3 European Stocks Estimated To Be Up To 49.5% Below Intrinsic Value

As the pan-European STOXX Europe 600 Index edges closer to record highs amid positive sentiment about future earnings and economic prospects, investors are increasingly focused on identifying opportunities within the market. In this environment, finding stocks that are trading below their intrinsic value can present potential for growth, making them attractive considerations for those looking to capitalize on perceived undervaluations.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.122 | €6.09 | 48.7% |

| Unimot (WSE:UNT) | PLN130.00 | PLN257.36 | 49.5% |

| Streamwide (ENXTPA:ALSTW) | €73.20 | €142.58 | 48.7% |

| Sanoma Oyj (HLSE:SANOMA) | €9.50 | €18.45 | 48.5% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.90 | NOK66.21 | 48.8% |

| KB Components (OM:KBC) | SEK41.90 | SEK83.05 | 49.5% |

| Hemnet Group (OM:HEM) | SEK173.20 | SEK337.49 | 48.7% |

| Dynavox Group (OM:DYVOX) | SEK102.00 | SEK202.98 | 49.7% |

| Allegro.eu (WSE:ALE) | PLN31.02 | PLN60.13 | 48.4% |

| Allcore (BIT:CORE) | €1.35 | €2.67 | 49.4% |

Underneath we present a selection of stocks filtered out by our screen.

KB Components (OM:KBC)

Overview: KB Components AB (publ) is a company that designs, develops, manufactures, and sells polymer components for various sectors including automotive, medical, and industrial applications in Sweden and internationally with a market cap of SEK2.35 billion.

Operations: The company generates revenue from several regions, with SEK144.72 million from Asia, SEK1.28 billion from Europe, and SEK1.49 billion from North America.

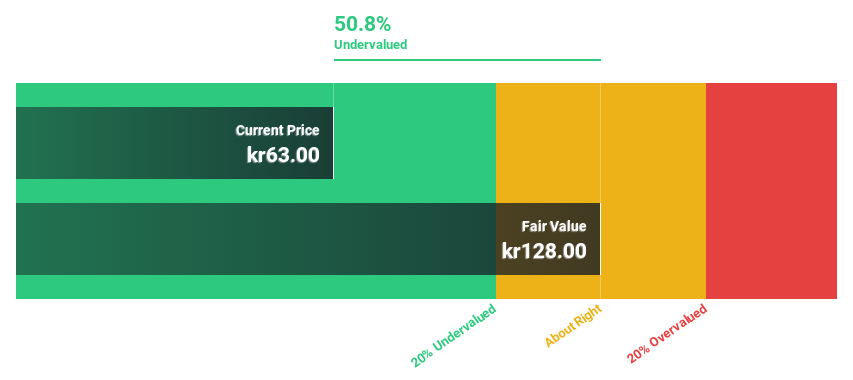

Estimated Discount To Fair Value: 49.5%

KB Components is trading at SEK41.9, significantly below its estimated fair value of SEK83.05, suggesting it may be undervalued based on cash flows. Despite a volatile share price and high debt levels, earnings are forecast to grow by 25.85% annually, outpacing the Swedish market's growth rate of 13.7%. Recent earnings reports show stable revenue growth but a decline in quarterly net income from SEK33.79 million to SEK15.32 million year-on-year.

- The growth report we've compiled suggests that KB Components' future prospects could be on the up.

- Dive into the specifics of KB Components here with our thorough financial health report.

ALSO Holding (SWX:ALSN)

Overview: ALSO Holding AG is a technology services provider for the ICT industry, operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF2.63 billion.

Operations: The company's revenue is primarily derived from its Central Europe segment, which generated €6.16 billion, and its Northern/Eastern Europe segment, which contributed €5.46 billion.

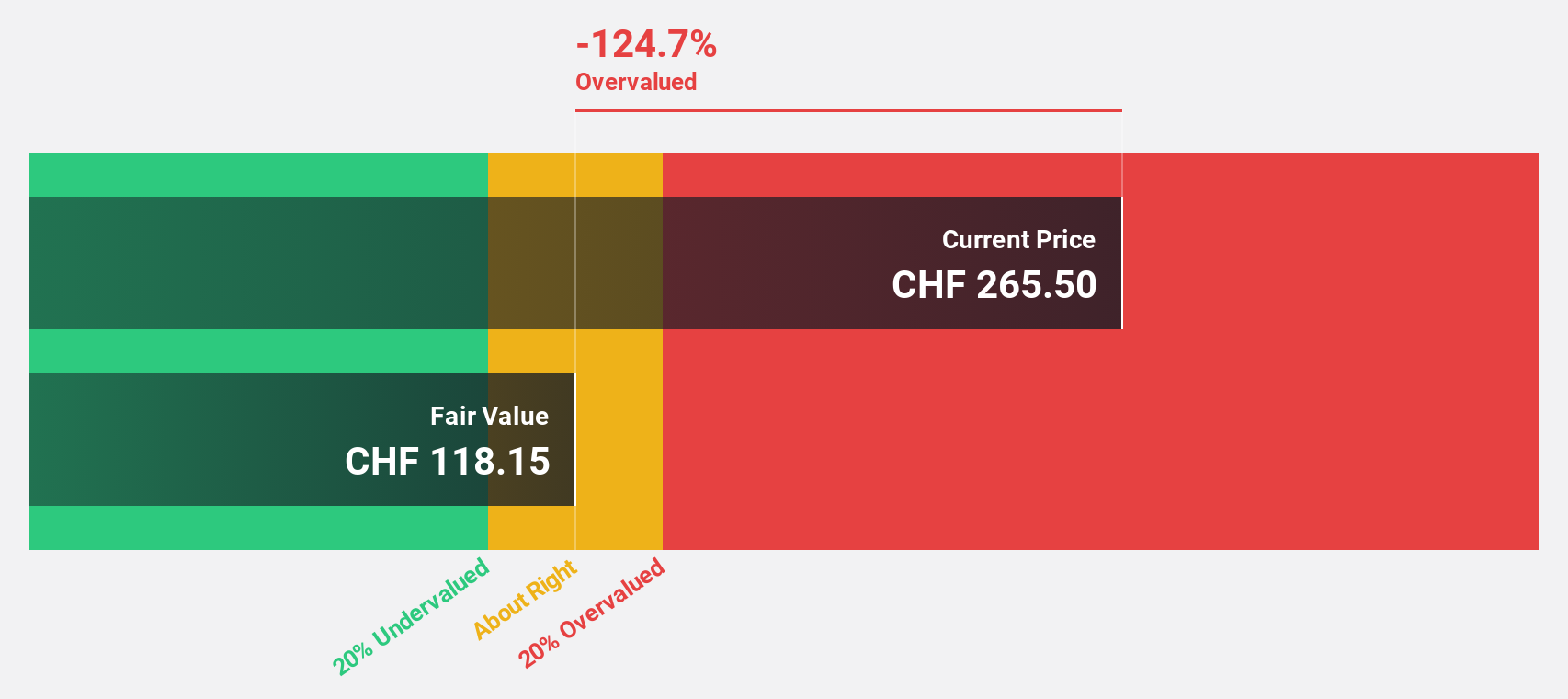

Estimated Discount To Fair Value: 39.1%

ALSO Holding is trading at CHF215, considerably below its estimated fair value of CHF353.02, highlighting potential undervaluation based on cash flows. Despite a dividend yield of 2.29% not fully covered by free cash flows, earnings are projected to grow by 23.68% annually over the next three years, outpacing the Swiss market's growth rate of 10.6%. Recent management restructuring aims to enhance efficiency and responsiveness through strategic focus on AI and digital platforms.

- According our earnings growth report, there's an indication that ALSO Holding might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of ALSO Holding.

Avolta (SWX:AVOL)

Overview: Avolta AG operates as a travel retailer company with a market cap of CHF6.84 billion.

Operations: The company's revenue comes from several regions: CHF4.21 billion from North America, CHF725 million from Asia Pacific (APAC), CHF1.61 billion from Latin America (LATAM), and CHF7.35 billion from Europe, Middle East, and Africa (EMEA).

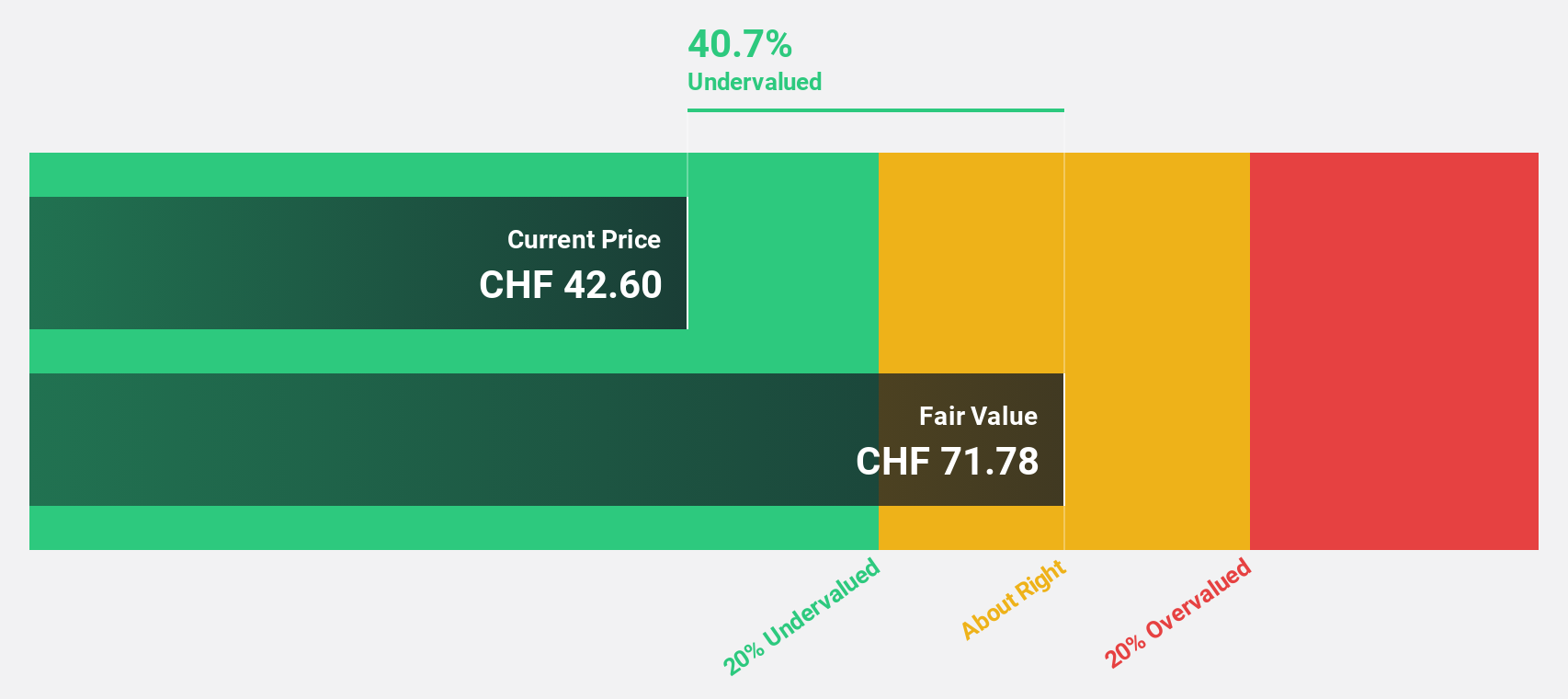

Estimated Discount To Fair Value: 13.7%

Avolta, trading at CHF47.14, is below its fair value of CHF54.64, suggesting undervaluation based on cash flows. Earnings are expected to grow significantly at 20.92% annually over the next three years, outpacing the Swiss market's growth rate of 10.6%. However, interest payments are not well covered by earnings and the dividend yield of 2.12% lacks coverage by earnings. Recent expansions include strategic wins in Shanghai and Washington Dulles airports, enhancing global presence and growth potential.

- Our expertly prepared growth report on Avolta implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Avolta's balance sheet by reading our health report here.

Seize The Opportunity

- Reveal the 191 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com