Qassim Cement And 2 Other Undiscovered Gems In The Middle East

The Middle East markets have shown a mixed performance, with Egypt's stock exchange outpacing its Gulf counterparts in 2025, while oil prices and regional tensions have weighed on Saudi Arabia's market sentiment. Amid these dynamics, identifying stocks that can thrive involves looking for companies with strong local economic fundamentals and resilience to broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 31.20% | 44.24% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| C. Mer Industries | 76.92% | 13.56% | 68.93% | ★★★★★☆ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Qassim Cement (SASE:3040)

Simply Wall St Value Rating: ★★★★★★

Overview: Qassim Cement Company is involved in the manufacture and sale of cement within the Kingdom of Saudi Arabia, with a market capitalization of SAR4.62 billion.

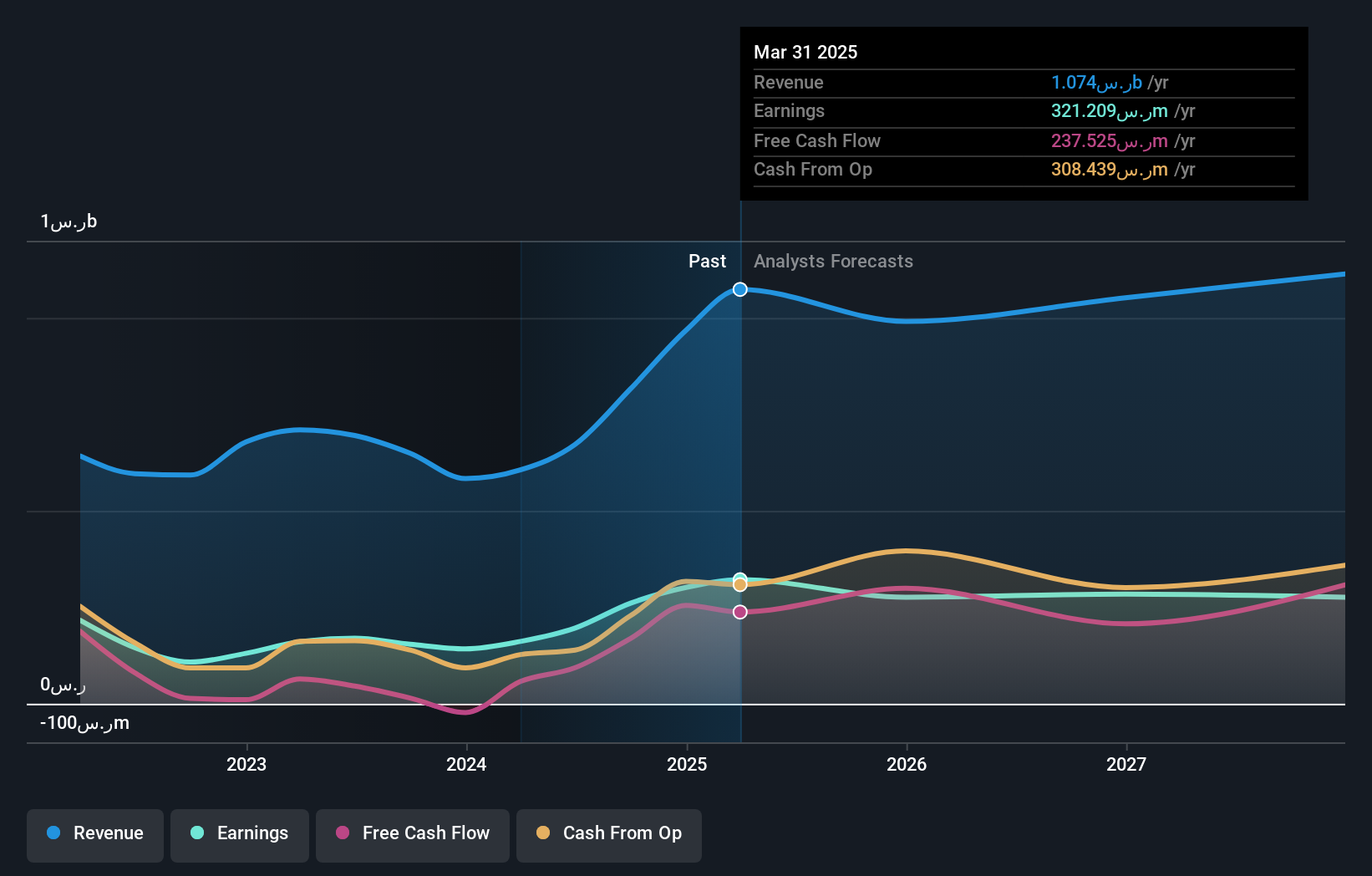

Operations: Revenue from manufacturing and selling cement is SAR1.15 billion. The net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and market conditions.

Qassim Cement, a debt-free player in the Middle East cement industry, has shown resilience despite some challenges. Over the past year, its earnings grew by 11%, outperforming the Basic Materials sector's -4% performance. Trading at approximately 31% below its estimated fair value, it appears undervalued. Recent earnings for Q3 reported sales of SAR 246 million and net income of SAR 41 million, down from SAR 65 million last year. For nine months ending September 2025, sales reached SAR 843 million with net income at SAR 191 million. The company also declared a quarterly dividend of SAR 0.80 per share payable in December.

- Navigate through the intricacies of Qassim Cement with our comprehensive health report here.

Gain insights into Qassim Cement's historical performance by reviewing our past performance report.

Gold Bond Group (TASE:GOLD)

Simply Wall St Value Rating: ★★★★★☆

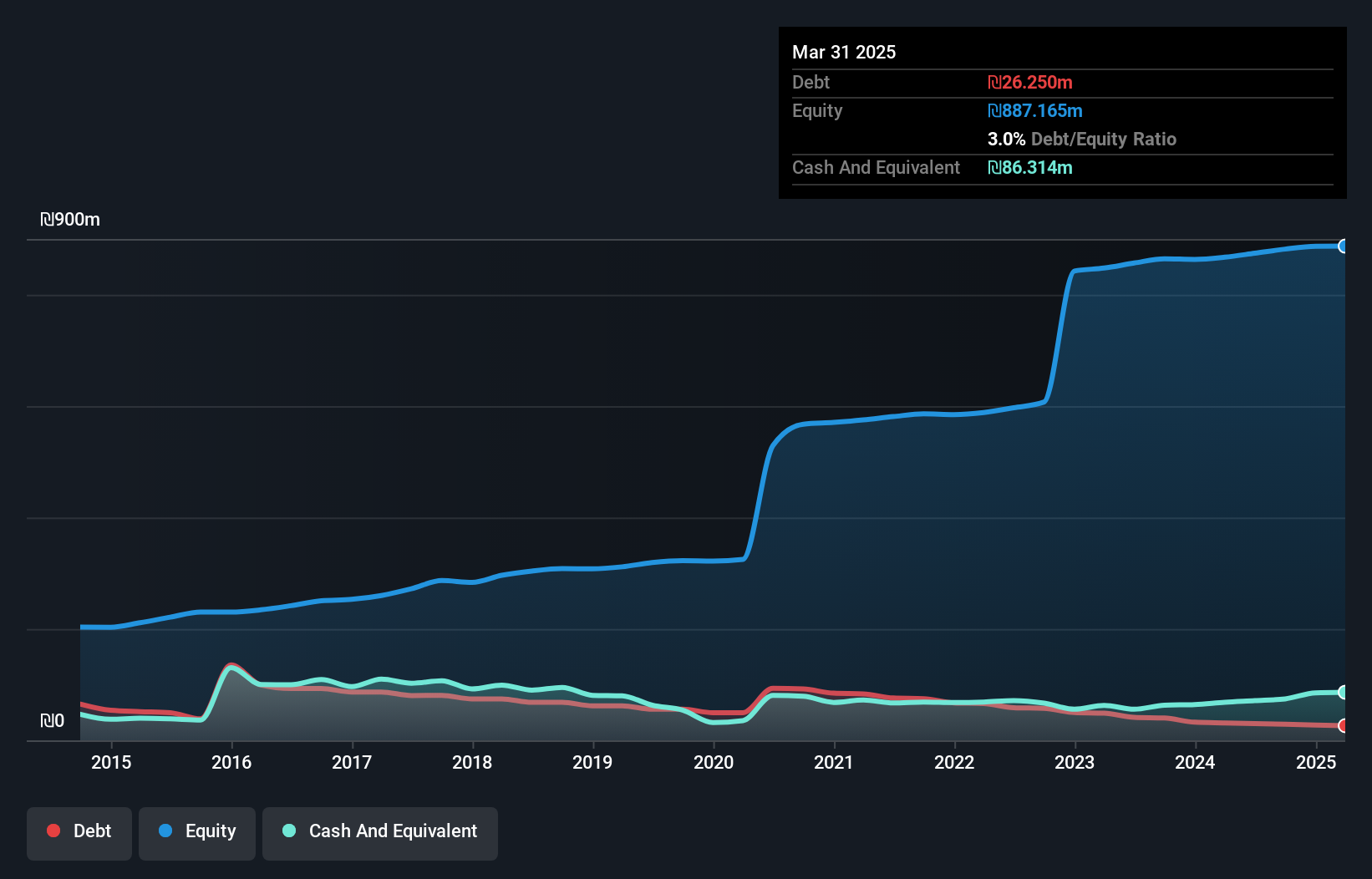

Overview: The Gold Bond Group Ltd. provides storage, conveyance, and logistical solutions for cargoes and containers, with a market capitalization of ₪904.55 million.

Operations: Gold Bond Group generates revenue primarily from Free Activities (₪91.88 million), FCL Terminal Operations (₪74.75 million), LCL Terminal Operations (₪57.23 million), and Ecommerce Activity (₪15.76 million).

Gold Bond Group, a smaller player in the Middle East market, has shown impressive earnings growth of 34% over the past year, outpacing its industry peers. The company has effectively reduced its debt to equity ratio from 16.2% to 2.7% in five years and maintains high-quality earnings with more cash than total debt. Recent results highlight sales of ILS 63 million for Q3, up from ILS 52 million last year, though net income saw a slight dip to ILS 7.15 million from ILS 7.43 million. Despite this, Gold Bond remains profitable with strong free cash flow generation and interest coverage capabilities.

- Dive into the specifics of Gold Bond Group here with our thorough health report.

Understand Gold Bond Group's track record by examining our Past report.

Rapac Communication & Infrastructure (TASE:RPAC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rapac Communication & Infrastructure Ltd operates in trade commerce, electrical projects, government services, and electricity production sectors in Israel with a market capitalization of ₪1.14 billion.

Operations: Rapac Communication & Infrastructure generates revenue primarily from electricity projects (₪779.02 million), trade (₪40.37 million), and power generation (₪7.40 million). The company's net profit margin reflects its financial performance, with adjustments impacting the overall figures.

Rapac Communication & Infrastructure, a small-cap player in the Middle East, has seen its earnings grow by 116.9% over the past year, outpacing the construction industry's 3.6%. Despite this impressive growth, the company's interest payments are not well covered by EBIT at 2.7 times coverage. Over five years, Rapac's debt-to-equity ratio improved significantly from 361.8% to a satisfactory 48%, indicating better financial management. However, recent results show a net loss of ILS 8.67 million for Q3 and ILS 4.14 million over nine months in contrast to last year's profits of ILS 20.22 million and ILS 194.53 million respectively.

- Click here to discover the nuances of Rapac Communication & Infrastructure with our detailed analytical health report.

Learn about Rapac Communication & Infrastructure's historical performance.

Key Takeaways

- Access the full spectrum of 182 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com