IPO News | Husong Technology reports that the Hong Kong Stock Exchange ranks first in the country in the smart production line market for lithium battery anode materials

Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 31, Husong Technology Group Co., Ltd. (Husong Technology for short) submitted a listing application to the main board of the Hong Kong Stock Exchange, with CICC and SPDB International as co-sponsors. With its pioneering advantage in the construction of smart factories for new energy battery materials, Husong Technology has established a leading market position. According to Insight Consulting's fiscal year 2024 revenue, the company ranked first in the country in the smart production line market for lithium battery anode materials, with a market share of 6.6%; the company ranked second in the country in the smart production line market for lithium battery materials, with a market share of 4.9%.

Company profile

According to the prospectus, Husong Technology was founded in Shanghai in 2012 and restructured as a limited company in 2015. It is a leading provider of intelligent production line platforms for the process industry. Based on self-developed micro-nano dispersive grinding core technology and the i-Neuron intelligent control system, the company precipitates equipment, software, process algorithms and process parameter models into a replicable production line level platform, and large-scale output of standards and modules in new energy, fine chemicals, biological manufacturing, etc., to help customers achieve high-quality production, intelligent operation and sustainable value creation.

Husong Technology is committed to providing smart factory solutions and high-end intelligent equipment for micro and nano materials customers. Currently, its main products and solutions include intelligent production line solutions for micro and nano materials, as well as stand-alone equipment such as intelligent dispersion equipment and intelligent grinding equipment. Through the acquisition of Syd Qirui, the company has horizontally expanded its business coverage in the field of intelligent production line solutions for the process industry to include biomantry process solutions. Currently, the company is actively developing innovative materials such as 3D fluid collectors and nanoceramics, and innovative products such as solid-state batteries downstream of the industrial chain to create a diversified growth curve.

Relying on deep partnerships with leading downstream customers in the new energy battery materials industry, Husong Technology has become its preferred partner for global business expansion. At the same time, the company is digging deeper into the capacity expansion needs of overseas customers with huge potential for growth and seeking opportunities for business cooperation. The company's customer base has covered more than 10 countries or regions around the world, including the United States, South Korea, Indonesia, and Malaysia. It will respond positively to downstream industry trends, build a global R&D, production and sales system, and further accelerate products and brands to go overseas to implement global operations.

The picture below shows the achievements of Husong Technology:

Husong Technology has closely followed the rise of China's new energy industry, developed complete and mature overall solutions for the process industry for new energy battery materials in different application fields, different technical routes, and different performance parameters, and has maintained a leading position in the industry for a long time. The company is one of the few companies in China that can provide intelligent production solutions covering lithium battery positive and negative electrode materials such as lithium iron phosphate, ternary cathodes, natural graphite and artificial graphite anodes, and silicon-carbon anodes.

Financial data

revenue

In fiscal year 2022, fiscal year 2023, fiscal year 2024, and the first half of 2025, the company achieved revenue of about 409 million yuan (RMB, same below), 572 million yuan, 710 million yuan, and 82.461 million yuan, respectively.

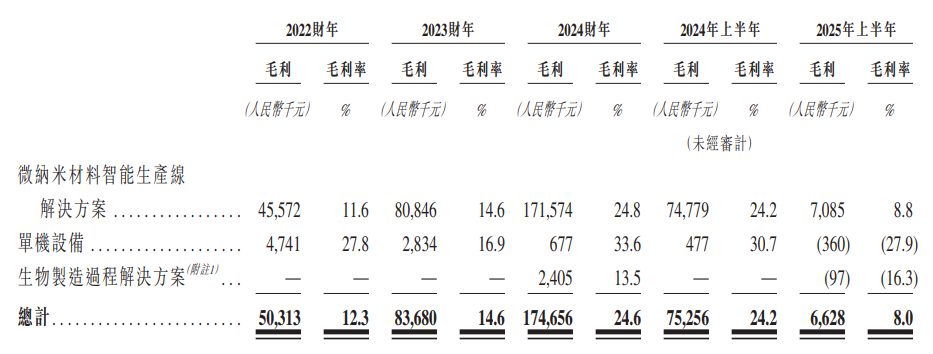

Gross profit and gross profit margin

In fiscal year 2022, fiscal year 2023, fiscal year 2024, and the first half of 2025, the company recorded gross profit of approximately RMB 503.13 million, RMB 83.68 million, RMB 175 million, and RMB 6.628 million, respectively, with corresponding gross margins of 12.3%, 14.6%, 24.6%, and 8.0% respectively.

Profit during the year/period and total comprehensive revenue during the year/period

In fiscal year 2022, fiscal year 2023, fiscal year 2024, and the first half of 2025, the company recorded annual profit and total revenue for the year/period of approximately -26.126 million yuan, -684.77 million yuan, 15.298 million yuan, and -597.15 million yuan, respectively.

Industry Overview

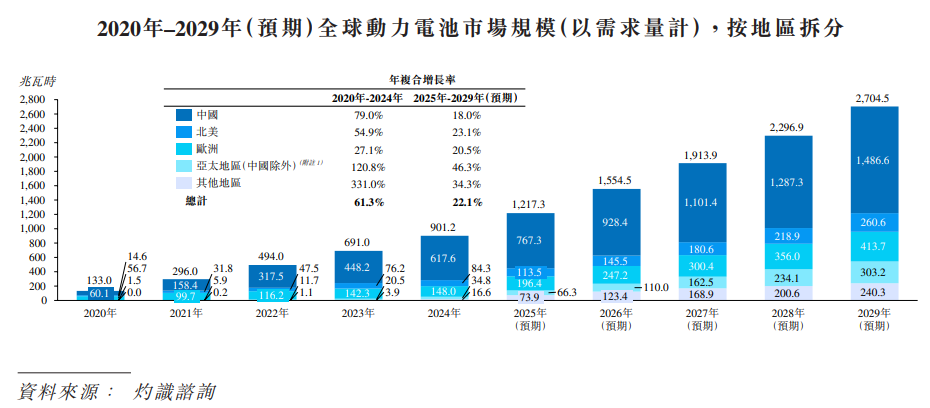

The increase in sales of new energy vehicles has led to continued growth in the size of the global power battery market. From 2020 to 2024, global power battery demand increased from 133.0 megawatt-hours to 901.2 megawatt-hours, with a compound annual growth rate of 61.3%. Global power battery demand is expected to grow steadily over the next five years, reaching 2,704.5 megawatt-hours in 2029, with a compound annual growth rate of 22.1% from 2025 to 2029.

By region, China's power battery demand ranked first in the world from 2020 to 2024. It has grown from 60.1 megawatt-hours in 2020 to 617.6 megawatt-hours in 2024, with a compound annual growth rate of 79.0%. By 2029, China's power battery demand will reach 1,486.6 megawatt-hours, accounting for 55.0% of the global total demand, and 18.0% compound annual growth rate from 2025 to 2029.

In 2024, the demand for power batteries in North America, Europe, and the Asia-Pacific region (excluding China) will reach 84.3 megawatt-hours, 148.0 megawatt-hours, and 34.8 megawatt-hours, respectively. The Asia Pacific region (excluding China) benefited from rapid growth in demand for new energy vehicles in Southeast Asia, and the compound annual growth rate from 2020 to 2024. By 2029, demand for power batteries in North America, Europe, and the Asia-Pacific region (excluding China) is expected to reach 260.6 megawatt-hours, 413.7 megawatt-hours, and 303.2 megawatt-hours, respectively.

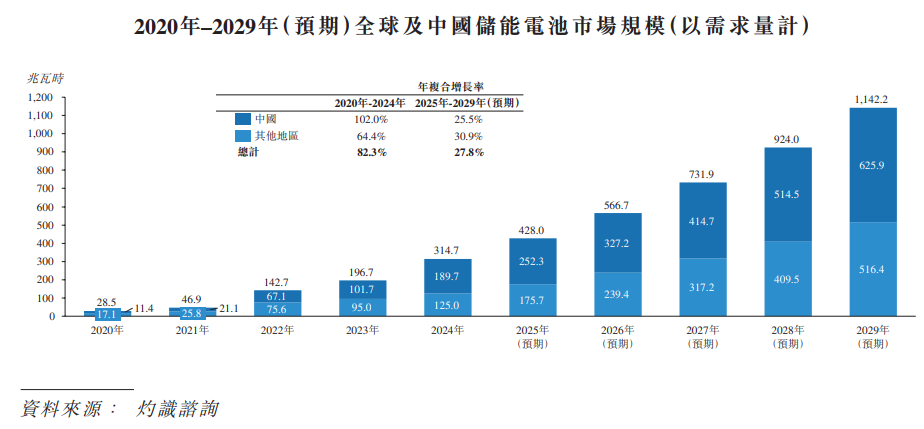

The global energy storage battery market grew significantly between 2020 and 2024. Demand increased from 28.5 megawatt-hours in 2020 to 314.7 megawatt-hours in 2024, with a compound annual growth rate of 82.3%. Among them, China's energy storage battery market maintained a high growth rate. Demand increased from 11.4 megawatt-hours in 2020 to 189.7 megawatt-hours in 2024. The compound annual growth rate from 2020 to 2024 was 102.0%. By 2024, China's energy storage battery demand had reached 60.3% of global demand.

Emerging markets (including the Middle East, Asia, Africa and Latin America) are expected to drive up demand for energy storage due to power shortages and policy support. The European market's attention to energy security, the high proportion of renewable energy connected to the grid, and the economic benefits brought by energy storage systems have also made energy storage an important development direction. It is expected that global demand for energy storage batteries will reach 1,142.2 megawatt-hours by 2029, with a compound annual growth rate of 27.8% from 2025 to 2029. Among them, China's demand for energy storage batteries will increase to 625.9 megawatt-hours, with a compound annual growth rate of 25.5% from 2025 to 2029.

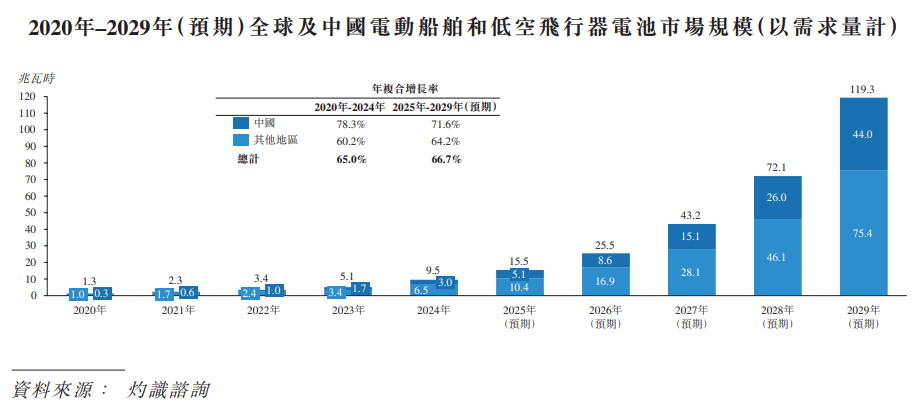

Electric ships and low-altitude aircraft are emerging application scenarios for lithium batteries. Global battery demand for electric ships and low-altitude aircraft increased from 1.3 megawatt-hours in 2020 to 9.5 megawatt-hours in 2024, with a compound annual growth rate of 65.0%. Among them, the demand for batteries for electric ships and low-altitude aircraft in China increased from 0.3 megawatt-hours in 2020 to 3.0 megawatt-hours in 2024, with a compound annual growth rate of 78.3%.

Driven by policy support, technological progress, and commercialization of new scenarios such as green logistics and urban air traffic, global demand for electric ships and low-altitude aircraft batteries is expected to explode from 2025 to 2029. Demand is expected to reach 119.3 megawatt-hours by 2029, with a compound annual growth rate of 66.7%.

By 2029, the battery demand for electric ships and low-altitude aircraft in China is expected to reach 44.0 megawatt-hours. The compound annual growth rate from 2025 to 2029 is 71.6%, mainly due to the acceleration of mass production and landing of electric vertical take-off and landing vehicles (eVTOL).

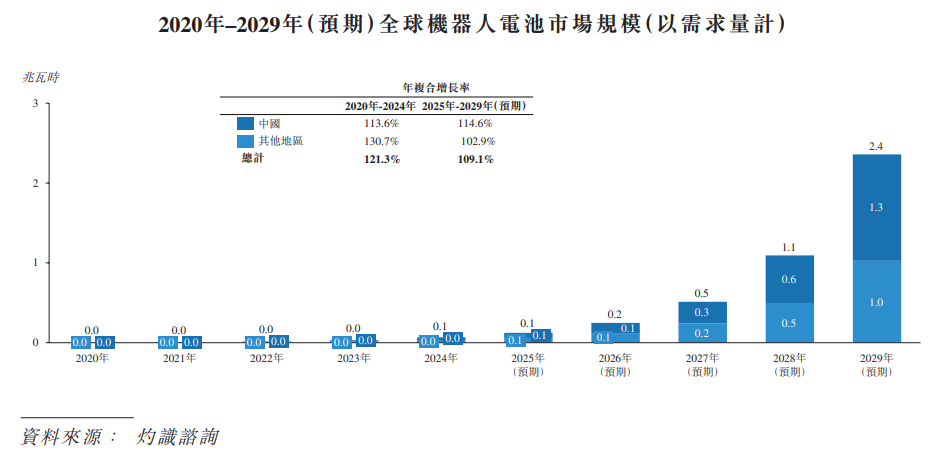

The robotics industry is developing rapidly. This market mainly includes industrial, research-grade and consumer-grade robot dogs, and humanoid robots. It is expected that with the rapid development of artificial intelligence technology, the commercialization of artificial intelligent robots for downstream demand scenarios will accelerate, which will drive the demand for lithium batteries for robots to grow rapidly. Global robot battery demand is expected to grow from 0.1 megawatt-hours in 2025 to 2.4 megawatt-hours in 2029, with a compound annual growth rate of 109.1% from 2025 to 2029. Among them, the demand for robot batteries in China is expected to grow from 0.06 megawatt-hours in 2025 to 1.3 megawatt-hours in 2029, with a compound annual growth rate of 114.6% from 2025 to 2029.

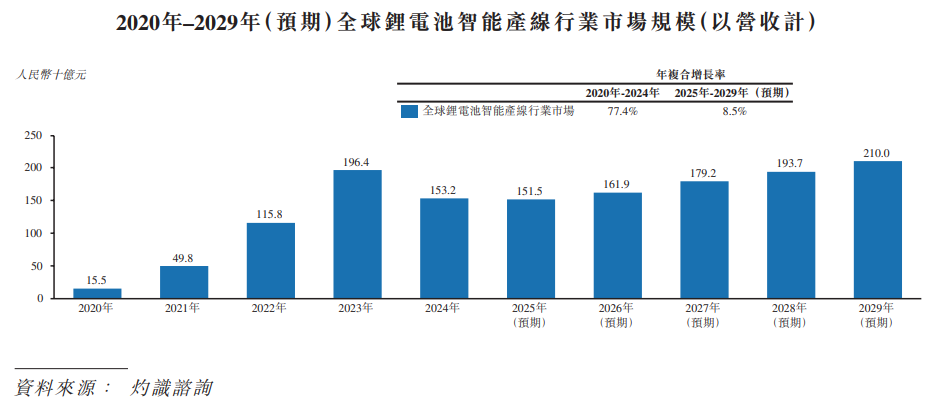

Driven by the rapid expansion of downstream applications of lithium batteries such as new energy vehicles and energy storage systems, global lithium battery manufacturers are investing heavily in expanding production, and the smart lithium battery production line market is growing rapidly. In terms of revenue scale, the global smart lithium battery production line market grew from RMB 15.5 billion to RMB 196.4 billion between 2020 and 2023. However, due to changes in demand in the terminal market and the large-scale expansion of production in the early stages, the lithium battery supply and demand structure was unbalanced, and the expansion of new production capacity slowed down. Subsequently, the market size of the global smart lithium battery production line industry declined.

During the forecast period, demand for lithium batteries in the terminal NEV and energy storage markets will grow steadily. Combined with the acceleration of commercialization in emerging industries, demand for lithium batteries will increase, and demand for the construction of intelligent lithium battery production lines will increase. With the gradual adjustment of the supply and demand structure of the lithium battery market, it is expected that the size of the global lithium battery smart production line market will pick up and increase to RMB 210 billion in 2029, with a compound annual growth rate of 8.5% over the next five years.

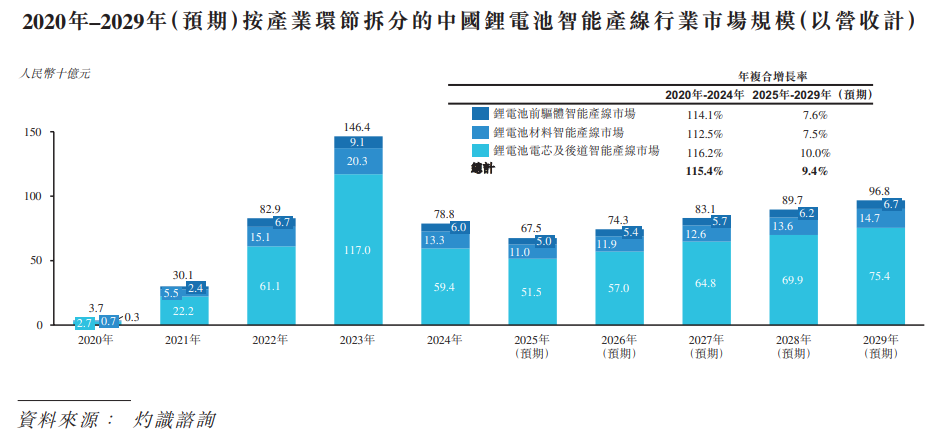

Similar to the global market, in terms of revenue, China's smart lithium battery production line market increased from RMB 3.7 billion in 2020 to RMB 146.4 billion in 2023, and fell back to RMB 788 billion in 2024. The compound annual growth rate from 2020 to 2024 was 115.4%. Since then, due to the recovery in downstream demand and the resumption of production line construction, the size of China's smart lithium battery production line market is expected to expand further to RMB 96.8 billion, with a compound annual growth rate of 9.4% from 2025 to 2029.

Looking at the industrial sector, the market size of all sectors is basically in line with the market size trend of lithium battery smart production lines. They all grew rapidly from 2020 to 2023 and declined in 2024, and are expected to pick up in the next five years. The market size of smart production lines for lithium battery precursors is expected to grow to RMB 6.7 billion in 2029, with a compound annual growth rate of 7.6% from 2025 to 2029. The smart production line market for lithium battery materials is expected to grow to RMB 14.7 billion in 2029, with a compound annual growth rate of 7.5% from 2025 to 2029. The market size of lithium battery cells and future smart production lines is expected to grow to RMB 75.4 billion in 2029, with a compound annual growth rate of 10.0% from 2025 to 2029.

Board Information

The board of directors of the company consists of 9 directors, including 4 executive directors, 2 non-executive directors and 3 independent non-executive directors. The Board of Directors is responsible for and has general powers to manage and operate the Group. The term of office of directors is 3 years, and they must be re-elected at the end of their term of office.

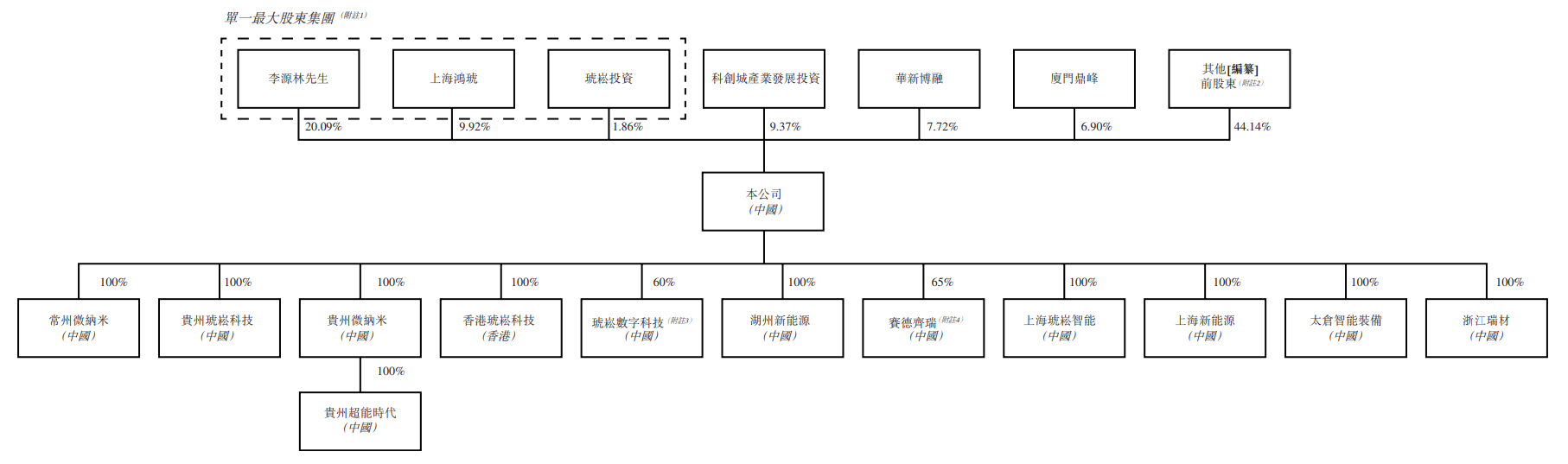

Shareholding structure

Mr. Li Yuanlin, Ms. Fang Linlin, Shanghai Honghu and Songhu Investment form the single largest shareholder group, holding a total of 31.87%; Science Innovation City Industrial Development Investment holding 9.37%; Huaxin Borong holding 7.72% of the shares; Xiamen Dingfeng holding 6.90% of the shares; and other pre-listing shareholders holding a total of 44.14% of the shares.

Shanghai Honghu is the Group's employee shareholding platform. Mr. Li Yuanlin owns 37.53%. Mr. Li Yuanlin and Ms. Fang Linlin own 60% and 40% respectively of Husong Investment. Mr. Li Yuanlin is the general partner of Shanghai Honghu and Husong Investments. Therefore, according to the Securities and Futures Regulations, Mr. Li Yuanlin is considered to have an interest in shares held by Shanghai Honghu and Husong Investment. Ms. Fang Linlin is the spouse of Mr. Li Yuanlin. According to the Securities and Futures Regulations, she is deemed to have an interest in shares in which Mr. Li Yuanlin has an interest. According to this, Mr. Li Yuanlin, Ms. Fang Linlin, Shanghai Honghu and Husong Investments form the single largest shareholder group.

Intermediary team

Co-sponsors: China International Finance Hong Kong Securities Limited and SPDB International Finance Limited.

Company Legal Adviser: Hong Kong Law: DeHeng Law Firm (Hong Kong) Limited Liability Partnership; Related Chinese Law: Beijing Deheng Law Firm; Related International Sanctions Law: Ashurst Tokyo (Ashurst Horitsu Jimusho Gaikokuho Kyodo Jigyo).

Co-sponsor Legal Advisers: Regarding Hong Kong and US law: Haiwen Law Firm; relating to Chinese law: Jingtian Gongcheng Law Firm.

Independent Auditor and Reporting Accountant: Hong Kong Lixin Dehao Certified Public Accountants Limited.

Industry consultant: Insight Enterprise Management Consulting (Shanghai) Co., Ltd.

Property Valuer: Asia Pacific Appraisal Consultants Ltd.

Compliance Advisor: Huafu Construction Enterprise Finance Co., Ltd.