European Growth Stocks With Strong Insider Ownership

As the pan-European STOXX Europe 600 Index edges closer to record highs, buoyed by optimism about future economic conditions, investors are increasingly focused on identifying growth opportunities within the region. In this climate, companies with high insider ownership can be particularly appealing, as they often signal strong alignment between management and shareholder interests—an important consideration in a market characterized by cautious optimism.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Trifork Group (CPSE:TRIFOR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trifork Group AG is an information technology and business services provider operating in Switzerland, Denmark, the United Kingdom, the Netherlands, the United States, and internationally with a market cap of DKK1.76 billion.

Operations: The company's revenue segments include Trifork - Run at €66.35 million, Trifork - Build at €144.97 million, and Trifork - Inspire at €6.66 million.

Insider Ownership: 19.7%

Earnings Growth Forecast: 21.5% p.a.

Trifork Group, a growth-oriented company in Europe with high insider ownership, recently announced a share buyback program valued at DKK 14.94 million to meet employee stock obligations and possibly reduce share capital. The company is engaged in strategic partnerships, such as with Loft Dynamics for innovative pilot training solutions and Replik A/S to enhance legal services through AI. Despite recent earnings challenges, Trifork's forecasted annual profit growth of 21.5% surpasses the Danish market average.

- Click to explore a detailed breakdown of our findings in Trifork Group's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Trifork Group shares in the market.

Altri SGPS (ENXTLS:ALTR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Altri SGPS is a company that produces and sells cellulosic fibers both in Portugal and internationally, with a market cap of €913.86 million.

Operations: The company's revenue from the production and commercialization of cellulosic fibers amounts to €692 million.

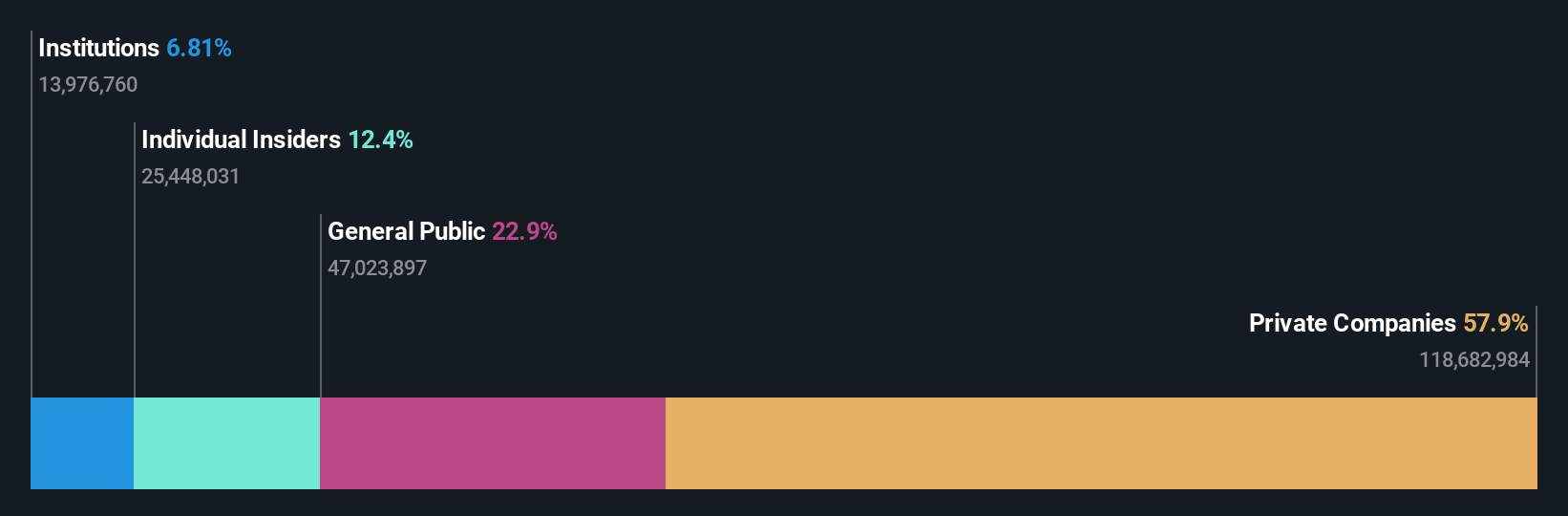

Insider Ownership: 12.4%

Earnings Growth Forecast: 34.4% p.a.

Altri SGPS, with significant insider ownership, faces mixed prospects. Recent earnings showed a net loss of €1.66 million for Q3 2025 and a decline in profit margins to 4.3%. However, its annual earnings growth is expected to be strong at 34.4%, surpassing the Portuguese market average. Despite revenue growth forecasted at only 4.7% per year and interest payments not well covered by earnings, analysts agree on a potential stock price increase of 25%.

- Click here and access our complete growth analysis report to understand the dynamics of Altri SGPS.

- In light of our recent valuation report, it seems possible that Altri SGPS is trading beyond its estimated value.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VusionGroup S.A. provides digitalization solutions for commerce across Europe, Asia, and North America and has a market cap of €3.42 billion.

Operations: The company generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €1.16 billion.

Insider Ownership: 12.8%

Earnings Growth Forecast: 58.3% p.a.

VusionGroup, with high insider ownership, is poised for growth as it expands its digital solutions across Europe. The company recently secured a €200 million revolving credit facility to enhance financial flexibility and sustainability initiatives. Strategic partnerships with OBI Germany and DM highlight VusionGroup's technological prowess in retail innovation, while collaborations with Morrisons and Asda underscore its expanding market presence. Analysts predict profitability within three years, supported by robust revenue forecasts exceeding the French market average.

- Delve into the full analysis future growth report here for a deeper understanding of VusionGroup.

- Our valuation report here indicates VusionGroup may be overvalued.

Key Takeaways

- Click through to start exploring the rest of the 207 Fast Growing European Companies With High Insider Ownership now.

- Looking For Alternative Opportunities? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com