Discover 3 Middle Eastern Dividend Stocks Yielding Up To 6.4%

The Middle Eastern stock markets have shown varied performances recently, with Egypt's bourse outpacing its Gulf counterparts in 2025, while oil prices have weighed on Saudi Arabia's market. In this dynamic environment, dividend stocks can offer investors a potential source of steady income, particularly when local economic fundamentals and corporate earnings are strong.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.46% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.18% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.45% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.15% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.12% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.35% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.47% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 6.54% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.01% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.92% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Riyad Bank (SASE:1010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Riyad Bank offers banking and investment services in the Kingdom of Saudi Arabia and has a market capitalization of SAR81.08 billion.

Operations: Riyad Bank's revenue is primarily derived from its Corporate Banking segment at SAR8.94 billion, followed by Retail Banking at SAR4.23 billion, Treasury and Investments at SAR2.39 billion, and Investment Banking and Brokerage at SAR1.07 billion.

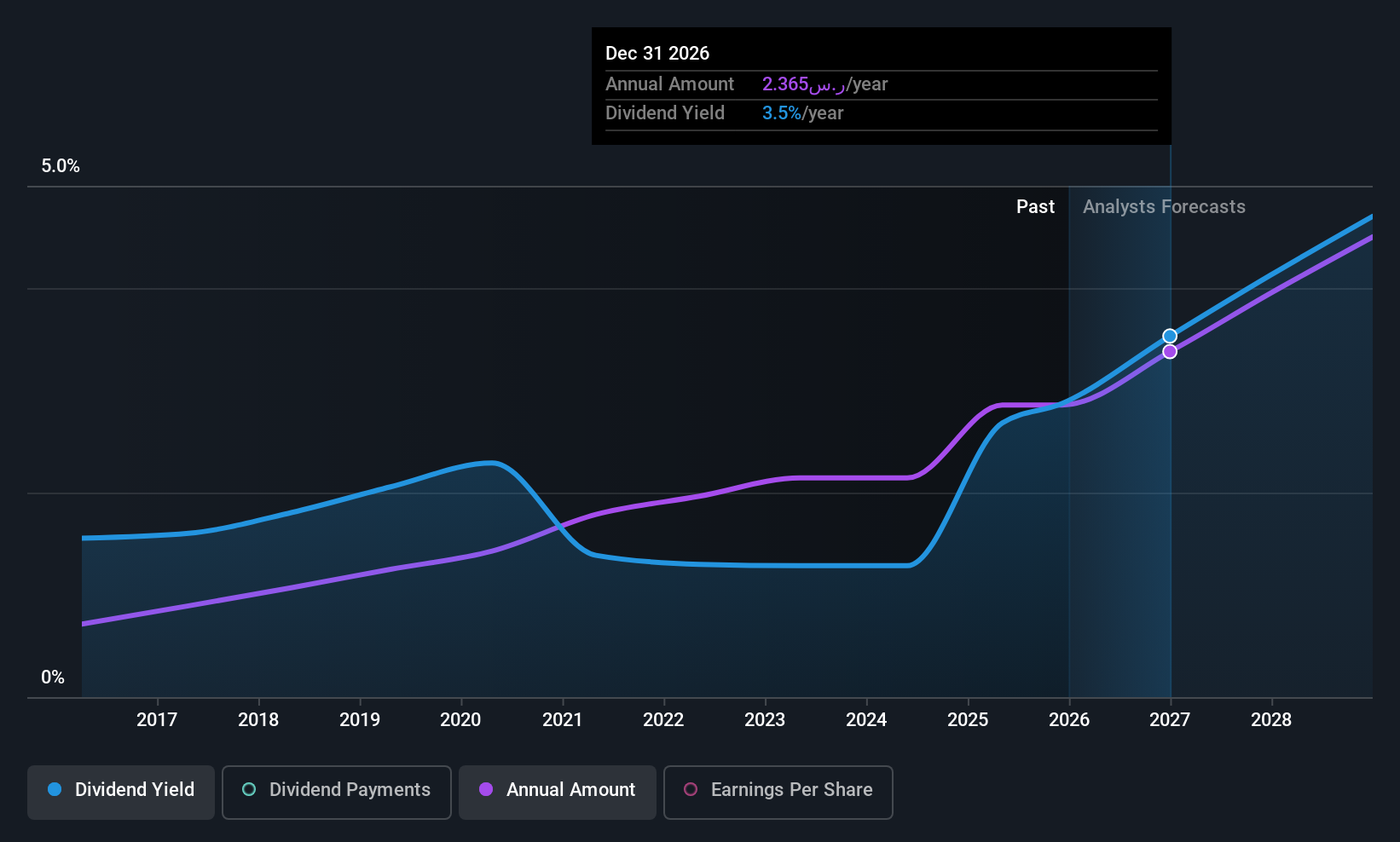

Dividend Yield: 6.4%

Riyad Bank's dividend payments are currently covered by earnings with a payout ratio of 54.7%, and future forecasts suggest continued coverage at 49.4%. Despite past volatility, dividends have grown over the last decade, placing Riyad Bank among the top 25% of dividend payers in its market. Recent board changes include appointing Ms. Mona Mohammed Al-Tawil as Audit Committee Chairman, potentially impacting governance positively. The bank's strategic headquarters relocation aligns with its transformation plan.

- Click to explore a detailed breakdown of our findings in Riyad Bank's dividend report.

- In light of our recent valuation report, it seems possible that Riyad Bank is trading behind its estimated value.

Mouwasat Medical Services (SASE:4002)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mouwasat Medical Services Company operates hospitals, medical centers, drug stores, and pharmacies in Saudi Arabia and has a market cap of SAR13.33 billion.

Operations: Mouwasat Medical Services Company generates revenue from its Pharmaceuticals segment, which accounts for SAR466.90 million, and its Medical Services segment, contributing SAR2.63 billion.

Dividend Yield: 3%

Mouwasat Medical Services offers a stable dividend yield of 3%, supported by earnings with a payout ratio of 79.4% and cash flows at 56.9%. The company's dividends have been reliable over the past decade, though not among the highest in its market. Recent earnings showed growth, with net income rising to SAR 199.66 million for Q3 2025. Expansion plans include a new hospital in Abha, financed through local banks and internal funds, potentially enhancing future revenue streams.

- Navigate through the intricacies of Mouwasat Medical Services with our comprehensive dividend report here.

- According our valuation report, there's an indication that Mouwasat Medical Services' share price might be on the cheaper side.

Mizrahi Tefahot Bank (TASE:MZTF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mizrahi Tefahot Bank Ltd., along with its subsidiaries, offers international, commercial, domestic, and personal banking services to individuals and businesses in Israel and internationally, with a market cap of ₪57.81 billion.

Operations: Mizrahi Tefahot Bank Ltd. generates revenue through its diverse range of banking services, catering to both individual and business clients across international and domestic markets.

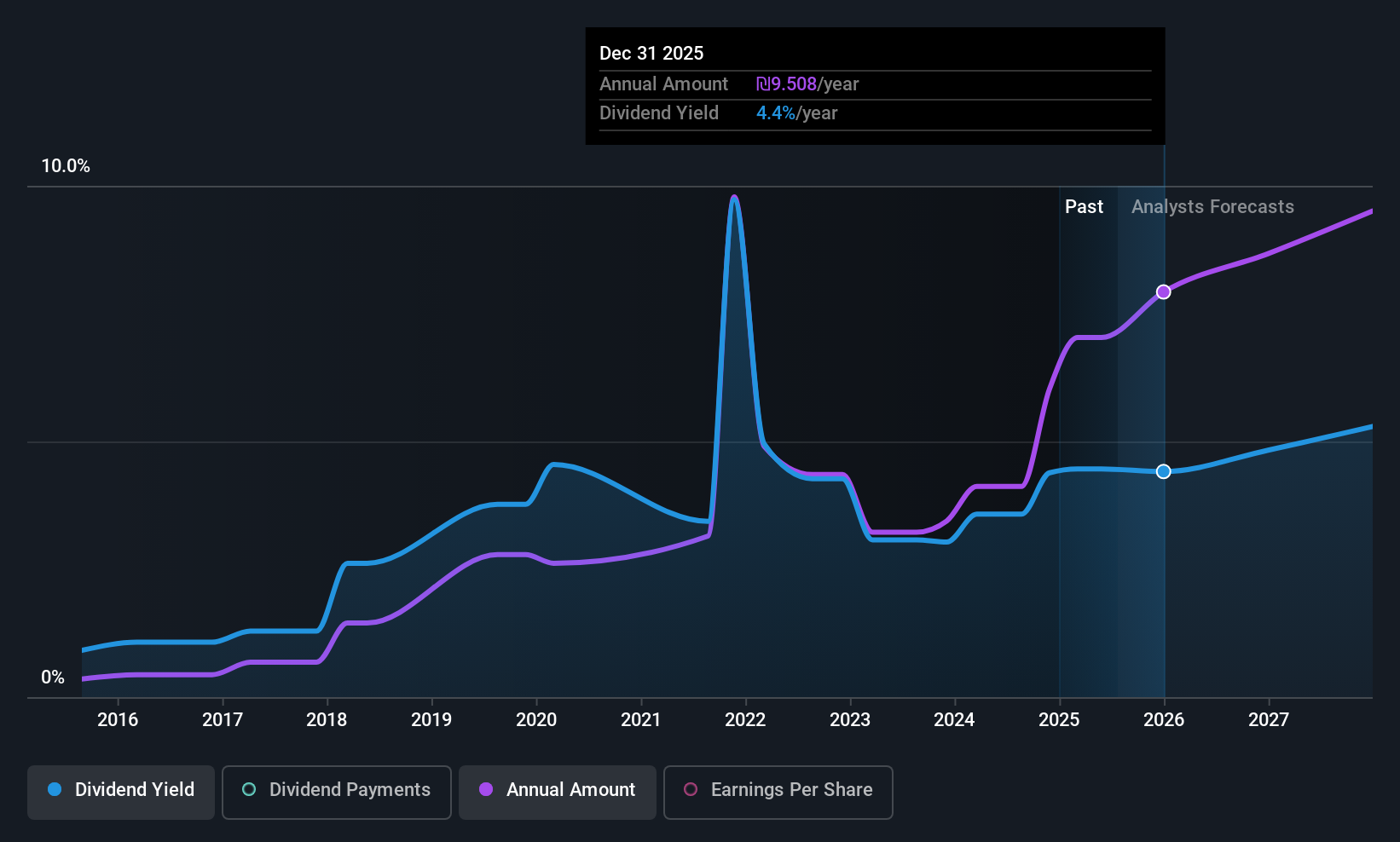

Dividend Yield: 3.8%

Mizrahi Tefahot Bank's dividend yield of 3.79% is modest compared to top-tier Israeli dividend payers, but its payout ratio of 45.2% indicates dividends are well-covered by earnings, with future coverage projected at 43.5%. Despite a decade-long increase in payments, the bank's dividends have been volatile and unreliable due to significant annual drops. Recent Q3 results show stable earnings growth with net income reaching ILS 1.48 billion, supporting continued dividend sustainability amidst market fluctuations.

- Click here and access our complete dividend analysis report to understand the dynamics of Mizrahi Tefahot Bank.

- In light of our recent valuation report, it seems possible that Mizrahi Tefahot Bank is trading beyond its estimated value.

Key Takeaways

- Investigate our full lineup of 59 Top Middle Eastern Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com