US stock outlook | Futures of the three major stock indexes fell sharply, precious metals fell across the board and the market was closed for one day on January 1

Pre-market market trends

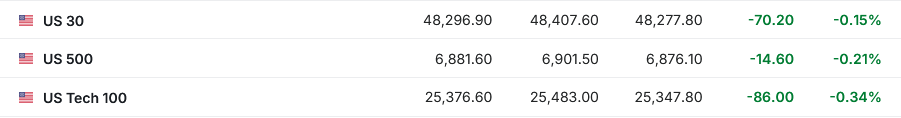

1. On December 31 (Wednesday), the futures of the three major US stock indexes fell sharply before the US stock market. As of press release, Dow futures were down 0.15%, S&P 500 futures were down 0.21%, and NASDAQ futures were down 0.34%.

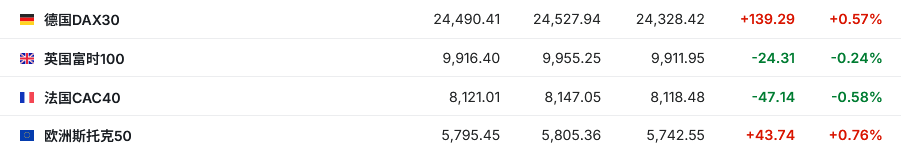

2. As of press release, the German DAX index rose 0.57%, the UK FTSE 100 index fell 0.24%, the French CAC40 index fell 0.58%, and the European Stoxx 50 index rose 0.76%.

3. As of press release, WTI crude oil rose 0.29% to $58.12 per barrel. Brent crude rose 0.24% to $61.48 per barrel.

Market news

Precious metals declined across the board. As of press release, gold futures fell 1.5% to 4320.7 US dollars/ounce; spot gold fell 0.70% to US $4308.6 per ounce. Silver futures fell more than 8% to 71.35 US dollars/ounce; spot silver fell nearly 6% to 71.75 US dollars/ounce. Platinum futures fell nearly 10% to $2031.2 per ounce; platinum spot fell nearly 8% to 2008.9 US dollars/ounce. Palladium futures fell more than 6% to $1613.3 per ounce; palladium spot fell nearly 3% to $1579.3 per ounce. Regarding the future of the precious metals market, UBS warned that the current rapid rise in precious metals prices is due in large part to insufficient market liquidity — which means a rapid decline is likely. Kaitou's macro analyst said, “Precious metal prices have risen to a level that we think is difficult to explain with fundamentals.”

“I'm afraid others are greedy”? At a time when Wall Street was bullish, experts bucked the trend and warned that US stocks would pull back by more than 10%. Professional investor Dividend Seeker expects large US stocks, especially the S&P 500 index, to recover 10% or more in early or mid-2026 — the general bullishness of the market and the overvaluation of the S&P 500 index compared to other global indices all support its cautious attitude towards the US stock market. However, the analyst believes that the potential weakness in the US stock market is a good buying opportunity and is adjusting its investment portfolio accordingly. Furthermore, to deal with this correction, the analyst is inclined to invest in UK and European stocks, gold, and bonds.

The boom period for US stocks continues! Citi optimistically predicts that technology stocks will lead next year and the backward sector will follow suit. Scott Cronett, head of US stock strategy at Citigroup, believes that the market is currently in a “boom period” rather than a “bubble period.” Looking ahead to the new year, he remains optimistic about the market outlook based on strong profit expectations and upcoming industry sector proliferation trends. Despite admitting that investors may be paying early premiums for next year's fundamentals, Cronet stressed that the overall market environment is still showing a “very constructive” positive trend. Citi's profit forecast is in the high range that sellers agree to expect, and its model predicts that corporate profits will grow by 3.2% in the coming year. The core driver of this optimistic forecast is the continued overperformance of large technology stocks. The second driver is that the rally is expected to spread to other sectors that have recently lagged behind.

A sharp drop of nearly 20% during the year! International oil prices may have the worst annual performance since the pandemic, and clouds of oversupply loom over the New Year market. Driven by continued market concerns about oversupply, international oil prices are heading towards the worst annual decline since the outbreak of the epidemic in 2020. This negative factor not only dominates current market sentiment, but will also suppress trading trends in the new year. Since this year, OPEC+ and its rivals have continued to increase supply, compounded by a slowdown in the growth rate of global crude oil demand, which together led to a sharp drop in international oil prices. Mainstream agencies, including the International Energy Agency (IEA), predict that there will be a large-scale surplus in the crude oil market next year; even the OPEC Secretariat, which has always been optimistic, is expected to show a slight pattern of excess.

Due to the New Year's Day holiday, the US stock market will be closed for one day on January 1st. Affected by the New Year's Day holiday, the US stock market will be closed for one day on January 1 (Thursday), local time, and US stocks will resume trading on January 2 (Friday).

Individual stock news

Chinese tech giants are rumored to have swept away over 2 million H200 chips, and Nvidia (NVDA.US) asked TSM.US to urgently expand production. According to some sources, Nvidia is working to meet the strong demand from Chinese technology companies for its H200 artificial intelligence chip, and has reached out to the foundry TSMC to increase production. Two of these sources said that Chinese technology companies have ordered more than 2 million H200 chips for 2026, while Nvidia's current inventory is only 700,000. They said the exact amount Nvidia plans to order more from TSMC is unclear. A third source said that Nvidia has asked TSMC to begin production of additional chips, and production is expected to begin in the second quarter of 2026.

Retreat or hibernate? After criticizing Tesla (TSLA.US) for being overvalued, the “big short” denied shorting. Michael Berry, the prototype for the movie “The Big Short,” denied shorting Tesla's stock, even though he had earlier this month called the company “ridiculously overvalued.” In response to a user asking if he would short Tesla on social networking platform X, Bury said, “I'm not shorting (Tesla).” According to reports, Bury pointed the finger at Tesla at the end of November and claimed in his column that Tesla's market value was “ridiculously overvalued,” and that this situation has been going on for quite some time. Burry not only clearly questioned Tesla's valuation, but also believed there was a problem with the company's shareholding structure and business strategy. He pointed out that if Musk's previous proposed $1 trillion compensation plan is implemented, it will further dilute Tesla's existing shareholders' equity and weaken the earnings value per share.

The Hollywood Century takeover is in a tug-of-war! Warner Bros. (WBD.US) plans to once again reject Paramount's (PSKY.US) latest plan. According to people familiar with the matter, Warner Bros. plans to once again reject Paramount's revised takeover offer. Warner Bros. had previously rejected Paramount's offer, arguing that it was inferior to the plan proposed by streaming giant Netflix (NFLX.US). People familiar with the matter said that the Warner Bros. board of directors is still unmoved and is waiting for Paramount to increase the financial terms in its offer. A number of shareholders said they expected more funding from Paramount. The board is also concerned that the deal with Paramount will cause Warner Brothers to be unable to manage their debts without the approval of Ellison's father and son, and that Paramount has yet to guarantee that it will bear the cancellation fee that Warner Brothers must pay to Netflix.

Being in deep trouble is a bargaining chip! Boeing (BA.US) may become the Trump administration's next target for “strategic shareholding.” Since this year, the Trump administration has reached a series of deals to invest in companies critical to national security and the supply chain. This “strategic industry share acquisition” plan is expected to continue in 2026, and the next target is likely to be aircraft manufacturer Boeing. Boeing is part of the global commercial aircraft duopoly pattern. It is a huge supplier of military equipment and the largest single exporter in the US. At the same time, it is struggling with a series of long-term setbacks associated with the fatal failure of its aircraft. The company's current predicament provided sufficient bargaining chips for the Trump administration to take a stake in the company.

Accused of allegedly violating the Children's Privacy Act, Disney (DIS.US) agreed to pay $10 million to reach a settlement with the US Department of Justice. The US Department of Justice said Disney has agreed to pay a $10 million civil fine as part of a settlement to resolve allegations that it violated children's privacy laws in some of the videos uploaded to YouTube. According to a Justice Department indictment, Disney Global Services and Disney Entertainment Operating Company failed to correctly mark some videos uploaded to YouTube as “for children.” This allows Disney and its agents to collect personal data from children under 13 and use this information for targeted advertising.