Unveiling Undiscovered Gems in the Middle East This December 2025

As geopolitical tensions between Saudi Arabia and the UAE over Yemen have led to a retreat in most Gulf markets, investors are closely watching for opportunities amidst the volatility. In this environment, identifying stocks with strong fundamentals and resilience to regional challenges can be crucial for those seeking undiscovered gems in the Middle East.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 31.20% | 44.24% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Thob Al Aseel (SASE:4012)

Simply Wall St Value Rating: ★★★★★★

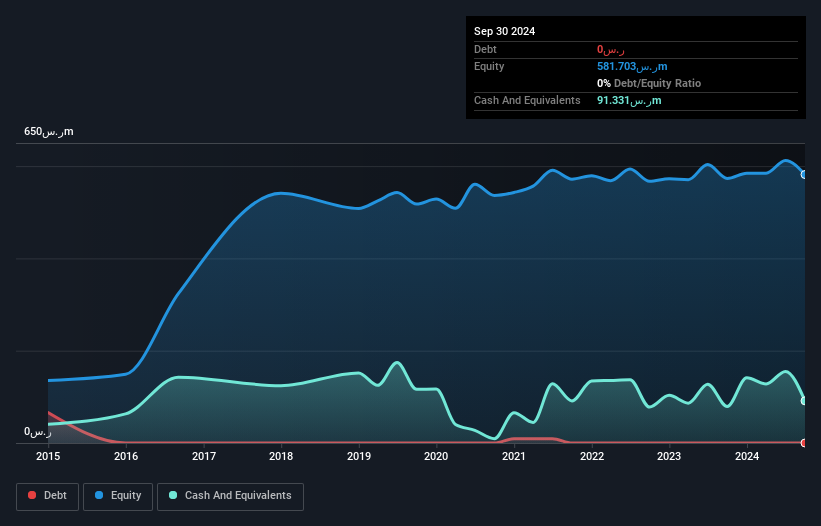

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market capitalization of SAR1.32 billion.

Operations: The company generates revenue primarily from two segments: Thobs, contributing SAR369.43 million, and Fabrics, adding SAR129.35 million. The net profit margin shows an interesting trend at 14%.

Thob Al Aseel, a dynamic player in the Middle East market, showcases impressive financial health with no debt and high-quality earnings. The company reported SAR 81 million in sales for Q3 2025, up from SAR 78.56 million last year, while net income rose to SAR 5.99 million from SAR 5.59 million. Over nine months, sales dipped slightly to SAR 393.84 million from SAR 406.16 million; however, net income improved to SAR 78.24 million compared to the previous year's SAR 72.31 million. Trading at a significant discount of about 86% below its estimated fair value suggests potential upside for investors seeking opportunities in this sector.

- Click here to discover the nuances of Thob Al Aseel with our detailed analytical health report.

Examine Thob Al Aseel's past performance report to understand how it has performed in the past.

Ashot Ashkelon Industries (TASE:ASHO)

Simply Wall St Value Rating: ★★★★★★

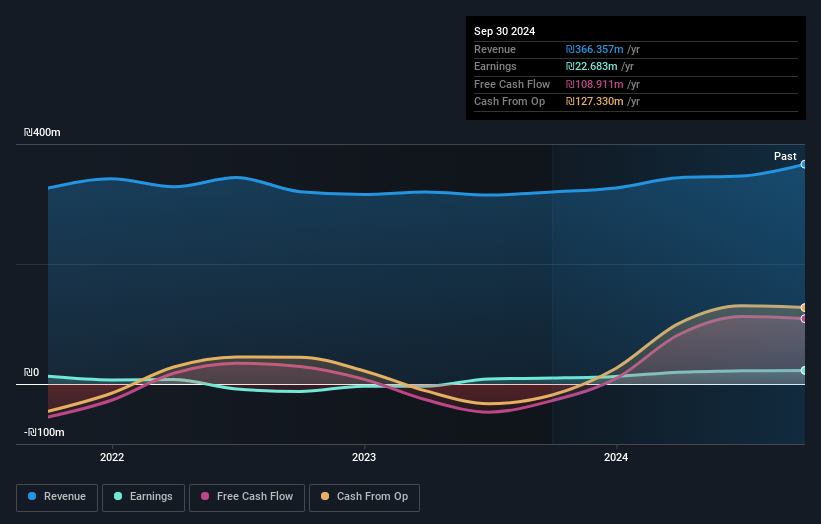

Overview: Ashot Ashkelon Industries Ltd. is engaged in the manufacturing and sale of systems and components for aerospace and defense sectors both in Israel and internationally, with a market capitalization of ₪1.92 billion.

Operations: Ashot Ashkelon Industries generates revenue primarily from its military segment, contributing ₪345.51 million, and its aviation and complex assemblies segment, contributing ₪92.83 million. The reliance gear segment adds another ₪48.14 million to the revenue stream.

Ashot Ashkelon Industries, a player in the Aerospace & Defense sector, has shown promising financial health with its debt to equity ratio dropping from 25% to 10.6% over five years. This reduction indicates solid financial management alongside a net debt to equity ratio of 6%, deemed satisfactory. The company's earnings surged by 62.9% this past year, outpacing industry growth of 58.2%. Recent results highlight sales reaching ILS 105 million for Q3 and net income climbing to ILS 15.82 million, showcasing robust performance and high-quality earnings with EBIT covering interest payments at an impressive rate of 7.4 times.

Gad-Dairies (Marketing 1992) (TASE:GAD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gad-Dairies (Marketing 1992) Ltd. is involved in the production of packaged food with a focus on dairy products and has a market capitalization of ₪1.20 billion.

Operations: Gad-Dairies generates revenue primarily from the retail sector, contributing ₪403.73 million, and the professional field, adding ₪285.74 million.

Gad-Dairies, a notable player in Israel's premium dairy sector, has demonstrated impressive earnings growth of 53% over the past year, outpacing the broader food industry. Despite its high net debt to equity ratio of 84.8%, the company comfortably covers interest payments with an EBIT coverage of 27 times. Gad-Dairies recently launched "The New Milk" in collaboration with Remilk, introducing innovative animal-free milk products that promise authentic taste and nutritional value. This venture aligns with consumer demand for quality and sustainability while potentially expanding market reach as it rolls out across cafes and supermarkets.

Turning Ideas Into Actions

- Navigate through the entire inventory of 179 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com