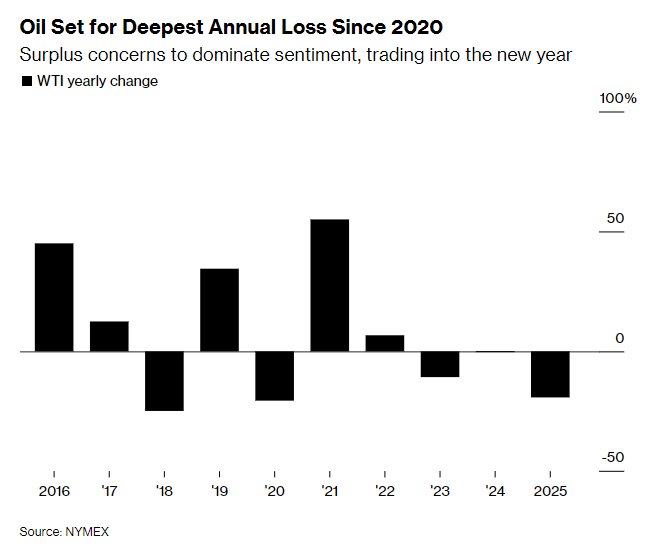

A sharp drop of nearly 20% during the year! International oil prices may hit the worst annual performance due to the pandemic, oversupply clouds loom over the New Year market

The Zhitong Finance App learned that due to continued market concerns about oversupply, international oil prices are heading towards the worst annual decline since the outbreak of the epidemic in 2020. This negative factor not only dominates current market sentiment, but will also suppress trading trends in the new year.

On Tuesday, the US WTI crude oil futures price fell below 58 US dollars per barrel. Not only did it fall for the fifth month in a row, but the decline during the year was close to 20%. The closing price of Brent crude oil futures for March delivery next year stood at $61 per barrel. Traders have focused their recent attention on the upcoming OPEC+ meeting, a negative US industry report, and a number of geopolitical tensions.

Since this year, OPEC+ and its rivals have continued to increase supply, compounded by a slowdown in the growth rate of global crude oil demand, which together led to a sharp drop in international oil prices. Mainstream agencies, including the International Energy Agency (IEA), predict that there will be a large-scale surplus in the crude oil market next year; even the OPEC Secretariat, which has always been optimistic, is expected to show a slight pattern of excess.

According to three OPEC+ representatives, the organization is scheduled to hold a video conference on January 4. Given the increasingly obvious signs of oversupply, member states are likely to maintain the established policy of suspending further production increases.

On the eve of the conference, the American Petroleum Institute (API) released data showing that U.S. crude oil inventories increased by 1.7 million barrels last week. If the data is officially confirmed later this Wednesday, this would be the biggest weekly increase since mid-November. At the same time, API data also showed that gasoline and distillate stocks were rising at the same time.

On the geopolitical front, the UAE announced that it would withdraw its troops from Yemen. Earlier, relations between the UAE and Saudi Arabia, an ally in the Gulf region, were strained for a while due to differences over military operations in the war-torn region of Yemen. Both Saudi Arabia and the United Arab Emirates are core members of OPEC.

Furthermore, traders are closely watching the US partial blockade measures against Venezuelan crude oil exports. US President Trump has revealed that the US side carried out a secret military attack on a drug-related facility. This move has also sparked speculation from the outside world about how much pressure the US government will take to put pressure on the Maduro regime.

Related efforts led by the United States to push for a Russian-Ukrainian cease-fire have also attracted much attention. Russian presidential press secretary Peskov stated on Tuesday that Russia will “toughly” adjust its negotiating position after the Russian presidential residence was allegedly attacked. Ukrainian President Zelensky refuted Russia's related accusations.

Market trading sentiment was lackluster this Wednesday, and most traders left the market for a vacation. Most financial markets around the world, including the crude oil market, will be closed this Thursday due to the New Year's Day holiday.