ASX Penny Stocks To Watch In January 2026

As the Australian market winds down for the year, experiencing a slight dip amid holiday profit-taking, investors are turning their attention to potential opportunities in the new year. Penny stocks, despite being an older term, continue to capture interest due to their potential for growth at lower price points. In light of current market conditions and investor sentiment, we explore several promising penny stocks that combine solid financial foundations with potential for long-term value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.395 | A$113.2M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.41 | A$66.51M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.77 | A$47.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$462.61M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.10 | A$228.98M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$39.45M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.00 | A$3.43B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.805 | A$115.87M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.24 | A$124.42M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 418 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Australian Clinical Labs (ASX:ACL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Australian Clinical Labs Limited operates in Australia, offering pathology diagnostic services with a market capitalization of A$524.97 million.

Operations: The company generates revenue of A$741.27 million from its pathology and clinical laboratory services segment.

Market Cap: A$524.97M

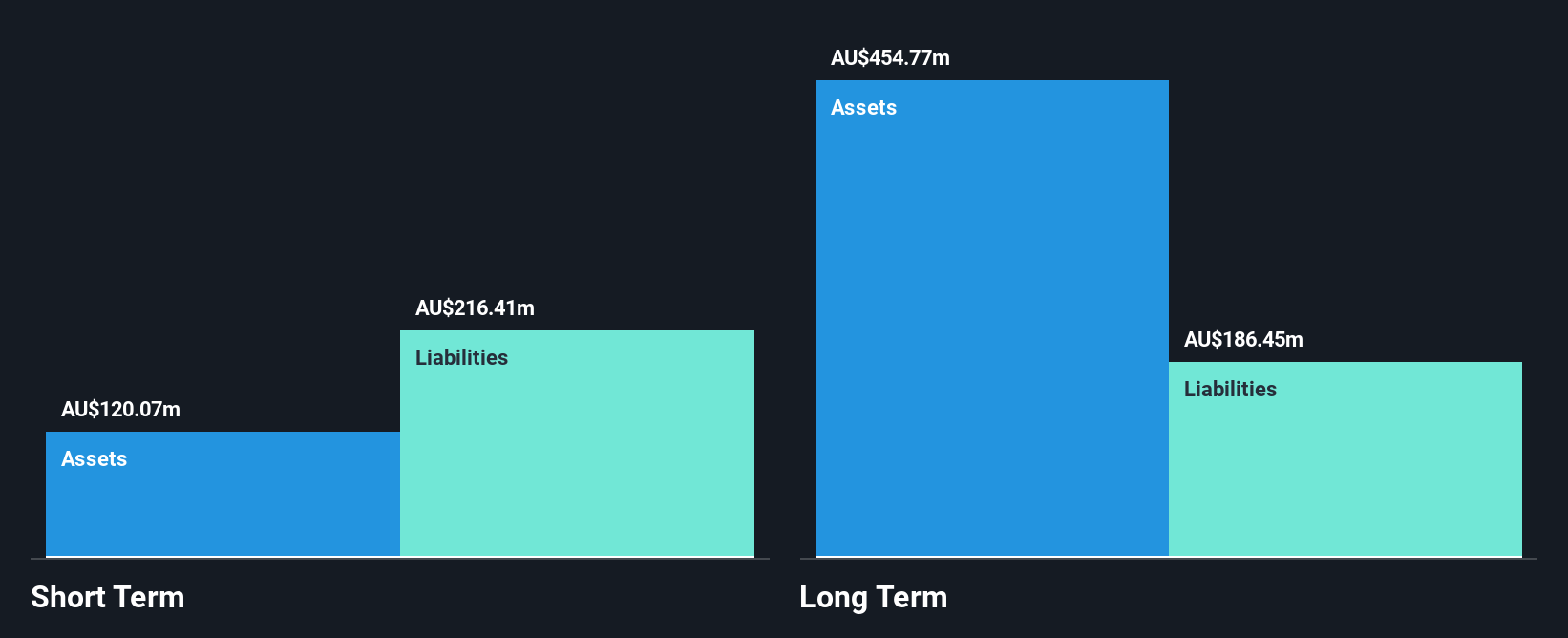

Australian Clinical Labs Limited, with a market cap of A$524.97 million, shows mixed signals for investors interested in penny stocks. The company has demonstrated strong recent earnings growth of 35.5%, outpacing the healthcare industry, and its debt is well managed with a net debt to equity ratio at 11.5%. However, the company faces challenges such as short-term liabilities exceeding short-term assets and an unstable dividend track record. Recent legal settlements related to a cyberattack may affect financials but are balanced by an authorized share buyback program aimed at enhancing shareholder value.

- Click here to discover the nuances of Australian Clinical Labs with our detailed analytical financial health report.

- Examine Australian Clinical Labs' earnings growth report to understand how analysts expect it to perform.

Beacon Minerals (ASX:BCN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beacon Minerals Limited, with a market cap of A$296.39 million, is involved in the development and production of minerals in Western Australia through its subsidiaries.

Operations: The company generates revenue of A$92.73 million from its activities in the exploration and development of minerals.

Market Cap: A$296.39M

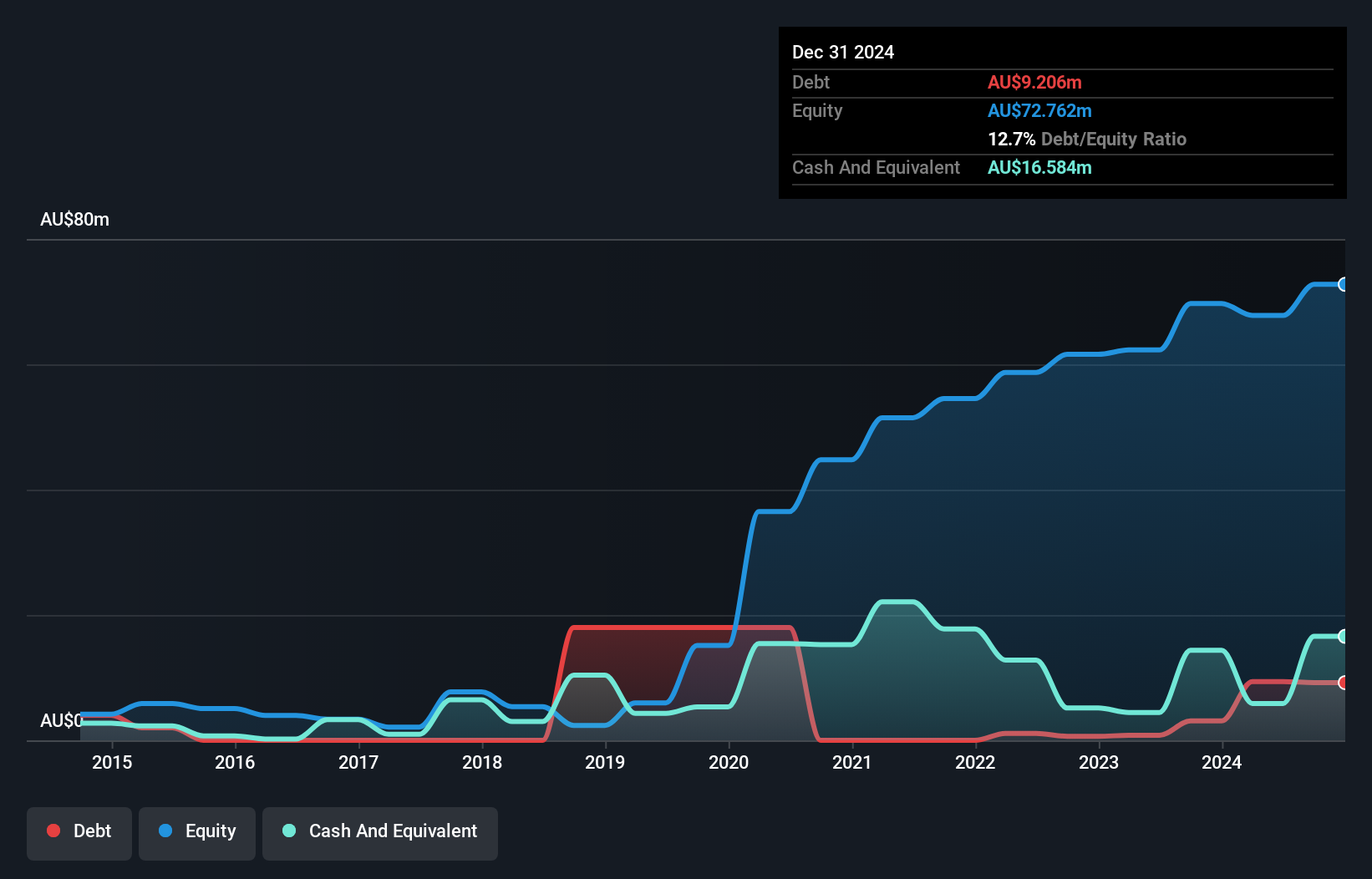

Beacon Minerals Limited, with a market cap of A$296.39 million, presents an intriguing option for penny stock investors. Despite being unprofitable and experiencing increased losses over the past five years, the company maintains strong financial management with its debt well covered by operating cash flow and reduced from 49.3% to 12.5% in debt-to-equity ratio over five years. Recent announcements include regular and special dividends payable in December 2025, indicating cash availability for shareholder returns. The board's seasoned experience adds stability amidst volatility, while short-term assets comfortably cover both short- and long-term liabilities.

- Unlock comprehensive insights into our analysis of Beacon Minerals stock in this financial health report.

- Gain insights into Beacon Minerals' historical outcomes by reviewing our past performance report.

Intelligent Monitoring Group (ASX:IMB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intelligent Monitoring Group Limited offers security, monitoring, and risk management services for businesses, homes, and individuals in Australia and New Zealand with a market cap of A$266.01 million.

Operations: The company's revenue is derived from four primary segments: Services (A$11.77 million), Monitoring (A$85.32 million), Maintenance (A$18.10 million), and Installations (A$59.70 million).

Market Cap: A$266.01M

Intelligent Monitoring Group Limited, with a market cap of A$266.01 million, offers potential within the penny stock landscape despite being unprofitable and having a high net debt to equity ratio of 185.6%. The company has shown improvement by reducing losses at a significant rate over the past five years and maintaining a sufficient cash runway for more than three years even as free cash flow shrinks. Recent developments include raising A$20.01 million through a follow-on equity offering, which could support future growth initiatives like the discussed acquisition of BlueSky Holdco Limited.

- Click to explore a detailed breakdown of our findings in Intelligent Monitoring Group's financial health report.

- Learn about Intelligent Monitoring Group's future growth trajectory here.

Seize The Opportunity

- Investigate our full lineup of 418 ASX Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com