Investors Holding Back On Close the Loop Ltd (ASX:CLG)

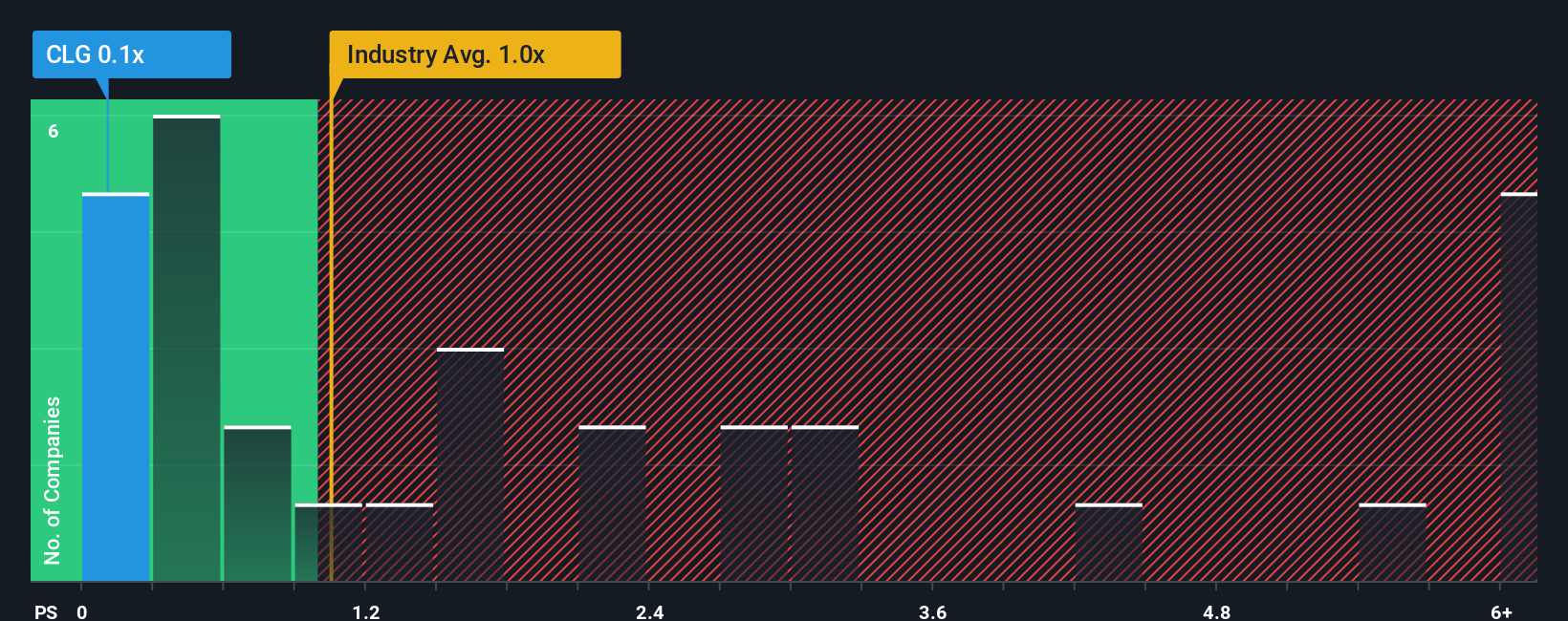

You may think that with a price-to-sales (or "P/S") ratio of 0.1x Close the Loop Ltd (ASX:CLG) is a stock worth checking out, seeing as almost half of all the Commercial Services companies in Australia have P/S ratios greater than 1.7x and even P/S higher than 6x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Close the Loop

How Has Close the Loop Performed Recently?

While the industry has experienced revenue growth lately, Close the Loop's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Close the Loop's future stacks up against the industry? In that case, our free report is a great place to start.How Is Close the Loop's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Close the Loop's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 6.6% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 178% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 6.8% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 5.5% each year, which is not materially different.

With this information, we find it odd that Close the Loop is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Close the Loop's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Close the Loop's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 2 warning signs for Close the Loop (1 doesn't sit too well with us!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.