ASX Growth Companies With High Insider Ownership December 2025

As the Australian market approaches the end of 2025, it seems to be winding down with a slight dip, likely due to profit-taking before the holiday season, even as Wall Street indices flirt with all-time highs. In this context, identifying growth companies with high insider ownership can be particularly appealing, as such stocks often indicate strong confidence from those closest to the business and may offer resilience in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.2% | 96.3% |

| Titomic (ASX:TTT) | 14.8% | 74.9% |

| Sea Forest (ASX:SEA) | 15.1% | 92.6% |

| Pure One (ASX:P1E) | 10.6% | 114.6% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Elsight (ASX:ELS) | 17.3% | 85% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 32.1% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

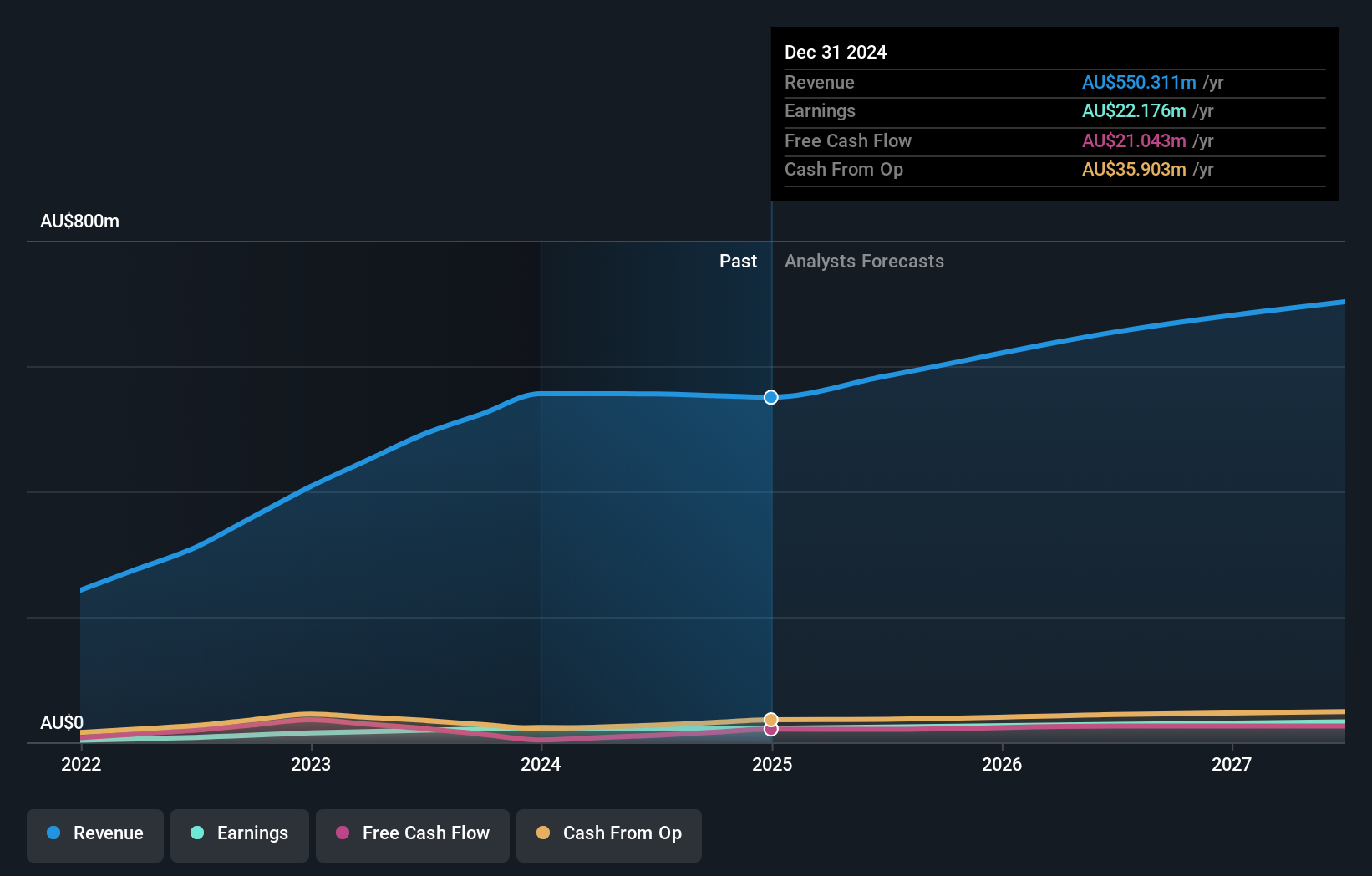

Duratec (ASX:DUR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Duratec Limited, with a market cap of A$487.34 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: The company's revenue segments include Energy (A$82.51 million), Defence (A$181.36 million), Buildings & Facades (A$111.87 million), and Mining & Industrial (A$136.65 million).

Insider Ownership: 29.3%

Return On Equity Forecast: 30% (2028 estimate)

Duratec, with a focus on growth through diversification and strategic acquisitions, is well-positioned for future expansion. The company expects revenue growth of 7.7% annually, outpacing the broader Australian market. Earnings are projected to rise by 13.09% per year, supported by high forecasted return on equity at 29.7%. Trading below estimated fair value enhances its appeal as an investment opportunity in the sector of companies with significant insider ownership in Australia.

- Take a closer look at Duratec's potential here in our earnings growth report.

- Our expertly prepared valuation report Duratec implies its share price may be too high.

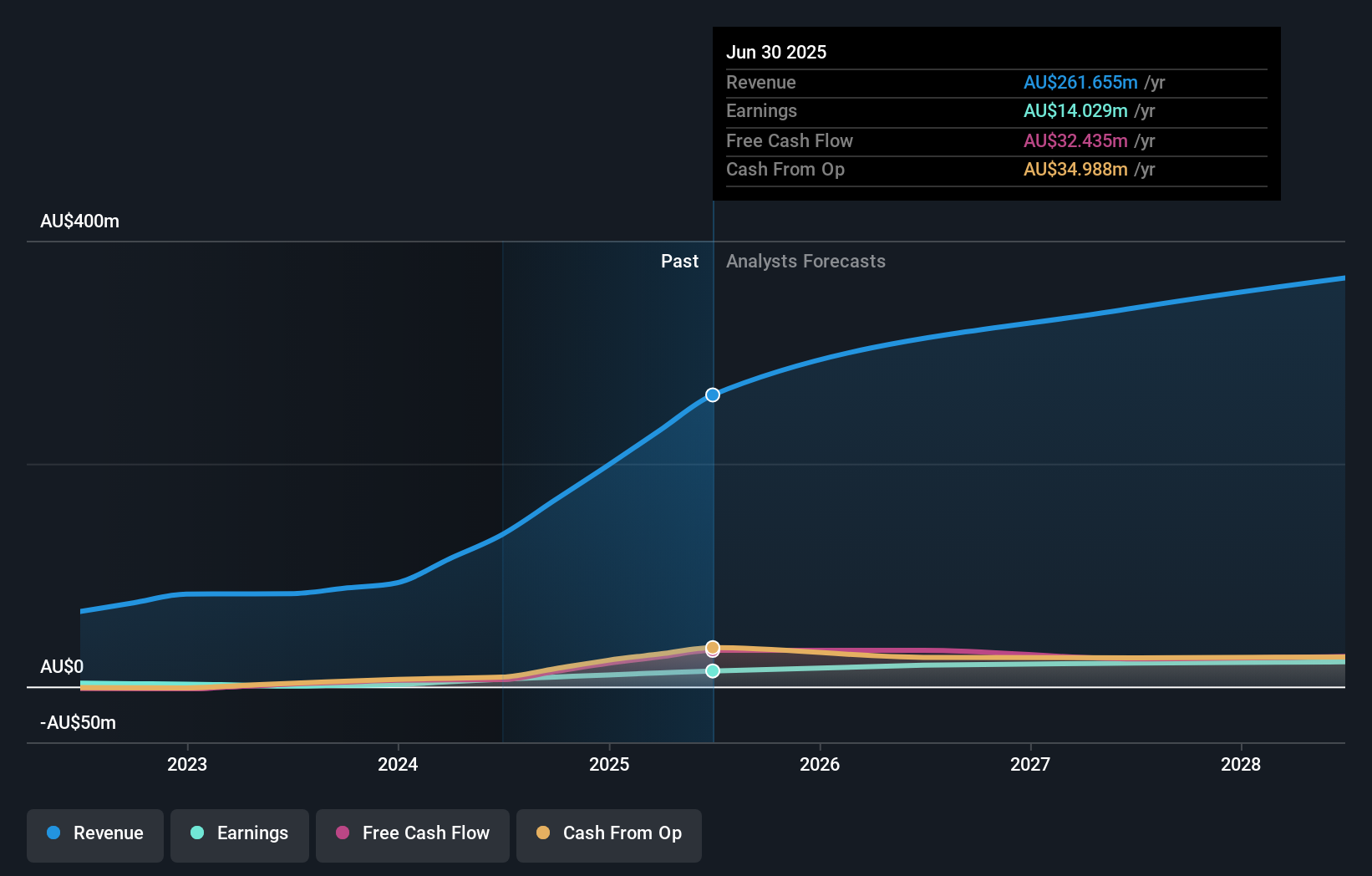

SKS Technologies Group (ASX:SKS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services, with a market cap of A$462.27 million.

Operations: The company's revenue is primarily derived from its Lighting and Audio-Visual Markets segment, which generated A$261.66 million.

Insider Ownership: 28.3%

Return On Equity Forecast: 38% (2028 estimate)

SKS Technologies Group is poised for substantial growth, with earnings projected to increase significantly at 23.8% annually, surpassing the Australian market average. Revenue is expected to grow at 13.4% per year, also outpacing the broader market. The company's return on equity is forecasted to be high in three years, enhancing its investment profile. Despite trading slightly below its estimated fair value, no significant insider trading activity has been reported recently.

- Dive into the specifics of SKS Technologies Group here with our thorough growth forecast report.

- The analysis detailed in our SKS Technologies Group valuation report hints at an inflated share price compared to its estimated value.

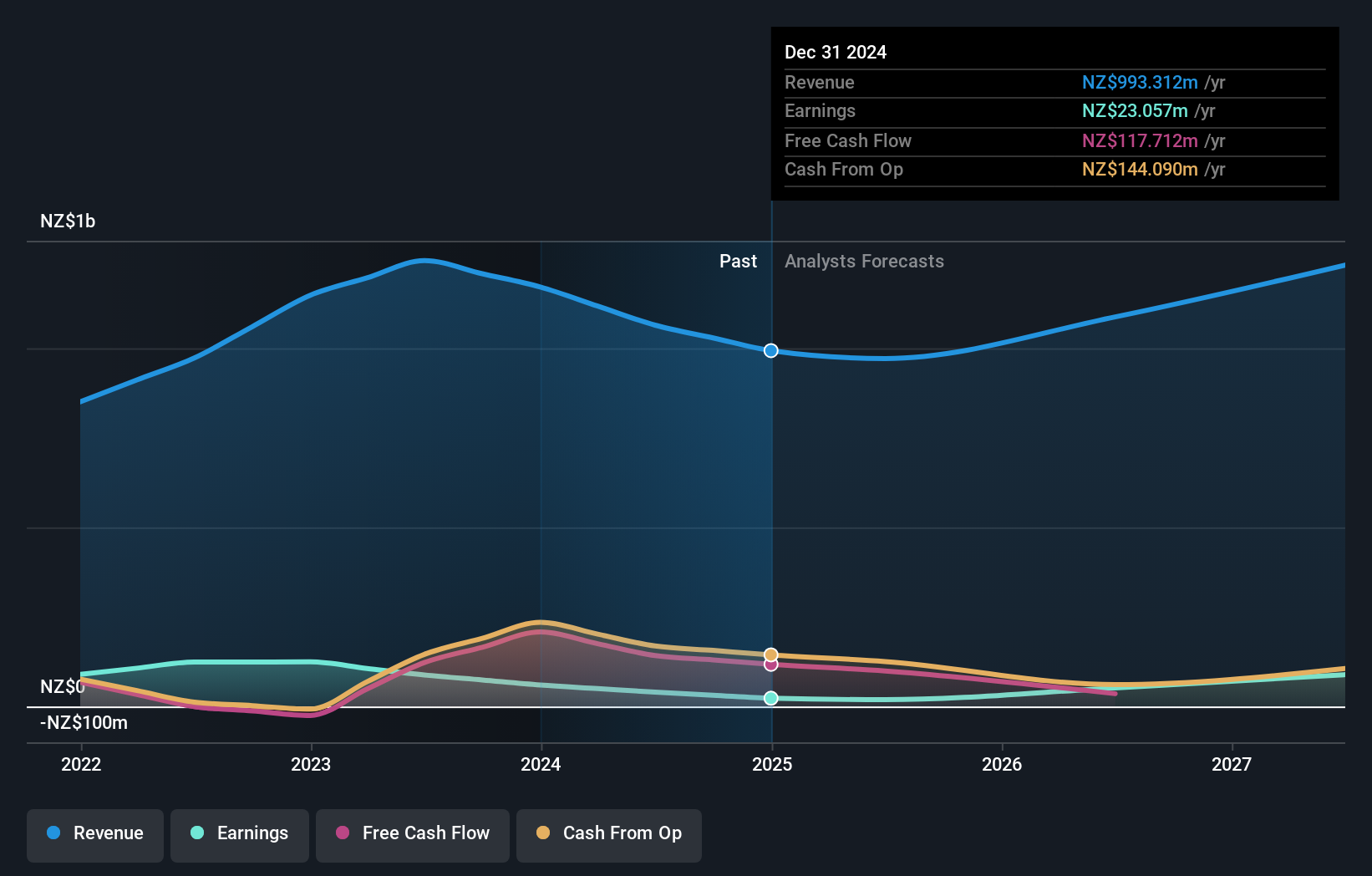

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vulcan Steel Limited, along with its subsidiaries, operates in the sale and distribution of steel and metal products across New Zealand and Australia, with a market cap of A$1.08 billion.

Operations: The company's revenue segments comprise NZ$409.74 million from steel and NZ$538.41 million from metals.

Insider Ownership: 33.9%

Return On Equity Forecast: 29% (2028 estimate)

Vulcan Steel is positioned for significant earnings growth, with forecasts indicating a 34.15% annual increase, well above the Australian market average. Despite this, recent profit margins have declined to 1.7% from 3.8%, and revenue growth of 10.3% per year is slower than its earnings trajectory but still exceeds the market's pace. Insider trading shows more purchases than sales recently, though not in substantial volumes, and interest payments are not well covered by earnings.

- Click to explore a detailed breakdown of our findings in Vulcan Steel's earnings growth report.

- Our comprehensive valuation report raises the possibility that Vulcan Steel is priced higher than what may be justified by its financials.

Taking Advantage

- Delve into our full catalog of 111 Fast Growing ASX Companies With High Insider Ownership here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com