3 Insider-Favored Growth Companies To Consider

As 2025 comes to a close, major U.S. stock indexes have experienced a mix of record highs and recent declines, with the Dow Jones Industrial Average, Nasdaq, and S&P 500 all showing significant annual gains despite ending the year on a downward trend. In this fluctuating market environment, growth companies with high insider ownership can offer appealing prospects for investors seeking alignment between company leadership and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.8% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 42.5% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

Let's take a closer look at a couple of our picks from the screened companies.

AerSale (ASLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AerSale Corporation supplies aftermarket commercial aircraft, engines, and parts to a global clientele including airlines and defense contractors, with a market cap of $335.49 million.

Operations: AerSale's revenue segments include Tech Ops - MRO Services at $95.08 million, Tech Ops - Product Sales at $25.34 million, Asset Management Solutions - Engine at $185.29 million, and Asset Management Solutions - Aircraft at $33.38 million.

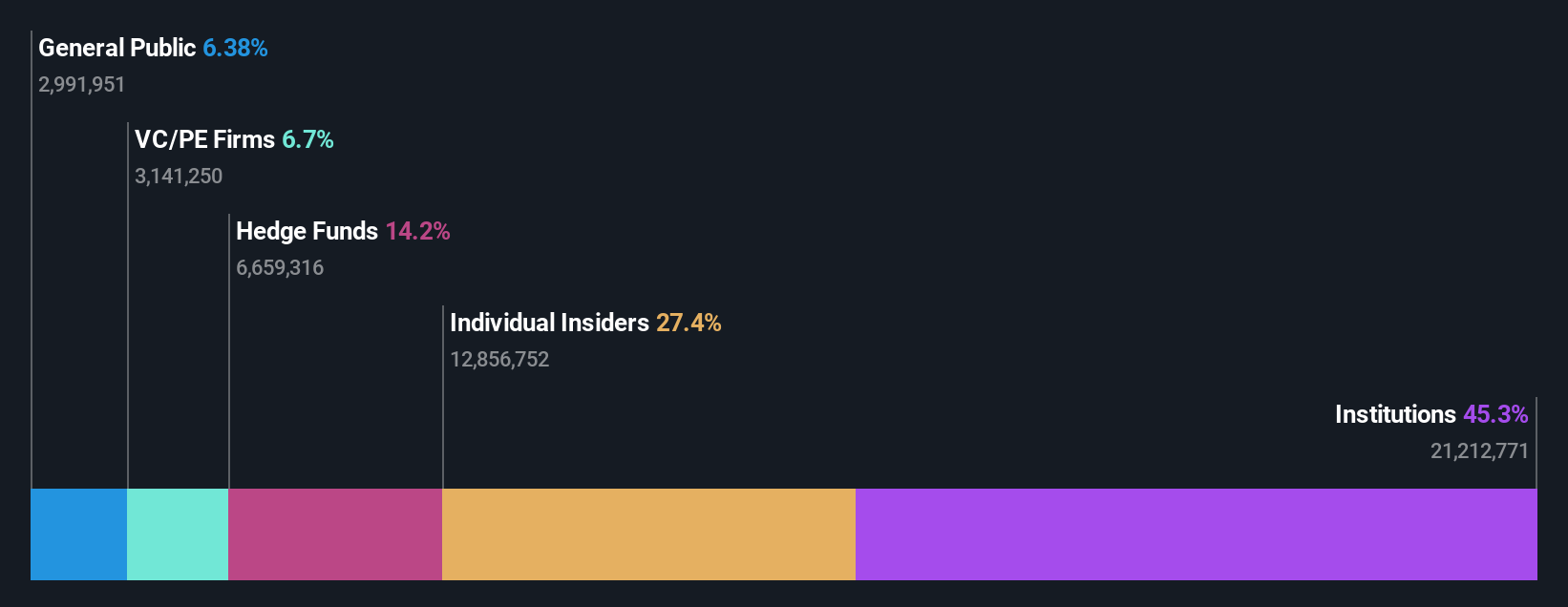

Insider Ownership: 27.4%

Earnings Growth Forecast: 67.8% p.a.

AerSale shows strong growth potential with earnings forecasted to grow significantly at 67.8% annually, outpacing the US market. Despite a recent net loss of US$0.12 million in Q3 2025, insider confidence remains high with substantial buying activity and no significant selling over the past three months. Revenue is expected to increase by 18% per year, although it declined slightly from US$82.68 million to US$71.19 million compared to last year's third quarter results.

- Get an in-depth perspective on AerSale's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that AerSale's share price might be on the expensive side.

Lifeway Foods (LWAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lifeway Foods, Inc. produces and markets probiotic-based products both in the United States and internationally, with a market cap of approximately $363.82 million.

Operations: The company's revenue primarily comes from its Cultured Dairy Products segment, which generated $204.07 million.

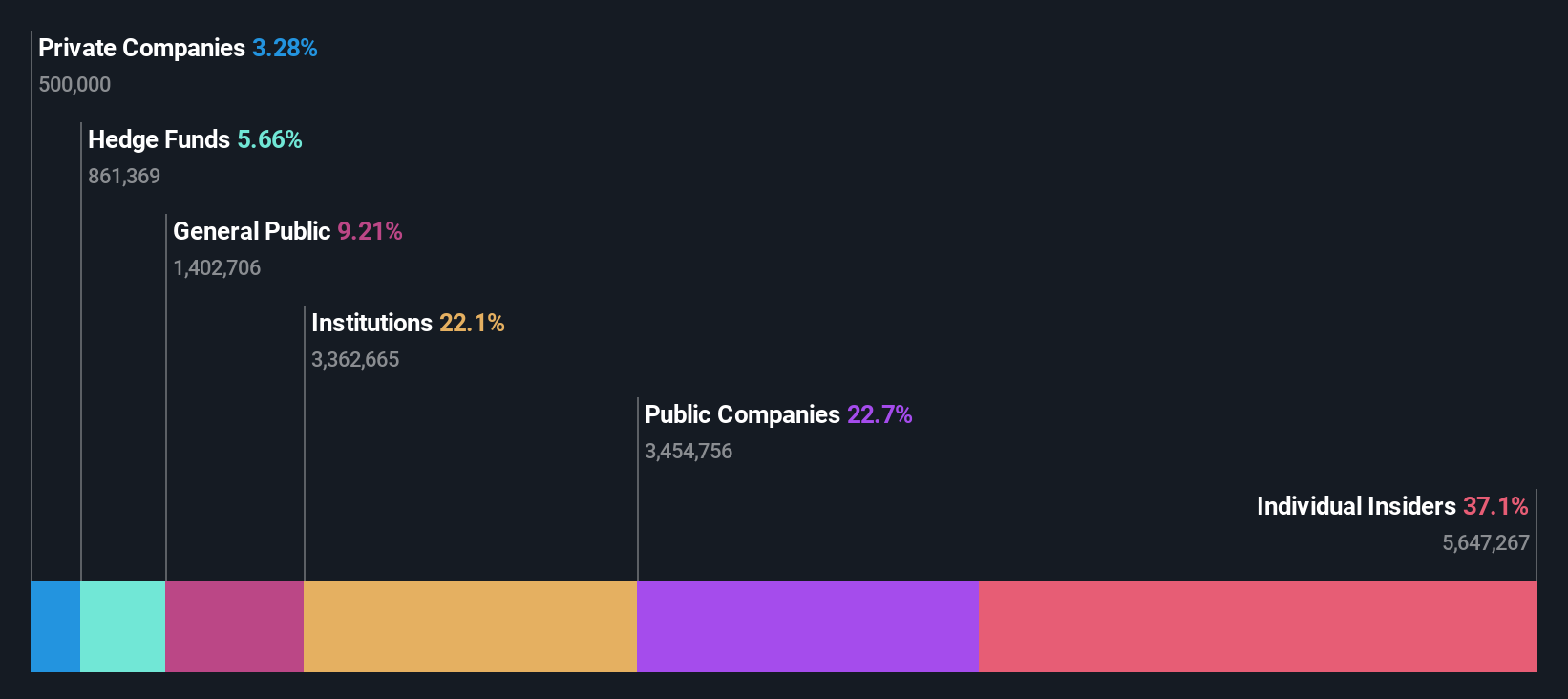

Insider Ownership: 39.9%

Earnings Growth Forecast: 41.7% p.a.

Lifeway Foods is poised for significant earnings growth at 41.7% annually, surpassing the US market average. Despite governance concerns raised by Institutional Shareholder Services about board practices and transparency, Lifeway's revenue is projected to grow at 13.1% per year, outpacing the market rate. Recent insider activity shows more shares bought than sold in the past three months, indicating potential confidence despite ongoing activist challenges and calls for board changes from key shareholders.

- Take a closer look at Lifeway Foods' potential here in our earnings growth report.

- Our valuation report here indicates Lifeway Foods may be overvalued.

Vital Farms (VITL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vital Farms, Inc. is a food company that packages, markets, and distributes shell eggs, butter, and other products in the United States with a market cap of approximately $1.48 billion.

Operations: The company's revenue primarily comes from its eggs and butter segment, which generated $711.88 million.

Insider Ownership: 15.1%

Earnings Growth Forecast: 19.9% p.a.

Vital Farms shows strong growth potential with forecasted revenue expansion of 20.9% annually, outpacing the US market. Recent earnings guidance indicates a projected net revenue of $930 million to $950 million for 2026, reflecting a significant increase from 2025's revised outlook. The company was recently added to several S&P indices, enhancing its visibility among investors. Despite no recent insider trading activity reported, Vital Farms maintains substantial insider ownership, aligning management interests with shareholders.

- Navigate through the intricacies of Vital Farms with our comprehensive analyst estimates report here.

- The analysis detailed in our Vital Farms valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Embark on your investment journey to our 209 Fast Growing US Companies With High Insider Ownership selection here.

- Seeking Other Investments? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com