Buckle And Two Other Top Dividend Stocks To Consider

As the year comes to a close, major U.S. stock indexes like the Dow Jones, Nasdaq, and S&P 500 have experienced a mixed performance with recent declines but overall substantial gains for 2025. In this fluctuating market environment, dividend stocks can offer investors a sense of stability and potential income through regular payouts, making them an appealing option amidst broader market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.83% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.42% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.76% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.35% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.07% | ★★★★★★ |

| Ennis (EBF) | 5.46% | ★★★★★★ |

| Dillard's (DDS) | 5.09% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.10% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.53% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.63% | ★★★★★☆ |

Click here to see the full list of 122 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Buckle (BKE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Buckle, Inc. is a U.S.-based retailer specializing in casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands with a market cap of approximately $2.70 billion.

Operations: The Buckle, Inc.'s revenue is primarily derived from its casual apparel, footwear, and accessories segment, which generated $1.28 billion.

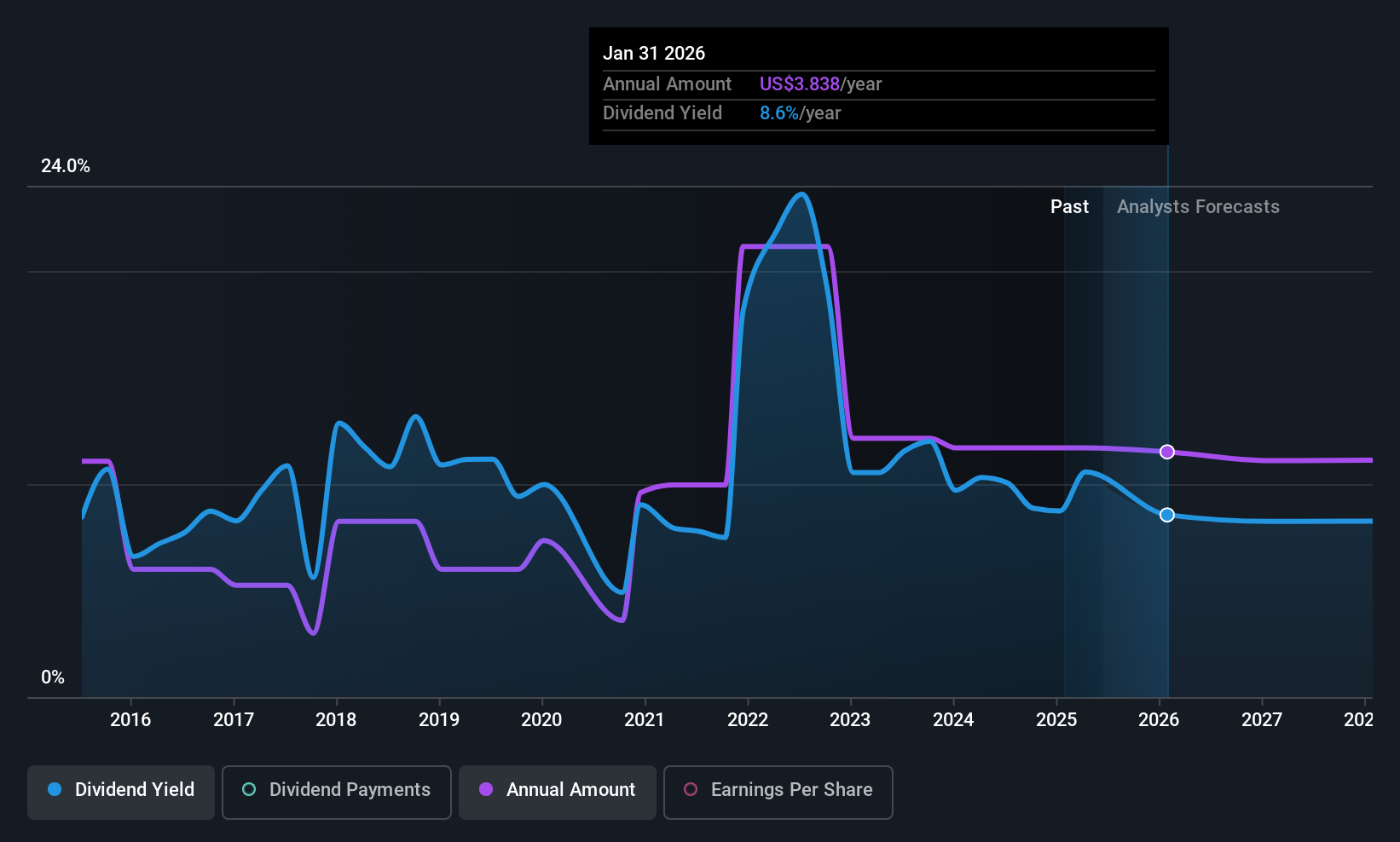

Dividend Yield: 8.2%

The Buckle, Inc. recently announced a quarterly dividend of $0.35 per share and a special cash dividend of $3.00 per share, both payable in January 2026. Despite these payouts, the company's high cash payout ratio suggests dividends are not well covered by free cash flows, indicating potential sustainability concerns. While dividends have grown over the past decade, they have been volatile and unreliable. The stock trades at a discount to its estimated fair value but presents risks for dividend stability.

- Dive into the specifics of Buckle here with our thorough dividend report.

- Our expertly prepared valuation report Buckle implies its share price may be lower than expected.

Cullen/Frost Bankers (CFR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cullen/Frost Bankers, Inc. is the bank holding company for Frost Bank, offering commercial and consumer banking services in Texas with a market cap of $8.23 billion.

Operations: Cullen/Frost Bankers, Inc. generates revenue primarily from its Banking segment at $1.94 billion and Frost Wealth Advisors at $216.27 million.

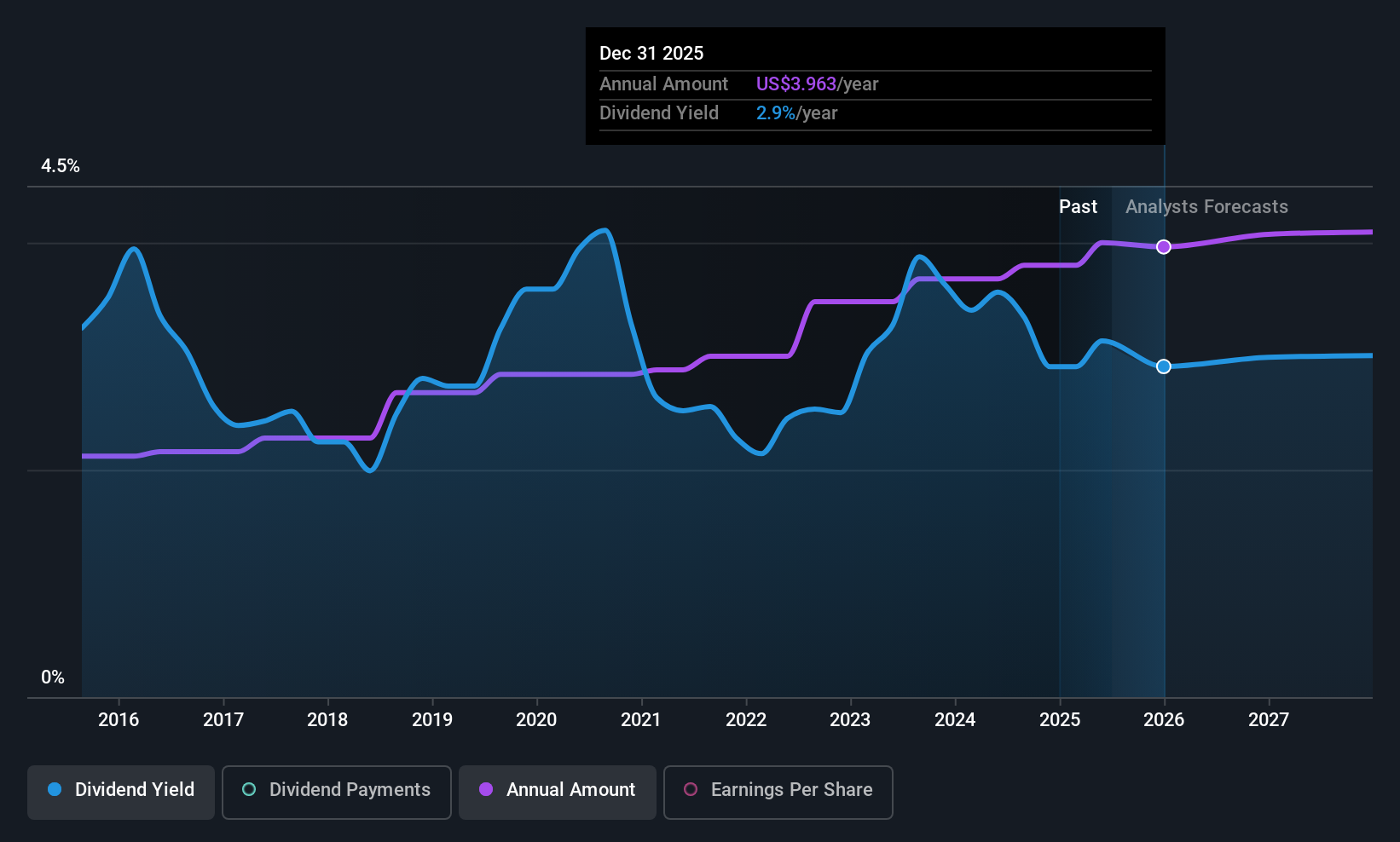

Dividend Yield: 3.1%

Cullen/Frost Bankers offers a stable dividend profile, with payments increasing over the past decade and maintaining reliability. The current dividend yield of 3.12% is below the top quartile in the US market but is well-covered by earnings, with a payout ratio of 40.1%. Recent earnings growth supports this stability, as net income rose to $174.38 million in Q3 2025 from $146.5 million a year ago, alongside an improved earnings guidance for the year.

- Get an in-depth perspective on Cullen/Frost Bankers' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Cullen/Frost Bankers' share price might be too pessimistic.

ConocoPhillips (COP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ConocoPhillips is an energy company engaged in the exploration, production, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids with a market cap of approximately $114.46 billion.

Operations: ConocoPhillips generates revenue from several key segments, including Alaska ($5.99 billion), Canada ($5.78 billion), Lower 48 ($41.66 billion), Asia Pacific ($2.60 billion), and Europe, Middle East, and North Africa ($7.22 billion).

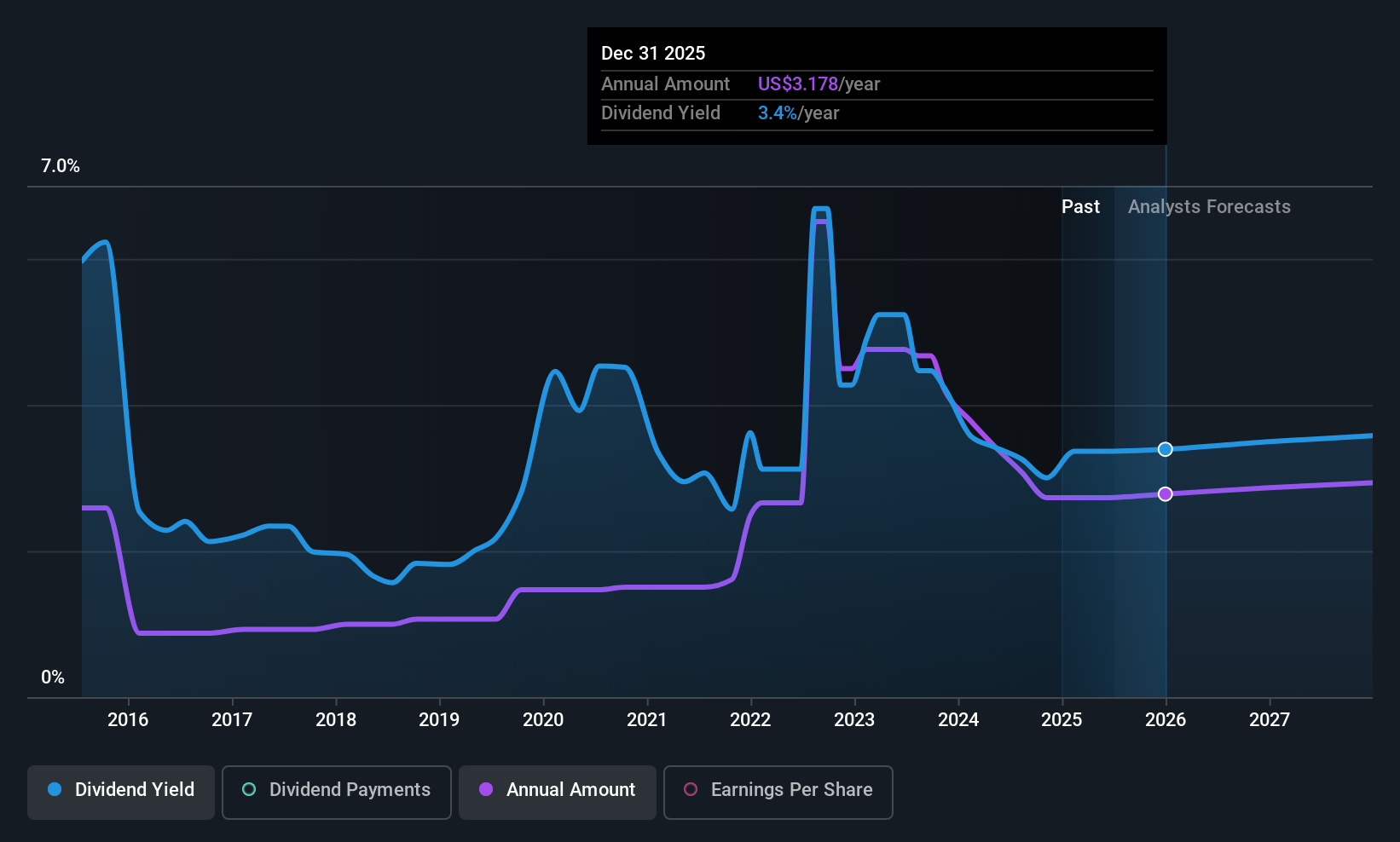

Dividend Yield: 3.6%

ConocoPhillips recently increased its quarterly dividend by 8% to $0.84 per share, reflecting a commitment to returning value despite a historically volatile dividend track record. The payout is well-covered by earnings and cash flow, with payout ratios of 44.1% and 58.6%, respectively. Q3 results showed strong sales growth but a decline in net income to $1.73 billion from $2.06 billion year-on-year, while production guidance for the year was raised slightly.

- Navigate through the intricacies of ConocoPhillips with our comprehensive dividend report here.

- According our valuation report, there's an indication that ConocoPhillips' share price might be on the cheaper side.

Key Takeaways

- Click through to start exploring the rest of the 119 Top US Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com