Uncovering 3 Australian Small Caps with Promising Potential

As the Australian market approaches the end of the year, it appears to be winding down with a slight dip, likely due to profit-taking ahead of the holiday season. Despite this temporary lull, small-cap stocks continue to attract attention for their potential growth opportunities, especially in sectors like mining and technology where recent developments have shown promising signs.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Argosy Minerals | NA | -12.81% | -19.89% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Cogstate (ASX:CGS)

Simply Wall St Value Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience solutions company that develops and commercializes digital brain health assessments globally, with a market capitalization of A$387.87 million.

Operations: Cogstate generates revenue primarily from its Clinical Trials segment, contributing $50.58 million, while the Healthcare segment adds $2.51 million.

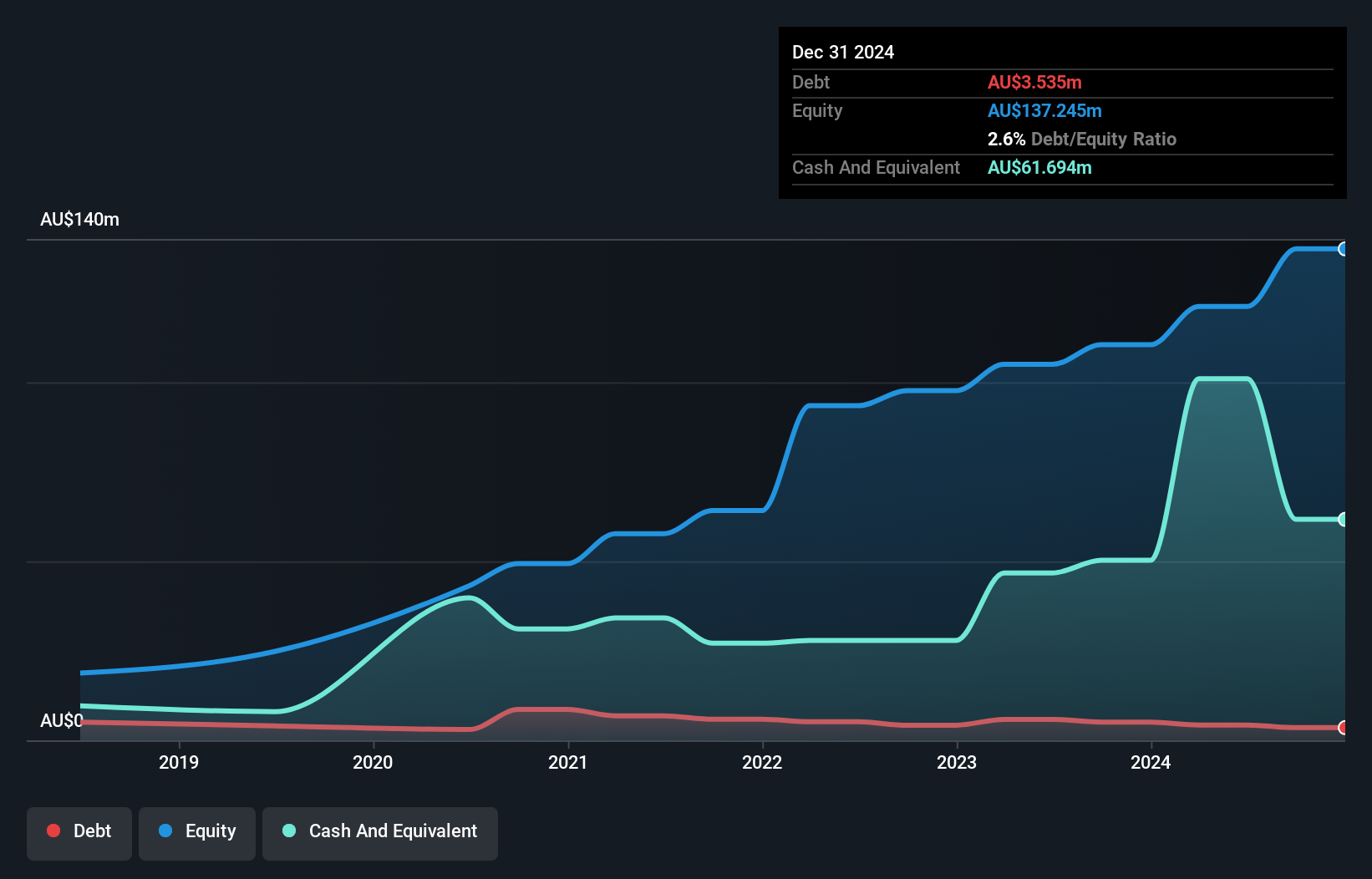

Cogstate, a neuroscience tech firm focusing on digital brain health assessments, is capitalizing on strategic partnerships and AI innovation to broaden its market presence. With no debt compared to five years ago when the debt-to-equity ratio was 16.4%, Cogstate’s financial health seems robust. The company's earnings growth of 86% over the past year surpasses the industry average of 20%. Analysts forecast an annual revenue increase of 7.6% over three years and project profit margins rising from 19.1% to 21.5%. Trading at A$1.69, with a target price of A$2.19, suggests potential upside amid competitive pressures and regulatory challenges.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems in Australia, with a market capitalization of A$1.14 billion.

Operations: GenusPlus Group generates revenue through three primary segments: Infrastructure (A$405.10 million), Energy & Engineering (A$224.06 million), and Services (A$122.11 million).

With a strong foothold in Australia's renewable energy sector, GenusPlus Group is poised to benefit from the country's grid upgrades and diverse project pipeline that reduces geographic risks. The company has strategically reduced its debt to equity ratio from 7% to 6.3% over five years, while maintaining profitability with more cash than total debt. Earnings growth of 83.6% last year outpaced the industry average by a significant margin, showcasing high-quality earnings potential. However, challenges such as integration issues from acquisitions and reliance on government infrastructure spending could impact future performance despite projected annual revenue growth of 14.2%.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tasmea Limited specializes in providing shutdown, maintenance, emergency breakdown, and capital upgrade services across Australia with a market capitalization of A$1.10 billion.

Operations: Tasmea generates revenue primarily from Electrical Services (A$212.71 million), Civil Services (A$103.07 million), and Mechanical Services (A$144.87 million). Water & Fluid services contribute A$87.06 million to the total revenue.

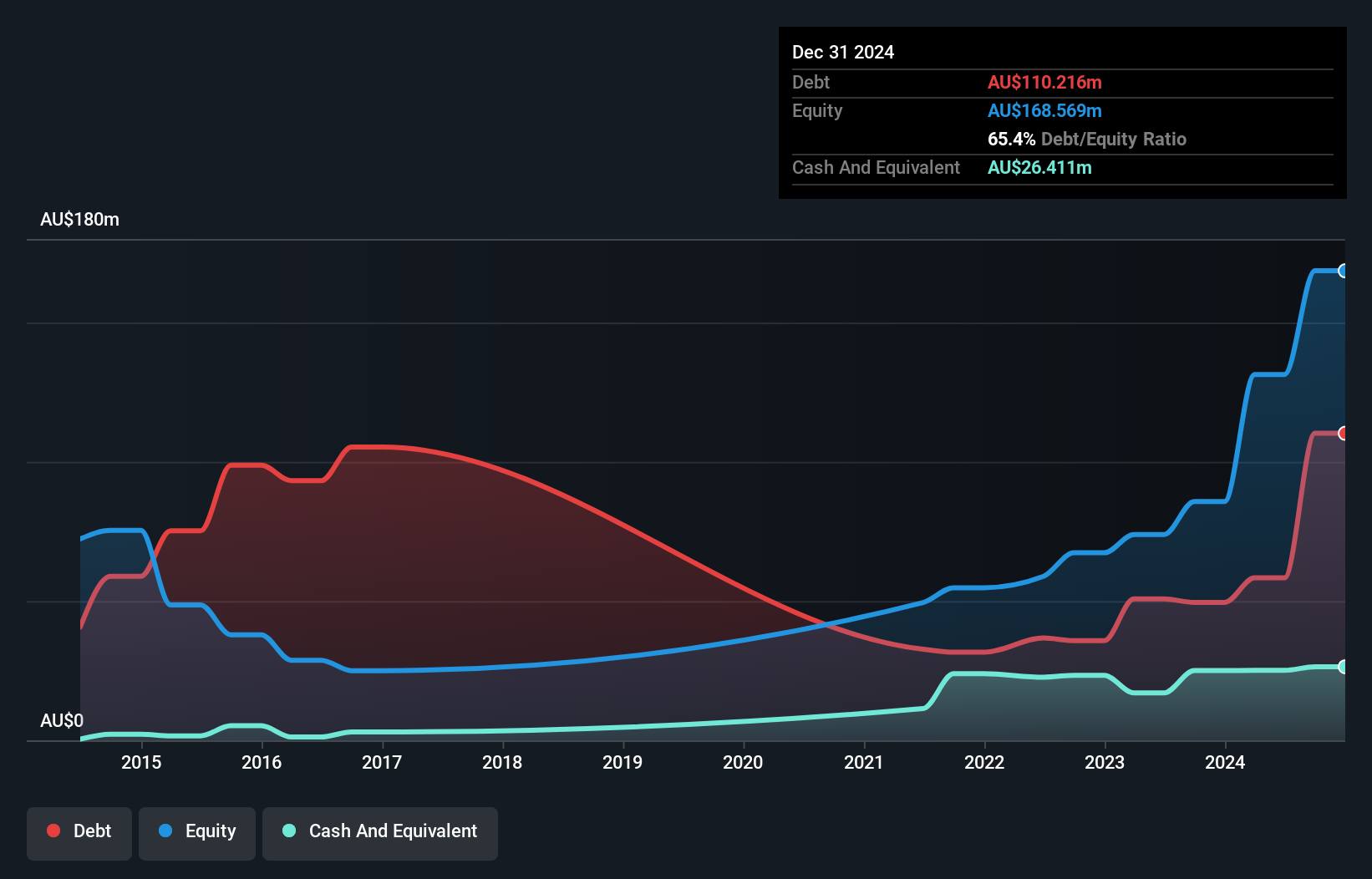

Tasmea, a smaller player in the construction sector, showcases impressive earnings growth of 74.9% over the past year, significantly outpacing the industry average of 6.5%. Despite its high net debt to equity ratio at 59.8%, Tasmea's interest payments are well-covered by EBIT at 10.5 times, indicating robust financial health in this regard. The company recently completed a follow-on equity offering worth A$27.5 million and announced an acquisition of WorkPac, suggesting strategic expansion plans. Trading nearly half below its estimated fair value and with forecasted earnings growth of 15.96% annually, Tasmea seems poised for further development despite its debt concerns.

- Dive into the specifics of Tasmea here with our thorough health report.

Evaluate Tasmea's historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 59 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com