Little Excitement Around S.N. Nuclearelectrica S.A.'s (BVB:SNN) Earnings

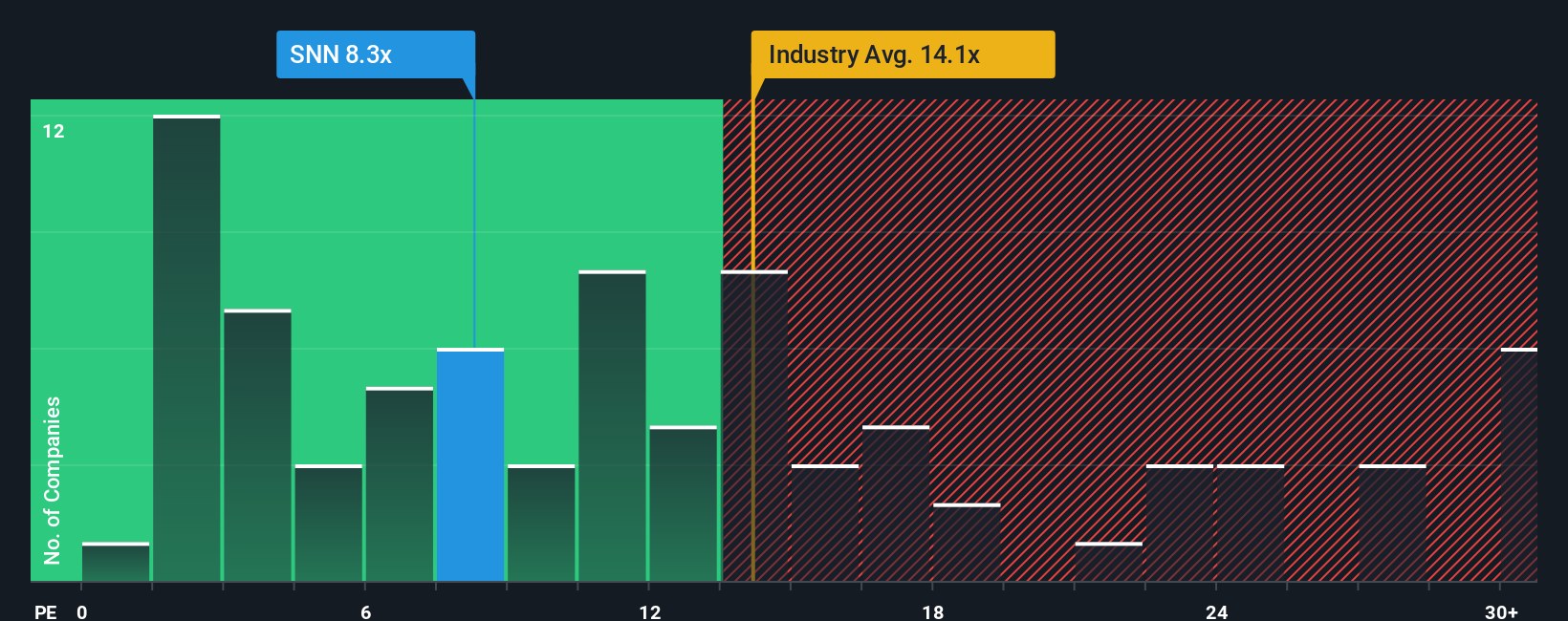

S.N. Nuclearelectrica S.A.'s (BVB:SNN) price-to-earnings (or "P/E") ratio of 8.3x might make it look like a buy right now compared to the market in Romania, where around half of the companies have P/E ratios above 16x and even P/E's above 39x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, S.N. Nuclearelectrica has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for S.N. Nuclearelectrica

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like S.N. Nuclearelectrica's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 7.3%. Still, lamentably EPS has fallen 14% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 54% per year over the next three years. Meanwhile, the broader market is forecast to expand by 8.3% per year, which paints a poor picture.

With this information, we are not surprised that S.N. Nuclearelectrica is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On S.N. Nuclearelectrica's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that S.N. Nuclearelectrica maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with S.N. Nuclearelectrica (at least 1 which is concerning), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.