High Growth Tech Stocks In Asia For December 2025

The Asian tech market has been buoyed by a surge in optimism around artificial intelligence, mirroring trends seen globally where major indices like the S&P 500 and Nasdaq Composite have reached record highs. In this environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and innovation while navigating broader economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 36.73% | 37.89% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Fositek | 37.16% | 51.58% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Samsung Electronics (KOSE:A005930)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samsung Electronics Co., Ltd. operates globally in consumer electronics, IT and mobile communications, and device solutions, with a market cap of ₩785.26 trillion.

Operations: Samsung Electronics generates revenue primarily from its Device Experience (DX) and Device Solutions (DS) segments, contributing ₩184.19 trillion and ₩116.22 trillion respectively. The company also includes SDC and Harman as part of its revenue streams, with contributions of ₩28.47 billion and ₩15.13 billion respectively.

Samsung Electronics, with its forecasted annual revenue growth of 11.8% and earnings surge of 38.9%, remains a compelling narrative in Asia's high-growth tech landscape. The company's strategic emphasis on R&D is evidenced by its significant allocation towards innovation, ensuring it stays at the forefront of technological advancements. Recent product launches, including the expanded Micro RGB TV lineup and AI-enhanced home appliances at CES 2026, underscore Samsung’s commitment to integrating cutting-edge technology into consumer products. These initiatives not only enhance user experience but also solidify Samsung's position in competitive tech markets, despite facing challenges like a recent $191.4 million patent infringement verdict which highlights the volatile nature of tech innovation and intellectual property disputes.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Growth Rating: ★★★★★☆

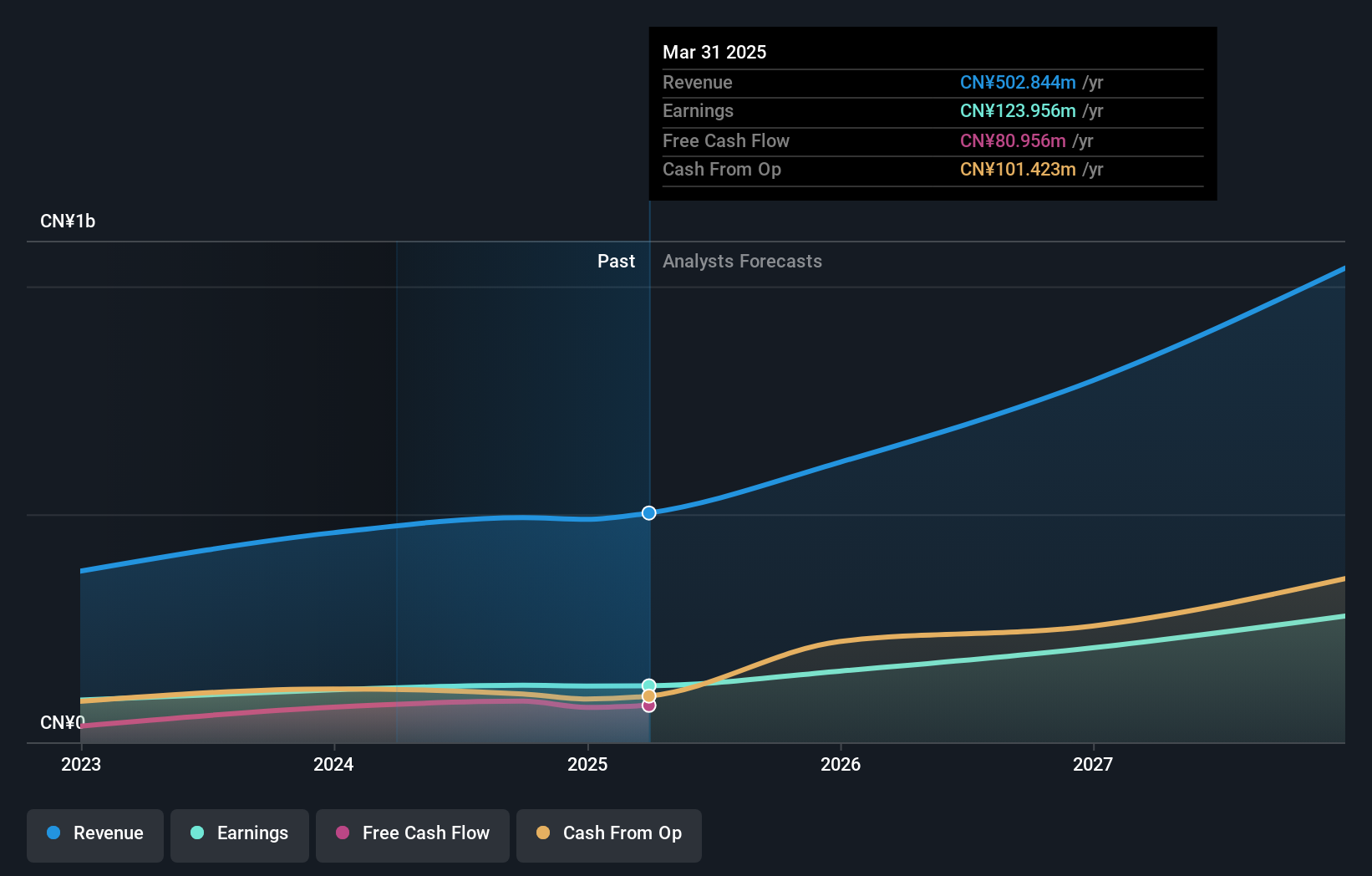

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. specializes in agricultural technology solutions and has a market capitalization of CN¥8.20 billion.

Operations: Zhejiang Top Cloud-agri Technology Co., Ltd. focuses on agricultural technology solutions, contributing to its market presence with a significant capitalization of CN¥8.20 billion.

Zhejiang Top Cloud-agri Technology Co.,Ltd. is carving a niche in Asia's tech scene with its robust revenue growth of 27.9% annually, outpacing the Chinese market average of 14.6%. This growth is complemented by an impressive earnings increase of 29.7% per year, signaling strong operational efficiency and market demand. The company's commitment to innovation is underscored by significant R&D investments, which have led to recent advancements in agricultural technology that enhance productivity and sustainability for its clients. Despite challenges such as a slight dip in EPS from CNY 1.2 to CNY 1.07 this year, the firm’s strategic focus on high-tech farming solutions positions it well for future growth amidst evolving industry dynamics.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

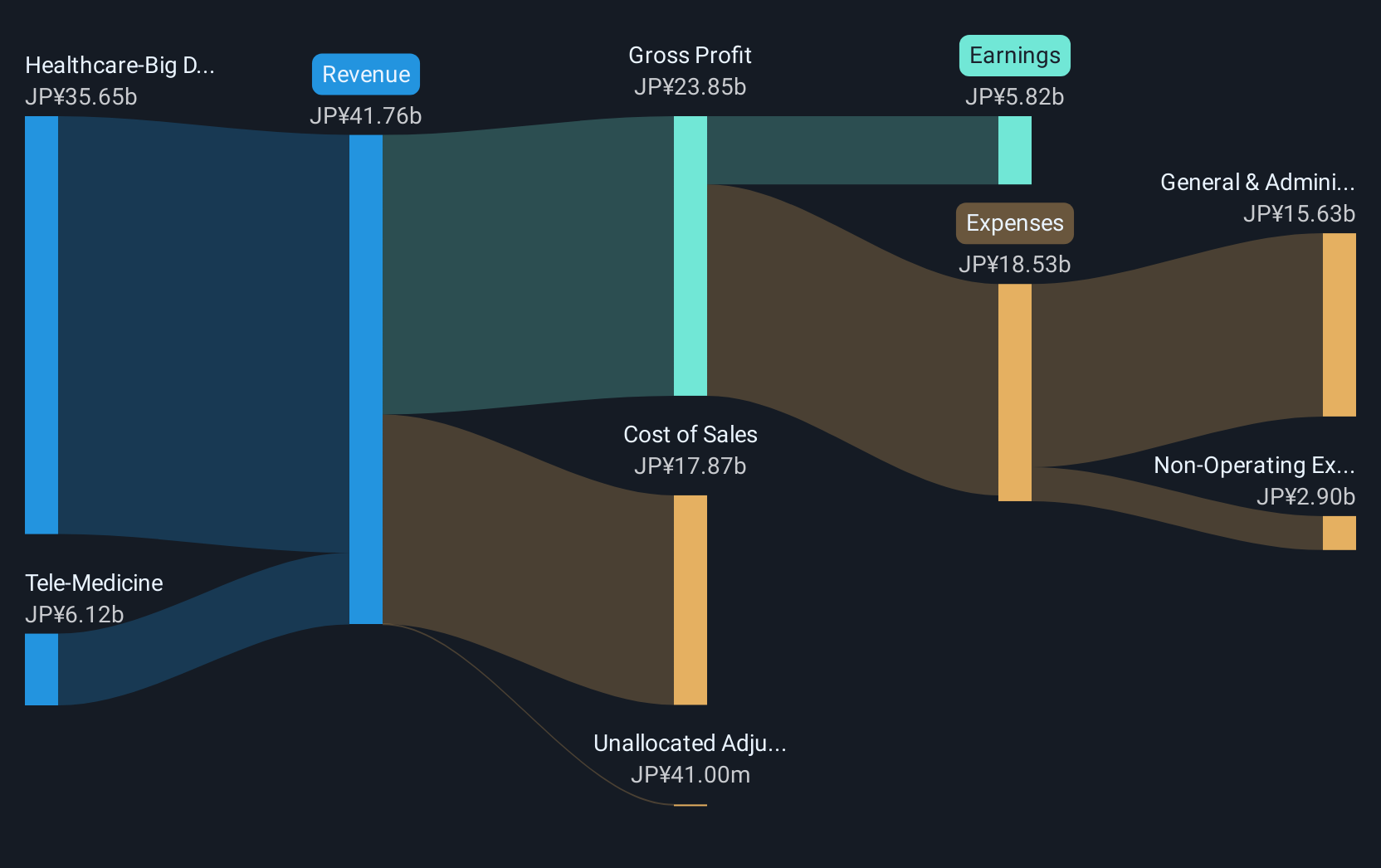

Overview: JMDC Inc. offers medical statistics data services in Japan and has a market cap of ¥260.68 billion.

Operations: The company generates revenue primarily through its Healthcare-Big Data segment, contributing ¥40.03 billion, and Tele-Medicine services, which add ¥6.25 billion.

JMDC stands out in Asia's high-growth tech landscape with a notable annual revenue increase of 15.4%, surpassing Japan's average of 4.6%. This performance is bolstered by an earnings surge of 21.6% per year, reflecting robust operational strengths and market receptivity. The firm has channeled substantial funds into R&D, totaling 12% of its revenue, fostering innovations that promise to keep it competitive in evolving tech sectors. Despite a volatile share price recently, JMDC's strategic investments and solid growth metrics position it favorably for future trends and demands in the technology domain.

Summing It All Up

- Unlock our comprehensive list of 185 Asian High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com