3 Dividend Stocks In Global With Up To 5.9% Yield For Your Portfolio

As global markets experience positive momentum, with U.S. indices reaching record highs and European stocks nearing peak levels, investors are keenly observing the economic indicators that continue to shape market sentiment. Amidst this backdrop of optimism fueled by robust U.S. GDP growth and AI advancements, dividend stocks offer a compelling opportunity for those seeking income stability in their portfolios. In such an environment, selecting dividend stocks with strong fundamentals and consistent payout histories can provide a reliable income stream while potentially benefiting from broader market trends.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.52% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.42% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.15% | ★★★★★★ |

| NCD (TSE:4783) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.43% | ★★★★★★ |

Click here to see the full list of 1290 stocks from our Top Global Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

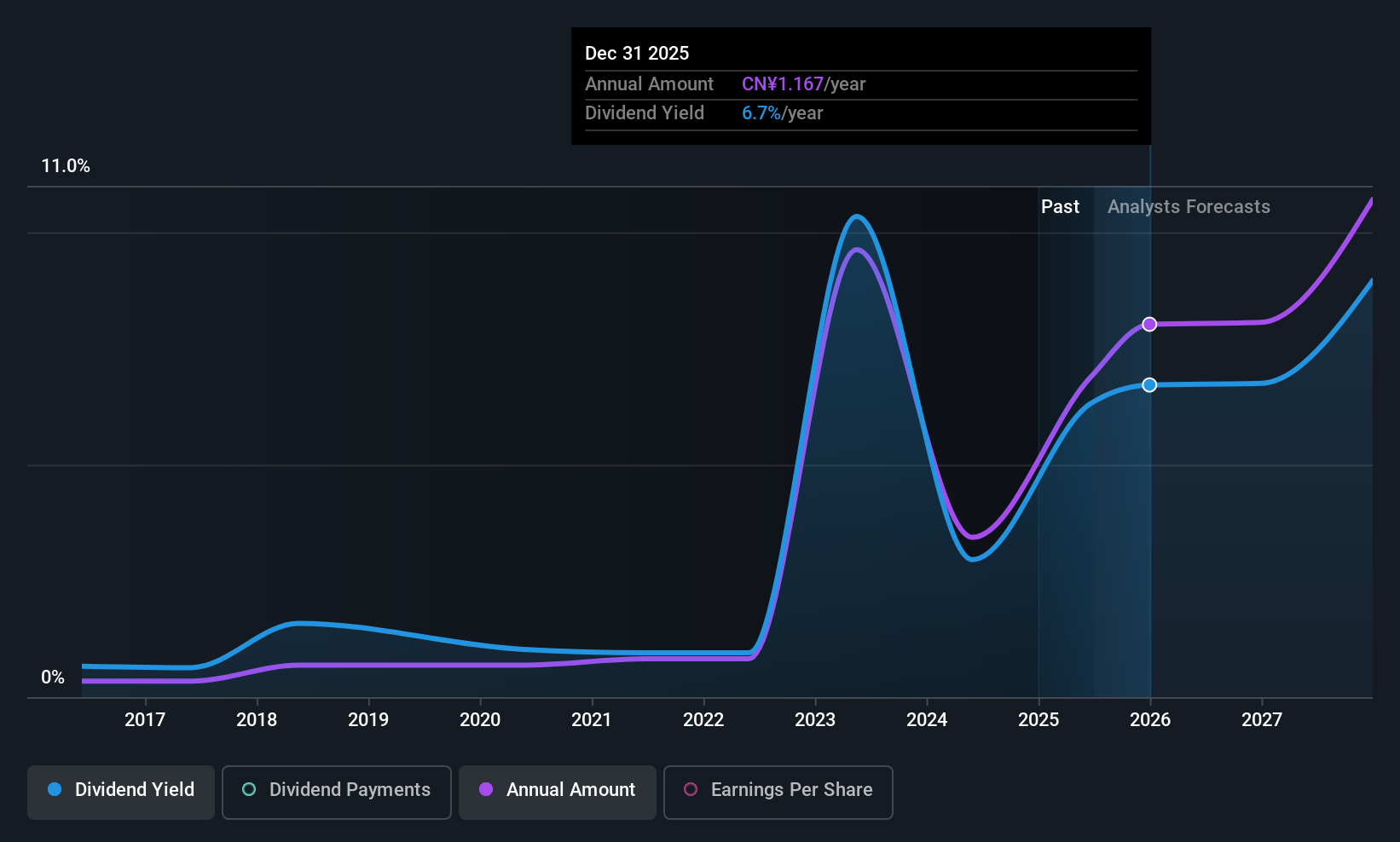

Western MiningLtd (SHSE:601168)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Western Mining Co., Ltd., with a market cap of CN¥64.22 billion, operates in the mining, smelting, and trading of metals both in Mainland China and internationally through its subsidiaries.

Operations: Western Mining Co., Ltd. generates its revenue through the mining, smelting, and trading of metals both domestically and internationally.

Dividend Yield: 3.6%

Western Mining Ltd. offers a dividend yield in the top 25% of the Chinese market, supported by a payout ratio of 75.8% and a cash payout ratio of 42.7%, indicating dividends are well covered by earnings and cash flows. While trading at good value compared to peers, its dividend history is volatile with past drops over 20%. Despite increasing dividends over ten years, high debt levels may affect future sustainability. Recent earnings show improved sales and net income growth.

- Get an in-depth perspective on Western MiningLtd's performance by reading our dividend report here.

- Our valuation report here indicates Western MiningLtd may be undervalued.

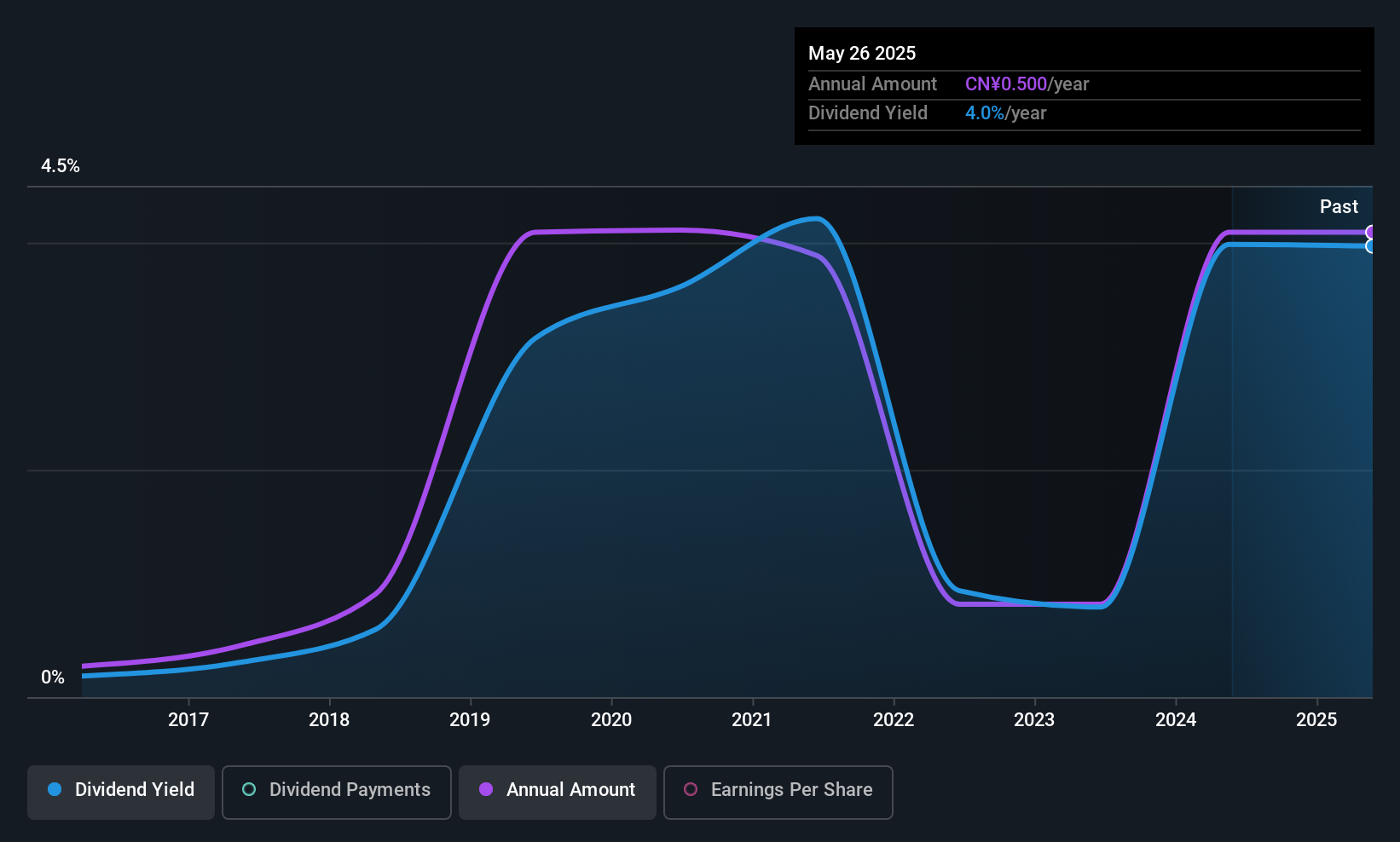

Goldcard Smart Group (SZSE:300349)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goldcard Smart Group Co., Ltd. manufactures and sells digital energy products and solutions both in China and internationally, with a market cap of CN¥5.98 billion.

Operations: Goldcard Smart Group Co., Ltd. generates revenue through its digital energy products and solutions business, serving both domestic and international markets.

Dividend Yield: 3.2%

Goldcard Smart Group's dividend yield of 3.2% ranks in the top 25% of the Chinese market, but its sustainability is questionable due to a high cash payout ratio of 188%, indicating dividends are not well covered by cash flows. The company trades at good value with a P/E ratio below the market average, yet profit margins have declined from last year. Despite dividend growth over ten years, payments have been volatile and unreliable. Recent earnings show increased sales but decreased net income.

- Delve into the full analysis dividend report here for a deeper understanding of Goldcard Smart Group.

- In light of our recent valuation report, it seems possible that Goldcard Smart Group is trading behind its estimated value.

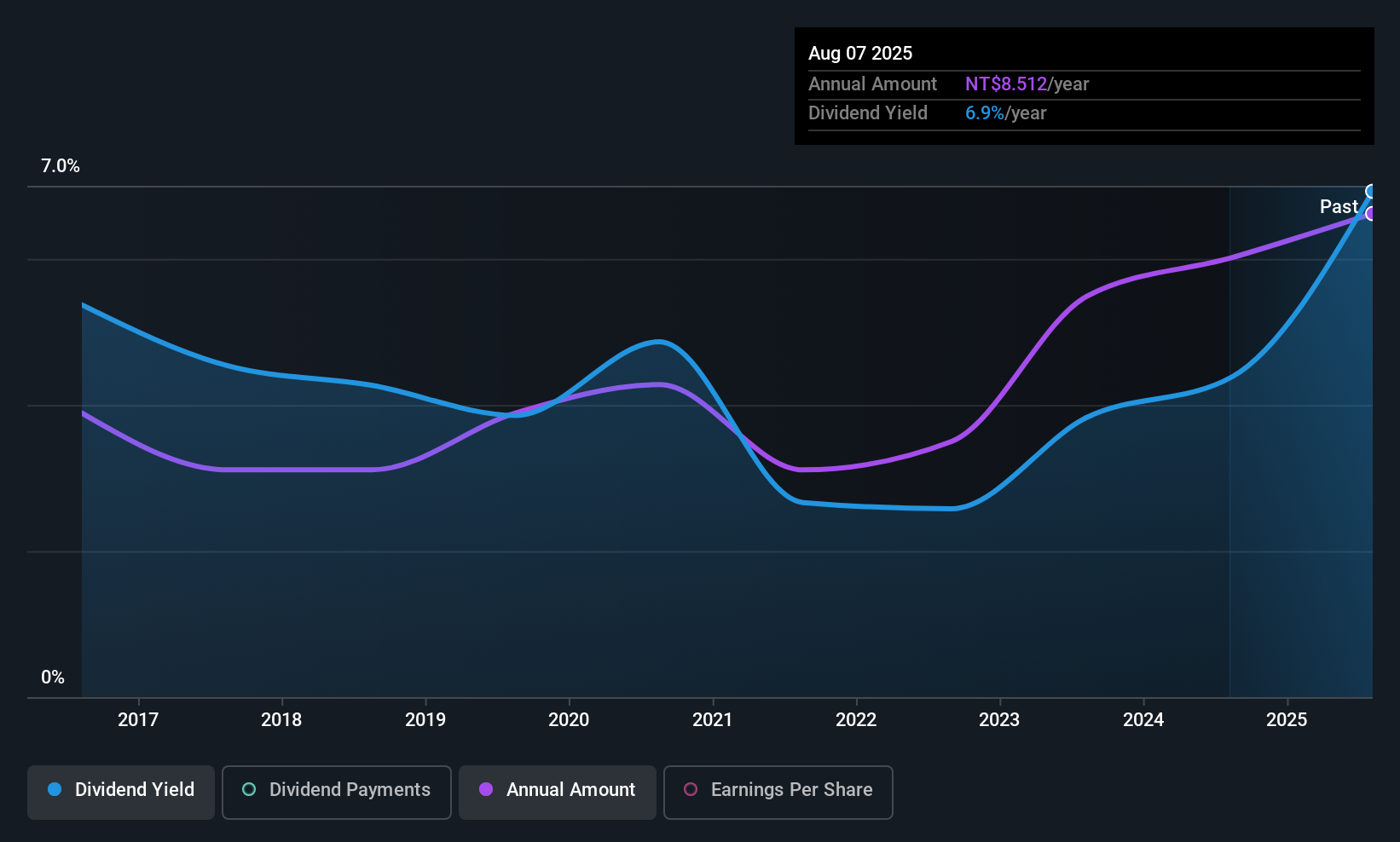

Eurocharm Holdings (TWSE:5288)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eurocharm Holdings Co., Ltd. operates in the manufacturing and sale of motorcycle and auto equipment parts, medical equipment, and machine parts across Taiwan, Vietnam, the United States, and internationally with a market cap of NT$9.13 billion.

Operations: Eurocharm Holdings Co., Ltd. generates revenue of NT$6.87 billion from its operations in manufacturing and selling automobile and motorcycle parts, as well as medical equipment.

Dividend Yield: 6%

Eurocharm Holdings' dividend yield is among the top 25% in Taiwan, supported by a payout ratio of 57.4% and cash payout ratio of 58.2%, indicating dividends are well-covered by earnings and cash flows. Despite trading at a significant discount to estimated fair value, its dividend history is marred by volatility and unreliability over the past decade. Recent earnings show decreased sales but improved net income, suggesting potential for future stability in payouts if trends continue positively.

- Dive into the specifics of Eurocharm Holdings here with our thorough dividend report.

- Our valuation report unveils the possibility Eurocharm Holdings' shares may be trading at a discount.

Summing It All Up

- Take a closer look at our Top Global Dividend Stocks list of 1290 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com