3 Asian Dividend Stocks To Consider Yielding Up To 4.2%

As Asian markets navigate a landscape marked by cautious optimism and economic uncertainty, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In this context, selecting dividend stocks with strong fundamentals and consistent payout histories can be an attractive strategy for those looking to balance growth potential with income stability.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.35% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.15% | ★★★★★★ |

| NCD (TSE:4783) | 3.99% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.70% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.43% | ★★★★★★ |

Click here to see the full list of 1024 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Taiyo KagakuLtd (NSE:2902)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiyo Kagaku Co., Ltd. is engaged in the manufacturing and sale of functional food ingredients for various applications including food, beverage, supplements, and cosmetics both domestically in Japan and internationally, with a market capitalization of ¥41.87 billion.

Operations: Taiyo Kagaku Co., Ltd.'s revenue is primarily derived from its Nutrition Business at ¥16.22 billion, Interface Solution Business at ¥13.98 billion, and Natural Ingredient Business at ¥20.71 billion.

Dividend Yield: 3.3%

Taiyo Kagaku Ltd. offers a mixed dividend profile. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 32.6% and 22.4%, respectively, suggesting sustainability. However, the dividend yield of 3.35% is slightly below the top tier in Japan's market, and its track record shows volatility over the past decade despite overall growth in payments. The stock trades significantly below its estimated fair value, potentially offering good value for investors seeking dividends in Asia.

- Click to explore a detailed breakdown of our findings in Taiyo KagakuLtd's dividend report.

- Our valuation report here indicates Taiyo KagakuLtd may be undervalued.

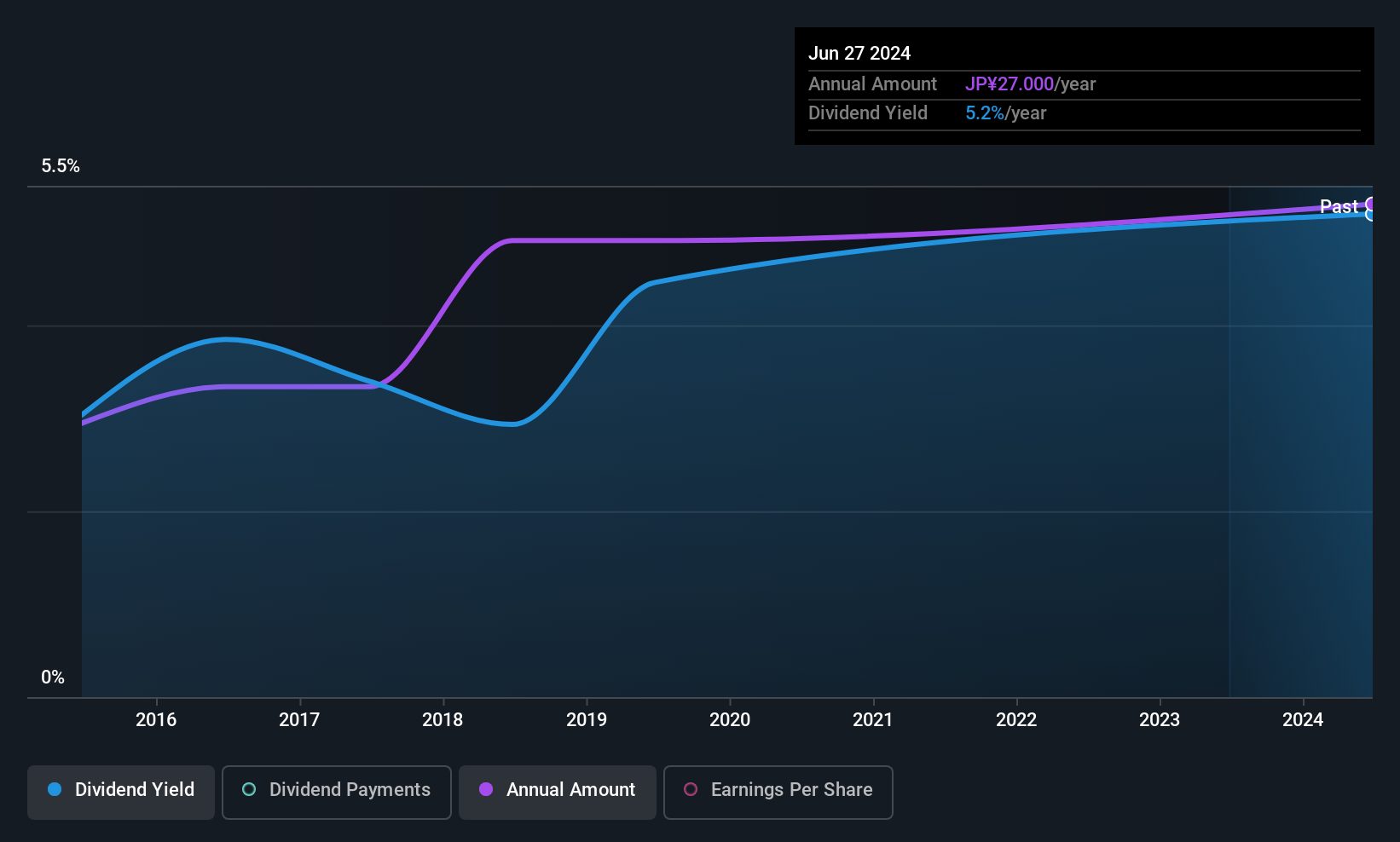

Guangzhou KDT Machinery Group (SZSE:002833)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guangzhou KDT Machinery Co., Ltd. focuses on the research, development, and manufacturing of CNC furniture equipment both in China and internationally, with a market cap of CN¥7.05 billion.

Operations: Guangzhou KDT Machinery Group generates revenue primarily from its Special-Purpose Equipment segment, totaling CN¥2.28 billion.

Dividend Yield: 4.2%

Guangzhou KDT Machinery Group's dividend profile shows potential with a yield in the top 25% of China's market and coverage by earnings and cash flows, indicated by payout ratios of 73.8% and 65.2%, respectively. Despite recent earnings decline, dividends have been affirmed for 2025, but the company's nine-year track record reveals volatility in payments. Trading at a favorable value compared to peers, its price-to-earnings ratio is notably below the market average.

- Get an in-depth perspective on Guangzhou KDT Machinery Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Guangzhou KDT Machinery Group shares in the market.

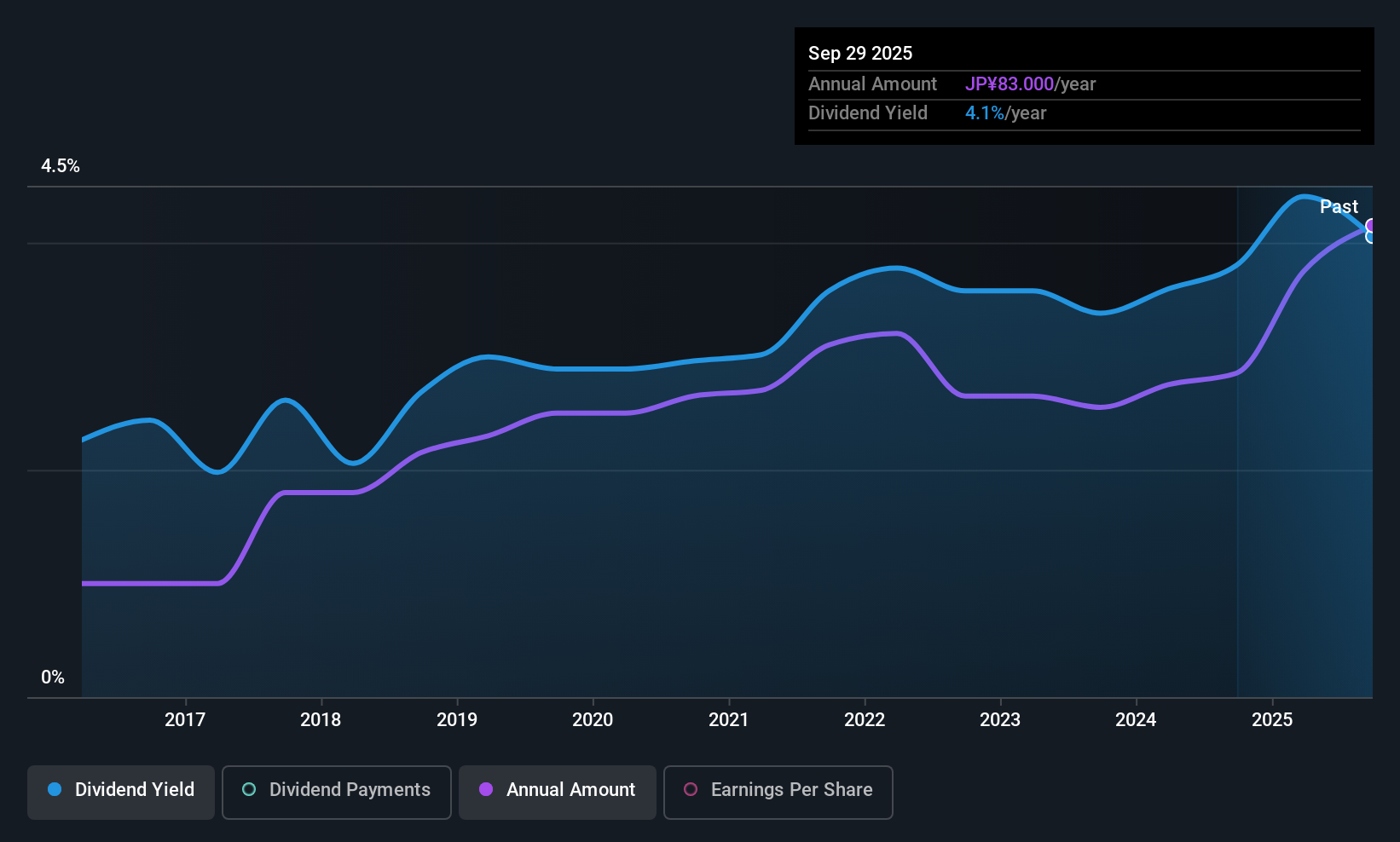

Global (TSE:3271)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Global Ltd., with a market cap of ¥26.13 billion, operates in Japan's real estate sector through its subsidiaries.

Operations: Global Ltd.'s revenue is primarily derived from its Income Property Business at ¥57.47 billion, followed by the Condominium Business (Excluding Hotel Business) at ¥1.09 billion, Sales Agency Business at ¥435.72 million, and Building Management Business at ¥529.20 million.

Dividend Yield: 3.6%

3271 offers an appealing dividend yield, ranking in the top 25% of Japan's market, with dividends well-covered by earnings and cash flows due to low payout ratios of 35.1% and 5%, respectively. Despite a history of volatility in dividend payments, recent growth in earnings suggests potential for stability. The stock trades significantly below its estimated fair value, presenting a potentially attractive opportunity for investors seeking undervalued dividend stocks in Asia.

- Unlock comprehensive insights into our analysis of Global stock in this dividend report.

- According our valuation report, there's an indication that Global's share price might be on the cheaper side.

Taking Advantage

- Access the full spectrum of 1024 Top Asian Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com