Asian Penny Stocks: IVD Medical Holding And Two More To Watch

As Asian markets continue to navigate a complex economic landscape, investors are increasingly looking for opportunities in smaller, emerging companies. Penny stocks, often seen as relics of past market eras, still hold potential for those seeking affordable entry points with growth prospects. This article will explore several penny stocks that stand out for their financial strength and potential long-term value.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.44 | HK$890.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.60 | THB1.09B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.104 | SGD54.45M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.65 | HK$20.57B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.51 | HK$52.36B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.84 | NZ$243.04M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 968 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

IVD Medical Holding (SEHK:1931)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IVD Medical Holding Limited is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally, with a market cap of HK$4.32 billion.

Operations: The company's revenue is primarily derived from its Distribution Business, which accounts for CN¥2.87 billion, followed by After-sales services at CN¥198.51 million and Self-Branded Products Business at CN¥9.54 million.

Market Cap: HK$4.32B

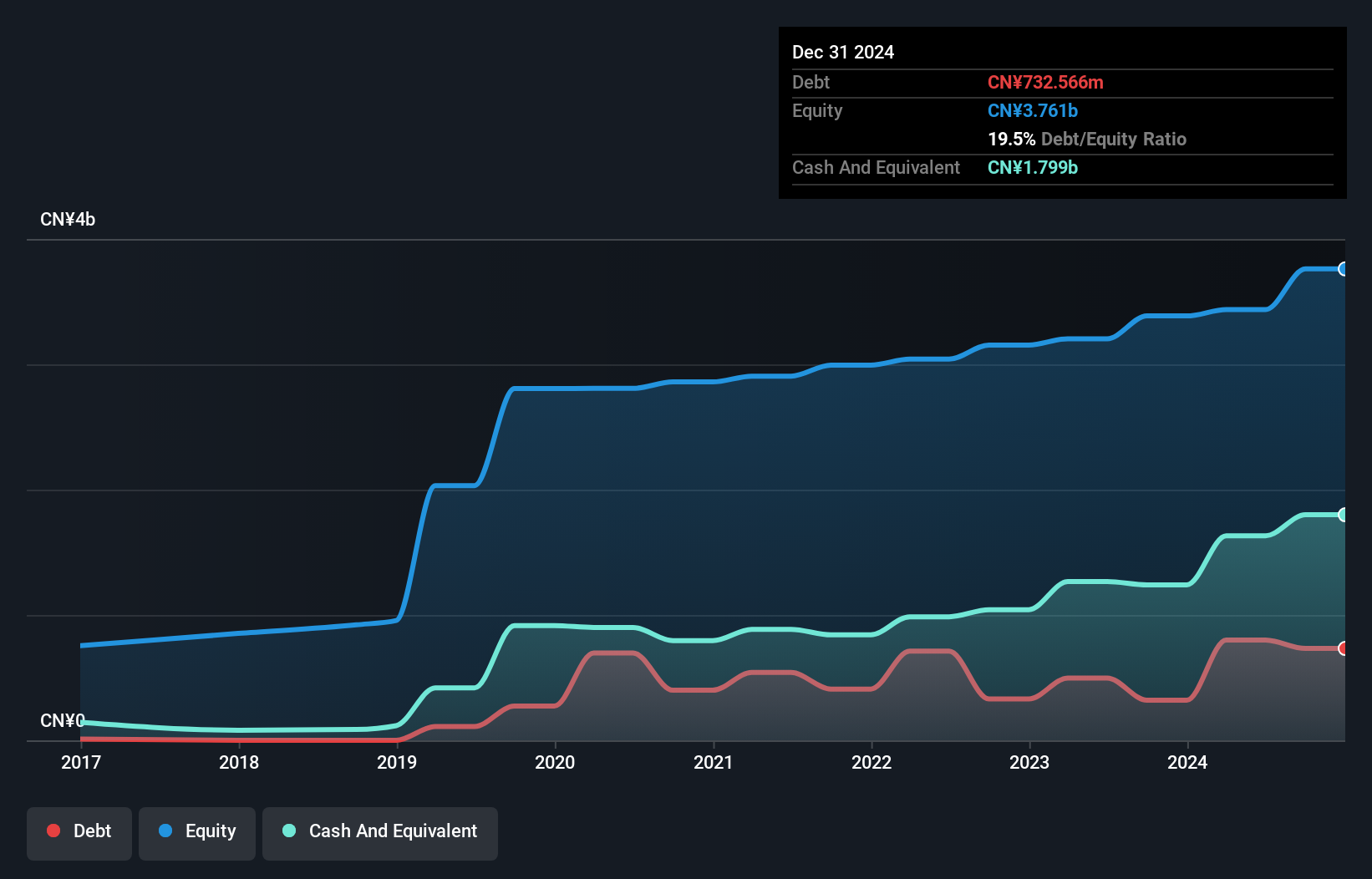

IVD Medical Holding's recent strategic moves reflect a focus on expansion and innovation, notably through the acquisition of property in Irvine, California for its US headquarters. This facility will support research and development in stablecoin public blockchain technology and intellectual property securitization. Despite a volatile share price over the past three months, the company maintains strong short-term asset coverage over liabilities (CN¥4.3 billion vs CN¥2.4 billion) and satisfactory debt levels with a net debt to equity ratio of 34.6%. However, negative earnings growth (-33.1%) contrasts with its five-year profit growth trend, highlighting potential risks amid ambitious expansion plans.

- Get an in-depth perspective on IVD Medical Holding's performance by reading our balance sheet health report here.

- Assess IVD Medical Holding's previous results with our detailed historical performance reports.

China Brilliant Global (SEHK:8026)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Brilliant Global Limited, with a market cap of HK$759.56 million, is an investment holding company involved in the research and development, design, wholesale, and retail of gold and jewelry in Hong Kong and the People's Republic of China.

Operations: The company's revenue is primarily generated from its Gold and Jewellery Business, which accounts for HK$48.42 million, followed by Property Management Services at HK$29.42 million, and a smaller contribution from its Lending Business at HK$0.51 million.

Market Cap: HK$759.56M

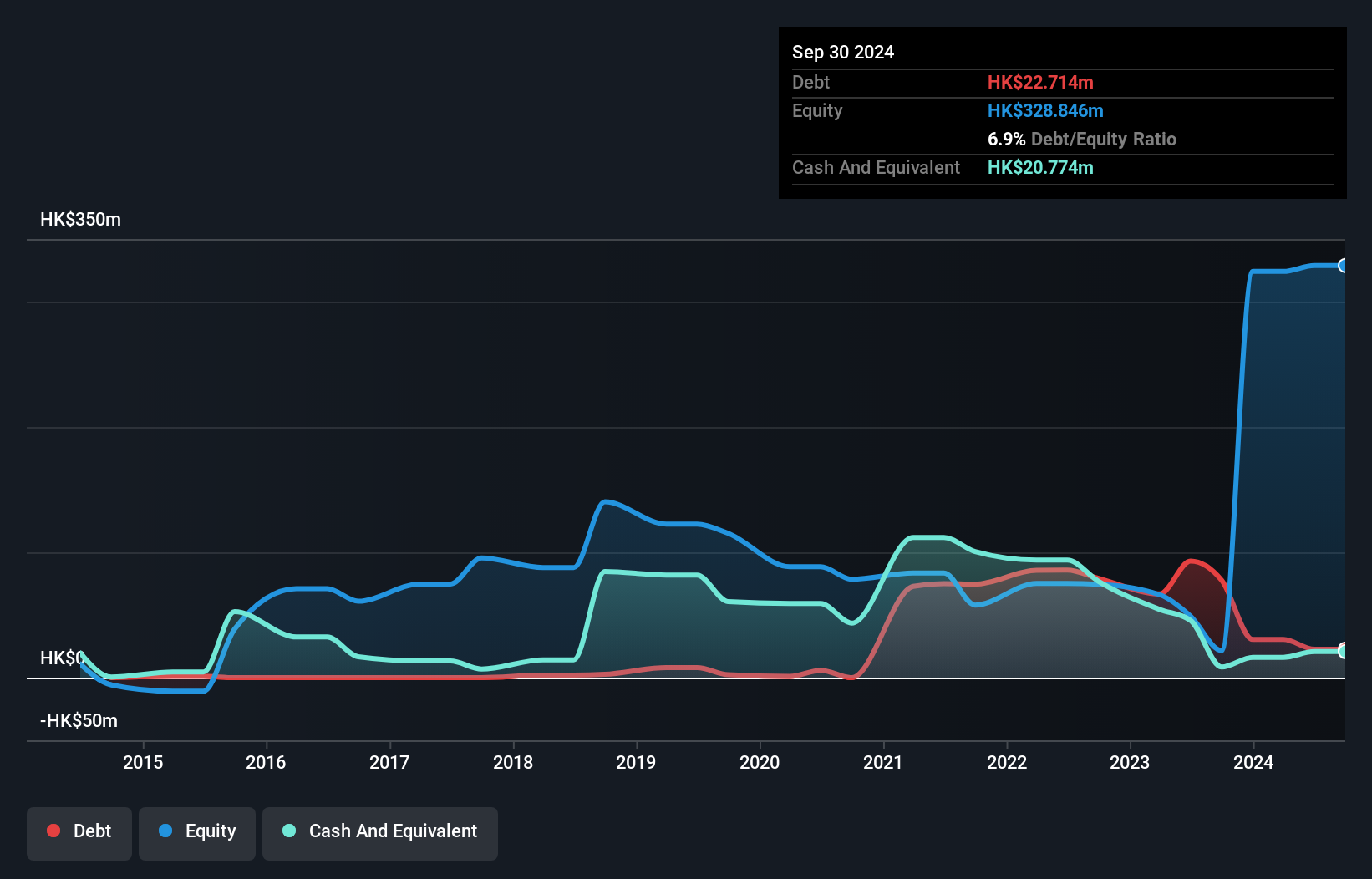

China Brilliant Global Limited has shown a transition to profitability, with earnings growth of 28.3% annually over the past five years. Despite recent volatility in share price, the company maintains strong financial health, with short-term assets (HK$126.6M) exceeding both short and long-term liabilities. Its debt is well-covered by operating cash flow and interest payments are comfortably managed by EBIT. Recent business expansion includes establishing a new branch for property management services in Dongguan City, enhancing its revenue streams beyond gold and jewelry. However, earnings have slightly declined year-on-year, indicating potential challenges ahead.

- Unlock comprehensive insights into our analysis of China Brilliant Global stock in this financial health report.

- Understand China Brilliant Global's track record by examining our performance history report.

Zhejiang Jinke Tom Culture Industry (SZSE:300459)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Jinke Tom Culture Industry Co., LTD operates in the cultural industry sector and has a market cap of CN¥15.72 billion.

Operations: The company's revenue primarily comes from the Mobile Internet Culture Industry, generating CN¥971.40 million.

Market Cap: CN¥15.72B

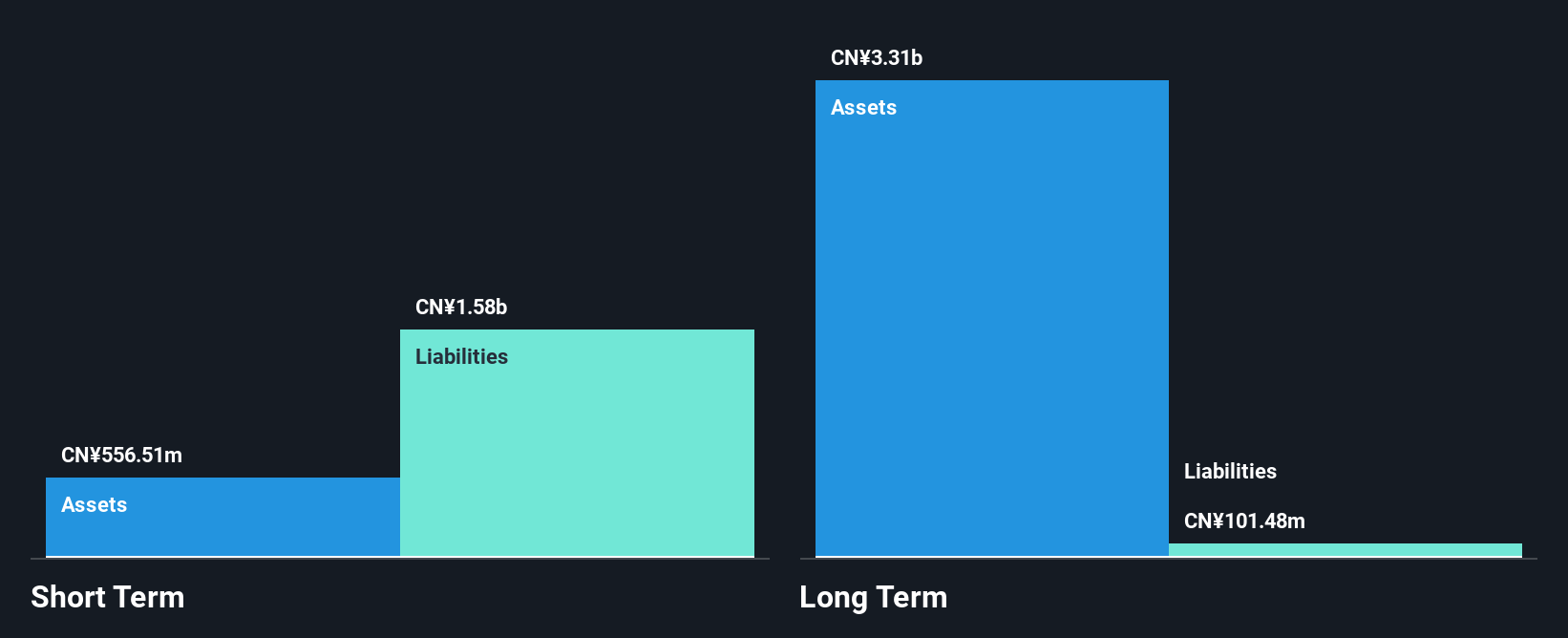

Zhejiang Jinke Tom Culture Industry Co., LTD. faces challenges with declining sales and a net loss of CN¥43.94 million for the nine months ending September 2025, compared to a profit last year. Despite being unprofitable, the company has a solid cash runway exceeding three years, supported by positive free cash flow. However, its high net debt to equity ratio of 54.2% poses financial risks. While short-term assets cover long-term liabilities, they fall short of covering short-term liabilities (CN¥1.6 billion). The experienced board and management provide stability amidst these financial hurdles but profitability remains elusive.

- Click here to discover the nuances of Zhejiang Jinke Tom Culture Industry with our detailed analytical financial health report.

- Explore historical data to track Zhejiang Jinke Tom Culture Industry's performance over time in our past results report.

Make It Happen

- Unlock our comprehensive list of 968 Asian Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com