, outpaces the Australian market averages significantly. Despite a minor profit margin contraction to 0.01% from last year's 5.3%, the company's strategic focus on innovative software solutions in mining could drive future profitability. A recent shareholder meeting highlighted an approval scheme with Caterpillar, potentially enhancing RPMGlobal's market position and operational scope, marking it as a noteworthy contender in Australia’s tech landscape despite some financial volatility marked by one-off losses totaling A$2.2M last fiscal year.

- Click here to discover the nuances of RPMGlobal Holdings with our detailed analytical health report.

Evaluate RPMGlobal Holdings' historical performance by accessing our past performance report.

Next Steps

- Gain an insight into the universe of 22 ASX High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com