ASX Penny Stock Picks For December 2025

As the Australian market winds down for the year, experiencing a slight dip amid profit-taking and holiday closures, investors are reflecting on their portfolios. Despite being an older term, penny stocks continue to capture attention due to their potential for value and growth in smaller or newer companies. By focusing on those with strong financials and growth prospects, investors can uncover opportunities that might not be apparent in larger firms.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.395 | A$113.2M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.41 | A$66.51M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.77 | A$47.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$462.61M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.10 | A$228.98M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$39.45M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.00 | A$3.43B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.805 | A$115.87M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.24 | A$124.42M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 418 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Beamtree Holdings (ASX:BMT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beamtree Holdings Limited offers artificial intelligence-based decision support software and data insight solutions to the healthcare industry both in Australia and internationally, with a market cap of A$65.38 million.

Operations: The company generates revenue from its healthcare software segment, amounting to A$28.60 million.

Market Cap: A$65.38M

Beamtree Holdings Limited, with a market cap of A$65.38 million, is focused on AI-driven healthcare solutions and generates A$28.60 million in revenue from its software segment. Despite being unprofitable and experiencing increased losses over the past five years, the company maintains a stable cash runway exceeding three years and has more cash than debt. Recent executive changes include appointing Michelle Spiller as CFO, bringing extensive financial expertise to support strategic growth initiatives. The board is seasoned with experienced directors like Stuart MacDonald joining recently, potentially strengthening governance during this transformative phase for Beamtree Holdings.

- Take a closer look at Beamtree Holdings' potential here in our financial health report.

- Gain insights into Beamtree Holdings' outlook and expected performance with our report on the company's earnings estimates.

Mach7 Technologies (ASX:M7T)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mach7 Technologies Limited develops and commercializes medical imaging and data management software solutions for healthcare organizations globally, with a market cap of A$144.51 million.

Operations: The company's revenue is derived from Software Licenses (A$17.11 million), Professional Services (A$3.65 million), and Maintenance and Support (A$13.01 million).

Market Cap: A$144.51M

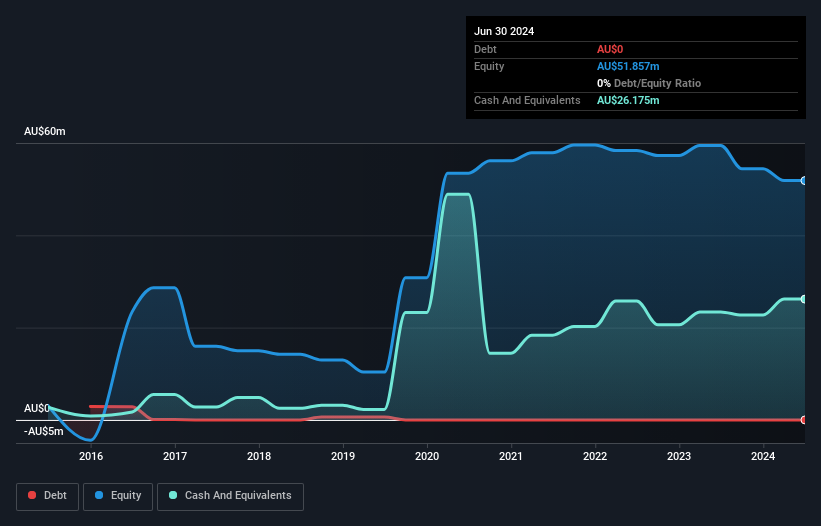

Mach7 Technologies Limited, with a market cap of A$144.51 million, focuses on medical imaging software solutions and reports revenue from Software Licenses (A$17.11 million), Professional Services (A$3.65 million), and Maintenance and Support (A$13.01 million). Despite being unprofitable with increasing losses over the past five years, it has no debt and sufficient cash runway for over three years based on current free cash flow. The management team is relatively new, averaging 0.3 years in tenure, while the board is experienced with an average tenure of 5.9 years, potentially aiding strategic direction amid upcoming earnings announcements and conference presentations.

- Get an in-depth perspective on Mach7 Technologies' performance by reading our balance sheet health report here.

- Assess Mach7 Technologies' future earnings estimates with our detailed growth reports.

XRF Scientific (ASX:XRF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XRF Scientific Limited manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries in Australia, Canada, and Europe with a market cap of A$294.56 million.

Operations: The company's revenue is derived from three primary segments: Consumables (A$19.26 million), Precious Metals (A$21.51 million), and Capital Equipment (A$22.56 million).

Market Cap: A$294.56M

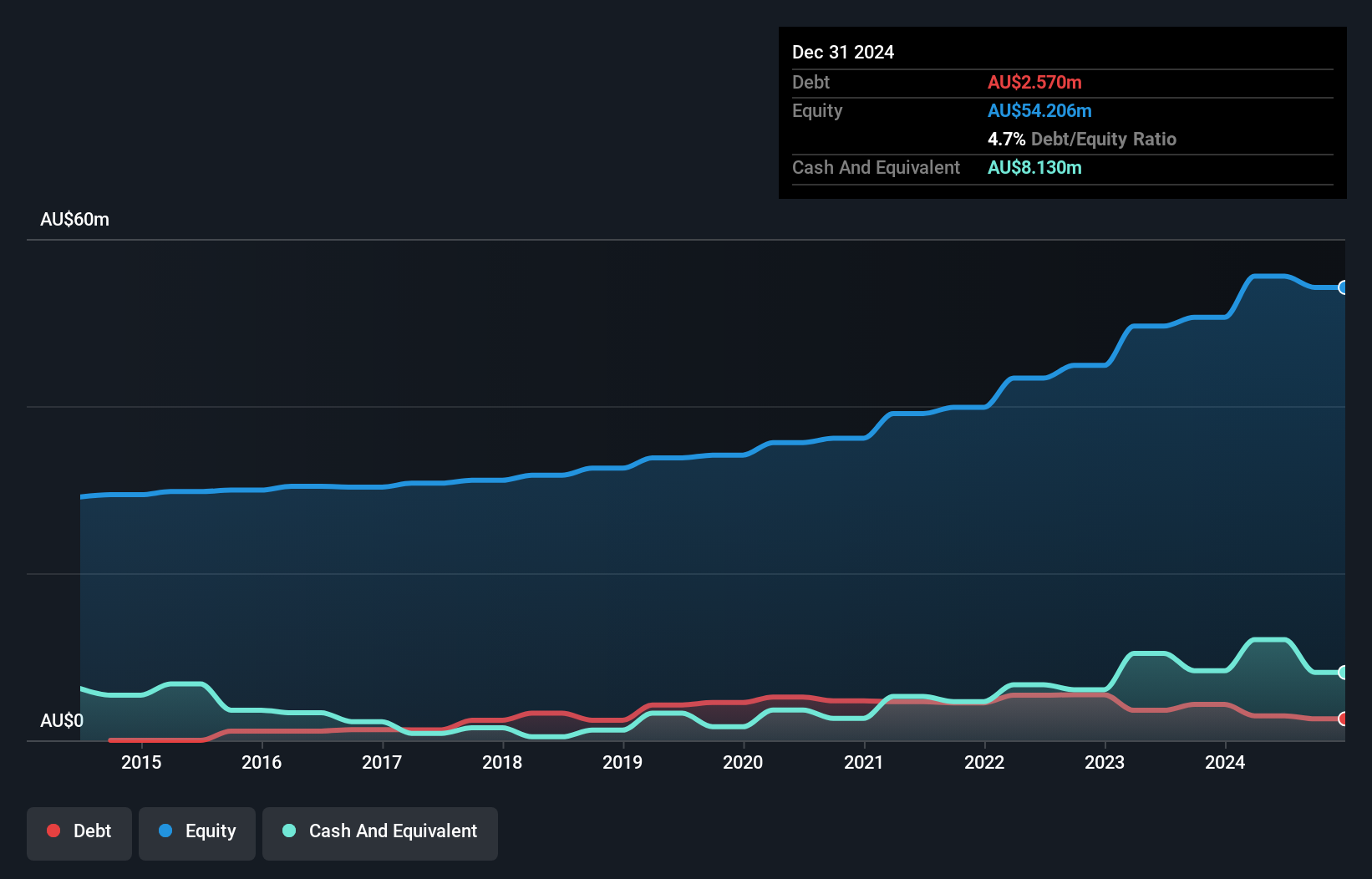

XRF Scientific, with a market cap of A$294.56 million, shows robust financial health with its short and long-term assets exceeding liabilities and cash surpassing total debt. Its revenue streams from Consumables (A$19.26 million), Precious Metals (A$21.51 million), and Capital Equipment (A$22.56 million) contribute to stable earnings growth, which outpaces the industry average. The company's board and management are highly experienced, enhancing strategic stability. Despite a low Return on Equity of 17.2%, XRF's interest payments are well covered by EBIT at 57.6 times coverage, indicating strong operational efficiency amidst moderate earnings growth forecasts of 11.29% annually.

- Click here to discover the nuances of XRF Scientific with our detailed analytical financial health report.

- Explore XRF Scientific's analyst forecasts in our growth report.

Key Takeaways

- Dive into all 418 of the ASX Penny Stocks we have identified here.

- Curious About Other Options? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com